Marketing

14 September 2022

Walmart's drive to add third-party sellers kicks into high gear

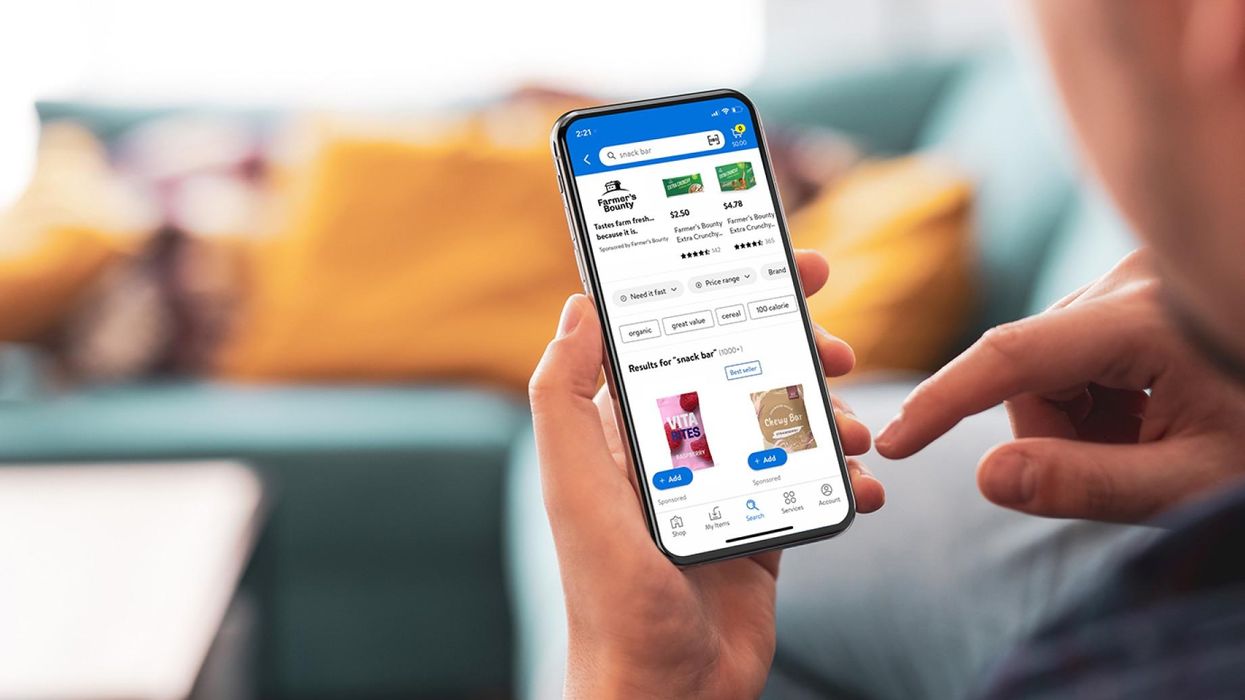

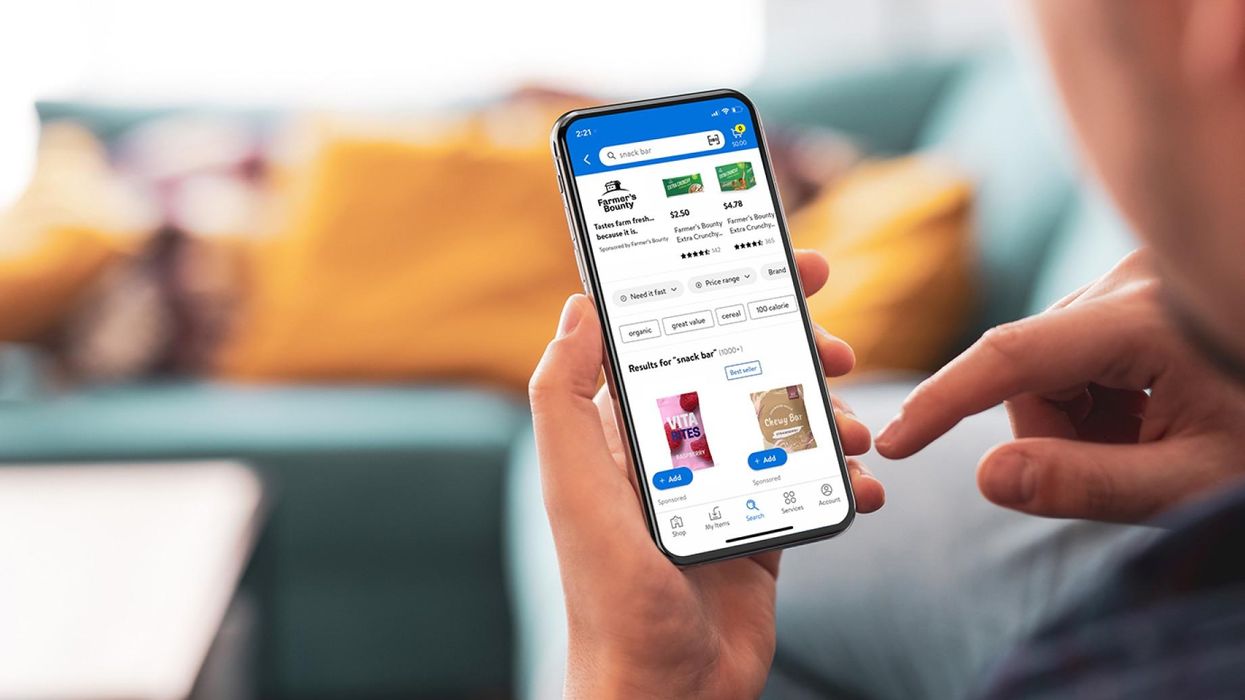

Walmart Marketplace is making it easier for sellers to join, and opening up access to advertising tools.

Walmart Marketplace is making it easier for sellers to join, and opening up access to advertising tools.

As Walmart looks to grow its ecommerce business, the retailer is making a push to attract more sellers to its third-party marketplace by making it easier to get started, providing access to more advertising tools and reaching out beyond US borders.

This comes at a time when Walmart Marketplace is gaining importance for the world’s largest retailer. Alongside the goods from first-party suppliers that are sold directly by Walmart, the retailer’s ecommerce platform contains products from brands that list their own goods, and are responsible for pricing and fulfilling the orders. This third-party marketplace was initially launched in 2009, but Walmart has made a series of increasingly visible moves to grow it following the ecommerce boom that accompanied the pandemic. While it's often one of several marketplaces where sellers list their items, Marketplace can be part of a lucrative equation: Jungle Scout found earlier this year that 95% of Marketplace sellers had a profitable business.

Against this backdrop, Walmart voiced an expectation that 40,000 sellers would join the Marketplace in 2022. On a company earnings call in February, CEO Doug McMillon talked about how third-party growth was among first-order priorities.

“Growing our marketplace expands choice for our customers, helps our sellers grow, and enhances our profit margins,” he said. “Our plan for this year includes strengthening the experience for sellers and adding fulfillment capacity so customers have access to more items faster.”

Working in concert with the membership program Walmart+, the company’s wider ecommerce business and the advertising business Walmart Connect, the Marketplace helps create a flywheel for the company’s digital business: Boosting the number of Marketplace sellers grows the assortment available on the platform, which adds to the appeal of tapping into advertising to stand out in order to reach a growing number of Walmart+ subscribers, who will in turn seek out more products from the growing assortment through repeat visits.

The company’s executives routinely stress the importance of growing this digital business to the company’s future. Walmart’s ecommerce business grew rapidly during the pandemic – posting two-year growth of 90% in 2020-21 – and continued to be a bright spot for the company even as comps moderated when compared to the early quarantine quarters of 2020. In the second quarter of 2022, the company said its ecommerce business outpaced the company's overall sales by growing 12% year-over-year, while advertising was up 30%.

Alongside demand, the supply of items and brands that Walmart has available through online channels is also an important indicator of growth. On Walmart’s recent second quarter earnings call, CFO John David Rainey said the company has over 240 million items in its US ecommerce assortment, and had increased its Marketplace seller count 60% year-over-year.

As it heads into the busy holiday shopping season, Walmart is making a new push to grow the number of sellers on the Marketplace, and deepen the access they have to advertising tools through Walmart Connect.

In one step, Walmart made it easier to join the Marketplace as a seller. According to Marketplace Pulse, Walmart in August replaced a “Request to sell” button that required the company to grant approval to sellers with a “Join Marketplace” button and streamlined registration form that required only key identification and contact info before selling could begin. The move had an immediate impact, as the number of new sellers joining on that week alone was four-times the number of the prior week.

“Previously, Walmart appeared to operate the marketplace as a traditional retailer, trying to control the number of sellers providing assortment in the same niche,” Marketplace Pulse founder Juozas Kaziukėnas wrote. “It doesn’t seem to want to do that anymore, leaving it up to the competition of sellers to surface the best products.”

It’s fitting, then, that Walmart this week announced plans to make it easier for marketplace sellers to access tools that help them stand out.

The company revamped the onboarding process for its Ad Center, where sellers can set up Sponsored Products campaigns to increase visibility during search and browsing on Walmart’s platforms. New sellers are now automatically onboarded to the self-serve ad platform, while existing sellers have had the process to join reduced from three days to “a few seconds,” according to the company.

This comes as Walmart is getting set to roll out a revamped version of the Ad Center later this month. It will include a new look and step-by-step instructions to launch search campaigns.

In October, Walmart said third-party sellers will get access to a tool called the Search Brand Amplifier. This tool boosts products that are being advertised to the top of search results. Previously, this tool was only open to a smaller number of managed sellers and suppliers, but now it will be open to all Marketplace sellers, and managed through the Ad Center.

Walmart's Search Brand Amplifier in Action. (Courtesy photo)

Walmart Connect Head of Marketplace Mike Greenberg wrote in an announcement that this is especially beneficial to “smaller brands, new brands and brands with new products that may not yet have high organic search rankings at Walmart.”

Walmart’s bid to grow the marketplace also includes a campaign to reach out to sellers internationally. In March 2021, it reversed a longtime policy that required sellers to have a US business registration, and opened up the Marketplace to all international sellers. This move was viewed in part as a way to expand into China, but it is open to sellers beyond that country and India, where Walmart owns Flipkart.

This month, Walmart launched a recruiting drive to sign Canadian ecommerce companies up on the platform.

“The drive to attract Canadian companies builds on decades of Walmart’s engagement with retailing and ecommerce in Canada,” Walmart wrote in an announcement. “Giving sellers on the thriving Walmart.ca marketplace an opportunity for international expansion, it also comes as local businesses, especially small- and medium-sized enterprises, are looking to reap the benefits of the Canada-United States-Mexico free trade agreement (CUSMA).”

Now, Walmart is looking to make the backend of its marketplace more internationally friendly, as well. The retailer said it will add more API partners to its platform that offer global support before the end of the third quarter. It will focus on partners from countries where sellers are congregated, like China.

Walmart also made the following resources available for third-party sellers:

The work to attract Marketplace sellers isn’t happening by itself. Other pieces of the flywheel are moving into place.

It can add more offerings for sellers. Earlier this year, Walmart sought to incentivize sellers to join Walmart Fulfillment Services (WFS), which offers access to Walmart’s growing logistics network for businesses outside the retailer. While advertising to attract customers, this creates an additional business line for Walmart in the process of sending packages to customers.

For consumers, Walmart is also moving additional pieces into place.

This week, it rolled out holiday season upgrades to its ecommerce experience on web and mobile, including online styling using visual outfitting, a revamped registry and Spanish language search.

It has also beefed up Walmart+ with a host of new perks over this year, including an expanded fuel discount, access to the Paramount+ streaming service, and the opportunity to upgrade to InHome, the company’s “direct-to-fridge” grocery delivery service. In recent weeks, Walmart+ launched a new rewards program that offers CPGs additional opportunities to reach customers through the advertising business.

And alongside ecommerce and advertising, financial services are set to become a third piece of the equation. According to a Bloomberg report on Wednesday, the Walmart-backed fintech company One is set to start introducing checking accounts for employees and a small number ecommerce customers. It’s described as a beta that the company hopes to eventually expand to more consumers, and additional services including loans and investment.

From third-party sellers to members to bank account holders to employees to suppliers, Walmart is creating a digital ecosystem with a variety of constituencies. With barriers to entry being lowered, the key will be watching how they are connected as they scale.

New advertising opportunities are being beta tested for in-store audio and product demos.

Retail media’s fast growth isn’t only limited to increasing spend. The advertising itself is also poised to appear in more places beyond ecommerce marketplaces, and even beyond the web.

The latest example comes from Walmart Connect, which is the retail media arm of the world’s largest retailer.

Walmart shared details on testing that it is completing for in-store retail media. To this point, Walmart Connect has been considered the advertising platform for Walmart’s ecommerce site. But these tests indicate that’s poised to expand.

Stores present a potent opportunity for Walmart. It has 4,700 big box locations around the U.S., and customers returned to them in droves last year. In 2022, 88% of the retailer’s customers visited Walmart stores.

Walmart Connect already has already dipped a toe into in-store advertising, with a TV wall, self-checkout ads and integrated marketing. The new pilots aim to take a step further.

“The next frontier of retail media is in-store experiences, and it’s one we’re excited to chart,” Whitney Cooper, head of omnichannel transformation at Walmart Connect, wrote in a blog post on the new tests. “But it’s still an emerging opportunity for us, as we continue to test what serves customers best and which solutions are scalable to Walmart’s size.”

Here’s a look at the two new offerings currently under beta test:

Walmart suppliers will be able to integrate product demos into campaigns across in-store and digital environments.

Product demos aren’t new to store floors, but Walmart Connect is seeking to give them an update that blends digital and physical experiences.

“Part of our test is how to enhance the omnichannel experience by bridging the physical back to digital: For example, by pairing a demo cart with QR codes that link back to a curated Walmart.com landing page so customers can find inspiration and shop their list all in one spot,” Cooper wrote.

Walmart is currently offering 120 demos at stores each weekend, and plans to scale to 1,000 by the end of 2023.

Walmart Connect will now offer advertising placements on Walmart’s in-store radio network. Suppliers will have the option to purchase ads by region or store, enabling targeting of key markets.

“This is the first time brands will be able to speak directly to Walmart customers through this medium,” Cooper writes. “These ads also create a new upper-funnel touchpoint for brand marketers and out-of-home (OOH) buyers to create awareness, because in-store audio is about connecting with customers wherever they are in the store — they don’t have to pass the brand in the aisle.”

With the tests, we’ll be watching for how this advertising is measured, and whether Walmart Connect is tracking impact across different types of formats, and not just a single campaign.