Shopper Experience

01 May 2023

Meet Flip, a social network powered by the 'voice of the shopper'

CEO Noor Agha says shopper-generated reviews are the key to creating a commerce community built on trust.

(Image courtesy of Flip)

CEO Noor Agha says shopper-generated reviews are the key to creating a commerce community built on trust.

(Image courtesy of Flip)

Social media and ecommerce are closely intertwined. In fact, they’ve long been in a symbiotic relationship.

Last decade, consumer product advertising helped to supercharge the businesses of social media platforms like Facebook and Instagram, while the audiences those networks attracted and the targeting tools they offered in turn became a powerful conversion engine for ecommerce brands.

Eventually, this close relationship inspired ecommerce marketplaces and social media platforms to attempt to bring elements of each other into their platforms. Social commerce held out the promise that brands could depend on one platform for the entirety of the shopping journey, from discovery and browsing to evaluating the product via visualizations and reviews to checkout and post-purchase.

Yet despite many experiments, the major platforms have yet to crack the code on social commerce. In part, that’s because the attributes that make one platform so strong haven’t been at the core of the other’s business. Either a commerce platform is trying to add social elements, or a social platform is attempting to add ecommerce. In either case, it often feels like one of the elements was added on, and ultimately doesn't take off with users.

But the team behind the recently launched platform Flip believes it has the keys to social commerce success, and that lies in turning much of what we know about ecommerce today on its head.

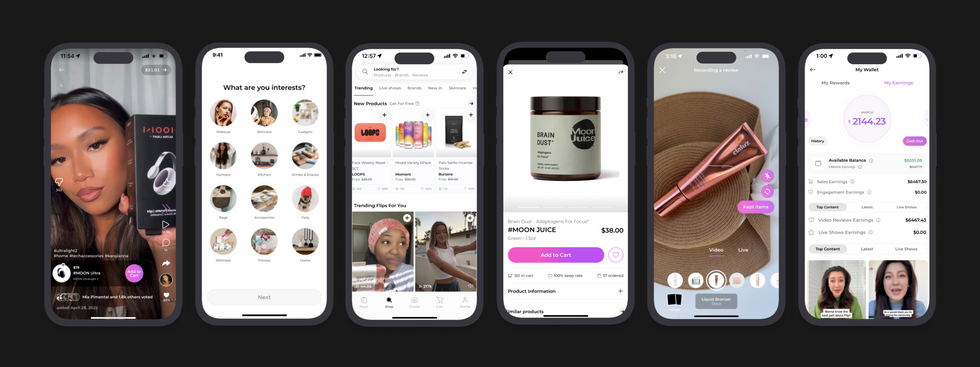

At its core, Flip is a social network for shopping. It aims to provide engaging video-based content that can drive discovery, while offering checkout and logistics that represent the “best-in-class” infrastructure of an ecommerce platform, such as order tracking and revenue, said Flip CEO Noor Agha.

The throughline that truly differentiates the network, however, is the shopping experience. It’s powered by people, and not brands.

The users of the social network are the people who are shopping. They’re buying the products. They’re also sharing what they think to inform other shoppers’ decisions by creating content about those products to review them. All of that content is connected to a product through a patented tagging technology, which is what focuses the platform around commerce.

Crucially, this review content is being completed by people who actually bought the products it covers, without compensation from the brands. That means Flip has an important difference from other ecommerce marketplaces and social networks: Brands aren’t behind the content that shoppers see.

“Decisionmaking is completely given to the shopper, rather than to the influencer or creator or the marketer or the brand,” Agha said. “So basically, the only voice in this shopping social network is the voice of the shopper. What other shoppers think about what you want to buy is way more important than the person that created it or the platform that is trying to boost it.”

This is designed to create trust. By removing mediating forces such as advertising, there is room for authenticity in reviews, whether they are positive or negative, Agha said. Shoppers are also speaking as a user, rather than as an expert or the creator of the product.

“The inherent solution here is, when you give it to the shopper, the only way the shopper talks about it is from a non-expert point of view, and a personal experience point of view, which is the only thing valuable for the next person that's interested in that product.”

For brands, the role is simply to list products, then ship orders out when they receive them. Flip recently launched an operating system for sellers called MagicOS, which provides self-serve tools to launch on the network, as well as track inventory, content and orders. Flip believes this system will help the marketplace extend from a base of beauty into more categories such as lifestyle, nutrition, electronics, fitness, and home goods.

Brands can still promote content, but it can only be content created by the user. This means giving up a measure of control compared to most platforms. But Agha believes there’s a trade-off that brands will embrace: They will be part of a marketplace that has trust built in, and get genuine feedback in the process. It could even reduce issues like copycatting that have sprung up on other marketplaces, he said.

“It is a haven for somebody that actually believes in what they're building, and likes what they're building,” Agha said.

Flip has initial traction that indicates brands are listening to Agha's pitch. It has 1,000 brands live on the platform, including E.l.f., Goop, and MOON Ultra. On the shopper side, Flip also has 2 million registered users who have racked up more than 30 million views, and is signing up more than 200,000 monthly. So far, brands have shipped 321,000 orders.

Flip has fuel to continue to grow. The brand raised a $60 million Series B funding round led by WestCap & Streamlined Ventures in 2022, which valued the company at $500 million. It recently hired Hao Ma, a former director at Meta’s Discovery Org, as VP of AI and data science. Kapil Mokhat, the former head of commerce at Venmo and head of payments programs and partnerships at Airbnb, also recently joined the company as president.

If successful, Flip stands to usher in a new model for social networks. Such platforms have long been centered on social connections, but Flip shifts that rallying force to shopping. It is also shifting the social business model to commerce. Rather than an ad-focused model, Flip receives percentages of orders as a result of the services it performs for brands. For their part, ecommerce marketplaces have solved the problem of shopping for consumers who navigate to a site and already know what they want to buy, said Agha. Flip aims to center discovery of new products, where there is still room to grow.

But it is the focus on trust and integrity where Agha becomes most passionate.

Shoppers have gotten used to a world where most of the messages they receive about a product is paid for by the brand. In turn, ecommerce success has become driven by mastering marketing. For brands that are willing to put their product forward, Agha believes the shopper-powered experience that Flip offers will be one of the best selling points of the platforms for brands.

In a world of multichannel commerce, there’s room for many kinds of marketplaces to grow. Flip shows a differentiator can come down not just to the products a platform sells, but how it sells them.

Labor disputes on the West Coast could cause further disruption heading into peak season.

When the first half of 2023 is complete, imports are expected to dip 22% below last year.

That’s according to new data from the Global Port Tracker, which is compiled monthly by the National Retail Federation and Hackett Associates.

The decline has been building over the entire year, as imports dipped in the winter. With the spring, volume started to rebound. In April, the major ports handled 1.78 million Twenty-Foot Equivalent Units. That was an increase of 9.6% from March. Still it was a decline of 21.3% year over year – reflecting the record cargo hauled in over the spike in consumer demand of 2021 and the inventory glut 2022.

In 2023, consumer spending is remaining resilient with in a strong job market, despite the collision of inflation and interest rates. The economy remains different from pre-pandemic days, but shipping volumes are beginning to once again resemble the time before COVID-19.

“Economists and shipping lines increasingly wonder why the decline in container import demand is so much at odds with continuous growth in consumer demand,” said Hackett Associates Founder Ben Hackett, in a statement. “Import container shipments have returned the pre-pandemic levels seen in 2019 and appear likely to stay there for a while.”

Retailers and logistics professionals alike are looking to the second half of the year for a potential upswing. Peak shipping season occurs in the summer, which is in preparation for peak shopping season over the holidays.

Yet disruption could occur on the West Coast if labor issues can’t be settled. This week, ports from Los Angeles to Seattle reported closures and slowdowns as ongoing union disputes boil over, CNBC reported. NRF called on the Biden administration to intervene.

“Cargo volume is lower than last year but retailers are entering the busiest shipping season of the year bringing in holiday merchandise. The last thing retailers and other shippers need is ongoing disruption at the ports,” aid NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “If labor and management can’t reach agreement and operate smoothly and efficiently, retailers will have no choice but to continue to take their cargo to East Coast and Gulf Coast gateways. We continue to urge the administration to step in and help the parties reach an agreement and end the disruptions so operations can return to normal. We’ve had enough unavoidable supply chain issues the past two years. This is not the time for one that can be avoided.”