Retail Channels

18 May 2023

Walmart ecommerce grew 27% in Q1. Here's what drove it

Fulfillment, third-party sellers and advertising are all expanding.

Fulfillment, third-party sellers and advertising are all expanding.

Walmart’s U.S. ecommerce sales grew 27% year-over-year in the first quarter of 2023, as the retailer sees digital sales growing among high-income consumers flocking to Walmart to save money amid inflation following extensive investments in pickup and delivery.

The ecommerce growth stood out as a high-growth area in the quarterly results from the world’s largest retailer. Overall, Walmart grew US comp sales 7.4% and operating income 17.3%.

On the company’s Q1 earnings call, executives broke down the parts of the ecommerce business where it is seeing growth:

At Walmart, ecommerce sales are connected to the store. The notable ecommerce growth was led by continued double-digit growth in store fulfilled pickup and delivery, said CFO John David Rainey.

“Customers increasingly value convenience and speed of delivery. We have an advantage here as we leverage the proximity of our stores to fulfill and deliver digital orders to customer homes. In many cases, we can get orders delivered faster to customers while building a sustainable omni economic model,” said Rainey.

Walmart is putting an emphasis on growings its ecommerce assortment by adding third-party sellers to its marketplace. Seller counts have increased more than 40%-year-over-year as a result, said Rainey.

Ecommerce isn’t just a digital reflection of a Walmart store.

“We're adding higher profile, in-demand brands that our customers are searching for, but not typically distributed at Walmart, elevating our profile as a digital shopping destination,” Rainey said. The platform is also enabling sellers and suppliers to be more targeted in how they reach consumers, said Walmart US President John Furner.

The seller growth is not only broadening the number of available products in specific vertical categories, but horizontally expands the categories that are available. In particular, there has been strength in food and consumables, as well as acceleration in apparel and home.

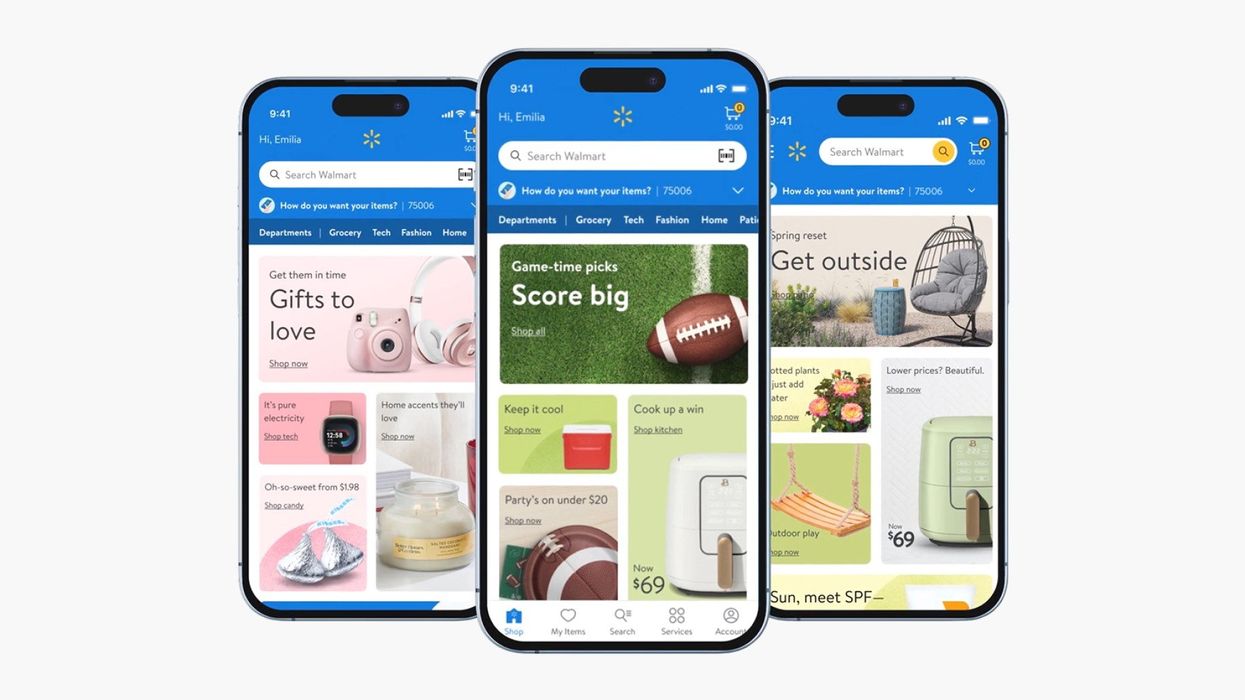

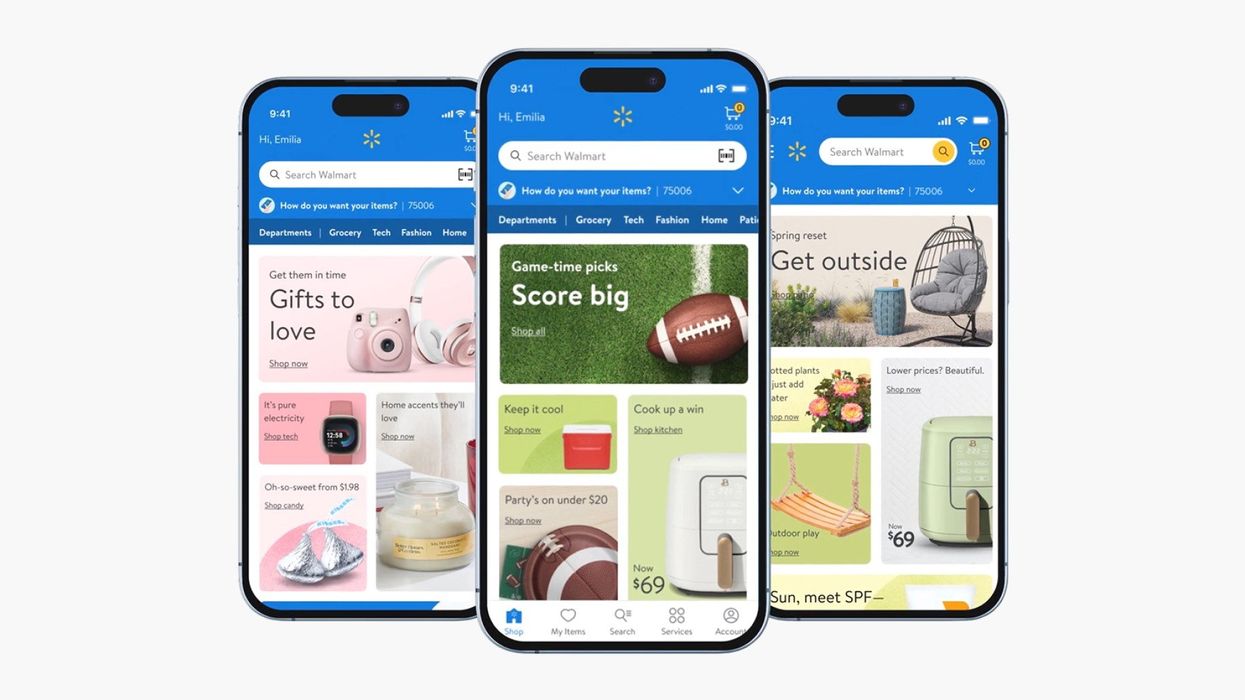

It comes after Walmart has made upgrades to the ecommerce experience by enhancing search results and redesigning its website.

“I think that will continue as both the seller count and the item count continue to expand,” Furner said. “So we're really looking at customer channel and driving the business with search to ensure that the customer gets whatever they want when they want it from Walmart.”

Additionally, the number of these sellers using Walmart Fulfillment Services to pack and ship items more than doubled.

Fulfillment is a particularly important part of delivering customer satisfaction, so Walmart has built that into the marketplace expansion, Furner said.

“Customers want to get their delivery when they ordered it,” Furner said. “They don't want it early. They don't want it late. They want it the day-of. And when sellers move their assortment, their inventory, into our fulfillment channels, then it's more certain for a customer that it's going to be next-day delivery or two-day delivery. And that just helps with conversion rates.”

As Furner referenced, the media arm Walmart Connect is also continuing to expand, with growth north of 30% in the first quarter. That included a U.S. sales increase of nearly 40%.

Sam’s Club advertising network, called the Member Access Platform, also grew double-digits, with active advertisers up more than 50% year-overyear.

“Advertisers are responding to our recently-launched in-club sales attribution feature, which provides advertisers with clear insights on the returns of digital ads, both online and in clubs while enhancing member experience,” Rainey said.

For Walmart Connect, the big moment of change was the introduction of a second place auction capability last year. It turned the advertising network into a two-sided marketplace.

“Ultimately, what we're trying to do is connect our sellers, our suppliers to customers, and that can be at the one-to-one level, it can be at the cohort level,” Furner said. “And so the team has done a lot to really increase our capacity and capability to handle those transactions really well.”

In the end, advertising growth is tied to the marketplace expansion. Many of the new advertisers joining the platform are also sellers on the marketplace. In fact, the number of third-party sellers using the retailer’s ad capabilities doubled over the last 12 months, Rainey said.

With more marketplace sellers, advertising to stand out from the crowd becomes more valuable, while the ability to target specific groups of users becomes more useful.

The company’s membership program, called Walmart+, is in a place where the company’s leadership team “likes the trends” it is seeing. That’s because it is building loyalty through ecommerce.

Nearly 50% of Walmart+ members come from the online pickup and delivery channel. Walmart+ members also spend more than other shoppers.

“They shop with us more frequently and the membership deepens engagement, helps enable personalization, and allows us to offer more services and to provide more offers on things that are important to our customers,” Rainey said.

Walmart has yet to release the hard numbers of Walmart+ membership, but said Furner said it is “an important part of the offer.”

“We're encouraged by the growth of new members," Furner said. "And importantly, what we are really ensuring on these new members is that we are helping them see the entire path to get to all the benefits we offer. The core offer, of course, is based in deliveries that are unlimited without cost once you buy into the membership. That's the most important thing that we get right. We measure ourselves really carefully in something we call the perfect order, which is exactly what you ordered on time. And then we continue to work on things like substitutions."

Amid inflation, Walmart is attracting more high-income shoppers that are seeking out the retailer as they seek to save money on groceries. They also tend to be more likely to shop digitally, and Walmart now has expanded pickup and delivery capabilities to offer.

“As we have these new shoppers coming to us, as we have higher income shoppers coming to shop for not only grocery, but general merchandise, we want to retain those," Rainey said. "We want to retain them with better experiences, better product offerings, and we're seeing that in the actions that we're taking today.”

In the end, these pieces of the digital ecosystem don’t operate in isolation. Walmart constructed its ecommerce business so that each service is mutually reinforcing for another. For sellers, they are also integral to success, Furner said.

“If you're a marketplace seller and you want to know how to drive business at Walmart, it's to list on the marketplace, the inventory and fulfillment services,” Furner said. “And then Walmart Connect is just a great way for the seller to be able to find audiences, targeted audiences who are looking for products in categories like the ones they're offered. So it's really the three of those things...that make the customer experience much greater.”

Campbell Soup Company CEO Mark Clouse offered thoughts on messaging amid inflationary shifts in consumer behavior.

After months of elevated inflation and interest rate hikes that have the potential to cool demand, consumers are showing more signs of shifting behavior.

It’s showing up in retail sales data, but there’s also evidence in the observations of the brands responsible for grocery store staples.

The latest example came this week from Campbell Soup Company. CEO Mark Clouse told analysts that the consumer continues to be “resilient” despite continued price increases on food, but found that “consumers are beginning to feel that pressure” as time goes on.

This shows up in the categories they are buying. Overall, Clouse said Campbell sees a shift toward shelf-stable items, and away from more expensive prepared foods.

There is also change in when they make purchases. People are buying more at the beginning of the month. That’s because they are stretching paychecks as long as possible.

These shifts change how the company is communicating with consumers.

Clouse said the changes in behavior are an opportunity to “focus on value within our messaging without necessarily having to chase pricing all the way down.”

“No question that it's important that we protect affordability and that we make that relevant in the categories that we're in," Clouse said. "But I also think there's a lot of ways to frame value in different ways, right?”

A meal cooked with condensed soup may be cheaper than picking up a frozen item or ordering out. Consumers just need a reminder. Even within Campbell’s own portfolio, the company can elevate brands that have more value now, even if they may not always get the limelight.

The open question is whether the shift in behavior will begin to show up in the results of the companies that have raised prices. Campbell’s overall net sales grew 5% for the quarter ended April 30, while gross profit margins held steady around 30%. But the category-level results were more uneven. U.S. soup sales declined 11%, though the company said that was owed to comparisons with the quarter when supply chains reopened a year ago and expressed confidence that the category is seeing a longer-term resurgence as more people cook at home following the pandemic. Snacks, which includes Goldfish and Pepperidge Farm, were up 12% And while net sales increased overall, the amount of products people are buying is declining. Volumes were down 7%.

These are trends happening across the grocery store. Campbell is continuing to compete. It is leading with iconic brands, and a host of different ways to consume them. It is following that up with innovation that makes the products stand out. Then, it is driving home messaging that shows consumers how to fit the products into their lives, and even their tightening spending plans.

Campbell Soup is more than 150 years old, and has seen plenty of difficult economic environments. It is also a different business today, and will continue to evolve. At the end of the day, continued execution is what’s required.

“If it's good food, people are going to buy it, especially if it's a great value,” Clouse said.