Retail Channels

04 October 2022

Third-party sellers can help Macy's improve selection, price

Riverbend Consulting's Joe Zalta breaks down the retailer's digital marketplace.

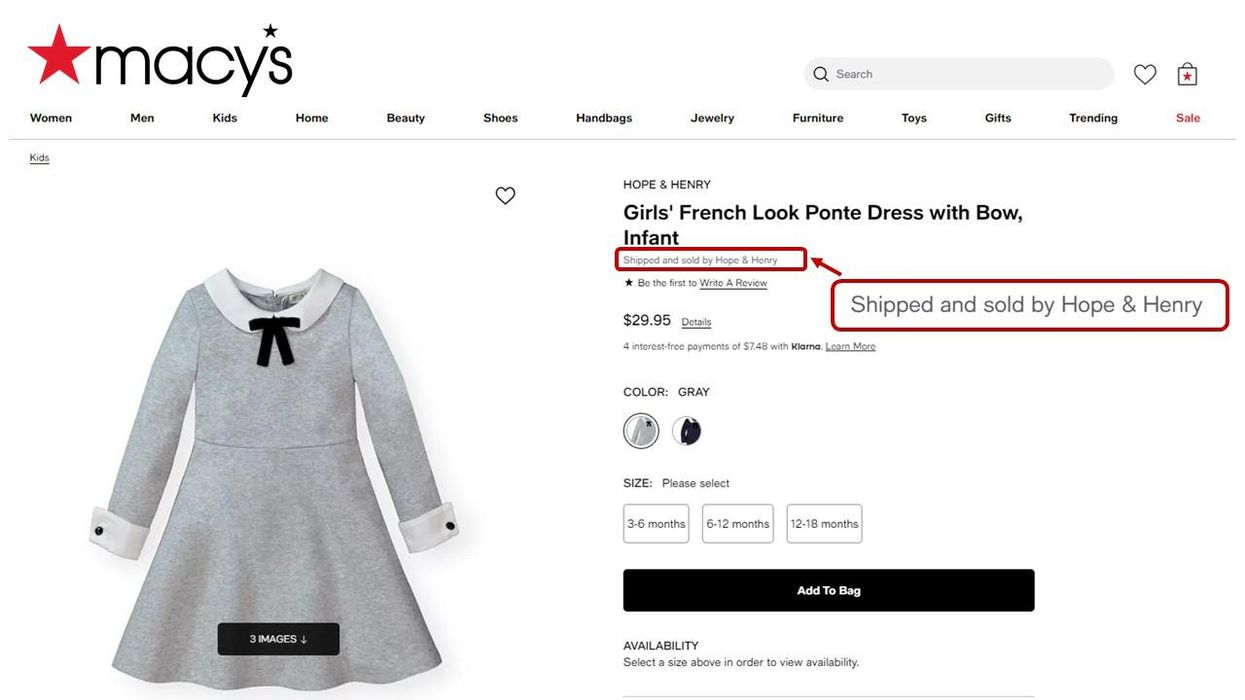

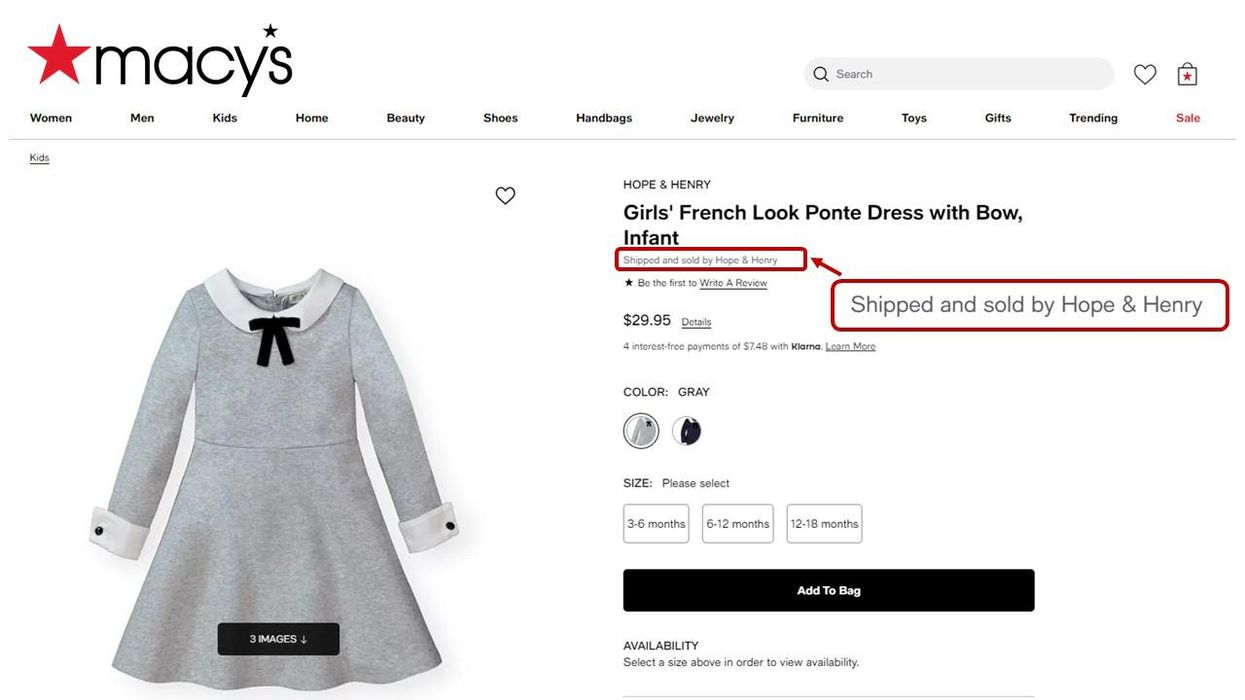

A product page on Macy's marketplace. (Courtesy photo)

Riverbend Consulting's Joe Zalta breaks down the retailer's digital marketplace.

A product page on Macy's marketplace. (Courtesy photo)

With the launch of a digital marketplace, department store retailer Macy’s is looking to tap into a network of third-party sellers as a source of growth for its ecommerce business.

Launched on September 28 after a year of “intense” work, as Macy’s Chief Digital and Customer Officer Matt Baer put it, the marketplace is seeking to add 400 brands in 20 consumer categories as it launches this fall. Macy’s partnered with Mirakl, a marketplace tech provider, to stand up the new offering.

Macy’s has several key building blocks that make the marketplace an appealing avenue for expansion, said Joe Zalta, who brings experience with apparel as a cofounder of Riverbend Consulting, a firm that works with third-party sellers. Following the launch, Zalta provided perspective to The Current on the marketplace's prospects for success.

Zalta said Macy’s standing as a large retailer has made its ecommerce platform a destination with sizable organic traffic. That’s an environment where adding more products and brands via third-party sellers can bring several advantages.

“They'll have to do some policing, but this move will bring better product assortment,” Zalta said. “Over time it will promote more competition and competitive pricing, and the cream will rise to the top. That’s great for consumers.”

The approach harkens back to Amazon’s famous flywheel. Adding more sellers grows the number of products on the platform, and in turn helps to drive prices down. Growing these offerings all keep consumers coming back. Following Amazon’s success with the third-party marketplace model. Walmart and Target launched marketplaces in the years before the pandemic, and are now seeing opportunities for growth. After building up digital offerings to meet demand in the pandemic, longtime retailers such as Bed Bath & Beyond, Land’s End, Hudson’s Bay and United Natural Foods followed suit last year to add the third-party dimension as a part of their ecommerce strategy. Now, Macy’s is among them.

Macy’s position can help to attract sellers to the platform. The cachet and brand equity of a 164-year-old retailer can be an attractive proposition for sellers. It has also proven it can attract shoppers with promotional events, which will provide opportunities for sellers on the platform to benefit.

“They always have sales,” Zalta said, noting that the upcoming holidays are a particularly attractive time, as well as special days such as Mother’s Day. “This will keep consumers coming back,” Zalta said.

Brands such as L’Occitane, Mary Ruth’s, Smeg and Sunday Citizen have already joined the marketplace. Macy’s said that the marketplace will also be an avenue to increase the number of products from women-owned, diverse-owned, and sustainable brands that it offers. This fall, 20% percent of marketplace sellers and brands will be from underrepresented enterprises. When it comes to categories, Macy’s will also add products in areas such as apparel, beauty, home improvement, toys and pet products.

As it adds many new products, Macy’s will aim to keep the visible changes for shoppers to a minimum. The marketplace will be woven into Macy’s existing ecommerce channel, rather than being a standalone section of its site and app. This means that third-party products will appear right alongside the others that Macy’s offers. They will be identified by a badge that notes the sellers handle their own fulfillment and shipping.

Macy’s has said the goal is to provide a curated offering, and the marketplace will also help the retailer customize assortments. As it scales, sellers will be “carefully chosen to ensure alignment with business needs and Macy’s high-quality product and fulfillment standards,” Macy’s said.

When it comes to execution, one key for Macy’s will be to ensure that the user interface remains easy to use, Zalta said. As it adds more brands, Macy’s will have to strike a balance to ensure it doesn’t become too crowded.

“They must strive to simplify things,” Zalta said.

Labor disputes on the West Coast could cause further disruption heading into peak season.

When the first half of 2023 is complete, imports are expected to dip 22% below last year.

That’s according to new data from the Global Port Tracker, which is compiled monthly by the National Retail Federation and Hackett Associates.

The decline has been building over the entire year, as imports dipped in the winter. With the spring, volume started to rebound. In April, the major ports handled 1.78 million Twenty-Foot Equivalent Units. That was an increase of 9.6% from March. Still it was a decline of 21.3% year over year – reflecting the record cargo hauled in over the spike in consumer demand of 2021 and the inventory glut 2022.

In 2023, consumer spending is remaining resilient with in a strong job market, despite the collision of inflation and interest rates. The economy remains different from pre-pandemic days, but shipping volumes are beginning to once again resemble the time before COVID-19.

“Economists and shipping lines increasingly wonder why the decline in container import demand is so much at odds with continuous growth in consumer demand,” said Hackett Associates Founder Ben Hackett, in a statement. “Import container shipments have returned the pre-pandemic levels seen in 2019 and appear likely to stay there for a while.”

Retailers and logistics professionals alike are looking to the second half of the year for a potential upswing. Peak shipping season occurs in the summer, which is in preparation for peak shopping season over the holidays.

Yet disruption could occur on the West Coast if labor issues can’t be settled. This week, ports from Los Angeles to Seattle reported closures and slowdowns as ongoing union disputes boil over, CNBC reported. NRF called on the Biden administration to intervene.

“Cargo volume is lower than last year but retailers are entering the busiest shipping season of the year bringing in holiday merchandise. The last thing retailers and other shippers need is ongoing disruption at the ports,” aid NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “If labor and management can’t reach agreement and operate smoothly and efficiently, retailers will have no choice but to continue to take their cargo to East Coast and Gulf Coast gateways. We continue to urge the administration to step in and help the parties reach an agreement and end the disruptions so operations can return to normal. We’ve had enough unavoidable supply chain issues the past two years. This is not the time for one that can be avoided.”