Tools and resources to support selling on Amazon are in focus this week, as the ecommerce company is holding its annual Accelerate conference for its third-party seller community.

As the event unfolds online and in Seattle, Amazon is rolling out new marketing features to help attract customers. This is coming in the form of tools for third-party sellers, and new features for Buy With Prime – the five-month-old program that allows DTC websites to offer Prime delivery and checkout to customers.

These tools for advertising and email marketing arrive at a time when many brands are seeking new ways to reach consumers at scale and drive loyalty among existing customers as performance marketing on platforms like Facebook and Instagram becomes more difficult due to rising customer acquisition costs and more difficult attribution as a result of Apple’s App Tracking Transparency.

Here’s a look at the latest offerings to roll out, and The Current’s take on each:

Email marketing with Tailored Audiences

New features announced at Amazon Accelerate will allow third-party sellers to send marketing emails to people beyond brand followers.

Within Amazon Customer Engagement, three new audience types will be added to help sellers reach their most loyal customers: repeat customers, recent customers, and high-spend customers.

“Brands are able to quickly acquire new customers in the Amazon store, but they expressed a need for improved tools to increase customer lifetime value,” said Benjamin Hartman, vice president of Amazon North America Selling Partner Services. “These improvements help unlock the value of remarketing as we further our commitment to helping sellers reach the right customer, at the right time.”

A tool that is currently in beta called Tailored Audiences will allow sellers to select an audience, and Amazon then sends the email. Sellers can also monitor the impact of email campaigns with metrics like open rate, click-through rates, opt-out rates, sales and conversion.

Tailored Audiences will be available for free in Seller Central to all US sellers in 2023. Amazon also plans to add design to the platform’s design capabilities with custom HTML content and improved templates.

The Current’s view: As noted above, loyalty is becoming a more important focal point for brands and sellers, so it’s smart of Amazon to extend its email tools, which are legendary in its first-party segment. The company in 2021 allowed third-party sellers to send emails to followers of their brand for the first time, so this shows Amazon is expanding that capability in short order. Of course, this also makes Amazon an email marketing provider: You can bet Klaviyo, Mailchimp and Hubspot are watching closely.

Customers ask Alexa

Customers ask Alexa in Seller Central. (Courtesy photo)

FAQs go voice through this feature. Brands can provide the answers to common customer questions about a product through Alexa.

Available through Seller Central to those in the Amazon Brand Registry, this capability allows brands to submit answers to questions. In turn, Alexa will provide these responses when asked questions about a product’s functionality.

“Amazon recognizes brands as experts on their products. With this new capability, we have made it easier for brands to connect with customers to help answer common questions and better inform their purchase decisions,” said Rajiv Mehta, general manager of Alexa Shopping at Amazon.

Currently invite-only in 2022, this feature will be available to all US sellers in 2023. It will be accessible through the Amazon search bar in late 2022, and via Echo devices in mid-2023.

The Current’s view: While voice shopping often conjures up visions of people calling out direct orders, this a step down that road harnesses what Alexa is already used for: providing information in response to questions for which it can tap Amazon to locate answers. Whether those questions sync with what customers ask Alexa remains to be seen. It will also be interesting to watch how Amazon communicates the availability of this feature as it rolls out. Either way, it’s an intriguing complement to a shopping experience that is increasingly taking place across mediums.

Premium A+ Content

This is an upgrade to the standard content management system that supports new and bigger modules on product pages. These include video, interactive hover hotspots, image carousels and Q&A. Amazon said brands using this system have seen sales increase up to 20% for products.

The Current’s view: Amazon has been adding more features to its product pages for years, but they have maintained a fairly staid Amazon look in the process. These features include more moving imagery that will make the pages stand out in a way that’s more familiar to social media or a DTC brand’s website. Which brings us to…

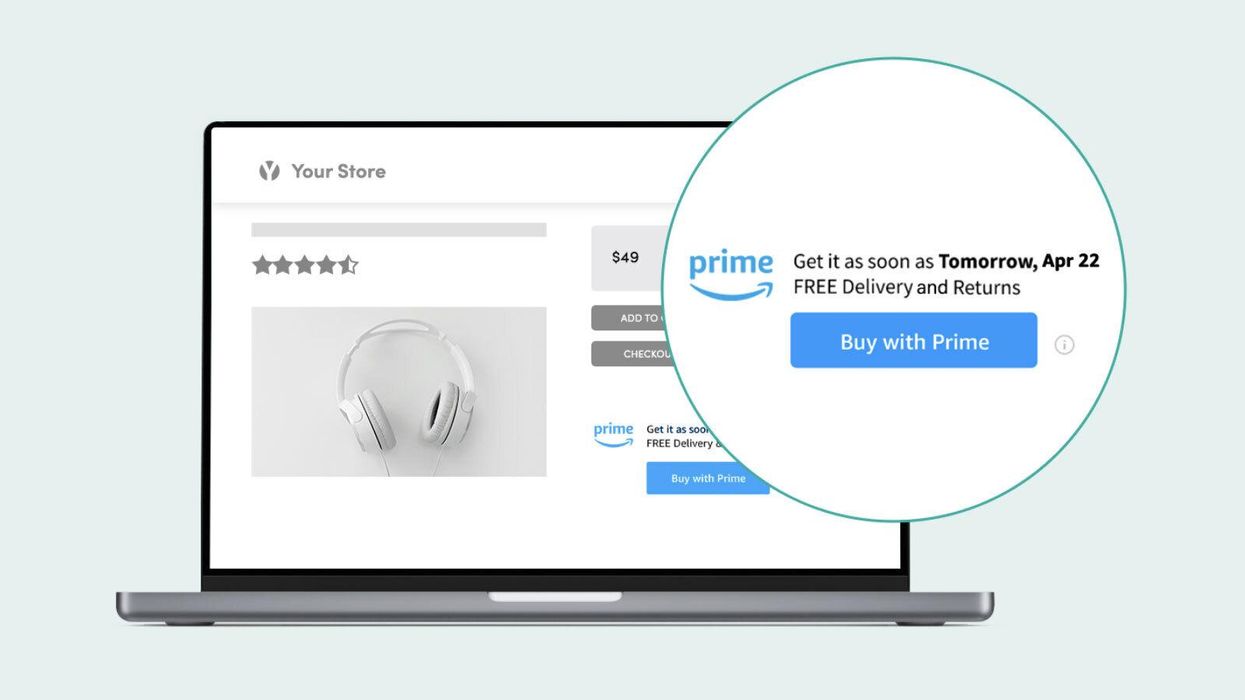

Buy With Prime advertising on Amazon

Buy with Prime on Amazon. (Courtesy photo)

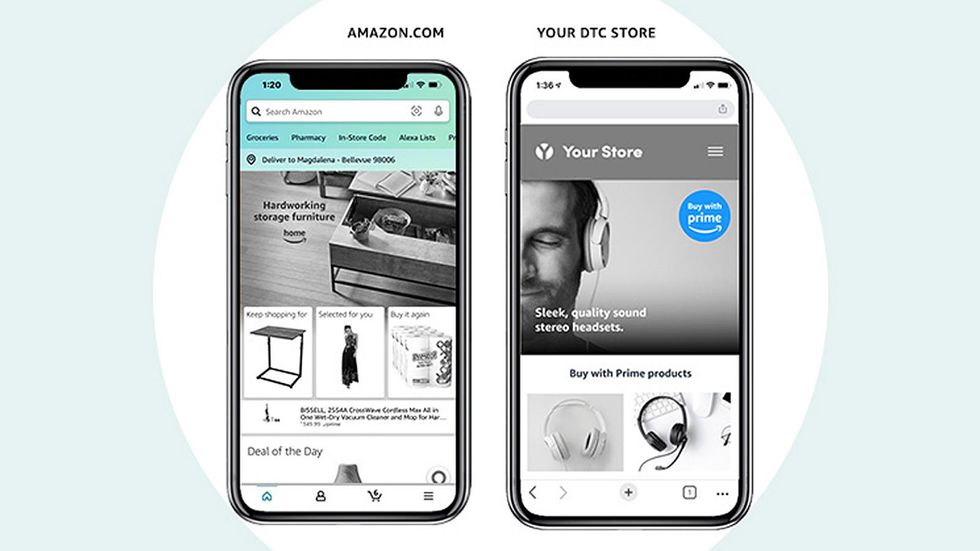

Buy With Prime is the new service Amazon introduced in April that allows Prime to extend beyond Amazon.com. Brands that operate independent websites can embed Prime checkout within their stores, and in turn guarantee two-day delivery and free returns through Amazon’s fulfillment network. The service is still invitation-only, but Amazon is already very publicly rolling out new features.

Buy With Prime helps with the back-end of a purchase, but it is also a way to tap into Prime’s reputation to help seal the deal on the front-end. With new marketing tools, Amazon said it wants to help brands leverage Prime to attract customers to their stores, as well.

One of the new features rolling out this week allows Buy With Prime products – which, remember, are available off-Amazon – to be advertised on Amazon. Brands can create multipage storefronts to show the products, and use customizable Sponsored Brands ads to direct users from shopping results pages to the storefronts. From the storefront, shoppers can view product details, and choose whether they want to buy the product directly from the brand at their website, or check out on Amazon. Both Sponsored Brands ads and Buy With Prime stores pages are in invitation-only beta.

The Current’s view: On its face, this sounds like Amazon is carving a path through Buy with Prime where DTC brands will eventually sell on Amazon. But the execution will matter here, particularly the functionality of the storefront. There’s a big distinction to be made depending on whether it offers anything near the level of detail of a normal Amazon product page, or essentially serves as a vehicle to get back to the DTC site. Plus, brands will want to keep control of the checkout page and customer relationships. That’s a big reason why they have DTC sites. Will they have to give any of that up for this storefront? Still, this could prove to be a lucrative option for Amazon advertising, given that many brands will want to appear on a site where 61% of US consumers begin their product searches, according to Jungle Scout.

Buy with Prime social media ads

Amazon is set to offer funded and managed social media ads for brands that use Buy with Prime. In particular, this feature will help these sellers reach customers on Facebook and Instagram, then direct them to their own store. It works like this: Buy With Prime has a page on Facebook and Instagram where brand ads appear. When users click through, they are taken to the Buy with Prime product’s page for a direct purchase. This feature is in invitation-only beta.

The Current’s view: Amazon didn’t offer a long description, but there’s a lot here. Facebook and Instagram are the very properties that are now more challenging advertising landscapes to navigate for many DTC brands as a result of the changes of the last year, so any solution that is moving onto those platforms is intriguing. Does Amazon have a solution embedded in this product to make advertising more effective on Meta properties? Will the Buy With Prime pages that appear on those platforms aggregate many DTC brands? Especially as Shopify releases Audiences to allow brands to tap the data of many stores on that platform to create lookalike audiences, could Amazon be taking a similar approach, but going straight to the platform? The questions abound, but this certainly has our attention.

Buy With Prime Badge

A Buy with Prime badge. (Courtesy photo)

DTC brands also have a way to show Buy With Prime within their own marketing. The free Buy with Prime Marketing Toolkit is set to roll out to make it easier for brands to include Buy with Prime branding as a part of their campaigns. The toolkit includes a Buy With Prime badge that can be displayed alongside their own brand in marketing.

The Current’s view: Offering two-day shipping, easy checkout and returns are table stakes in ecommerce operations these days, but customers still seek out details to make sure a brand offers them. Guaranteeing them is a way to build trust, and including Buy With Prime in marketing is a shorthand that could save customers the hassle of doing their own research. Again, execution will matter, though. Will there be rules on how and where the Buy with Prime brand can be displayed? Nevertheless, it’s another way that Buy with Prime could make Amazon even more ubiquitous across the web.

Epilogue: The Anti-Shopify?

Reading the new details about Buy With Prime features immediately brings to mind how they contrast with Shopify, and the looming competition between the two.

This is perhaps inevitable: Talk about direct-to-consumer brands, and it doesn’t take long before Shopify comes up. Shopify is the platform on which many DTC brands built their stores. Yet even as its leaders boasted of arming the rebels in contrast to Amazon’s empire, Shopify famously always wanted to stay in the background, at the infrastructure level. A store advertised its own brand, not that it was built with Shopify. Further, advertising doesn’t take place on Shopify itself. It provides the tools to build a store and helps to jumpstart ad buying and other functions, but brands must go to other platforms to attract customers back to their sites. This had lots of benefits, including offering the independence from platforms that many brands sought. But now the performance marketing playbook that helped many scale through Facebook and Instagram has to be rewritten, and brands are seeking other solutions.

With Buy with Prime, Amazon is not with a store builder, but by embedding itself within DTC websites. Even in these early stages, it is making some very anti-Shopify moves as it does so. Amazon is offering tools to help in marketing within its own ad network – something Shopify never had. Plus, the Buy with Prime badge is exactly the kind of overt display of association with a platform that Shopify long resisted. Buying Facebook and Instagram ads on behalf of brands isn’t territory that Shopify broached, either. Adding another ingredient to the brew, these are exactly the kinds of features that many have speculated and suggested that Shopify should build.

It only took five months for things to start to boil over. Shopify CEO Tobi Lütke initially voiced that he believed Shopify and Buy With Prime could co-exist, just as Shopify always has with Amazon. But the two prominent ecommerce companies seem to be increasingly on a collision course. After all, Shopify has its own checkout solution, called Shop Pay, which is offered as a feature that can be added to stores, and has also taken steps to expand it to other platforms like Google and Facebook. Looming in the background: Shopify is building out its own fulfillment network, and in turn is developing its own badge that guarantees two-day shipping and returns, called Shop Promise.

The signs of competition are starting to emerge. Marketplace Pulse reported last week that Shopify has started warning merchants who try to install a Buy with Prime script that they are installing code that violates Shopify’s terms of service, and removes protection against fraud, theft of customer data and price control. Buy With Prime now has marketing features that are designed to fill in gaps for brands.

These may just be the opening salvos. The question for brands is whether they will eventually have to choose between the two. That’s a tough position to put anyone in, let alone a rebel.

A Hexa 3D rendering (Courtesy photo)

A Hexa 3D rendering (Courtesy photo)