Operations

01 September 2022

With AWD, Amazon is introducing 'supply chain as a service'

Amazon Warehousing & Distribution is offering bulk inventory storage to third-party sellers.

Photo by Adrian Sulyok on Unsplash

Amazon Warehousing & Distribution is offering bulk inventory storage to third-party sellers.

Amazon is set to introduce a service for third-party sellers: Storage.

At a time when many brands and retailers continue to face supply chain issues, Amazon Warehousing & Distribution (AWD) is set to provide sellers with space to store bulk inventory.

Amazon said it is making new facilities available for the program, where sellers can store goods that are awaiting the move into position for ordering and shipment. From these facilities, the inventory can then be tapped to automatically replenish supplies at Amazon's fulfillment centers, where orders are packed and shipped to customers.

“With this simple pay-as-you-go service, sellers are free from the time-consuming, cumbersome process of moving inventory from upstream facilities to Amazon fulfillment centers,” Amazon VP of Distribution and Fulfillment Solutions Gopal Pillai, wrote in a blog post announcing the service. “AWD makes the promise of supply chain as a service a reality and is specifically designed to solve inventory management challenges and deliver operational efficiencies.”

Amazon added that sellers using the service will be able to consolidate global inventory into one pool, which can in turn be managed through Seller Central.

In 2023, Amazon said the service will be available for sellers to send their inventory to “any location,” including wholesale customers or brick-and-mortar stores.

At a time of supply chain headaches, storage has become one of the biggest challenges for brands and retailers selling consumer goods over the last three years. According to a recent report on the state of US logistics by the global management consulting firm Kearney, warehousing capacity reached its peak in 2021. Vacancy rates dropped to their lowest point on record, while the cost of storage per square foot rose to the highest. Michael Zimmerman, a partner at Kearney who runs the global logistics practice, told attendees of the NACDS Total Store Expo that supply chain issues are likely to continue, and advised them to work to add capacity.

“You’ve probably heard the expression, ‘Hope is not a strategy,’” said Zimmerman. “This is a perfect example of that. Get your supply chains ready.”

For its part, Amazon said a recent survey of US sellers showed that the three biggest pain points for sellers in upstream warehousing and distribution operations are:

As it navigated skyrocketing demand for goods sold online and sought to speed delivery times, Amazon added significantly to its logistics network over the last three years. It now stands at about 1,250 facilities in the US, according to the supply chain and logistics consulting firm MWPVL. In fact, the network had grown so large that in April executives said the company had overbuilt warehouse space, and would pursue subleasing and consolidation while slowing expansion in the latter half of 2022.

With new facilities coming online for AWD, apparently that doesn't mean expansion is being halted together. With AWD, Amazon is putting warehouses to work for sellers, who run independent businesses that sell on Amazon's marketplace. AWD will be a service offered to third-party sellers in addition to Fulfillment by Amazon, the service that allows third-party sellers to allow the fulfillment of orders to Amazon. It is also rolling out Buy With Prime, a service that allows brands to make Amazon's shipping and returns services available to websites outside of Amazon.com, and, in turn, presumably will lead these brands to tap into FBA.

For its part, AWD offers a path to enter Amazon's logistics network earlier in a good's journey, and adds capacity to that network. The new warehouses that will be part of AWD are “purpose-built facilities for bulk inventory storage and automated distribution,” the company wrote.

“With one click sellers can send their inventory to Amazon Distribution Centers and significantly reduce storage costs, while eliminating complex pricing schemes and long-term contracts that are common throughout the industry,” Pillai wrote. “Sellers can integrate their upstream inventory storage operations with the Amazon Fulfillment Network, ensuring they always have the right amount of inventory in stock, in the right places and at the right times.”

There are still specifics of AWD that must be filled in ahead of the 2023 launch. The blog post quoted Harris Chan, senior business manager at AmaMax, who said that," Automated replenishment and master case handling is the key of the program," but it's not clear how. Other details on how AWD will work and pricing were not immediately available. Amazon said it will share more about AWD at Amazon Accelerate, the annual seller conference that is set to take place September 14-15.

Offering services to third-party sellers has proven kind to Amazon's business. In its second quarter earnings report, the company said these sellers were responsible for 57% of sales on Amazon, which was a record. Revenue from third-party seller services rose 13% to more than $27 billion, a record for a non-holiday quarter. On the other hand, Amazon's overall sales from ecommerce fell 4%.

Amazon built its logistics network to serve its own needs in moving inventory into place, shipping and delivering packages. Now, it is one of the largest in the country. With that scale, it is offering parts of that network up to others, turning what could be a cost center into a potential business booster.

It recalls how Amazon offered the cloud infrastructure it built to others through Amazon Web Services (AWS), which was long run by current Amazon CEO Andy Jassy and is now one of the company's most lucrative divisions. Along with similar acronyms, the two services will now share a similar primary offering: storage.

Logistics are one of the most expensive parts of ecommerce, so it would be all the more impressive if Amazon could turn a profit in an area that leaves many in the red.

At the same time, the service arrives as other retail leaders are building out supply chain networks. Shopify is making a big investment in building an "asset light" fulfillment network following the $2.1 billion acquisition of Deliverr. Meanwhile, American Eagle Outfitters is standing up Quiet Platforms as a vertical network of logistics partners that can join forces and take on the biggest names. Gap Inc. said last week that it is making its fulfillment logistics services available to other brands and retailers, as well.

But Amazon remains the largest and most mature logistics network. New services like AWD show how it can press that advantage by adding major capacity. It also shows how it can create an easy-to-use service that is difficult for sellers to refuse. Amazon grew by promising one click service to consumers. Now, it wants to offer that convenience to sellers, too.

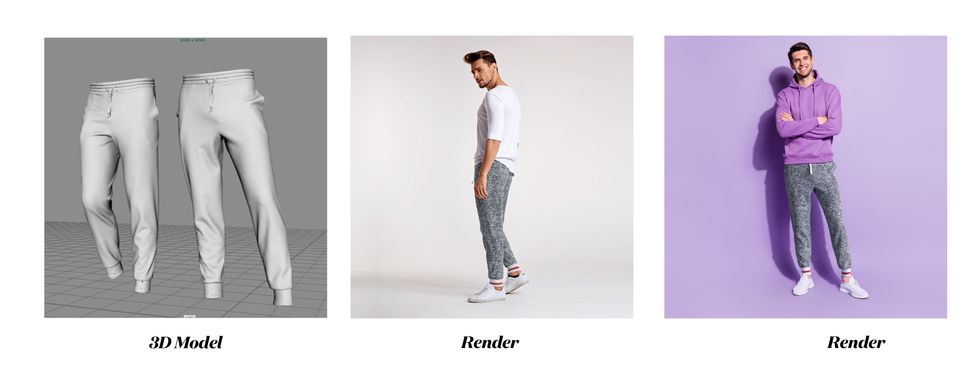

Amazon partnered with Hexa to provide access to a platform that creates lifelike digital images.

A 3D rendering of a toaster from Hexa and Amazon. (Courtesy photo)

Amazon sellers will be able to offer a variety of 3D visualizations on product pages through a new set of immersive tools that are debuting on Tuesday.

Through an expanded partnership with Hexa, Amazon is providing access to a workflow that allows sellers to create 3D assets and display the following:

Selllers don't need prior experience with 3D or virtual reality to use the system, according to Hexa. Amazon selling partners can upload their Amazon Standard Identification Number (ASIN) into Hexa’s content management system. Then, the system will automatically convert an image into a 3D model with AR compatibility. Amazon can then animate the images with 360-degree viewing and augmented reality, which renders digital imagery over a physical space.

Hexa’s platform uses AI to create digital twins of physical objects, including consumer goods. Over the last 24 months, Hexa worked alongside the spatial computing team at Amazon Web Services (AWS) and the imaging team at Amazon.com to build the infrastructure that provides 3D assets for the thousands of sellers that work with Amazon.

“Working with Amazon has opened up a whole new distribution channel for our partners,” said Gavin Goodvach, Hexa’s Vice President of Partnerships.

Hexa’s platform is designed to create lifelike renderings that can explored in 3D, or overlaid into photos of the physical world. It allows assets from any category to be created, ranging from furniture to jewelry to apparel.

The result is a system that allows sellers to provide a new level of personalization, said Hexa CEO Yehiel Atias. Consumers will have new opportunity see a product in a space, or what it looks like on their person.

Additionally, merchants can leverage these tools to optimize the entire funnel of a purchase. Advanced imagery allows more people to view and engage with a product during the initial shopping experience. Following the purchase, consumers who have gotten a better look at a product from all angles will be more likely to have confidence that the product matches their needs. In turn, this can reduce return rates.

While Amazon has previously introduced virtual try-on and augmented reality tools, this partnership aims to expand these capabilities beyond the name brands that often have 1P relationships with Amazon. Third-party sellers are an increasingly formidable segment of Amazon’s business, as they account for 60% of sales on the marketplace. Now, these sellers are being equipped with tools that enhance the shopping experience for everyone.

A video displaying the new capabilities is below. Amazon sellers can learn more about the platform here.

Hexa & Amazon - 3D Production Powerhousewww.youtube.com