Shopper Experience

07 July 2022

These new features show how Pinterest wants to grow ecommerce

The platform is rolling out a new API, product tagging and video capabilities for merchants.

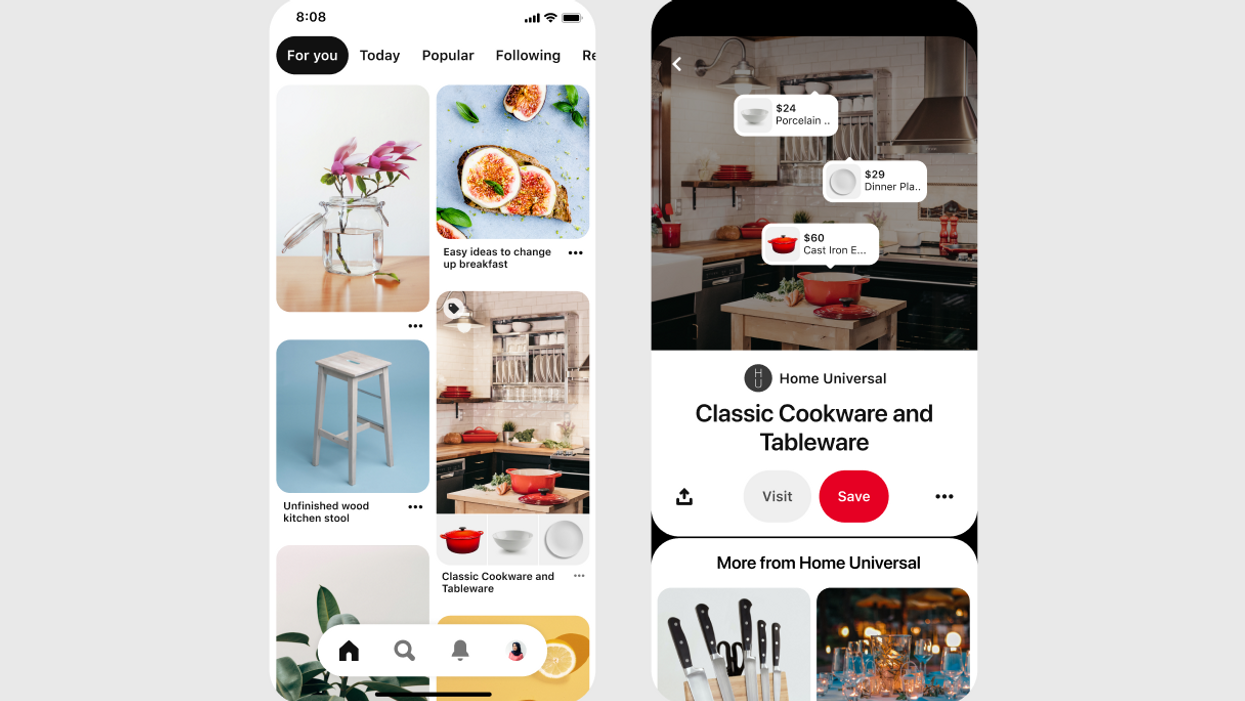

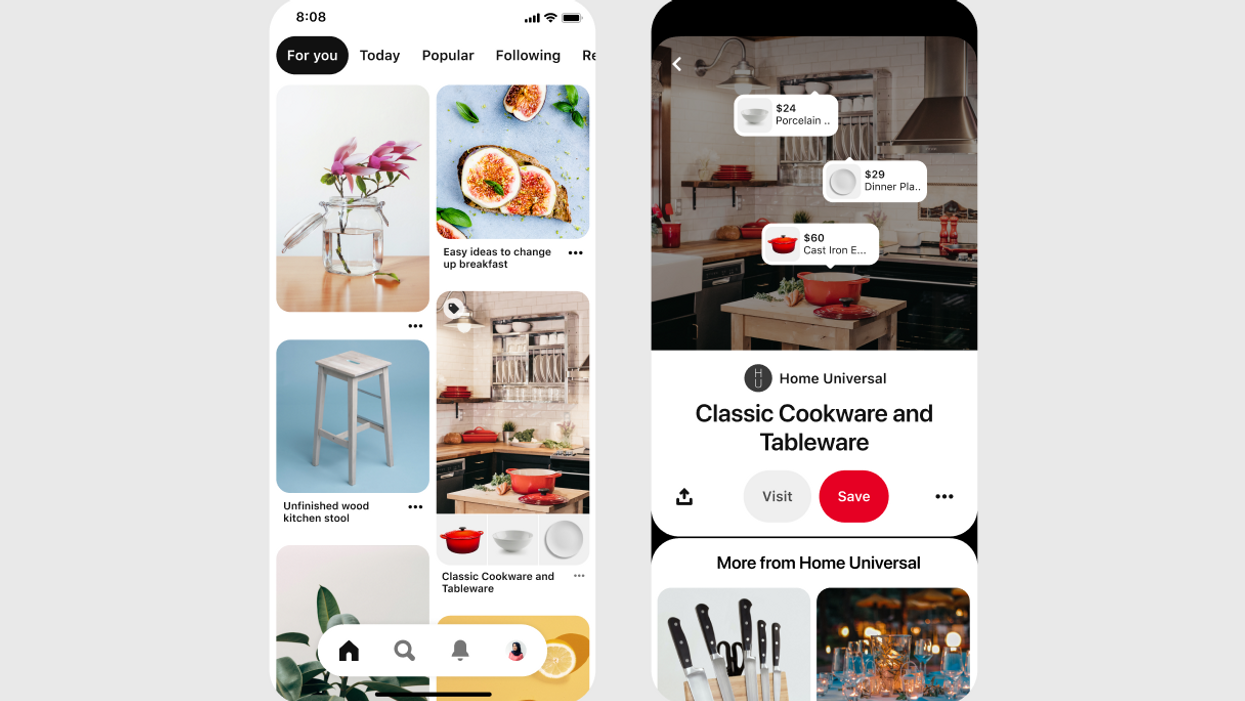

Product tagging on Pinterest. (Courtesy photo)

The platform is rolling out a new API, product tagging and video capabilities for merchants.

Product tagging on Pinterest. (Courtesy photo)

Pinterest has been making a series of moves signaling an expansion of ecommerce capabilities.

It was apparent as the visually-oriented social platform brought on a new CEO last week. Bill Ready brings experience as the former head of Google commerce and payments. In announcing his transition to executive chairman, cofounder Ben Silbermann hinted at how ecommerce would be the focus of Pinterest’s “next chapter.”

It was apparent through M&A. Earlier in June, Pinterest acquired The Yes, an AI-powered shopping app that provides a personalized feed of fashion items based on a user’s size and preferences. With the deal, Pinterest appointed The Yes CEO Julie Bornstein as its head of ecommerce strategy.

Now, it is apparent through product updates.

On Thursday, Pinterest announced a series of new features specifically designed for merchants, including a shopping-focused API and product tagging. The release offers a look at the tools through which the image-based platform will aim to grow as a shopping destination.

The company indicated it is seeing a convergence of commerce-related activities on the platform. The number of merchant catalogs on the platform increased 87% in Q1 2022 compared to the year prior, per the company.

At the same time, users are increasingly in a buying mood. The company said 89% of weekly Pinners use Pinterest as inspiration in their path to purchase, while the number of Pinners engaging with shopping surfaces on Pinterest grew over 215% in 2021.

The personnel announcements and data sets the tone for the company's designs on becoming a home for shopping. New features point at how it will work.

Pinterest’s strong suit is in the early stages of a journey. Users look to the platform for ideas. With commerce features, Pinterest wants to create a path where they can purchase what they see.

"Our vision for shopping is to make it possible to buy anything Pinners are inspired by on the platform," Pinterest SVP of engineering Jeremy King, said in a statement.

With the new features, King said, the goal is to allow brands and retailers to “reach high-intent Pinners during the earliest stage of their shopping journey with the most updated catalog data.”

The features announced Thursday include the following:

This will allow merchants to make lifestyle Pins shoppable. Building on already-available standalone product Pins, This allows merchants to add products from their catalog to scene images. “In initial tests, Pinners showed 70% higher shopping intent on product Pins tagged in scene/brand images than standalone product Pins,” Pinterest said.

This will provide merchants with new tools to manage a catalog and product metadata. This will allow merchants to give Pinterest users more accurate information about pricing and availability of items that appear on the platform.

Seeing success of “video-like ad formats,” Pinterest is rolling out new capabilities that allow merchants to add video of products within a catalog. This will offer the chance to show a product from multiple angles.

An updated shop tab will allow merchants to customize a product group’s cover image and description, and offers an enhanced mobile interface.

These aren’t the first shopping features Pinterest has rolled out recently. Back in March, it introduced a personalized shopping page for users, as well as a beta of in-app checkout. It has rolled out augmented reality try-on tools earlier this year.

With the recent acquisition of The Yes and Ready’s introduction as CEO all coming just within the last month, it’s probably a good bet that upgrades will continue.

But the features rolled out Thursday offer a look at pieces of the journey it is moving into place. Pinterest wants to help users get a good look at items displayed in Pins and engage directly with brands and retailers, while allowing brands to ensure those items are priced and available.

Pinterest isn’t alone among platforms making a push into social commerce. To name a few recent releases: Snapchat expanded AR features designed for ecommerce, Instagram added product tagging and Twitter recently announced a shopping-focused partnership with Shopify.

It means brands and retailers will have more places to not just run ads, but set up a store-like presence. It reinforces that a new wave of ecommerce is emphasizing reaching shoppers wherever they are, rather than directing them to a couple of platforms. This has the potential to be powerful. After all, Pinterest has more than 400 million monthly active users. That's a big community to tap.

With these buildouts, each platform's ecommerce capabilities will have its own distinct flavor. Along with an emphasis on the discovery phase of the shopping journey, Pinterest characterizes what it’s building as a “home for taste-driven shopping.” It will be intriguing to see where the personalization features from The Yes fit into that.

Still, it’s worth remembering that it’s widely acknowledged that no platform has cracked the code on social commerce yet.

Pinterest's ecommerce push has our attention. It will be interesting to see whether brands and retailers start to report success on the platform as these new features roll out.

A new AI Sandbox is the testing ground for generative features that could be soon rolling out to Facebook and Instagram ads.

Meta is bringing advancements in AI to its advertising tools, as the Facebook and Instagram owner seeks to improve performances for brands.

With AI advancing rapidly, the company is seeking to harness generative capabilities for social media advertising that has been an engine of ecommerce over the last decade.

Here’s a look at a series of new tools that Meta rolled out this week:

Meta rolled out a “testing playground” for new AI features. The idea is to provide space to learn what works, and create tools that are easy to use. The work is beginning with a small group of advertisers, and will roll out more widely in July. Some features may roll out more widely later this year, according to the company.

Initially, Meta is testing the following capabilities in the sandbox:

Text variation: This generates multiple versions of text, allowing advertisers to test different messages.

Background generation: This creates background images from text inputs, allowing rapid testing.

Image outcropping: Creative assets can be adjusted for different aspect ratios across Stories, Reels and other formats.

Advantage is Meta’s suite of automation and personalization tools for advertising. This week, it rolled out a series of features that are focused on expanding AI within this product set. These include:

Advantage+ audience: This product will provide a new way to reach people. Here’s how Meta describes it:

"Instead of using an advertiser’s audience targeting inputs as hard constraints, such as Men, 18-35 years, who like baseball, advertisers who use Advantage+ audience will add their audience inputs as suggestions to guide who sees an ad,” Meta writes. “This allows our ad system to find more people outside of those suggestions if we think they will be interested and likely to convert.”

Those "hard constraints" have long been key to Meta's targeting tools. The new product signals that their reach could extend. While intriguing, keep in mind that this is still in pilot mode, so it won't bring a paradigm shift just yet. The tool is currently in testing with a select group.

One-click Advantage+: Businesses will be able to switch from manual campaigns to AI-powered Advantage+ shopping campaigns with one click by clicking “duplicate” on a campaign in Ads Manager. The feature will roll out gradually within the next month.

Video creative: Advertisers will now be able to add video creative to catalog ads, which promote a variety of products. This includes the ability to upload brand creative or customer demos. Meta will then apply AI to show the “best” video to people Feed, Stories, Watch and Reels.

Performance comparisons: A new automatic report will allow a comparison between manual campaigns and Advantage+ shopping campaigns. This will enable a better understanding of how AI has a positive impact on performance.