Economy

29 March 2023

Ecommerce expected to grow 10-12% in 2023: NRF

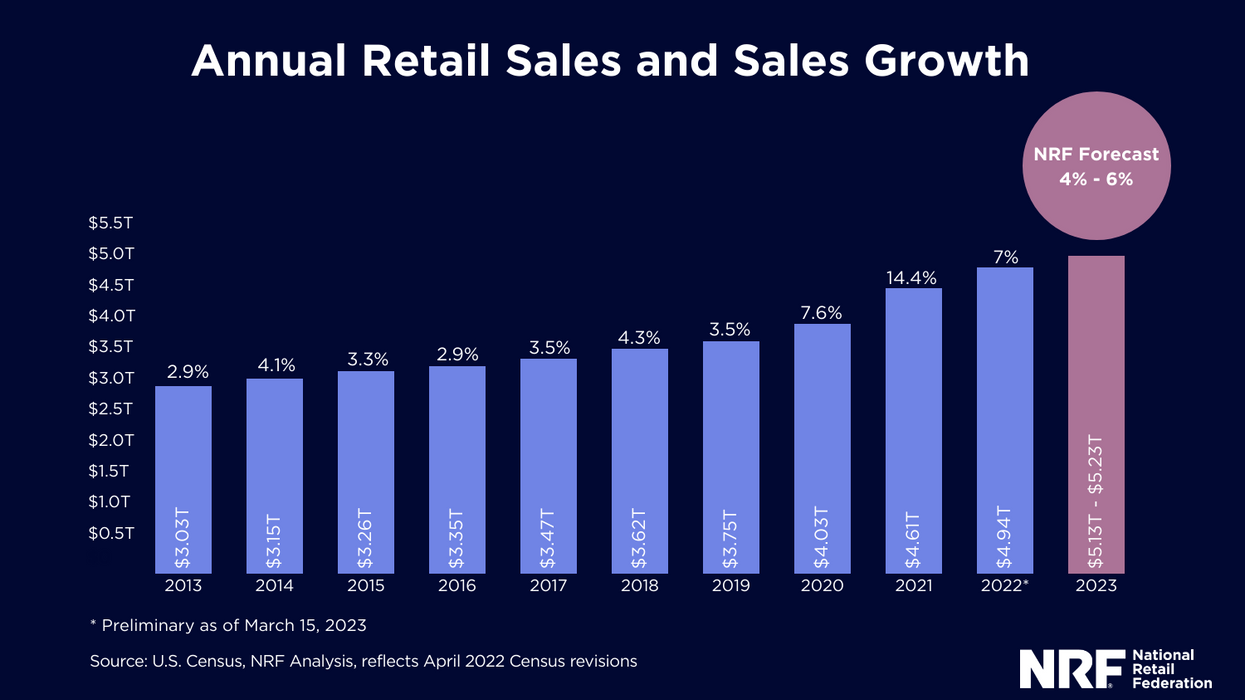

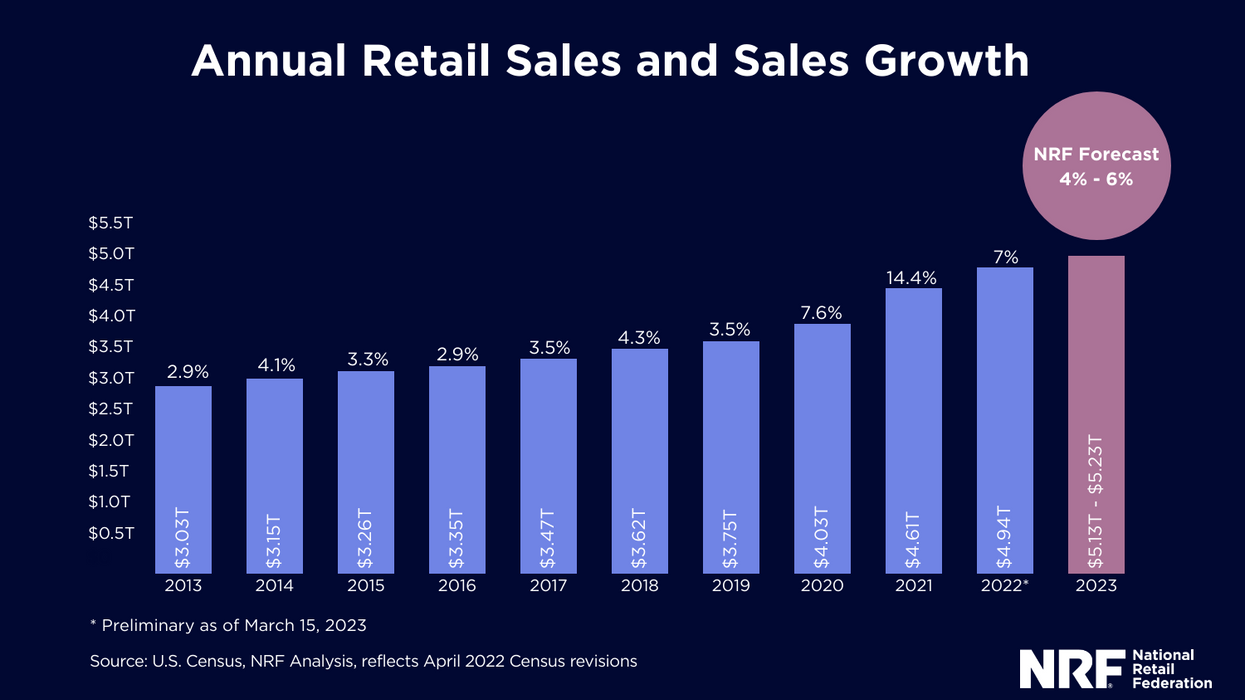

The National Retail Federation is expecting overall retail growth of 4-6%.

(Courtesy of National Retail Federation)

The National Retail Federation is expecting overall retail growth of 4-6%.

(Courtesy of National Retail Federation)

U.S. retail sales are expected to increase between 4 and 6% in 2023 over 2022, according to a new forecast from the National Retail Federation.

That would see retailers bring in revenue in the range of $5.13 trillion and $5.23 trillion for the year.

The estimate, which excludes restaurant, gas and motor vehicle sales, is above pre-pandemic average retail growth of 3.6%. However, it is below the pandemic years. In 2022, growth topped 7%.

Ecommerce and non-store sales are expected to outpace overall retail, with growth between 10 and 12% from 2022. That would range in revenue from $1.41 trillion to $1.43 trillion. While the inclusion of non-store sales from catalogs and vending machines mean this category isn't only ecommerce, the forecast would come well above the 7% growth of ecommerce in 2022, as observed by the federal government. Insider Intelligence released a separate projection on Wednesday that forecast 10% growth.

NRF said much of the ecommerce growth is now driven by multichannel sales that cross both digital and physical shopping. Physical stores continue to account for 70% of total retail, NRF notes.

The forecast arrives at a time of continued uncertainty surrounding the economy. While the supply chain issues and swings in demand of the pandemic have mostly moderated, high inflation and interest rates that are working to bring it down are combining to create headwinds on the consumer. Factor in the Silicon Valley Bank collapse’s ripple effects, and it remains a difficult job to predict results.

“While it is still too early to know the full effects of the banking industry turmoil, consumer spending is looking quite good for the first quarter of 2023,” said NRF Chief Economist Jack Kleinhenz, in a statement. “While we expect consumers to maintain spending, a softer and likely uneven pace is projected for the balance of the year.”

Here’s a look at key economic drivers of the forecast, as presented by Kleinhenz:

GDP: Overall U.S. economic activity is projected to rise between 0 and 1% in 2023. That’s below the 2.1% growth of 2022. Consumer spending makes up 70% of GDP, so this is a significant indicator for retailers.

Labor market: Jobs are a prime indicator of demand, and continued strength in new jobs created and wage growth to start the year is putting the year off to a fairly healthy start, despite inflation. But many economists believe the impact of interest rate hikes will eventually slow down job growth, and give way to a rise in unemployment above 4%, which would be up from its current historic lows later in the year.

Inflation: High prices have weighed on consumers over the last year. While it has come down to begin 2023, the pace of the decline is proving to make inflation stubborn. In the coming months, Kleinhenz said inflation is expected to cut in half to a range of 3-3.5%

Savings: Consumers continue to have access to healthy savings following the pandemic, but that could begin to wane more significantly as the year goes on, especially as continued high inflation leaves shoppers paying more for essentials like food, gas and rent.

Banking: One question mark is how the banking crisis that stemmed from the collapse of Silicon Valley Bank will filter out to consumers. Kleinhenz said it remained too early to determine the direct impact on consumption, but economists at the Federal Reserve have said it could lead to tighter credit conditions that will affect households.Labor disputes on the West Coast could cause further disruption heading into peak season.

When the first half of 2023 is complete, imports are expected to dip 22% below last year.

That’s according to new data from the Global Port Tracker, which is compiled monthly by the National Retail Federation and Hackett Associates.

The decline has been building over the entire year, as imports dipped in the winter. With the spring, volume started to rebound. In April, the major ports handled 1.78 million Twenty-Foot Equivalent Units. That was an increase of 9.6% from March. Still it was a decline of 21.3% year over year – reflecting the record cargo hauled in over the spike in consumer demand of 2021 and the inventory glut 2022.

In 2023, consumer spending is remaining resilient with in a strong job market, despite the collision of inflation and interest rates. The economy remains different from pre-pandemic days, but shipping volumes are beginning to once again resemble the time before COVID-19.

“Economists and shipping lines increasingly wonder why the decline in container import demand is so much at odds with continuous growth in consumer demand,” said Hackett Associates Founder Ben Hackett, in a statement. “Import container shipments have returned the pre-pandemic levels seen in 2019 and appear likely to stay there for a while.”

Retailers and logistics professionals alike are looking to the second half of the year for a potential upswing. Peak shipping season occurs in the summer, which is in preparation for peak shopping season over the holidays.

Yet disruption could occur on the West Coast if labor issues can’t be settled. This week, ports from Los Angeles to Seattle reported closures and slowdowns as ongoing union disputes boil over, CNBC reported. NRF called on the Biden administration to intervene.

“Cargo volume is lower than last year but retailers are entering the busiest shipping season of the year bringing in holiday merchandise. The last thing retailers and other shippers need is ongoing disruption at the ports,” aid NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “If labor and management can’t reach agreement and operate smoothly and efficiently, retailers will have no choice but to continue to take their cargo to East Coast and Gulf Coast gateways. We continue to urge the administration to step in and help the parties reach an agreement and end the disruptions so operations can return to normal. We’ve had enough unavoidable supply chain issues the past two years. This is not the time for one that can be avoided.”