This week, Target, Walgreens and Torrid made moves across the leadership suite, Conagra and Unilever made key appointment and StockX named its first chief impact officer.

Here’s the roundup:

Boxed seals leadership team

Grocery ecommerce company Boxed said it rounded out its leadership team with three key hires as it makes the transition from private to public company. Here’s a look:

- Anna Meyer joined the company as chief revenue officer, bringing experience leading the sales organization at fintech company Sezzle.

- Jung Choi is general counsel and secretary, bringing 15 years of experience in roles at Stanley Black & Decker and Bristol-Myers Squibb.

- Veracelle Vega joined the company as chief people officer, joining from DTC mattress company Resident.

Carhartt names Cornstubble SVP of DTC

Chad Cornstubble (Photo via Carhartt)

Workwear brand Carhartt appointed Chad Cornstubble as SVP of direct-to-consumer to attract customers both on ecommerce and brand-owned retail stores. Cornstubble most recently served as VP of ecommerce, marketing technology, and digital operations at lifestyle accessories company Fossil Group.

Brady to lead grocery and snacks at Conagra

Conagra Brands appointed Lucy Brady to the role of president of grocery and snacks, effective June 15. In the role, Brady will oversee brands such as Slim Jim, Duncan Hines, and Angie's BOOMCHICKAPOP.

Brady previously served as an executive at McDonald’s over the last six years as chief digital customer engagement officer and SVP of corporate strategy, business development and innovation. Prior to that, she spent 19 years at Boston Consulting Group.

HanesBrands names LeFebvre to oversee activewear

Vanessa LeFebvre. (Courtesy photo)

HanesBrands named Vanessa LeFebvre as president of global activewear. In the role, she will lead growth of the Champion brand with a focus on innovation, key markets and new channels.

In her last role, LeFebvre oversaw ecommerce as SVP of commercial for North America at Adidas. She previously served as president of Lord and Taylor, and held leadership and merchandising roles at Stitch Fix, Macy’s, Daffy’s and T.J. Maxx.

Matchesfashion poaches CFO from Farfetch

Luxury retailer Matchesfashion is bringing on Dave Murray as chief financial officer. Murray previously served as senior VP of finance at Farfetch, another luxury retail platform in the ecommerce space. He also spent four years at Amazon, and a decade at Sainsbury’s. Murray will succeed Sean Glithero when he starts in the fall.

Movado names Gerschel CMO

Stéphane Gerschel (Photo courtesy of Movado)

Watch and jewelry brand Movado Group named Stéphane Gerschel as chief marketing officer. No stranger to luxury, Gerschel brings prior experience as managing director of Pomellato for Kering Group, and he also worked for LVMH’s Bulgari and Veuve Clicquot.

Purple has a new COO

DTC mattress firm Purple appointed Eric Haynor to the role of chief operating officer. Haynor brings 30 years of supply chain management experience, most recently as SVP of global industrial supply chain at Ecolab. He will apply this to help the company take “a more wholistic approach to the end-to-end supply chain,” per a news release.

The move comes after former COO John Legg left the company in April. The appointment is effective June 6.

Starbucks names Lefevre as CTO

Deb Hall Lefevre (Photo via LinkedIn)

Starbucks is set for tech upgrades as it looks to improve the mobile app used by its workforce and start selling NFTs. With these moves, the coffee chain is also adding new tech leadership. Deb Hall Lefevre, a former McDonald’s CTO and VP of IT, took the CTO role on May 2, Reuters reported.

StockX names chief impact officer

Damien Hooper-Campbell (Courtesy photo)

Sneaker, apparel and collectible marketplace StockX appointed Damien Hooper-Campbell as its first-ever chief impact officer. In the role, Hooper-Campbell will oversee diversity, equity and inclusion, as well as environmental, social, and community engagement initiatives. Hooper-Campbell served in similar roles at tech companies including eBay, Zoom, Google, Uber and Goldman Sachs.

Target elevates tech, supply chain roles

Target announced key updates to its leadership team with a series of announcements that involve shifts for longtime team members. Here’s the roundup:

- Cara Sylvester was named EVP and chief guest experience officer. Having previously served as chief marketing and digital officer, Sylvester will now bring teams together from across the organization to focus on personalization and attracting more shoppers to stores and digital channels.

- Brett Craig was promoted to EVP and chief information officer, succeeding CIO Mike McNamara upon his retirement. Craig most recently served as SVP of digital.

- Matt Zabel was named EVP and general counsel.

- Arthur Valdez, Target’s EVP and chief supply chain and logistics officer, will join the company’s leadership team.

- Christina Hennington, Target’s EVP and chief growth officer, will assume responsibility for Target India.

Tradeswell appoints Pollett as chief revenue officer

David Pollett. (Courtesy photo)

Tradeswell, the ecommerce operating system that unifies retail, marketing, inventory, and finance data for DTC brands and CPG category leaders, appointed David Pollett to the role of chief revenue officer. Pollett brings experience as CRO of convergent TV platform Cross Screen Media, and has held leadership roles at Drawbridge, Neustar, Bank of America and LendingTree. Pollett will be responsible for accelerating company growth and transforming go-to-market operations.

Too Faced cofounders depart

Tara Simon. (Courtesy photo)

The Estée Lauder Companies announced that Too Faced Cosmetics cofounders Jerrod Blandino and Jeremy Johnson will depart the brand on June 30 as they embark on new entrepreneurial projects. In turn, Tara Simon will be promoted to global brand president. She joined the beauty brand in 2020 as SVP and general manager, after previously serving in leadership roles at Ulta Beauty. Blandino and Johnson started Too Faced in 1998 and led it to cult status. The brand was acquired by Estee Lauder in 2017.

Torrid announces C-suite shift

DTC plus-size apparel brand Torrid announced a series of leadership team changes and board of directors. Here’s a look:

- Lisa Harper was named CEO of the company. She had a previous stint in the role, and has also served as CEO of Belk and Hot Topic.

- Harper succeeds Liz Muñoz, who is taking a new role of chief creative officer with the company. In this role, she will focus on product, design, product development, fabrication, sourcing, technical fit, creative marketing and merchandising.

- Tanner MacDiarmid will serve as interim chief financial officer with the company.

- Michael Shaffer, former CFO of PVH Corp., will join the company’s board of directors.

Samir Singh promoted at Unilever

Samir Singh. (Photo via LinkedIn)

Consumer goods company Unilever promoted Samir Singh to chief marketing officer for personal care, the executive wrote on LinkedIn. In this role, he will serve as marketing lead for brands like Axe/Lynx, Closeup, Dove, Lifebuoy, Lux, Pepsodent, Rexona/Sure and more.

Vroom has a new CEO

Used car ecommerce platform Vroom promoted Tom Shortt from COO to CEO, succeeding Paul Hennessy. At the same time, current board chair Robert Mylod will become independent executive chair of the board. On a recent first quarter earnings call, the move was cast as part of a business realignment plan to reduce costs and create more operational efficiencies. Meanwhile, ecommerce sales were up 60% year-over-year for the company.

Walgreens appoints C-level leaders in marketing, merchandising, product

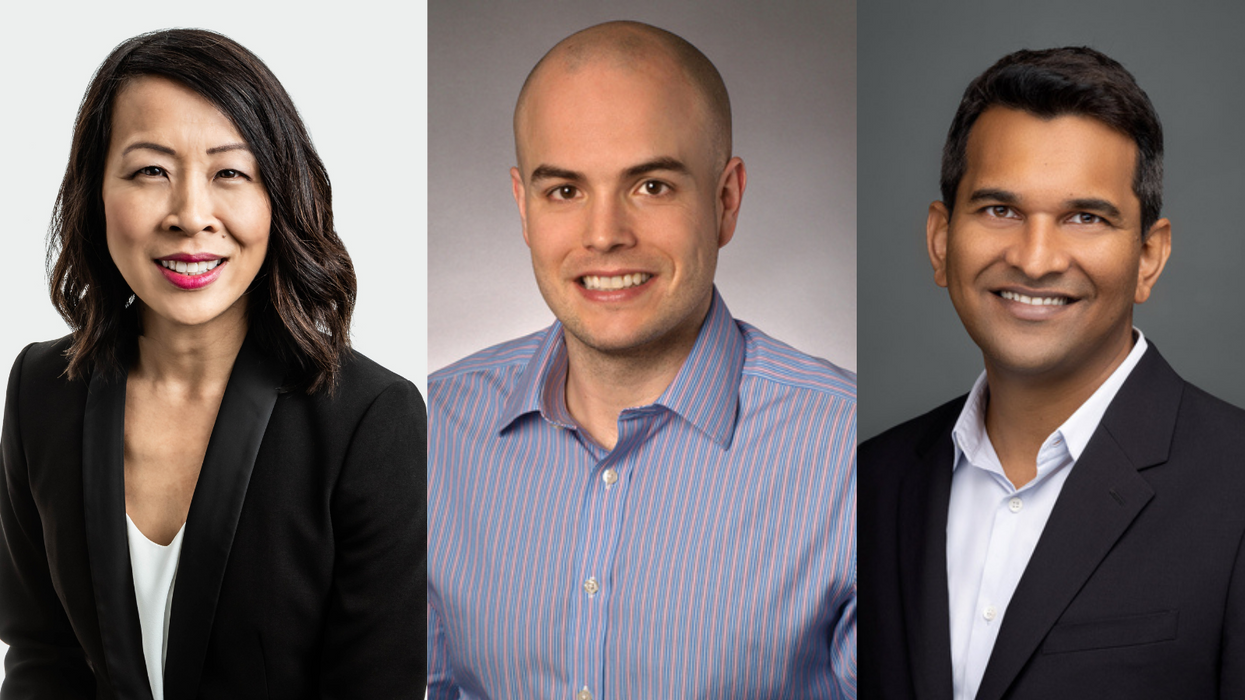

Left to right: Linh Peters, Luke Rauch and Bala Visalatha (Courtesy photos)

Walgreens made a series of appointments to C-level roles at it looks to bolster leadership in retail products and customer roles.

- Linh Peters was named chief marketing officer. She previously served as CMO at Calvin Klein, and brings experience honed at Starbucks, Target and Ulta Beauty.

- Luke Rauch was appointed to chief merchandising officer. He previously served as chief of staff to Walgreens Boots Alliance CEO Roz Brewer, and worked with Deloitte Consulting.

- Bala Visalatha is joining the company as chief product officer. It’s a newly created role that will oversee customer product strategy and UX. With 15 years experience in the product space, he most recently served as vice president of eCommerce at Walmart US.