Amazon is rolling out a new service that will allow merchants to offer the company’s Prime benefits through their own websites.

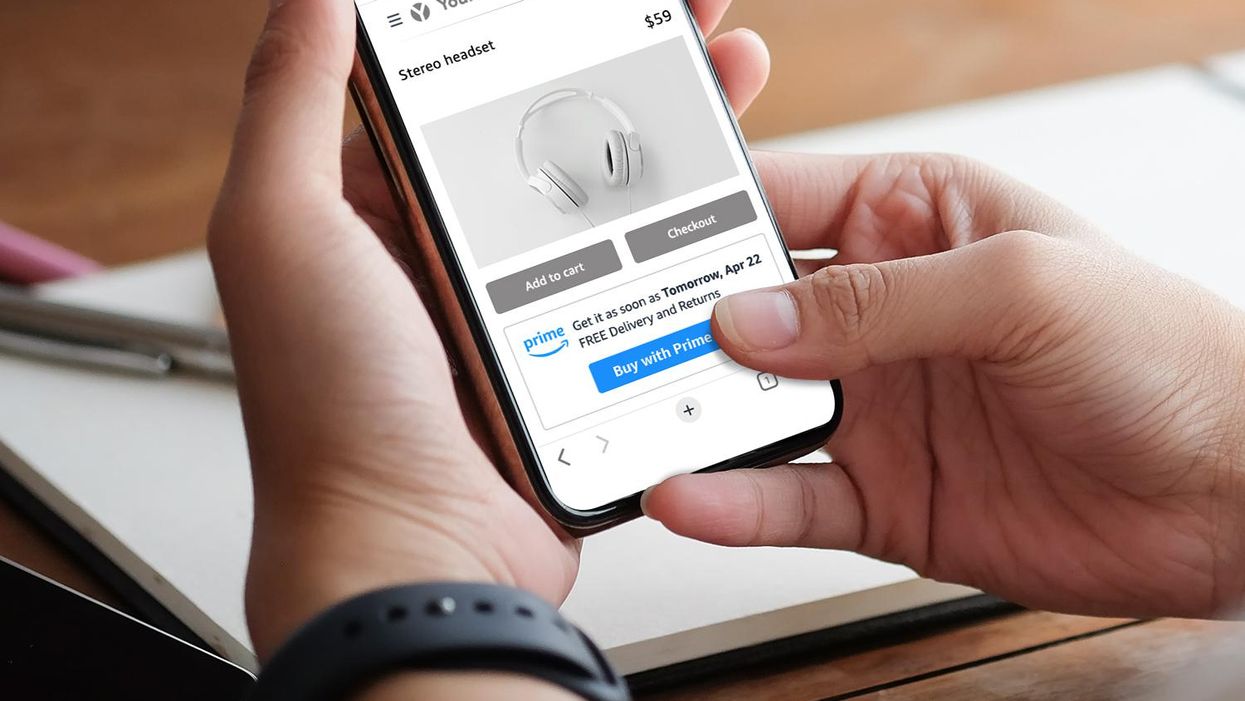

Buy With Prime opens up the checkout, fulfillment, delivery and returns that are hallmarks of the company’s subscription service for use at online stores beyond Amazon’s website.

The service will initially be available on an invitation-only basis for merchants using Fulfillment by Amazon (FBA). As it rolls out in 2022, Amazon indicated it will invite merchants that are not currently selling on Amazon or using FBA.

Supported by Amazon’s vast logistics network, Prime provides its 200+ million members with free delivery, shipping that comes as soon as the next day and free returns. Merchants who participate in Buy with Prime will be able to offer these services directly in their online stores, with a Prime badge displayed next to the products to which it applies. Prime members, in turn, will be able to use payment and shipping info from their Amazon account when they check out at the outside stores.

"For over 20 years, we’ve been empowering small and medium-sized businesses with opportunities to grow," said Peter Larsen, Amazon’s VP of Buy with Prime, in a statement. "Allowing merchants to offer Prime shopping benefits on their own direct-to-consumer online stores is an exciting next step in our mission to help merchants of all sizes grow their business—whether on Amazon or beyond. With shoppers purchasing directly from merchants’ online stores, Buy with Prime will allow merchants to build customer relationships and brand loyalty while offering conversion-driving benefits like fast, free shipping."

For merchants, there won’t be a subscription fee to the service. Rather, pricing will be based on a service fee, a payment processing fee and fulfillment and storage fees that are calculated per unit.

For sellers, here’s how it will work to get started, according to Amazon’s press release:

For merchants already using FBA, Buy with Prime can be added to their online store within minutes because their inventory is already stored in Amazon fulfillment centers. To get started, merchants sign up for Buy with Prime, link an Amazon Seller Central account, use Multi-Channel Fulfillment to offer one pool of inventory for multiple channels, and link an Amazon Pay account to offer a seamless checkout experience for Prime members. Then, by installing a JavaScript widget in their online store, merchants can easily add Buy with Prime to one or more products. With Buy with Prime, merchants will receive shopper order information, including email addresses for customer orders, which they can use to provide customer service and build direct relationships with shoppers.

The company said Buy With Prime will work with “most online stores,” and its press release pointed to BigCommerce, whose SVP of Product Troy Cox was quoted as saying that extending Prime benefits to merchants will “help elevate their online shopper experiences, build brand loyalty, and power them to grow and scale."

“Buy with Prime will be a game changer for our brand. Prime members will enjoy the trust and familiarity they have with shopping on Amazon while connecting with our business directly on our own site,” said David Ghiyam, president of vitamins brand MaryRuth Organics, in a statement included with Amazon's news release. “When we began using Fulfillment by Amazon, our business quadrupled in growth thanks to Amazon’s logistics network and our Prime-eligible listings. Using Buy with Prime, we will be able to drive the conversion we’ve experienced with Fulfillment by Amazon while running our business on our own site.”

By offering tools that appear on direct-to-consumer websites, Amazon is moving into territory that is often considered the province of Shopify. The ecommerce companies long took distinct approaches. Amazon created a central marketplace on its website, providing access to its massive audience while setting terms for how items could be displayed and priced. Shopify’s platform offered the infrastructure for independent online stores that attracted shoppers from other channels, while enabling entrepreneurs to maintain their own look and terms.

The Buy With Prime announcement comes at a time when Shopify is making moves to offer more shipping and logistics services to its merchants. Last month, it invested in Shippo and launched a native integration for its platform that allowed merchants to tap the service’s network of carriers and infrastructure. This week, Bloomberg reported that Shopify is in talks to acquire Deliverr, a fulfillment company that integrates with ecommerce marketplaces and allows merchants to offer two-day shipping.

Through Buy with Prime, Amazon is offering its own integration, backed by its massive logistics network. At the same time, sellers can present their products within their own stores and keep running their sites on platforms like BigCommerce, while still tapping into what Amazon offers. For shoppers, it means a Prime membership is beneficial beyond Amazon, or a property the company owns like Whole Foods. It remains to be seen whether the Buy With Prime strategy is successful, but the move appears to be one that could further embed Amazon within the ecommerce landscape.

A Hexa 3D rendering (Courtesy photo)

A Hexa 3D rendering (Courtesy photo)