Careers

21 March 2023

New Starbucks CEO rises early; Orlando Bloom joins nutrition brand

On the Move has hiring and promotion updates from Patrick Ta Beauty, Divi, REI and Munchkin.

Laxman Narasimhan. (Courtesy photo)

On the Move has hiring and promotion updates from Patrick Ta Beauty, Divi, REI and Munchkin.

Welcome to On the Move. Every week, The Current is rounding up the comings and goings of leaders at brands and retailers across the ecommerce, retail and CPG landscape.

This week, Starbucks and Patrick Ta Beauty welcome new CEOs. Meanwhile, we’ve got news on key ecommerce and digital hires at Divi and Munchkin, and a former eBay executive taking a seat on the marketplace’s board.

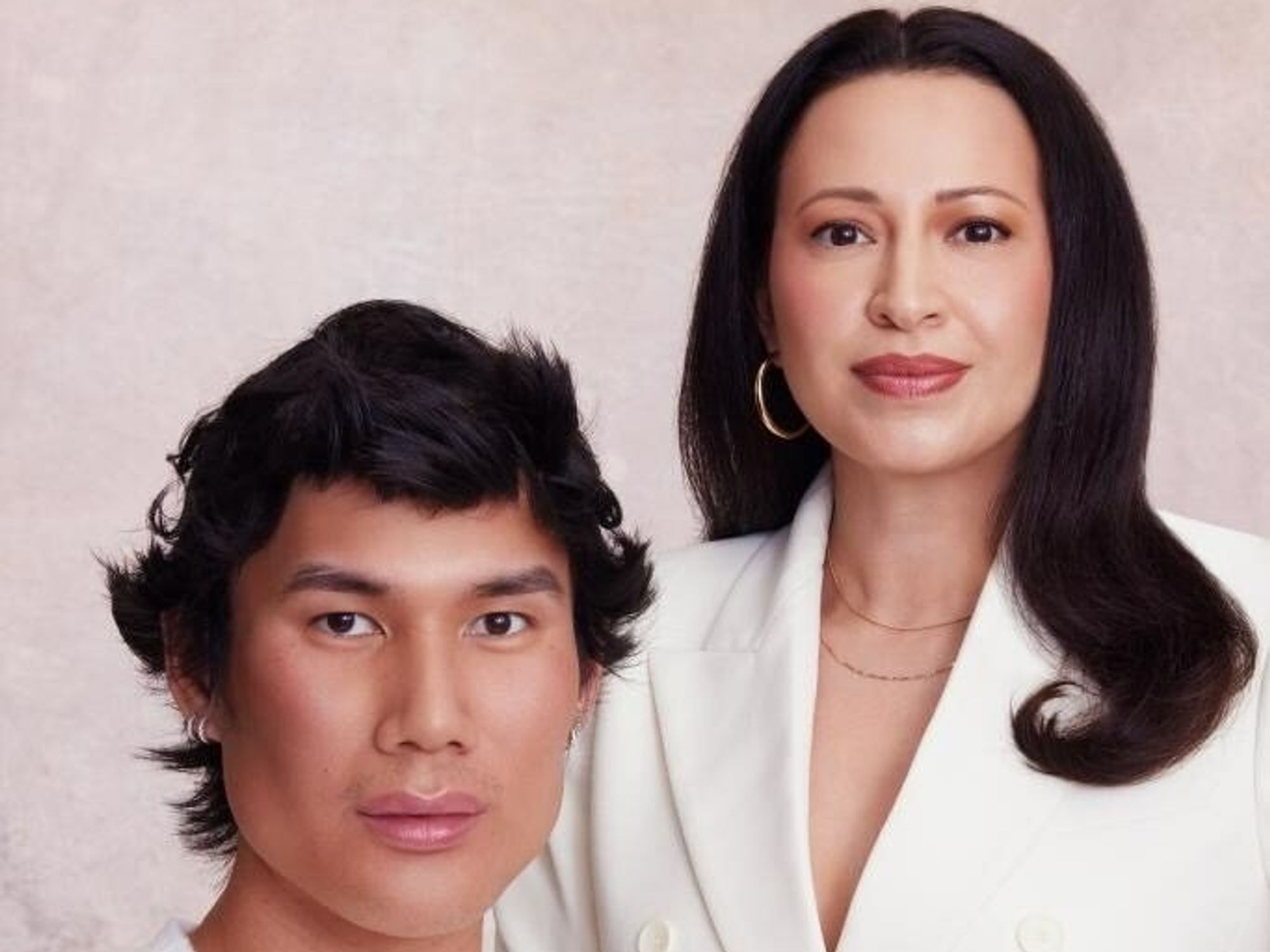

Patrick Ta and Kimberly Villatoro. (Courtesy photo)

Kimberly Villatoro was appointed to the CEO role at Patrick Ta Beauty.

Villatoro brings experience as VP of Estée Lauder brands Smashbox and Glamglow in North America. She also led and marketed the Barbie brand at Mattel.

With the move, former CEO Avo Minasyan will transition to chairman of the board.

Founded in 2019 by renowned makeup artist Patrick Ta, the brand received a minority investment from growth equity firm Stride Consumer Partners in October 2022. The next month, it brought on former L'Oreal executive Paul Parikh as chief operating officer.

Laxman Narasimhan is now officially the CEO of Starbucks.

Narasimhan, the former CEO of CPG company Reckitt, was appointed in September as the successor to founder Howard Schultz, who returned in an interim role last year after several prior stints as CEO.

Narasimhan is rising to the top role several weeks earlier than expected. With the move, Narasimhan will lead the company’s annual shareholder meeting later this week.

Josh Burris was named CEO of apparel retailer rue21, effective April 3.

For the last two years, Burris served as the CEO of nutrition retailer GNC, where he led a restructuring after the company was purchased by Chinese pharmaceutical firm Harbin Pharmaceutical Group in 2020.

Burris also held leadership roles at Abercrombie & Fitch, Hollister, DKNY, Karl Lagerfeld Paris, Calvin Klein Performance, Wilsons Leather, and GH Bass & Co.

Actor Orlando Bloom announced a new role, and this one isn’t scripted. Bloom will serve as chief wellness officer of Form Nutrition, a protein and supplement brand that recently expanded into the US market.

The Lord of the Rings and Pirates of the Caribbean star will now be involved in the brand’s product development process, and advise on creative direction. Bloom is also investing in the brand.

Form Nutrition's products are available at Vitamin Shoppe, Amazon, Walmart.com and through its direct-to-consumer website.

Erica Randerson was named vice president of ecommerce at Divi, a scalp health and haircare brand.

Randerson comes to the role from Edible Arrangements, where she served as VP of ecommerce across the company’s websites and 900+ retail locations.

Randerson will apply this experience to leadership of Divi’s direct-to-consumer growth strategy.

“With her incredible background, Erica will be instrumental in helping us more deeply engage with the Divi community,” said entrepreneur and influencer Dani Austin, who is the founder of Divi, in a statement. “We look forward to working with her to amplify our story during a time when more and more individuals are focused on improving their scalp health as a part of their overall health and wellness.”

Alan Wizemann. (Courtesy photo)

Alan Wizemann was named chief digital officer of children's feeding and care products brand Munchkin.

Munchkin previously served as CTO of Quip NYC, chief digital officer of Dollar Shave Club, interim chief digital officer of Goop and VP of guest experiences and digital product at lululemon. He was also VP of Target.com.

The appointment to the executive role comes after Wizemann joined the company’s board of directors in early 2022, and played a key role in advising on digital growth.

REI Co-op announced the following leadership additions:

Apple Musni was hired as chief people officer. Musni brings experience from Chipotle, serving as VP of field people experience and recruiting. She also served in people operations roles at McDonald’s and Target.

Chris Speyer was promoted to SVP and chief merchandising officer. Speyer joined REI in 2017 as VP of Co-op Brands, which is the company’s private label.

Isabelle Portilla was promoted to VP of Co-op Brands. Previously, Portilla led product strategy and design for Co-op Brands.

The Home Depot promoted William "Billy" Bastek to the role of EVP of merchandising.

Bastek is a 33-year veteran of the company, and has held several key roles in merchandising, most recently as VP of hardlines, overseeing the hardware and garden departments. Bastek is credited with driving growth of Halloween and holiday categories across both online and in-store channels.

Bastek is succeeding Jeff Kinnaird, who has decided to leave the company.

Shripriya Mahesh is joining the board of directors at eBay.

Mahesh is currently general partner at early-stage venture capital firm Spero Ventures, and was a partner at Omidyar Network.

Mahesh is also a former executive at eBay, having served as VP and head of global product management and strategy, VP of US product marketing and platform and VP of corporate strategy.

Campbell Soup Company CEO Mark Clouse offered thoughts on messaging amid inflationary shifts in consumer behavior.

After months of elevated inflation and interest rate hikes that have the potential to cool demand, consumers are showing more signs of shifting behavior.

It’s showing up in retail sales data, but there’s also evidence in the observations of the brands responsible for grocery store staples.

The latest example came this week from Campbell Soup Company. CEO Mark Clouse told analysts that the consumer continues to be “resilient” despite continued price increases on food, but found that “consumers are beginning to feel that pressure” as time goes on.

This shows up in the categories they are buying. Overall, Clouse said Campbell sees a shift toward shelf-stable items, and away from more expensive prepared foods.

There is also change in when they make purchases. People are buying more at the beginning of the month. That’s because they are stretching paychecks as long as possible.

These shifts change how the company is communicating with consumers.

Clouse said the changes in behavior are an opportunity to “focus on value within our messaging without necessarily having to chase pricing all the way down.”

“No question that it's important that we protect affordability and that we make that relevant in the categories that we're in," Clouse said. "But I also think there's a lot of ways to frame value in different ways, right?”

A meal cooked with condensed soup may be cheaper than picking up a frozen item or ordering out. Consumers just need a reminder. Even within Campbell’s own portfolio, the company can elevate brands that have more value now, even if they may not always get the limelight.

The open question is whether the shift in behavior will begin to show up in the results of the companies that have raised prices. Campbell’s overall net sales grew 5% for the quarter ended April 30, while gross profit margins held steady around 30%. But the category-level results were more uneven. U.S. soup sales declined 11%, though the company said that was owed to comparisons with the quarter when supply chains reopened a year ago and expressed confidence that the category is seeing a longer-term resurgence as more people cook at home following the pandemic. Snacks, which includes Goldfish and Pepperidge Farm, were up 12% And while net sales increased overall, the amount of products people are buying is declining. Volumes were down 7%.

These are trends happening across the grocery store. Campbell is continuing to compete. It is leading with iconic brands, and a host of different ways to consume them. It is following that up with innovation that makes the products stand out. Then, it is driving home messaging that shows consumers how to fit the products into their lives, and even their tightening spending plans.

Campbell Soup is more than 150 years old, and has seen plenty of difficult economic environments. It is also a different business today, and will continue to evolve. At the end of the day, continued execution is what’s required.

“If it's good food, people are going to buy it, especially if it's a great value,” Clouse said.