Shopper Experience

08 December 2022

Amazon and Walmart take new steps for social commerce

The top ecommerce platforms debuted visual shopping features that bring social elements to the marketplace.

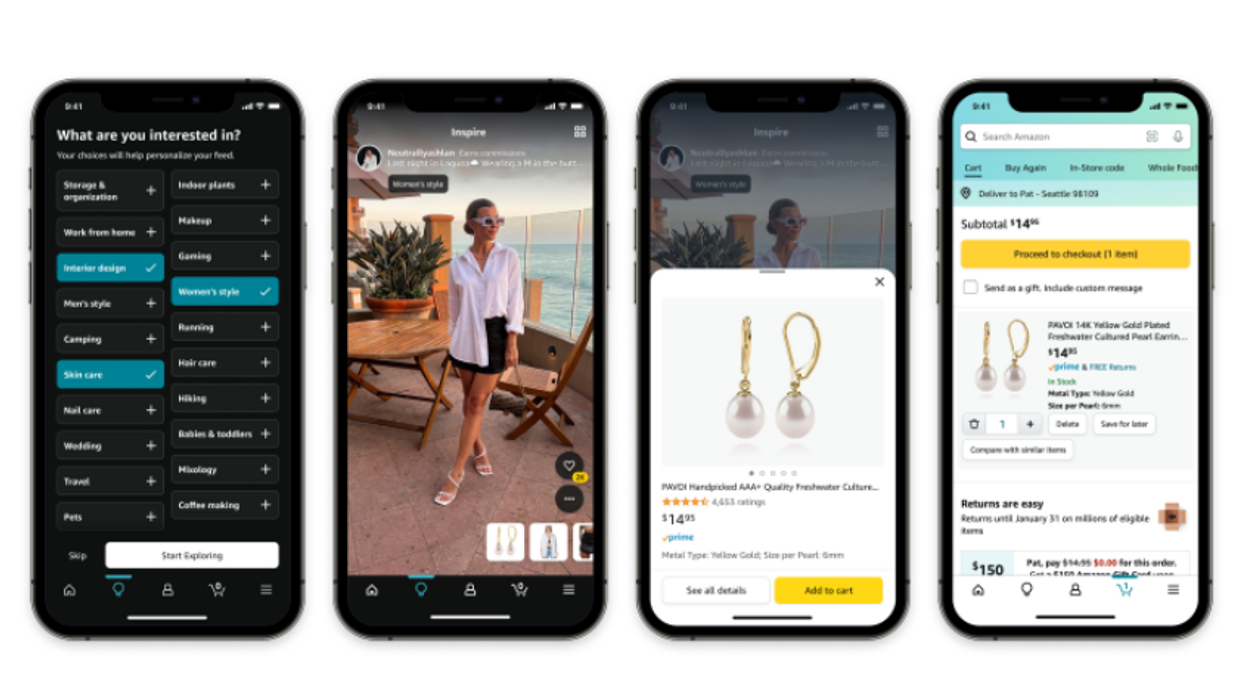

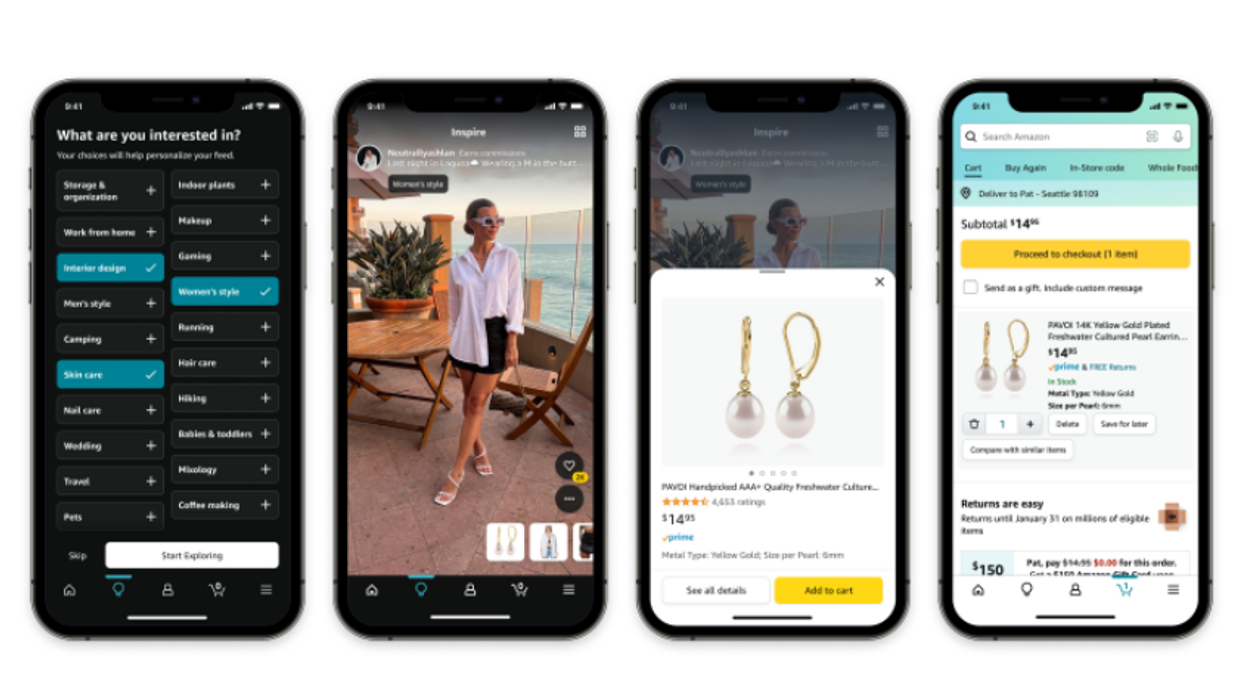

Amazon Inspire (Courtesy photo)

The top ecommerce platforms debuted visual shopping features that bring social elements to the marketplace.

Amazon Inspire (Courtesy photo)

For years, the developers of social commerce have been focused on bringing the elements of an ecommerce store to social media platforms, and making them more shoppable. But with a pair of releases from the largest ecommerce platforms on Thursday, that’s changing.

With the rise of visual, creator-driven content across the web, ecommerce platforms see an opportunity to bring the elements of social platforms to their marketplaces.

Here’s a look at how Amazon and Walmart are taking steps toward realizing this:

As previously teased via leak, Amazon is launching a new feed within its platform that mimics a social feed.

Amazon Inspire includes a feed of both short-form videos and photos featuring products shared by influencers, brands and other customers. While creators have found wide success marketing the products of others and even their own brands on social platforms, this feature is designed to bring shoppable content into the experience on Amazon’s app.

Accessible via a lightbulb icon on the homescreen of the Amazon app, the feed comes complete with the ability to like a product with a tap, and is scrollable in a similar vein to TikTok or Instagram. But there is something extra for the shopping experience, according to TechCrunch:

When you see something you like, you can tap on small buttons at the bottom of the window which link to the product on Amazon. Initially, a tap on these buttons will pop-up the product in an overlay window on top of the video, but a tap on “See all details” will take you to the item’s product page where you can read more, make a purchase, or add it to a list.

Coming a few months after the Wall Street Journal reported that Amazon was testing such a feature, Thursday’s launch marks a wider launch for Amazon to select US customers. An even broader rollout is set to follow in the coming months.

The Current’s view: This is important for ecommerce. To be clear, this isn’t Amazon’s first foray into social commerce, as it has a livestreaming feature and has had other tests over the years. But this addresses a longstanding issue with how Amazon is built. The shopping experience is known for being highly standardized. Photos, video and inspiration all stand to add more creativity than Amazon typically allows.

In the scope of the internet economy, it stands out for two reasons: TikTok’s rise, and Amazon’s own advertising prowess.

Taking the latter first, Amazon has grown advertising to become a major part of its business, representing $31 billion in 2021 revenue. It has done so because of its advantage as the platform where consumers not only search for products, but also buy them. At the same time, the more difficult attribution on social media platforms that followed Apple’s App Tracking Transparency has put a premium on the desire to access a closed-loop advertising network where brands and retailers can use first-party data to reach customers. With social content that allows sharing and will attribute sales to influencers and brands’ content, that advertising engine is positioned to only get stronger. There’s a lot to learn from the content people like, and inspires them to buy.

Second, TikTok has reordered the web around short-form video content. The platform’s rise over the last few years left all of the social platforms racing to develop their own versions of short-form video, and Google worried about losing search traffic Amazon’s jump into the fold shows TikTok’s primary features stand to not only change how people discover and watch content, but also how they shop. To be sure, shoppable content is also debuting on platforms like Instacart, but make no mistake that TikTok’s influence is felt here, right down to the fact that content will be tailored to a user’s interests, akin to the famed algorithm of the For You feed.

For brands and retailers, Inspire means creators could potentially have a new platform to market on. There is also an opportunity for brands to directly list their products on the feed, which could reorient how people discover items on Amazon. For an ecosystem that is built around search and PPC advertising, that could mean big change. To be sure, the debut is just a test, but it’s one that is worth watching closely.

Walmart's TrendGetter. (Courtesy photo)

In a brief news release, Walmart unveiled its own tool for social shopping Thursday. TrendGetter is designed to provide a connection point between social media content and Walmart.com through a photo.

Users take a screenshot of an image on social media or IRL, and the feature uses image recognition technology to locate those items on Walmart.com. Here’s how the news release describes the steps.

The Current’s View: First of all, this feels like it was rushed out on the same day as Inspire. There’s no way to know for sure, but the brevity of the press release and timing are interesting, indeed.

As a feature, the use of image recognition technology feels original, and it’s clear that the intent is to connect social and ecommerce platforms. More of those bridges are needed, especially as App Tracking Transparency makes it more difficult to attribute particular sales to specific platforms. But there may be challenges in attracting users because it requires directing people to a whole different website outside of Walmart.

More importantly, it is solving what feels like a fairly small problem on the digital commerce side. Many ads and creator posts on social media already have links to a product page. After all, the whole system is constructed to provide payment and credit when a link results in a click or a sale. Shoppable content will only make those links more embedded in our experience of the web. How many people see an item that is truly difficult to access details about?

The ability to take a photo of an IRL item and see it on Walmart could have more value for physical-digital crossover. That feature may also be a response to Google’s multisearch tools, which also allow users to take photos of items they want to find. Walmart is positioning TrendGetter as a way to :find great deals on those products and stay within their holiday budgets,” so perhaps there is a use case for price comparison. But this doesn’t feel very well fleshed out in the news release.

For now, there may be some incremental benefit to TrendGetter, but it doesn’t feel like a game-changer as presented.

Yet it’s significant because we know that Walmart is putting real investment into social commerce. It recently rolled out a marketplace that connects brands and influencers, and debuted tools to serve ads from its Walmart Connect service to platforms like TikTok and Snapchat. Whatever the reason for this release on Thursday, it’s probably a good bet that it will end up being part of something bigger.

Labor disputes on the West Coast could cause further disruption heading into peak season.

When the first half of 2023 is complete, imports are expected to dip 22% below last year.

That’s according to new data from the Global Port Tracker, which is compiled monthly by the National Retail Federation and Hackett Associates.

The decline has been building over the entire year, as imports dipped in the winter. With the spring, volume started to rebound. In April, the major ports handled 1.78 million Twenty-Foot Equivalent Units. That was an increase of 9.6% from March. Still it was a decline of 21.3% year over year – reflecting the record cargo hauled in over the spike in consumer demand of 2021 and the inventory glut 2022.

In 2023, consumer spending is remaining resilient with in a strong job market, despite the collision of inflation and interest rates. The economy remains different from pre-pandemic days, but shipping volumes are beginning to once again resemble the time before COVID-19.

“Economists and shipping lines increasingly wonder why the decline in container import demand is so much at odds with continuous growth in consumer demand,” said Hackett Associates Founder Ben Hackett, in a statement. “Import container shipments have returned the pre-pandemic levels seen in 2019 and appear likely to stay there for a while.”

Retailers and logistics professionals alike are looking to the second half of the year for a potential upswing. Peak shipping season occurs in the summer, which is in preparation for peak shopping season over the holidays.

Yet disruption could occur on the West Coast if labor issues can’t be settled. This week, ports from Los Angeles to Seattle reported closures and slowdowns as ongoing union disputes boil over, CNBC reported. NRF called on the Biden administration to intervene.

“Cargo volume is lower than last year but retailers are entering the busiest shipping season of the year bringing in holiday merchandise. The last thing retailers and other shippers need is ongoing disruption at the ports,” aid NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “If labor and management can’t reach agreement and operate smoothly and efficiently, retailers will have no choice but to continue to take their cargo to East Coast and Gulf Coast gateways. We continue to urge the administration to step in and help the parties reach an agreement and end the disruptions so operations can return to normal. We’ve had enough unavoidable supply chain issues the past two years. This is not the time for one that can be avoided.”