Economy

27 December 2022

The 22 most-read ecommerce stories of 2022

Inflation, Buy with Prime, ice cream delivery and Stranger Things brand collabs had the industry's attention this year.

Photo by Isabela Kronemberger on Unsplash

Inflation, Buy with Prime, ice cream delivery and Stranger Things brand collabs had the industry's attention this year.

The end of the year is a time to look back, and reflect on what will really matter going forward.

One way to start this process is to review what got the most attention.

The Current’s most-read stories of 2022 provide a handy primer on a few of the key areas we’re tracking:

Below is a look back at the top 22 most-viewed stories of 2022 on The Current. Thanks for reading.

(Photo: M·A·C Cosmetics)

(Photo: M·A·C Cosmetics)From May 19:

The new season of Stranger Things is coming May 27. But before that, fans can interact with the show while ordering pizza, putting on makeup and buying Doritos. As the fourth season of the hit streaming sci-fi-horror drama, approaches, Netflix is rolling out a series of brand collaborations to draw the public's attention. But it's not just putting the Stranger Things name on products. It's creating new ways to interact with the show, and its characters.

Rachel Marler (Courtesy photo)

From Sept. 1:

Spend time with [Haleon Chief Customer Officer Rachel] Marler, and it's clear that Haleon’s advantages as a standalone company don’t come only from the existing products and brands it oversees. The company is keen to forge partnerships as it works to innovate, and provide customers with new tools that support their journeys of lifelong prevention and self-care.

At the National Association for Chain Drug Stores Total Store Expo in Boston, The Current asked Marler about where consumer health is heading, and how retail is evolving in an increasingly digital landscape.. She also shared examples of how care, commerce and content are coming together.

Photo by Alexander Shatov on Unsplasheditac_unitsharetrending_updelete

From Sept. 8:

The Information’s report indicates that Instagram isn’t abandoning shopping, but it’s less clear what role it will play on the platform. ATT throws a big wrench in the engine of Meta's ecommerce-centered performance marketing prowess, as attributing a sale made on a Shopify store to an ad on Instagram is rendered more difficult. Meanwhile, Instagram just recently rolled out a new feature that allows purchases to be made through direct messages. That indicates it is still looking to provide checkout, even though the path to get there is less obvious.

Inside an Amazon warehouse. Photo by Flickr user Jaimie Wilson, used under a Creative Commons license)

From Sept. 1:

Offering services to third-party sellers has proven kind to Amazon's business. In its second quarter earnings report, the company said these sellers were responsible for 57% of sales on Amazon, which was a record. Revenue from third-party seller services rose 13% to more than $27 billion, a record for a non-holiday quarter. On the other hand, Amazon's overall sales from ecommerce fell 4%.

Amazon built its logistics network to serve its own needs in moving inventory into place, shipping and delivering packages. Now, it is one of the largest in the country. With that scale, it is offering parts of that network up to others, turning what could be a cost center into a potential business booster.

Crocs. (Photo by Flickr user Lynn Friedman, used under a Creative Commons license)

Crocs. (Photo by Flickr user Lynn Friedman, used under a Creative Commons license)From Bainbridge Growth’s Ben Tregoe on April 15:

Crocs is unquestionably a mature brand with a global presence and scale. Their challenges around supply chain, balance sheet leverage and maintaining their position are “good problems” that most DTC founders would love to eventually encounter. These are the strategic decisions that come with creating arguably the most successful footwear item of this young century. Crocs should be mentioned alongside the Converse Chuck Taylors and NIKE Air Jordans, but with a much broader appeal and a price point that allows for true global penetration. They look set for continued success with their original brand and through applying all they’ve learned to their new acquisition.

From April 11:

Under the banner of Walmart Commerce Technologies, the company is selling retail tech to brands and retailers in areas including, fulfillment, AI and checkout. With the growth of digital and a move toward omnichannel approaches like click-and-collect, Walmart is looking to not only provide a place for brands to sell goods, but also offer the tools that power a digital business.

“We have a world class organization including technology, product and operations teams that we believe, combined with our retail strength and scale, will allow us to build a mutually beneficial flywheel that unlocks new revenue for Walmart while improving the customer experience for everyone,” Anshu Bhardwaj, Walmart SVP of Strategy and Tech Commercialization, told The Current.

(Photo by Amy Shamblen on Unsplash)

(Photo by Amy Shamblen on Unsplash)From Sept. 21:

What should we expect for the 2022 holiday shopping season?

For brands and retailers, this is an important question. The holidays are not just a time when people are giving gifts, but also shopping deals for their own buys.

As a result, the festive season is also a time when retail puts its best foot forward, launching new campaigns, attractive deals and expanding capacity for the volume.

All of this doesn’t just appear on Thanksgiving week. Preparation starts early, and lasts all fall. Right on cue, the post-Labor Day period has brought a fresh round of predictions for the 2022 holiday season, with analysts putting numbers behind their expectations.

The Current dug through six of these forecasts to share the important figures, and key insights.

Estee Lauder products. (Photo by Melinda Seckington | Flickr) www.flickr.com

From August 23:

The Estée Lauder Companies is a beacon for beauty.

With more than 20 brands in its portfolio including MAC Cosmetics, Clinique and Bobbi Brown, Estée Lauder is a leader in the prestige beauty category with a global footprint. That means the business’ activities can say a lot about what’s happening in commerce and the consumer economy. This includes ecommerce, where Estée Lauder is growing its business by selling through its own websites, third-party marketplaces and other retailers’ websites.

In recently reported results for the fiscal year ended 2022, company leaders shared insights into how ecommerce fits into the wider picture of the business, and progress for online sales over the last year.

The barcode evolved for ecommerce. (Photo by Flickr user Conor Lawless, used under a Creative Commons license)

The barcode evolved for ecommerce. (Photo by Flickr user Conor Lawless, used under a Creative Commons license)From July 14:

GS1 US is the American organization that provides unique barcodes to brands and retailers, and a link to the global network that makes these tags truly universal.

At the same time, GS1 US is working on what’s next.

“It was a breakthrough technology in the 1970s,” Melanie Nuce, GS1’s SVP of innovation and partnerships, said of the UPC. “What we’re poised for now is, what are the next round of breakthroughs to drive these digital experiences?”

With an initiative called Sunrise 2027, it is set to usher in a transition from linear, one-dimensional barcodes, to more data-rich two-dimensional barcodes on product packaging. Alongside brands and retailers, GS1 US is also exploring how products and approaches to solving business challenges will evolve as digital and physical approaches blend.

From PrivCo’s Nellie Stokeld, on April 22:

Warren Buffett made his billions betting on the American dream with Coca-Cola, Bank of America, and Apple. The Becky ETF is built around a typical kind of consumer within that American dream. Think Lululemon, Starbucks, Etsy, and Ulta. According to TrackInsight, “the strategy stems from an article called "Female Economy" published in the Harvard Business Review that shows women make the purchasing decisions for 94% of home furnishings, 92% of vacations, 60% of automobiles, and 51% of consumer electronics.”

Ecommerce sales show steady growth, despite retailers' losses

Ecommerce sales show steady growth, despite retailers' lossesFrom May 19:

To be sure, spending is down from the early pandemic highs of spring 2020. After declarations that ecommerce accelerated 10 years in three months, it's easy for this to feel like a comedown.

But the latest federal data continues to suggest that ecommerce sales are leveling off, even as they continue to grow. Dollar totals have increased each quarter. Reaching $250 billion in ecommerce sales in the first quarter means ecommerce sales are on pace to reach an annual total of $1 trillion in 2022. This would mark the first time sales crossed this milestone.

When it comes to the share of overall retail, ecommerce sales figures are landing on a higher plane than they were pre-pandemic.

Notably, with the release of new quarterly data, the Census Bureau this month also revised upward its estimates of ecommerce share of total retail for the fourth quarter of 2021. This metric is closely watched, as it shows how big a place online shopping holds in the overall retail environment.

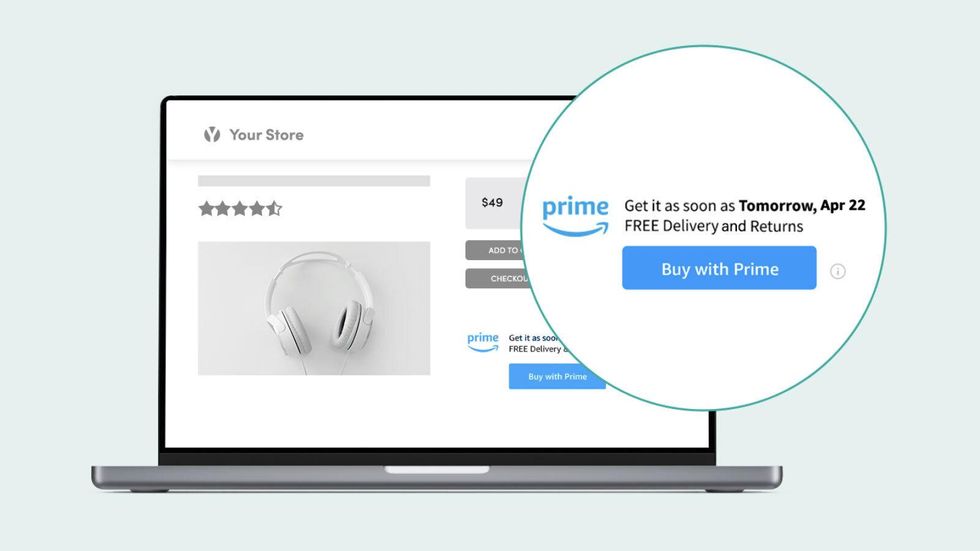

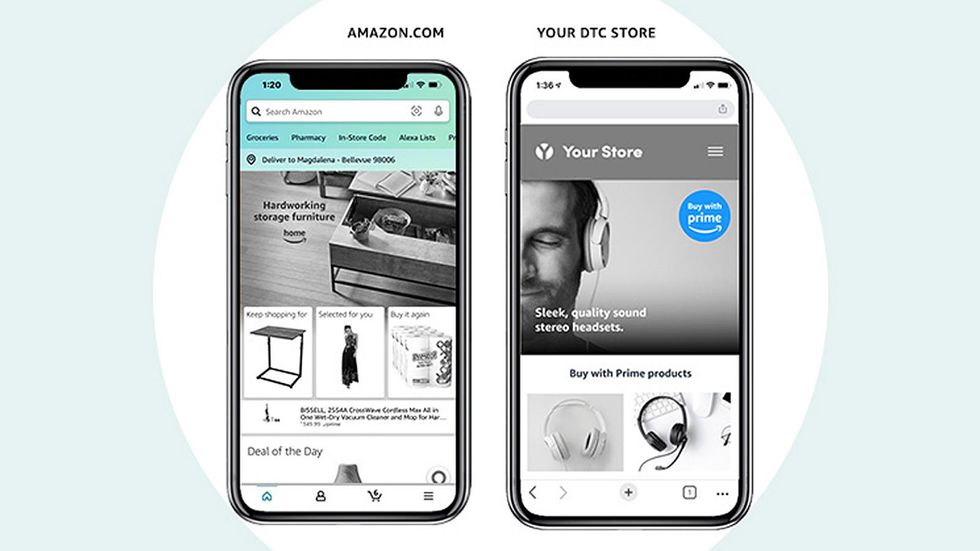

From April 21:

Through Buy with Prime, Amazon is offering its own integration, backed by its massive logistics network. At the same time, sellers can present their products within their own stores and keep running their sites on platforms like BigCommerce, while still tapping into what Amazon offers. For shoppers, it means a Prime membership is beneficial beyond Amazon, or a property the company owns like Whole Foods. It remains to be seen whether the Buy With Prime strategy is successful, but the move appears to be one that could further embed Amazon within the ecommerce landscape.

Robomart will deliver Ben & Jerry's. (Courtesy photo)

Robomart will deliver Ben & Jerry's. (Courtesy photo)From May 6:

When ecommerce successfully enables an item's fast journey from order to door, it can feel like magic. But for the humans making it all work, there are many problems to solve to get there.

One area that requires lots of innovation involves figuring out how to send items that don’t seem to be natural candidates for shipping and delivery.

Take frozen foods, like ice cream. Keeping the sweet treat cold during transport is the difference between a pint of joy and a melted mess.

However, one should never underestimate how much people love ice cream.

Ice cream ecommerce exists.

One of the companies at the forefront of this area is Unilever. The consumer goods company also happens to be the world’s largest ice cream company, per its own data, with brands in its freezer including Ben & Jerry’s, Breyers, Good Humor, Magnum and Talenti.

Photo by Sigmund on Unsplash

Photo by Sigmund on UnsplashFrom October 6:

On Sept. 29, GS1 US held an innovation summit to explore work taking place to create more sustainable supply chains. GS1 US is the American organization that provides unique barcodes to brands and retailers for tracking items throughout a supply chain. Through this, it works with partners across industries, and provides a link to a global network that make these standards universal.

It’s also uniquely positioned to identify what’s coming next, and the event put innovation in sustainability in focus.

“We cannot talk about supply chain resilience without factoring in circularity and sustainability, said Vivian Tai, director of innovation at GS1 US.

Steep Prime Day discounts are like a sign of holiday deals to come

Steep Prime Day discounts are like a sign of holiday deals to comeFrom May 20:

Amazon Prime Day is set to return for 2022 in July with a seemingly endless assortment of deals across the ecommerce platform. It offers brands the opportunity to attract attention from a massive audience of customers, and boost a presence that will keep paying dividends down the road.

Like any big event, it’s important to go into Prime Day with the pieces in place to execute. That means knowing key dates, preparing inventory, optimizing marketing and putting the metrics for success in place. With plenty going on already, that's a lot. So, to help, we consulted with experts and key sources to put together a guide to get ready for Prime Day.

Buy with Prime on Amazon. (Courtesy photo)

Buy with Prime on Amazon. (Courtesy photo)From Sept. 15:

Tools and resources to support selling on Amazon are in focus this week, as the ecommerce company is holding its annual Accelerate conference for its third-party seller community.

As the event unfolds online and in Seattle, Amazon is rolling out new marketing features to help attract customers. This is coming in the form of tools for third-party sellers, and new features for Buy With Prime – the five-month-old program that allows DTC websites to offer Prime delivery and checkout to customers.

These tools for advertising and email marketing arrive at a time when many brands are seeking new ways to reach consumers at scale and drive loyalty among existing customers as performance marketing on platforms like Facebook and Instagram becomes more difficult due to rising customer acquisition costs and more difficult attribution as a result of Apple’s App Tracking Transparency.

Here’s a look at the latest offerings to roll out, and The Current’s take on each.

From May 2:

Inflation is rising, yet consumer demand remains strong.

That was the early message delivered by retail sales data recapping March 2022.

With more data now available from additional metrics and earnings reports from public companies, that conclusion appears to be playing out around the economic landscape.

From June 23:

When a brand faces a crisis, the public response matters.

That’s one takeaway from the recall issued by vegan meal delivery service Daily Harvest. With the reports that led to the recall and the fallout all playing out on social media, the issue illustrates how safety and trust remain cornerstones for a brand.

With an eye toward lessons for other consumer companies, The Current explored how this unfolded, and contacted crisis communications experts for insights about the response and next steps.

(Photo via Shopify)

(Photo via Shopify)From May 5:

The timing here naturally heightens speculation about competition between Amazon and Shopify. The Deliverr acquisition sets up Shopify to offer DTC merchants similar services to what Fulfillment by Amazon (FBA) provides to third-party Amazon sellers. Buy with Prime, which will initially be offered to FBA merchants, debuted the day after news broke about the potential Deliverr acquisition, and it was immediately viewed as a “Shopify killer.”

With Shop Promise, Shopify appears to have an answer – or at least its side of a call and response. Its blog post announcing the service added that Shop Promise allowed merchants to maintain “full ownership of their brand, business intelligence, and customer data.” That could easily be read as a swipe at Amazon, as one of the tradeoffs quickly presented in analysis of Buy with Prime was that companies would have to give up customer data to Amazon.

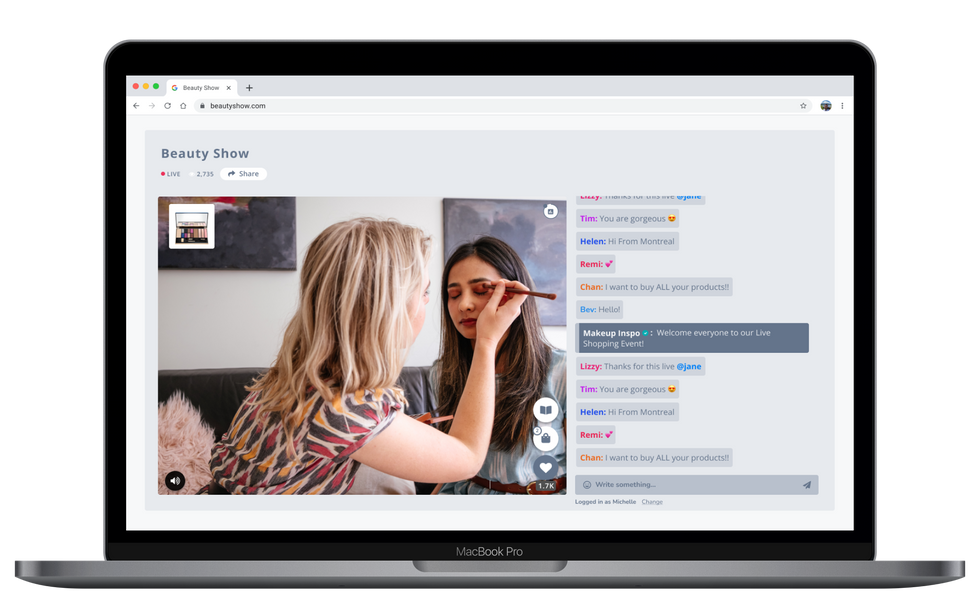

Livescale's platform includes video and chat tools. (Courtesy photo)

Livescale's platform includes video and chat tools. (Courtesy photo)From March 30:

But recently, Goldstein has found a new way to feature the brand's plus-size apparel front and center in the shopping experience, and deliver an experience that is both transparent about the product and makes her feel good. Working with the platform Livescale, Lola Getts is running live shopping experiences that show off products, offer special bundles for the events and make sales on the spot. Goldstein likes the approach because the livestreamed events offer a venue where Lola Getts’ audience can see all of the details of the product shown on a real person. Moreover, they can shop in an affirming space.

“It’s the safest place for us to engage with the consumers because we set ground rules early on saying this is a positive space,” [founder Stacey] Goldstein said. “There’s no heckling, there’s no judgement. We’re here to answer your questions, for you to meet other people that are like you in our community and for you to be able to shop like everyone else and have fun doing it.”

Micro-fulfillment is the behind the scenes engine for fast delivery. (Photo by Elevate on Unsplash)

Micro-fulfillment is the behind the scenes engine for fast delivery. (Photo by Elevate on Unsplash)From August 18:

A fast-emerging piece of this evolution is an approach called micro fulfillment. It builds on the fulfillment center model, in which goods that are ordered often are moved to a central place. Once a customer places an order, items are picked, packed and shipped out.

When this model emerged, fulfillment centers were typically large warehouse facilities located in rural areas. While strategically located these centers in areas between cities could help them reach large swaths of the country, these centers are typically located further from population centers.

As delivery times must speed up, being closer to customers provides an advantage. Micro fulfillment adds smaller-scale warehouse centers that are located within metro areas. Placing them along popular shipping routes only adds to the benefits.

Vast facilities can be augmented by smaller centers in dense areas.

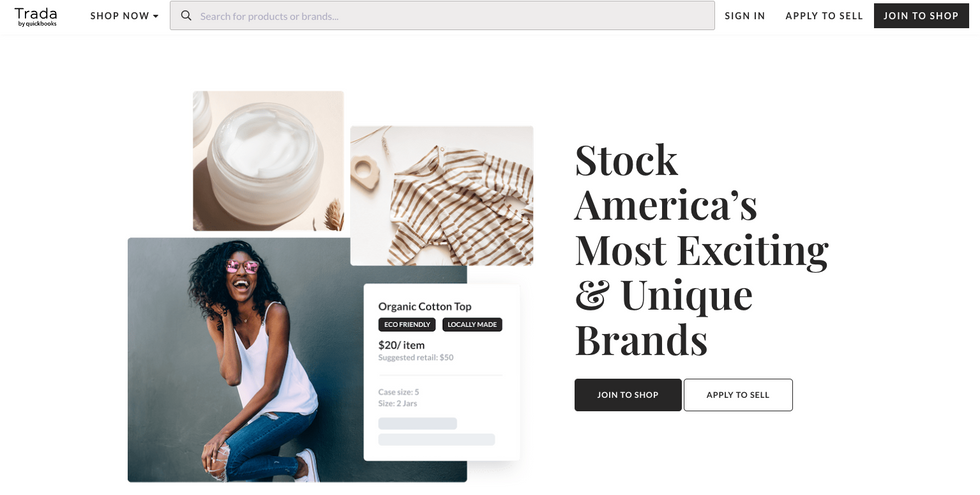

(via Trada by Quickbooks)

From August 12:

With the marketplace, QuickBooks seeks to apply the ecommerce principles and experiences that are familiar in consumer-facing online shopping to the process in which retailers obtain the goods that they sell in their stores. Under the wholesale model, suppliers ultimately want to find and build a customer base, but they reach people through the destination stores of retailers, who by turn are seeking suppliers that have great products. This creates challenges: Sellers are seeking to get in front of retailers, while retailers want to be able to easily access a selection of unique products.

Amazon partnered with Hexa to provide access to a platform that creates lifelike digital images.

A 3D rendering of a toaster from Hexa and Amazon. (Courtesy photo)

Amazon sellers will be able to offer a variety of 3D visualizations on product pages through a new set of immersive tools that are debuting on Tuesday.

Through an expanded partnership with Hexa, Amazon is providing access to a workflow that allows sellers to create 3D assets and display the following:

Selllers don't need prior experience with 3D or virtual reality to use the system, according to Hexa. Amazon selling partners can upload their Amazon Standard Identification Number (ASIN) into Hexa’s content management system. Then, the system will automatically convert an image into a 3D model with AR compatibility. Amazon can then animate the images with 360-degree viewing and augmented reality, which renders digital imagery over a physical space.

Hexa’s platform uses AI to create digital twins of physical objects, including consumer goods. Over the last 24 months, Hexa worked alongside the spatial computing team at Amazon Web Services (AWS) and the imaging team at Amazon.com to build the infrastructure that provides 3D assets for the thousands of sellers that work with Amazon.

“Working with Amazon has opened up a whole new distribution channel for our partners,” said Gavin Goodvach, Hexa’s Vice President of Partnerships.

Hexa’s platform is designed to create lifelike renderings that can explored in 3D, or overlaid into photos of the physical world. It allows assets from any category to be created, ranging from furniture to jewelry to apparel.

The result is a system that allows sellers to provide a new level of personalization, said Hexa CEO Yehiel Atias. Consumers will have new opportunity see a product in a space, or what it looks like on their person.

Additionally, merchants can leverage these tools to optimize the entire funnel of a purchase. Advanced imagery allows more people to view and engage with a product during the initial shopping experience. Following the purchase, consumers who have gotten a better look at a product from all angles will be more likely to have confidence that the product matches their needs. In turn, this can reduce return rates.

While Amazon has previously introduced virtual try-on and augmented reality tools, this partnership aims to expand these capabilities beyond the name brands that often have 1P relationships with Amazon. Third-party sellers are an increasingly formidable segment of Amazon’s business, as they account for 60% of sales on the marketplace. Now, these sellers are being equipped with tools that enhance the shopping experience for everyone.

A video displaying the new capabilities is below. Amazon sellers can learn more about the platform here.

Hexa & Amazon - 3D Production Powerhousewww.youtube.com