Retail Media

17 May 2023

How to avoid measurement pitfalls in retail media

Last touch attribution is the dominant form of measurement on many retail media networks today, but it has many limitations.

Last touch attribution is the dominant form of measurement on many retail media networks today, but it has many limitations.

Sponsored content with Incremental.

Retail media is growing up quickly. But if measurement doesn’t improve, it may not be able to stay at these heights forever. Even as retail media spurs a proliferation of new ad networks and transforms the digital advertising landscape, there are growing pains as brands and agencies seek to realize the full promise of advertising that harnesses close proximity to the point of sale and the power of first party retailer data.

In particular, questions are now being raised about how best to measure the effectiveness of retail media with the limited data being made available outside of walled gardens during a new era of privacy. This has driven the vast majority of retail media to be measured through self-reported last touch attribution, which has limited brands and agency’s ability to understand how those investments contribute to incremental growth for their business.

Let’s explore how retail media is being measured today, what got us here, and the limitations that come from how it is currently being measured.

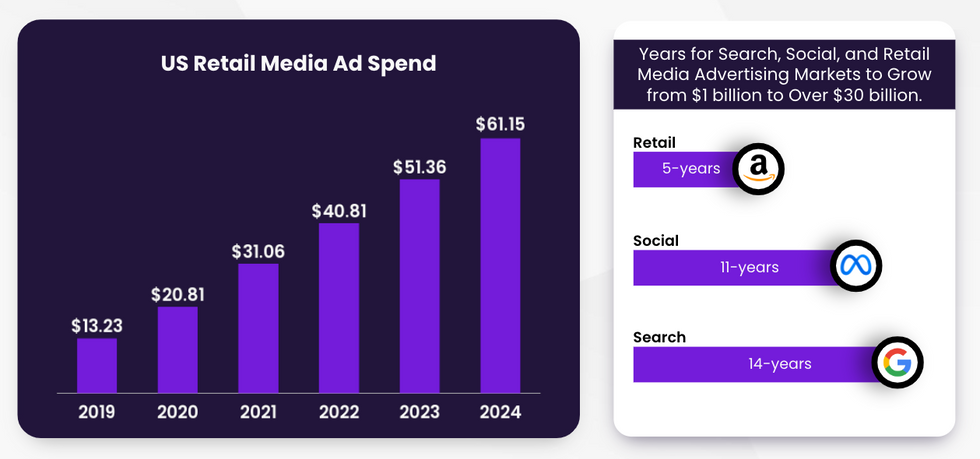

Retail media has exploded in the last five years. Pre-pandemic, U.S. retail media ad spend was $13.23 billion in 2019, according to eMarketer. By the end of 2023, it is expected to reach $51.36 billion by 2023, and $61.15 billion by 2024. Within the next two years, it will reach one in five digital advertising dollars.

The pace of this growth is unprecedented in advertising. Search advertising took 14 years to reach $30 billion in spend, while social media took 11 years to reach that level. By comparison, retail media reached $30 billion in a mere five years.

(Source: eMarketer, 2022)

Retail media was propelled by the growth of ecommerce over two years of the pandemic, and a wave of change in advertising technology that is reshaping the industry around privacy. This fast rise left a new landscape in its wake. Retail media is growing up in a very different environment from other forms of advertising. While there is massive opportunity to be had, there are also growing pains that are keeping retail media from reaching its full potential. Here’s a look at the emerging challenges:

More platforms. Every retailer is now an advertising business.The last two years brought a massive proliferation of retailers launching retail media networks and pushing their data into new ad types. Where advertisers previously worked with just one or two search-based retail media networks, they must now measure, manage, and coordinate across dozens of platforms and both on-platform and off-platform advertising inventory. This makes managing retail media a much more complicated task than it was in prior generations. It also means that measurement needs to be compatible across a growing landscape of not only platforms, but also a rapidly expanding menu of ad-types.

Walled gardens. Each of these ecommerce platforms is also an ad network unto itself. Advertising and sales take place within this walled garden. When it comes to data, there is almost no sharing or transfer taking place between the major networks. This means that marketing leaders looking to do their own measurement have to understand the nuances of each platform, and work with the relatively limited reporting that they make available contributing to a fragmented view of performance.

Privacy landscape. Consumer privacy has radically changed since the early days of digital advertising. The once stable foundation of cookies and IDFAs that powered prior waves of growth are no longer durable ways of tracking consumers. When combined with the dominance of walled gardens, this means brands have limited ability to track consumers across platforms.

This is only going to get more complicated. Retail media is becoming foundational advertising. Yet, if the recent past is a good teacher, complexity will only grow. The first party data that powers retail media is already moving into additional channels, such as CTV (connected TV). Consumers are also shopping across more platforms. This too will compound the growing pains already being experienced by advertisers.

Robust measurement has always been key to driving incremental growth from advertising. For brands and agencies, that means the ability to maximize the return on advertising has always been limited by the sophistication and robustness of the measurement tools made available to them. Those with better measurement have consistently been able to generate competitive advantage, from the early days of TV in the 1960’s with P&G pioneering what would become marketing mix models to the first mover's advantage in the DTC age of digital advertising.

One of the distinct advantages of retail media has been its clear tie to sales performance. Each retail media network has been able to close the loop on those ads with the sales on their ecommerce platform.

While the ability to directly link an ad to a sale is incredibly valuable, that doesn’t inherently make it a robust measure of how advertising influences consumer behavior. After all, consumers don’t shop in closed loops within a single platform, so measuring performance in this way only captures a sliver of the overall picture, which in turn, creates a fragmented view of how retail media fits into the overall customer journey.

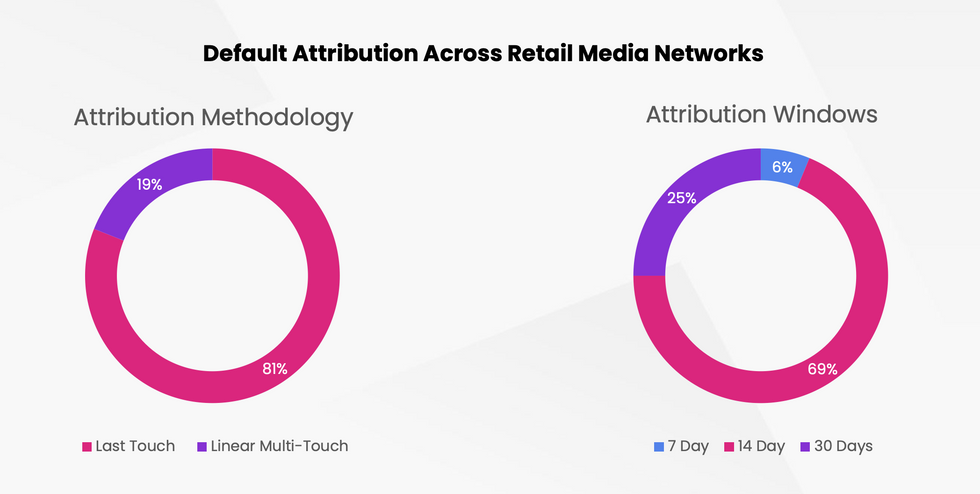

Beyond this splintering of measurement across multiple platforms and channels, the measurement approach or methodology itself can also limit the ability understand how advertising is driving incremental growth. While there are numerous media measurement methodologies that have been developed and refined over the years, retail media is almost exclusively measuring using a single approach. The vast majority of retail media networks today default to a single form of measurement: last touch attribution.

(Source: Incremental Research Based on count of RMN + Ad Type across Amazon, Criteo, Target, Walmart Connect, KPM, and Instacart)

An analysis conducted by Incremental of the top 16 ad types across major retail media networks showed that 80% use last-touch attribution. While there is variance in attribution windows, it’s fair to say that the efficiency of retail media today is nearly entirely based on last-touch.

This form of measurement aims to draw a direct link between an ad and a sale. The advertising gets credit for the sales as long as it takes place within a set attribution window. While this may seem like a straightforward approach to measuring advertising, it presents thorny questions in a couple of areas:

Which ad gets credit? If a user views two ads within an attribution window, which one gets credit? Should it be both, or only the most recent? Can a percentage be assigned to share credit?

Which product gets credit? If an ad viewed for one type of product unit results in a sale of a different unit in the same brand, what gets credit? For instance, if an ad is for a 2 liter of Coke and someone buys a six-pack, would the 2-liter ad still get credit? This is particularly important in retail media, which often advertises specific products.

While last touch attribution is widely used, this approach leaves many questions unanswered:

Incrementality: Does this advertising drive sales that I wouldn’t have without it? Am I just reaching users who would have converted anyway?

Cross-channel comparability: How does performance compare across platforms? Is there overlap in these investments across multiple retail media networks? Do ads in one retail media network drive sales through another? Does retail media also drive brick and mortar sales? How does retail media interact more broadly with my advertising? .

Budget: How does changing investment level impact the number of sales? If I double my budget will I get twice as many ad-attributed sales? When will I begin to see diminishing returns on my investment?

As the questions suggest, there are numerous shortcomings with last touch attribution. In particular, there are three pitfalls that make last-touch attribution poorly suited to measure retail media measurement today:

It inherently ignores the omni-channel nature of the customer’s journey.

Often, consumer journeys involve multiple retail and advertising channels. Before making a purchase, it’s common for a consumer to see an ad on CTV, conduct research on a brand’s website through Google, and pull up Amazon to click on a sponsored product ad and compare reviews. Yet the conversion may ultimately arrive offline during a last-minute run to the grocery store when a consumer sees an endcap.

Brands study these journeys closely and plan advertising campaigns to take advantage of the synergies between them. For example, lower-funnel advertising such as retail media may be more effective at converting users when run in concert with brand advertising on CTV that primes them to be more responsive to subsequent advertising.

But last touch attribution reduces this complexity to a single interaction. Because it only measures the last interaction with an ad before a sale in a single walled garden, last touch attribution does not assign credit to each of the touchpoints that led to the sale, and makes it difficult to understand the interaction between them. It also misses sales that convert in other channels, and ignores the synergy between retail media and other forms of advertising.

These relationships have a huge impact on planning, as advertisers may want to increase retail media spend during periods when the brand’s spend on upper funnel media is elevated or pull back during periods of high promotion. Last touch attribution won’t provide visibility into these cross-channel interactions, and ultimately that leads to ineffective decision-making.

It doesn’t account for external sales drivers.

Last touch attribution reduces the complexity of human decisionmaking to whether or not someone saw a single advertisement. This completely ignores the numerous other factors which drive purchases, from already being an existing customer to pricing, promotion, even seasonality, and the organic demand for the category.

These are often the biggest drivers of the business. In fact, most marketing mix models point to non-advertising factors driving 60-80% of sales. Without controlling for these external factors, the impact of retail media can be obscured under them. For example, it is not uncommon for brands to run advertising in concert with promotional efforts. In most cases, this causes a measurable spike in the campaign’s ROAS (return on advertising spend). But without untangling how two factors interact, how can we understand if it is the promotion driving the sale or the advertising? Or are both necessary to get the sale?

What is driving the sale – the advertising or the promotion?

If the impact of these external events are not disentangled from advertising, it can significantly misrepresent the actual impact of an ad on a sale. With limited visibility, marketers can also miss opportunities to increase spending during these periods in order to drive increased sales.

It lacks the predictive power to be used for budget planning.

The blunt nature of last touch attribution can imply that returns or yield of that investment will remain constant as you scale the investment. But marketing is non-linear. The relationship between budget and return can change drastically at different levels of spend.

Often, as spend increases, ROAS will reach a saturation point, where the returns will begin to flatten out. Last-touch attribution struggles to account for this.

Due to the blunt nature of how last-touch attribution assigns credit, it is not effective at predicting when a budget level reaches the point of diminishing returns. That means it is difficult to account for how changes in spend impact sales, as well as plan for future budgeting.

This limits brands’ ability to use retail media to generate incremental sales growth.

Collectively, these factors make last touch attribution a very poor measure of how retail media can drive incremental sales growth. At Incremental, we’ve done our own measurement of this at a campaign level. We compared last touch ad-attributed sales performance with our own incremental sales estimates – here we are looking at a cross section of 150 campaigns.

What this means is last touch attribution struggles to identify which campaigns are actually driving incremental sales for the business. As we’ve noted before, this can generate huge amounts of wasted investment that otherwise could be deployed for generating sales growth.

While last touch attribution is widely used today, it is not the only available methodology for measuring retail media. There are alternative approaches which can help unlock incremental growth from their retail media through better measurement. At Incremental, we are on a mission to help brands and agencies unlock this incremental growth through neutral measurement.

Here's the events and earnings calendar for June 5-9.

Welcome to a new week. We’ll get the latest look at the state of the consumer from big CPG companies and DTC brands alike via earnings reports. Plus, supply chain and marketing professionals each have conferences that offer networking and learning.

Here’s a look at the calendar:

GS1 Connect: Supply chain professionals gather in Chicago for a conference featuring more than 500 companies. Programming includes speakers, roundtables and sessions designed to educate attendees about doing business with industry leaders. (June 5-7, Denver, Colorado)

CRMC: Retail brands gather in Chicago to learn from case studies, keynotes and networking. Focus areas include marketing, loyalty and rewards, diversity and inclusion and influence and engagement. (June 7-9, Chicago)

WWDC: Apple will unveil new products and features at its annual conference for developers. A virtual reality headset is rumored to be among the big debuts.

Tuesday, June 6: JM Smucker & Co., Stitch Fix

Wednesday, June 7: Campbell Soup Co., Rent the Runway, Torrid

Thursday, June 8: Signet Jewelers, Designer Brands