Suddenly, Pokemon Go was everywhere.

In 2016, a mobile Pokemon game that used an app to mediate a find-and-capture experience in the real world with characters from Nintendo’s popular franchise exploded in popularity.

While there was plenty of marveling at the game’s ability to capture people’s attention and bring them to even lesser-visited urban locations, there was less attention paid to the technology behind it.

Augmented reality, in which the digital images or graphics on a device are overlaid onto a rendering of the physical world, was developed over years. During those years, it was the subject of many debates about when it would move from an interesting technology in development to wide adoption. With a viral hit, it seemed to finally have its moment.

But recall Pokemon Go, and it’s more likely that what will come to mind is Pokemon itself, or the craze around the game.

The development of augmented reality made the hit game for the masses possible, and its medium-blending capabilities are still being explored for more and more use cases, like shopping.

But the technology was not the reason that it catapulted to wide use in and of itself.

In the ecommerce community, this is worth remembering as leaders consider whether live shopping will take off in North America.

QVC-style sales events that are broadcast on social media and the web are wildly successful in China. It reached 30% of Chinese internet users in the early months of the pandemic, and achieved a GMV of $171 billion in 2020, according to research by McKinsey.

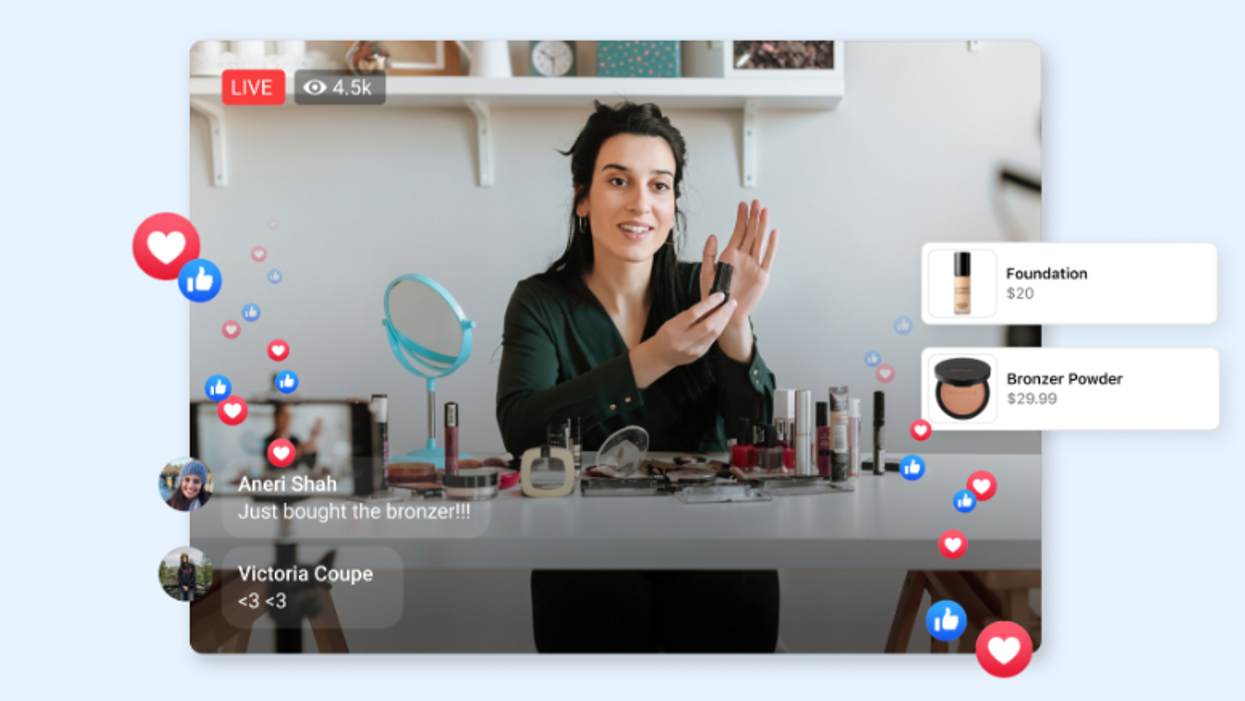

In the midst of the pandemic ecommerce boom, this led to a push to expand it to North America. Startups sprang up to offer the livestreaming video technology and ecommerce tools that could operate a session, and found brands eager to test a new capability that could help lead to conversions. Social platforms rolled out their own live shopping channels, positioning them at the forefront of social commerce, in which social media would be a key place not only to discover new products, but also complete purchases of them.

But recently, signs have emerged that the big social platforms aren't seeing the early returns on live shopping.

In July, TikTok said it wasn't going forward with expansion plans in the US and UK after a yearlong live shopping trial didn't go well in the latter, the Financial Times reported. This came after the Chinese app Douyin, which is owned by TikTok parent company ByteDance, saw 10 billion products sold in a year.

“The market just isn’t there yet,” a TikTok employee told the Financial Times.

Facebook, meanwhile, is shutting down its own live shopping feature in October. Initially launched in 2020, it was part of Facebook's plans to expand shopping functions. But now the app is heading toward a shorter format popularized by TikTok.

“As consumers’ viewing behaviors are shifting to short-form video, we are shifting our focus to Reels on Facebook and Instagram, Meta’s short-form video product,” the company wrote in early August.

Along with the focus on Reels, it's testing a livestreaming service called Super that allows creators to host livestreams. It has similar functionality to Twitch, Business Insider reports:

“As of now, the product runs on a tiered system, with fans paying for access to features included in the streams. Fans can also leave a tip for creators. Creators keep 100% of the income earned through the tired system and tipping feature.”

The creator-first approach is also evident on YouTube, which recently added new tools to make video shoppable and integrate a Shopify catalog. There, live shopping is one of a few options to choose from. From our report:

YouTube is adding new tools to create such content. It is opening up live shopping features to all creators, including the ability to tag products for a livestream. It is also adding a shopping tab within YouTube Studio where creators can manage how products are tagged and where they appear on a channel.

At the same time, it will be easier for brands and creators to bring their products into the platform, and enable checkout so a purchase can take place without leaving YouTube. A new partnership with Shopify will allow creators and merchants to link a Shopify store to their YouTube channel, and feature the available products.

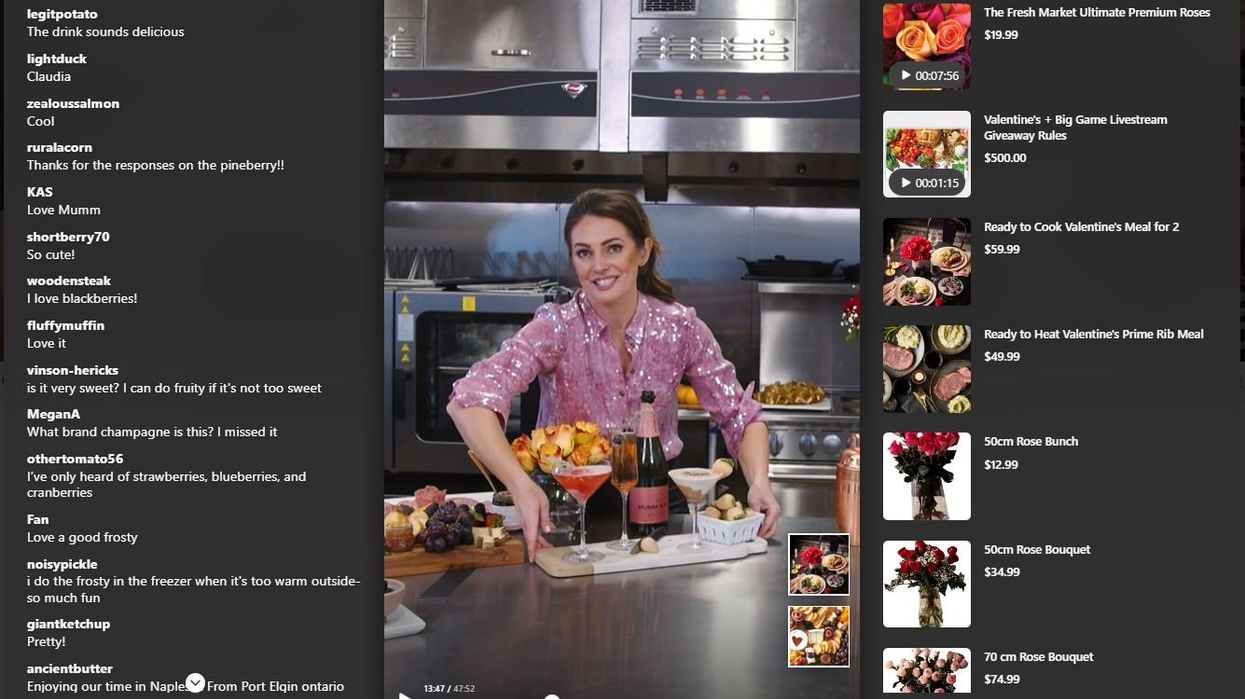

Ecommerce platforms are upping their capabilities, too. Amazon made live shopping a bigger feature than ever during Prime Day. eBay, meanwhile, is seeing early success with live shopping events focused on collectors with a beta of its own platform.

With some efforts pulling back and others just getting underway, it leaves live shopping’s future at something of a crossroads.

The platforms' actions indicate that they still think social commerce is poised to expand. Increasingly, it’s clear that creators are at the center of this wave, empowered with tools that bring together content and commerce.

The question is whether this will include longer live shopping sessions, or if the current move to short-form video will overtake everything else.

But that debate only goes as far as form and function. What will ultimately bring success is an experience that links the person presenting to the products they are selling to the audience they are interacting with.

That all starts with the host.

A charismatic presenter that can hold attention over a longer period and connect with an audience is already viewed as a key ingredient for live shopping success.

But there has yet to be a breakout star.

Find someone poised to break through and provide them with the right tools, and one has a good chance of emerging.

To be sure, technology is the cornerstone of any new application's rise. After all, the streaming capabilities, UI, shoppable video, chat and easy checkout functionality are key to making a session run smoothly, just as marketing and deft integration within an existing platform are crucial to getting the word out. Tools that can make content of a live shopping session more bite-sized and enable it to be evergreen will certainly help.

But those things aren't what will keep people there, and get them coming back. Earlier this year, we reported on how successful live shopping events for activewear brand Lola Getts gave customers a place to connect, and get their questions answered. That's what happens when a person is at the center that people can trust. If they're entertained along the way, all the better. From our report:

“You really have to understand who your consumer is and you really have to have somebody that is engaging to the audience,” [Founder Stacey] Goldstein said. “You need someone that’s passionate not only about the product but about the audience that they serve.

Goldstein hosts the Lola Getts sessions alongside the influencer Coach Tulin. They’ve built a rapport, as well as a connection to the audience and how the products serve them. In other cases, brands work with influencers in specific subject areas, or dedicated live shopping hosts to lead sessions. It’s about building community first, and engaging.

Centering the host may take live shopping in new directions. People have a tendency to shape things in ways that make sense for their context. It means that what ends up succeeding might not look exactly like the live shopping sessions we’ve seen to date in China or North America. It may not even be commonly known as live shopping, or live commerce.

Instead, we'll only think of the name of the person that brought it into the collective consciousness.

Remember, we think of Pokemon Go, and not augmented reality.

People connect with other people, and how experiences make them feel.

Lead with those. If the tech is effective, they probably shouldn't even notice it, anyway.