Activewear brand Lola Getts is reaching what founder Stacey Goldstein calls the “forgotten majority.”

The brand's data shows that 70% of American women wear size 14 or larger, yet this group is underserved by retailers. Often, clothes designed for plus-size women are in the back corner of a store, if they are available at all.

“For the most part, she can’t walk into a store and hope to find something in her size that’s going to fit her body,” Goldstein said of Lola Getts' shopper. When it comes to shopping online, they are often disappointed when clothes don’t match the photos or descriptions.

But recently, Goldstein has found a new way to feature the brand's plus-size apparel front and center in the shopping experience, and deliver an experience that is both transparent about the product and makes her feel good. Working with the platform Livescale, Lola Getts is running live shopping experiences that show off products, offer special bundles for the events and make sales on the spot. Goldstein likes the approach because the livestreamed events offer a venue where Lola Getts’ audience can see all of the details of the product shown on a real person. Moreover, they can shop in an affirming space.

“It’s the safest place for us to engage with the consumers because we set ground rules early on saying this is a positive space,” Goldstein said. “There’s no heckling, there’s no judgement. We’re here to answer your questions, for you to meet other people that are like you in our community and for you to be able to shop like everyone else and have fun doing it.”

Lola Getts is among a growing number of brands running regular live shopping events. With hosts that demo featured products and engage with shoppers in real-time, the sessions resemble in-store product demos, and the experiences popularized by QVC and HSN amid the cableTV boom. Using video and ecommerce tools that allow for interaction and checkout, platforms are bringing the approach into the internet era.

“It’s a one-stop solution for shopping online,” Livescale’s Shivani Persad said of live shopping. “We very much see it as being the future of retail technology. We see it as an extension of your ecommerce strategy.”

Westward expansion

China was the early adopter of this approach, with platforms such as Alibaba offering the tools that allowed brands to go live. With the lockdowns of the COVID-19 pandemic that closed in-person stores, live shopping soared in the country. It reached 30% of Chinese internet users in the early months of the pandemic, and reached a gross merchandise value of $171 billion in 2020, according to research by McKinsey.

Seeing that success, North America is beginning to tune in, and tech platforms are making new opportunities available. Facebook introduced live shopping Fridays in the summer of 2021, and sessions were held daily by the holiday season. Instagram’s influencers and TikTok creators are going live with products. Pinterest introduced Pinterest TV, which propelled DTC brands like Allbirds, Outdoor Voices and Mented Cosmetics to test it. YouTube introduced livestream shopping for all users over the holidays, and plans continued expansion.

Live shopping initially took off in categories such as beauty and apparel that benefited from the ability to model a product. Now, live shopping events are moving into areas like home goods and grocery.

The beginning of 2022 has shown how retailers are looking to build live shopping into their ecommerce offerings. After celebrity-led events during the holidays, Walmart partnered with the platform talkshoplive to hold regularly scheduled events in February and March. Lowe’s introduced a DIY-U learning platform that enables shoppers to sign up for home improvement workshops that focus on specific home projects. For pop culture aficionados, Hot Topic rolled out a series of events in March.

For retailers, live shopping is a way to reach consumers beyond their stores. A product demo or an in-store workshop may already be part of their strategy for making their products interactive. Live shopping allows them to bring that to ecommerce.

It also creates an event. At many live shopping experiences, brands offer product bundles specifically designed for the event, or hold product launches. This creates urgency around sales, and also speaks to loyalty customers.

A Lola Getts live shopping experience. (Courtesy photo)

A Lola Getts live shopping experience. (Courtesy photo)

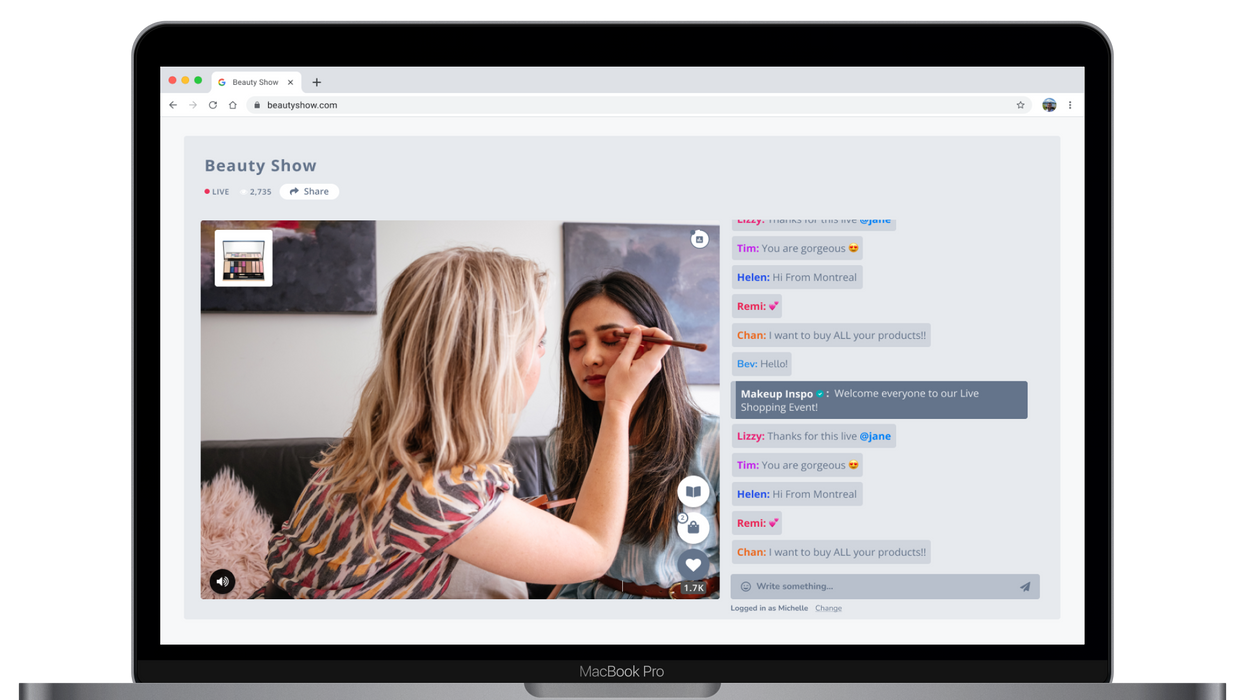

For brands seeking to host regular live shopping events, a growing number of platforms are available that are built to host experiences. Among them is Livescale, which is working with Lola Getts to run experiences at least monthly. Offering a white-label experience, the platform provides the tools for a live shopping event. It allows brands to integrate ecommerce and payment tools to browse products and make purchases within the live video. Chat features allow hosts to answer questions and engage directly. To reach consumers, brands can offer discounted bundles of items, or run polls. The brands also have access to a dashboard with analytics, and own the data generated by the experience.

Keys to success

Technology offers the infrastructure to make a live shopping experience happen, but a successful session has a very human element. After all, the goal is to offer an experience where people connect.

First, it's important to find the right host. It's important to team with an engaging and authentic personality to lead the session.

“You really have to understand who your consumer is and you really have to have somebody that is engaging to the audience,” Goldstein said. “You need someone that’s passionate not only about the product but about the audience that they serve.

Goldstein hosts the Lola Getts sessions alongside the influencer Coach Tulin. They’ve built a rapport, as well as a connection to the audience and how the products serve them. In other cases, brands work with influencers in specific subject areas, or dedicated live shopping hosts to lead sessions. It’s about building community first, and engaging.

There’s also an element of transparency. Presenting the products live on video lets consumers see what they’re buying. It helps provide a deep look at the product that goes beyond images on a product detail page. This is especially important to Goldstein’s audience, which often encounters false labeling about plus-size apparel.

“When you have something in front of you live, you can’t hide if the pants are see through, you can’t hide if they’ve been rolled down. We get to answer questions she normally wouldn’t get answered in a retail forum,” Goldstein said, referring to Lola Getts’ shoppers.

A look at Livescale's app. (Courtesy photo)

A look at Livescale's app. (Courtesy photo)

The folks working behind the scenes have an equally important role. Designating a team member to serve as a producer and moderate the chat is especially important, said Persad. With growth, she said brands will look to build out teams that are dedicated to running live commerce, and have expertise in this area.

Another key to success is commitment. Any new approach can require a few experiences to find one’s footing, so holding more than one session can allow the space to test, hold debriefs and iterate.

After live shopping is up and running, Persad said it’s important to be consistent. Regular events at a predictable cadence help to make live shopping a destination just like the store. Branding, creative elements and promotion only help to maintain their staying power.

A creative team that’s willing to try new approaches will help to establish a live shopping experience. Viewing it as a “pillar” of an ecommerce strategy will help it grow.

“This is not a one-and-done type of thing,” Persad said.

In the big picture, live shopping can help brands reach audiences where they are. That could be at home, where they are more comfortable shopping. As Persad pointed out, they could be located in a rural area that’s far from a store. It’s all part of the shift in commerce from a retail environment that’s dependent on going to a store and hoping they might have a product, to one that seeks to connect consumers with products that are right for them, and get it to them where they are.

“For years retail dictated to the consumer what they bought, when they wore it, what the timeframe was,” said Goldstein. “I think now there’s been a flip of the switch. The consumer is telling the retailer what they want to see, when they want to see it, how they want to see it, where they want to see it.”

From Your Site Articles

Related Articles Around the Web

A Lola Getts live shopping experience. (Courtesy photo)

A Lola Getts live shopping experience. (Courtesy photo) A look at Livescale's app. (Courtesy photo)

A look at Livescale's app. (Courtesy photo)