Shopper Experience

10 May 2023

Amazon’s age of discovery

New shopping feeds show Amazon is exploring how to show users what they want, not just what they need.

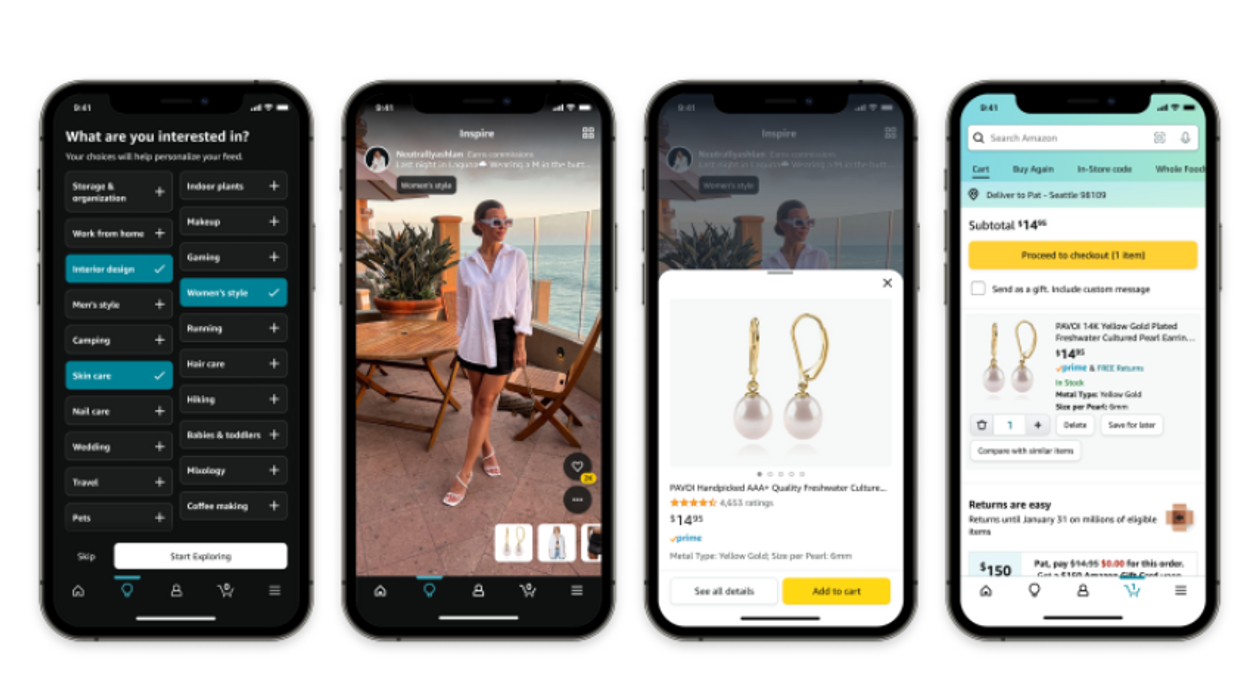

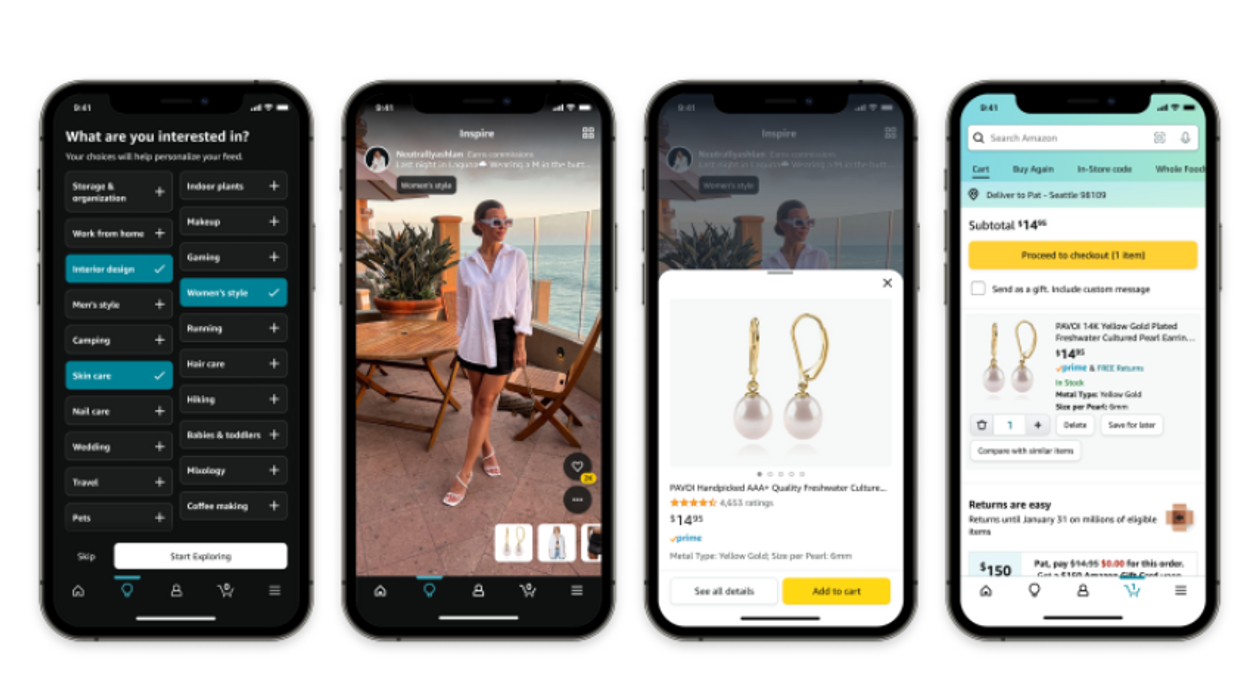

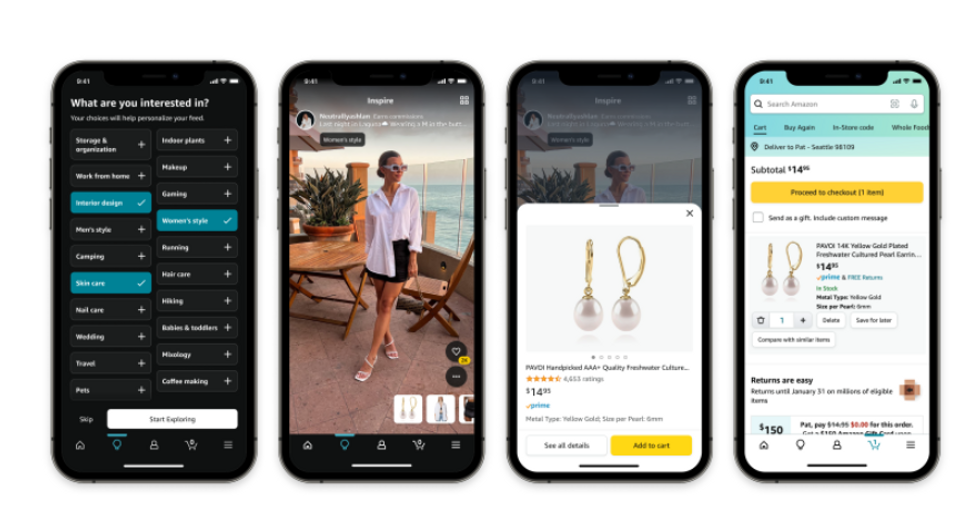

Amazon Inspire is a TikTok-like shopping feed. (Courtesy photo)

New shopping feeds show Amazon is exploring how to show users what they want, not just what they need.

Amazon Inspire is a TikTok-like shopping feed. (Courtesy photo)

Amazon has long been the primary ecommerce site to visit if you know what you want to buy. With a new wave of pilots, the retailer is showing signs that it wants to help users discover new items they didn’t knew they wanted – both on Amazon’s marketplace and beyond.

Over the last two weeks alone, Amazon rolled out the following:

These releases are separate products on different surfaces, but they unite around a common intent to bring Amazon products to users in the places where they are browsing. Today, navigating to Amazon is like going to the mall. With these features, Amazon’s mall is coming straight to shoppers in the place where they are spending time.

Amazon built a massive lead in ecommerce by becoming the everything store, and the destination for online shopping. The search-based shopping experience is honed to deliver users the results they are seeking, and make it as easy as possible to check out. By the late 2010s, Amazon’s constant, data-driven honing of this experience helped the company overtake Google as the top point of origin for new product searches.

But over that same decade, a new form of ecommerce was springing up. Direct-to-consumer brands honed social media-based advertising that met shoppers while they were scrolling Facebook. Instead of seeking out a specific item, consumers increasingly found themselves buying a new pair of pants when they meant to log on to check out their friends’ wedding photos. Influencer marketing only further embedded commerce into the social media experience. When powerful targeting algorithms combined with the visual experience of platforms like Instagram and TikTok, it proved to be a potent mix for driving conversions from ads on social platforms to checkout pages on brand websites.

To be sure, Amazon has been no stranger to advertising on social media, as any Prime Day Instagram feed will tell you. But for the most part, the shopping experience on Amazon itself didn’t change through the years of DTC disruption. Amazon.com kept all of the hallmarks of the marketplace that are designed to help shoppers find what they came to buy, pick from the largest selection possible, locate the item that’s right for them at the best price possible. There’s little space for interactivity and visuals in that mix. That shopping experience is also now the basis for a massive advertising business, so it is unlikely to undergo massive change quickly.

But with these new features, Amazon is signaling that it is learning the lessons of social media-based ecommerce, and its ability to turn casual users into customers with the right content. The additions described here are nascent – as all three are either new or merely experiments. Yet the results of these tests could inform a new phase of building at Amazon. So let’s take a look at each, and their implications:

Amazon Inspire. (Courtesy photo)

Announced in December, Amazon’s long-awaited visual shopping feed went live in early May. The in-app feed offers shoppable short-form videos and photos featuring products shared by influencers, brands and other customers.

Here’s how TechCrunch described the experience at launch:

To get started with Inspire, you have to open the Amazon Shopping app, sign in to your account and then tap the Inspire “light bulb” icon on the bottom navigation bar. You will then be prompted to choose from over 20 interests, including categories like makeup, skin care, pets, gaming, plants, hiking, interior design, travel, running and more to personalize your Inspire feed.

You can double-tap anywhere on the screen to “like” the content you see. As for the scrolling experience, it’s like using TikTok’s vertical video feed, where you swipe up from the bottom to see the next video. Engagement buttons are on the right side of the screen, just like they are on TikTok.

If you see something you like, you can scroll horizontally through the small buttons that display the products in the video at the bottom of your screen. When you click on a product, it will appear in an overlay window on top of the video. You can select the “See all details” button to be taken to the item’s product page where you can make a purchase or add the item to a list.

What it means: Inspire is taking a more person-centered approach to visuals, and prioritizing engagement in a way that has been rare on a marketplace that is laser-focused on moving users to checkout as efficiently as possible. It’s a big change, but shopping is still the main behavior. All of the content features products, as opposed to the mix of memes and dance crazes that you’d find on a TikTok feed.

Whether users want a shopping-only feed remains to be seen, but the potential upside for Amazon is that people will end up scrolling on Amazon just to watch the content. Maybe they’ll end up buying something, too. But even if they don’t, they will ultimately spend more time on Amazon. For now, Inspire just a test and occupies a small piece of real estate on the app, but the results could say a lot about whether Amazon can bring more social elements to its mix.

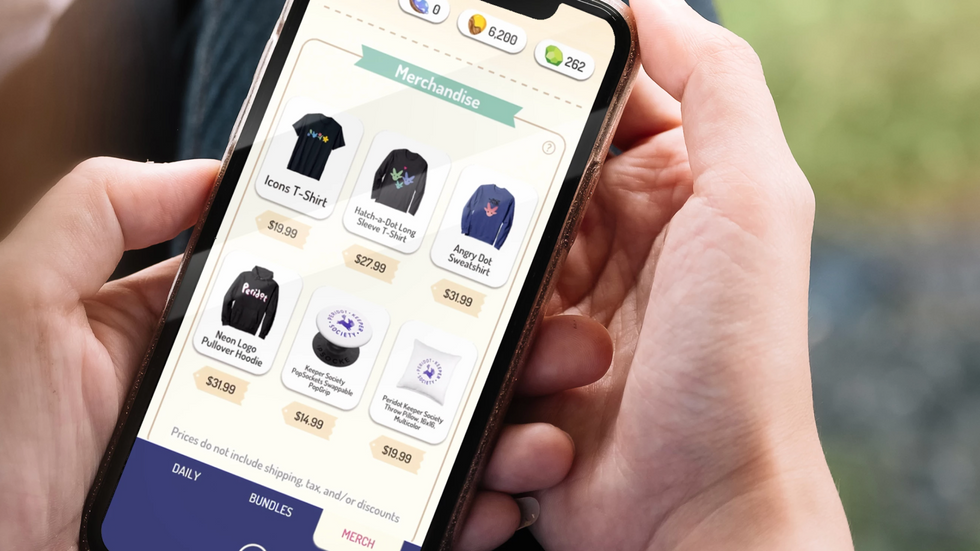

Amazon Anywhere. (Courtesy photo)

The metaverse may not be here yet, but Amazon is seeking to make good on the promise of crossing physical and digital shopping now. This new feature brings storefronts featuring physical goods to video games and other digital worlds. Initially, a shop will appear in the augmented reality game Peridot. Here’s how it works, per Amazon:

After seamlessly linking your Amazon account to Peridot, you can find Peridot-branded products such as T-shirts, hoodies, phone accessories, and throw pillows featuring artwork of magical creatures from the game. You’ll see the familiar product details, images, availability, Prime eligibility, price, and estimated delivery date as you would in Amazon stores.

It’s easy to then tap the “buy” button and check out using your linked Amazon account without leaving the game. Products will ship to you like any other purchase from Amazon, and you can track and manage orders via the Amazon app.

What it means: This is an example of Amazon introducing shopping into an experience where users may not have been seeking it out, and going beyond Amazon.com to reach them. A player probably doesn’t log into Peridot thinking they are going to buy something, but now they have a way to do so. Enabling in-game purchasing is another step that makes the process easier. This is similar to introducing a shopping ad to a user scrolling on social media, except in this case the browsing and buying experience is even more embedded.

More games and virtual worlds are likely to gain shops in the future. Amazon Anywhere also includes tools for developers and creators in virtual worlds to curate products from Amazon’s selection, including a brand’s own merchandise.

Amazon ads will soon be showing up in Pinterest feeds, thanks to a recently-announced partnership between the companies. It’s the first time Pinterest will be accepting third-party ads.

The ads aren’t live yet, but executives have said it works this way: Pinterest will now host shoppable ads from brands that advertise on Amazon. Users who click on a Pinterest ad will be taken to an Amazon checkout page.

What it means: Here, Amazon is making a direct play into social media-based advertising. It will help users that are browsing for ideas on Pinterest to discover products they can buy on Amazon. Coming at a time when Pinterest is seeking to elevate commerce within its user experience, there will likely be a lot for Amazon to learn about how people interact with shoppable content on a social feed from this partnership.

There are also important implications for Amazon advertising here, which is an increasingly important part of the company’s business. Right now, purchasing Amazon ads buys a brand space on Amazon’s website. Now, it could also buy space on Pinterest, and still leverage the first-party data that powers the placement on Amazon. It implies that shoppable ads can be a vehicle to extend the reach of retail media, which describes advertising on ecommerce marketplaces, to social media platforms.

Through shoppable content, Amazon’s reach figures to extend further across the web. Increasingly, shoppers may run into Amazon, wherever they happen to be browsing.

Labor disputes on the West Coast could cause further disruption heading into peak season.

When the first half of 2023 is complete, imports are expected to dip 22% below last year.

That’s according to new data from the Global Port Tracker, which is compiled monthly by the National Retail Federation and Hackett Associates.

The decline has been building over the entire year, as imports dipped in the winter. With the spring, volume started to rebound. In April, the major ports handled 1.78 million Twenty-Foot Equivalent Units. That was an increase of 9.6% from March. Still it was a decline of 21.3% year over year – reflecting the record cargo hauled in over the spike in consumer demand of 2021 and the inventory glut 2022.

In 2023, consumer spending is remaining resilient with in a strong job market, despite the collision of inflation and interest rates. The economy remains different from pre-pandemic days, but shipping volumes are beginning to once again resemble the time before COVID-19.

“Economists and shipping lines increasingly wonder why the decline in container import demand is so much at odds with continuous growth in consumer demand,” said Hackett Associates Founder Ben Hackett, in a statement. “Import container shipments have returned the pre-pandemic levels seen in 2019 and appear likely to stay there for a while.”

Retailers and logistics professionals alike are looking to the second half of the year for a potential upswing. Peak shipping season occurs in the summer, which is in preparation for peak shopping season over the holidays.

Yet disruption could occur on the West Coast if labor issues can’t be settled. This week, ports from Los Angeles to Seattle reported closures and slowdowns as ongoing union disputes boil over, CNBC reported. NRF called on the Biden administration to intervene.

“Cargo volume is lower than last year but retailers are entering the busiest shipping season of the year bringing in holiday merchandise. The last thing retailers and other shippers need is ongoing disruption at the ports,” aid NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “If labor and management can’t reach agreement and operate smoothly and efficiently, retailers will have no choice but to continue to take their cargo to East Coast and Gulf Coast gateways. We continue to urge the administration to step in and help the parties reach an agreement and end the disruptions so operations can return to normal. We’ve had enough unavoidable supply chain issues the past two years. This is not the time for one that can be avoided.”