Retail Channels

26 July 2022

'That bet didn't pay off': Shopify lays off 10% of workforce

The layoffs show that the pullback from ecommerce's early pandemic growth trajectory is affecting people.

The layoffs show that the pullback from ecommerce's early pandemic growth trajectory is affecting people.

In the latest fallout from ecommerce sales growth dipping amid a return to in-person activities, Shopfiy announced on Tuesday that it is making significant layoffs.

The Ottawa-based ecommerce company announced plans to lay off about 1,000 people, or 10% of its workforce. Most of the layoffs will be in recruiting, support and sales, CEO Tobi Lütke wrote in a memo to the team. Lütke added that the company is also eliminating “over-specialized and duplicate roles, as well as some groups that were convenient to have but too far removed from building products.”

Against the current macroeconomic headwinds and stock market downturn, Shopify is not unique among tech companies cutting jobs in recent months. Among tech companies with large workforces in ecommerce, layoffs have been reported at companies like Stitch Fix, Tonal, Gopuff and Carvana.

However, Shopify does hold a unique place in this area, making these layoffs significant. Offering the software that powers ecommerce for scores of brands, it serves as a barometer of ecommerce as a whole. And just two years ago, Shopify was one of the highest fliers amid pandemic-prompted digital adoption that affected not only consumers, but also the store-based entrepreneurs that needed to set up an ecommerce business in a hurry when the world changed and entrepreneurs that harnessed approaches like dropshipping to launch quickly in a time of flux.

With that in mind, it’s especially illuminating to read Lütke’s description of the reasoning for the layoffs with an eye toward the wider market. It's even more notable because Lütke doesn't point to inflation or the company's falling stock price.

it came down to what happened when the ecommerce pull-forward pulled back. The CEO said the company saw demand for ecommerce skyrocket in the pandemic, and made a bet that the share of dollars heading to ecommerce over in-person retail would permanently leap ahead by 5-10 years, following the same growth curve that was observed in the pandemic days of 2020. In turn, Lütke said the company expanded Shopify accordingly.

“It’s now clear that bet didn’t pay off,” Lütke wrote. “What we see now is the mix reverting to roughly where pre-Covid data would have suggested it should be at this point. Still growing steadily, but it wasn’t a meaningful five-year leap ahead. Our market share in ecommerce is a lot higher than it is in retail, so this matters. Ultimately, placing this bet was my call to make and I got this wrong. Now, we have to adjust.”

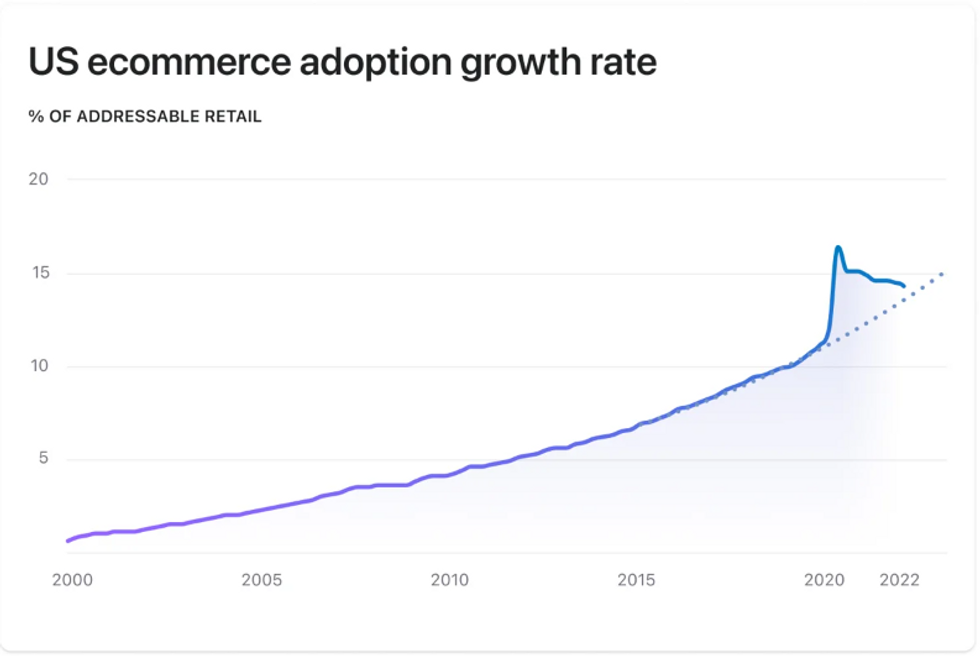

Growth of ecommerce share of overall retail, per the US Census Bureau. (Chart via Shopify)

After steady gains over the last decade, ecommerce's share of retail rose from about 11% at the end of 2021 to 16% in the second quarter of 2022. But in 2021, it started moderating, data from the US Census Bureau showed. On an adjusted basis, the share has hovered between 14 and 15 percent since the first quarter of 2021. A more moderate decline in Q1 suggests it may still end up on a slightly steeper growth trajectory than pre-pandemic. But overall, the growth in share is unlikely to return to the early pandemic path.

To be sure, ecommerce remains on a growth trajectory when it comes to the proportion of overall retail it makes up. Over time, the growth is expected to continue. But the early days of the pandemic looked a lot different than the fast growth suggested. In early 2020, observers were fond of pointing out that ecommerce’s share of retail jumped ahead by a decade in the first three months of that year. IBM predicted that the leap ahead was five years. This was in line with acceleration of digital adoption that was on view across sectors. As home became the place where people worked, shopped, ate “out” and entertained, the tools and businesses that provided these services saw explosive usage. Capital was easier to come by than ever with interest rates low, and investors sought to back those who were showing growth. Shopify decided to go big, adding team members in spades from all over both to meet demand among entrepreneurs for ecommerce offerings at a time when shops were closed, and build for a future trajectory that pointed along the same trend line. But the acceleration of growth didn’t sustain with the arrival of relaxed lockdown policies and vaccinations. The many Shopify brands who attracted customers through digital advertising were also faced with rising customer acquisition costs and changes from Apple in iOS 14.5 that made attribution more difficult.

Now, the trajectory is expected to get back to a more gradual pace. There’s still growth and even sales milestones in sight for ecommerce. But for companies that invested based on the steeper curve, the flattening out has real effects. While lots of focus is placed on the stock market share prices, businesses are making operational changes. In another case of getting the forecast wrong, Amazon said it built too many warehouse as it grew a logistics network, and ended up with excess space this year. Shopify's layoffs, in turn, show how these missed projections affect people.

“We have to say goodbye to some of you today and I’m deeply sorry for that,” Lütke wrote.

For those who are laid off, the company is offering 16 weeks of severance pay, plus an additional week for every year of tenure at Shopify, as well as removing an equity cliff and extending medical benefits. Employees will also be offered coaching services. Shopify will also cover internet for the period of severance pay and allow employees to keep the home office furniture provided by the company. A free Shopify subscription is available to those who want to start a business.

Those who remain will be building for a different era. A series of new products released recently signaled deeper investment in providing software for brands expanding in B2B, wholesale, loyalty, social commerce and physical stores. The company is also make a big bet on standing up its own fulfillment network for brands.

“Our opportunity is massive and it’s still early days for Shopify,” Lütke wrote. “Every team here is now either focused on building products or directly supporting those who do.”

Meanwhile, the economy is in a very different macro period from mid-2020 that is not as favorable for brands and retailers. It’s an open question as to whether a recession can be avoided, 40-year-high inflation is beginning to show effects on consumer behavior as prices rise, and in doing so challenging entrepreneurs who make products that aren’t deemed essential as discretionary spending tightens.

Just as in 2020, Shopify is setting out to build and provide support for businesses facing change as a result of bigger forces once again. But it will be doing so with a smaller team, and won’t have the wind at its back.

“Our customers are merchants, entrepreneurs, and small business owners – the bedrock of our economy and precisely those that are typically hit hardest during recessions,” Lütke wrote. “Most are already feeling it. We again have a clear objective in these challenging macro economic times, and we will use everything we’ve got to help them succeed and come out stronger.”

Shopify is scheduled to hold its second quarter earnings call on Wednesday, July 27.

Can Shop Cash entice more users to use the app for browsing and buying?

Shopify is launching a new rewards program for items purchased through its checkout system.

Shop Cash will provide the opportunity for consumers to earn 1% back on purchases made through Shop Pay.

The feature includes a direct tie-in with the Shop app. Users can check their balance through the app, and the rewards are redeemable for future purchases through Shop, as well.

“This is a coming of age moment for Shop. It’s become an incredible app that allows shoppers to discover great brands, check out with one tap, and track orders in real time,” said Harley Finkelstein, president of Shopify, in a statement. “Shop Cash represents the next evolution of Shop, connecting independent brands to more shoppers, and rewarding those shoppers for being loyal fans.”

The launch falls on Shopify’s 17th birthday, so the ecommerce software company is giving away Shop Cash to celebrate. For Shop Day, Shopify partnered with dozens of merchants, including Trixie Cosmetics, MrBeast and Monday Swimwear. They’ll share custom links across channels that offer cash to spend on the Shop app. In all, Shopify will give away more than $1,000,000. Brands will also be running exclusive Shop Cash offers throughout the day.

The rewards program marks a new way that Shopify is aiming to transform Shop into more of a shopping app where users can discover new items, extending beyond its initial use for post-purchase order tracking and management at launch in 2020.

Shopify has been making moves over the last year to provide more opportunities to browse and buy recommended products, as well as giving brands more tools to showcase storefronts and tell their stories. With Shop Pay, the app offers one-click checkout. There are signs that it is all inspiring users to seek out the app. Shopify said 35% of the orders on the Shop app are repeat purchases.

With more brands joining the app and infrastructure for the shopper experience and checkout in place, rewards can help make the app stickier for consumers. The opportunity to earn cash, redeem it and even check a rewards balance are all reasons to keep returning to the app, and make it a destination to shop.

Shopify has long been known as the infrastructure layer of commerce, as it provided the tools for brands to run and manage an online store under their own name. With the Shop app, it is aiming to make Shopify itself a destination for shopping. It remains a nascent effort, even as more brands have taken advantage of the new features to enhance storefronts.

This comes as marketplaces continue to rise across ecommerce, and giants like Amazon and Walmart experiment with tools that do more to boost discovery of new products.

Social media has long been the engine of discovery in ecommerce, especially in the direct-to-consumer realm that Shopify has owned. Users found products on Facebook or Instagram, then finished checkout on a brand's phase. With the push toward privacy making performance marketing more difficult and customer acquisition costs rising, the ecommerce platforms are attempting to take that power into their own hands. With advertising placed close to the point of sale through retail media and the ability to check out on the same page where a user sees a product, marketplaces and Shop are realizing new opportunities to attract, convert and deliver for users within one app. For Shop, the trick is to attract more shoppers to the app. Rewards like Shop Cash are a carrot to do just that.