Department store chain Macy’s is welcoming third-party sellers into its ecommerce fold.

The news: Macy’s on Sept. 28 launched a third-party marketplace on its digital channels, adding what it calls a “curated assortment” of products from third-party sellers and brand partners. Macy’s said the marketplace will allow it to expand the amount of available merchandise on its digital channels. This includes:

- Brand expansion: The marketplace will add 400 brands, including L’Occitane, Mary Ruth’s, Smeg and Sunday Citizen.

- Category growth: More than 20 consumer categories will be available in the marketplace, including apparel, beauty, home improvement, toys and pet products.

- Diversity and sustainability: The marketplace will highlight women-owned, diverse-owned, and sustainable offerings. This fall, 20% percent of marketplace sellers and brands will be from underrepresented enterprises, Macy's said.

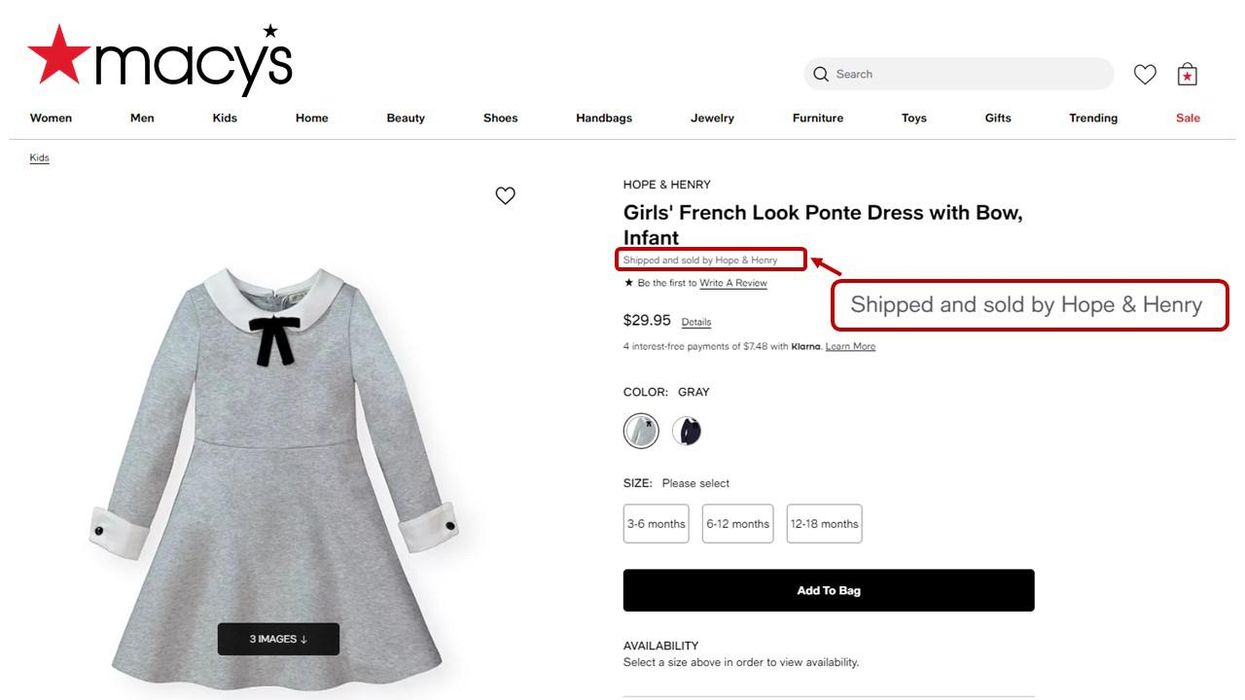

How it works: Within the shopping experience, third-party merchandise sits alongside Macy's other goods. In a statement, Macy’s said that customers of its website and app “should feel minimal differences." Marketplace sellers will be denoted by a badge. The difference comes behind the scenes, as marketplace sellers will be responsible for fulfilling and shipping their own orders. The offering is powered by Mirakl, a company that provides marketplace technology to retailers such as Best Buy, Kroger and Bed, Bath & Beyond.

Macy’s said the marketplace will also be a place to learn. It can adjust assortments for the changing preferences and buying behaviors of customers.

“Our marketplace complements our existing omnichannel strategy and is another platform we will use to find the most efficient distribution strategy for our partners,” said Josh Janos, Macy’s, Inc. vice president of marketplace, in a statement. “Not only will we continue to maximize brands and existing assortments, but we will use the marketplace to test and customize our assortments based on customer demand.”

For sellers: Macy’s said it will work with a “select, curated group of sellers and brands.” Macy’s said the sellers will be “carefully chosen to ensure alignment with business needs and Macy’s high-quality product and fulfillment standards.” The retailer said it has designed a simple onboarding experience, and will offer seller support and training, analytics and promotional participation.

Digital growth: The marketplace launches after Macy’s saw ecommerce sales grow over the last three years. In its earnings report for the second quarter of 2022, Macy’s said digital sales were up 37% over 2019. Digital channels accounted for 30% of Macy’s sales, up 8% from pre-pandemic. For the short-term, Macy’s is facing a number of headwinds due to shifting consumer behavior toward services over goods, and less discretionary spending as a result of higher costs of food and fuel amid inflation. Like other retailers, it also worked through an excess of inventory that was mismatched to demand as a result of supply chain challenges. Digital sales were down 5% year-over-year for the quarter. The retailer sees the marketplace as a way to continue to grow ecommerce offerings in an efficient manner. On the company's

earnings call with investors, CFO Adrian Mitchell said the marketplace has the potential to be a “high return investment that is all about assortment and brand expansion under a curated platform and without the inventory handling costs.”