Shopper Experience

13 May 2022

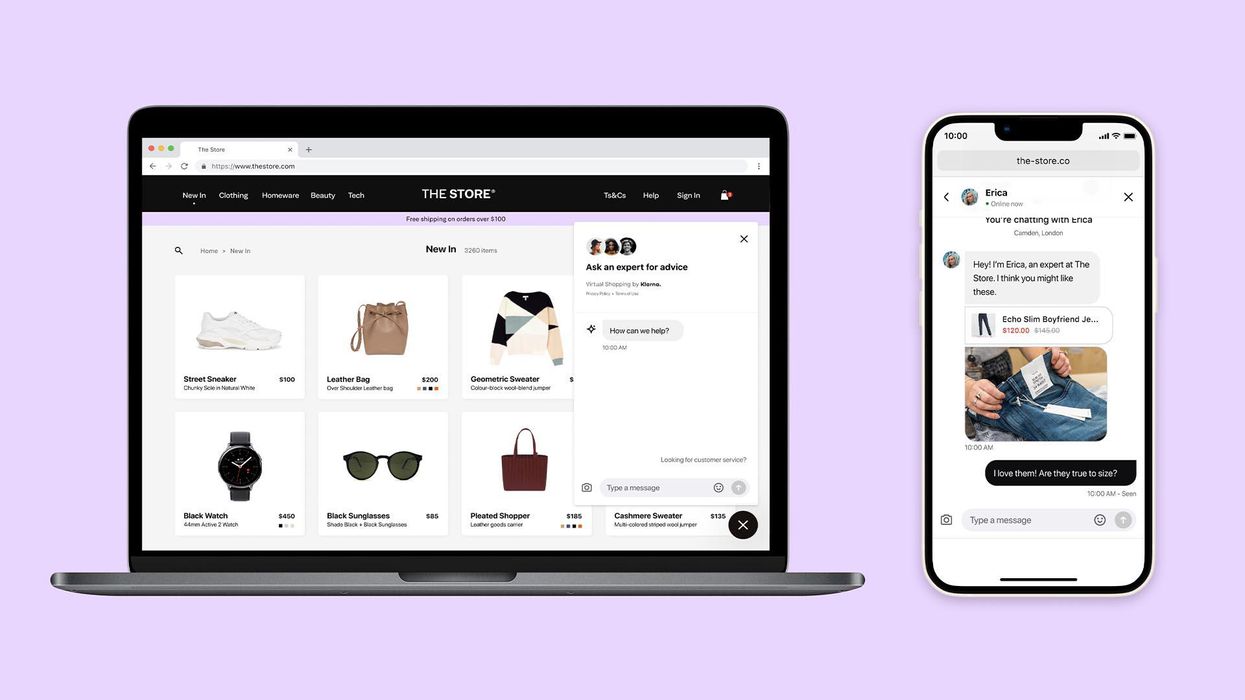

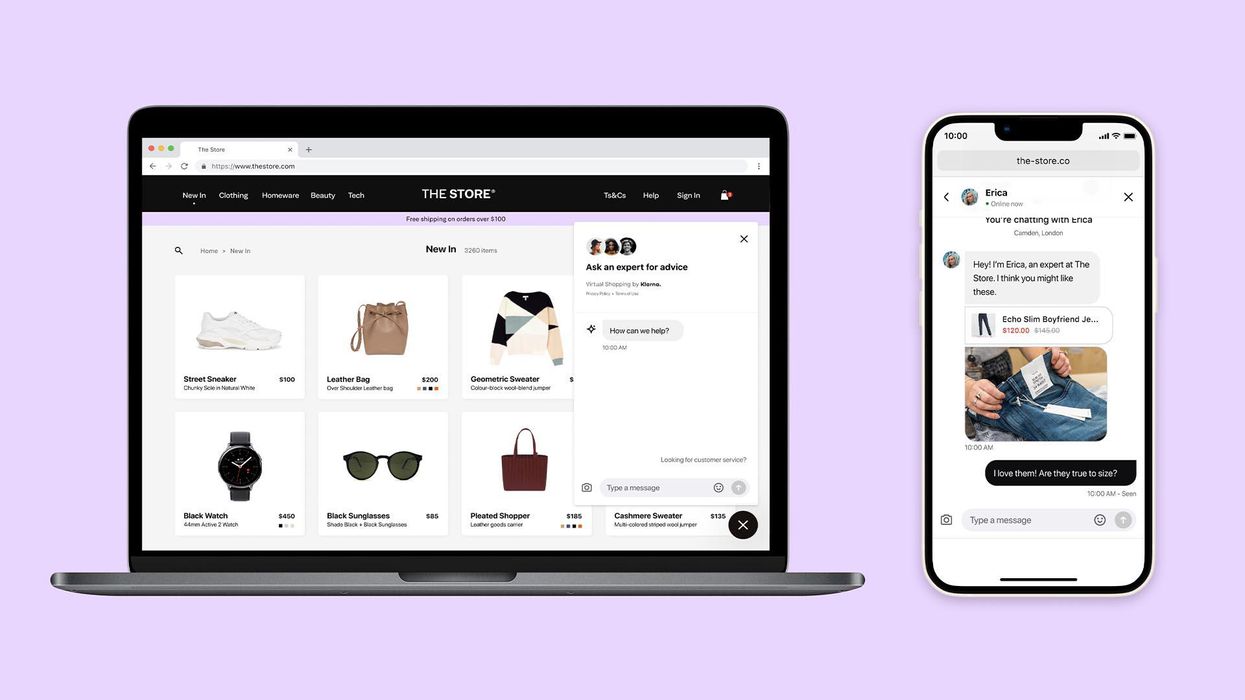

Klarna wants to bring the in-store experience to online shopping

Virtual Shopping connects store associates with ecommerce shoppers for product demos.

Klarna's Virtual Shopping. (Courtesy photo)

Virtual Shopping connects store associates with ecommerce shoppers for product demos.

Klarna's Virtual Shopping. (Courtesy photo)

As in-person shopping picks back up, brands and retailers that grew a digital presence over the last two years are seeking to blend experiences across their ecommerce and brick-and-mortar channels.

This convergence of digital and physical was among the key themes at this week’s Retail Innovation Conference & Expo in Chicago. With consumers increasingly comfortable in a digital format and retailers having strengthened their tech muscles during the pandemic, new tools are likely to emerge that bridge these formats. Factor in that shoppers want more personalized experiences when shopping online, and the kindling is there to light a fire for innovation.

In conversations at the conference, it was clear that a couple of areas on each side of the online-offline equation are ripe for imaginative ideas. One is the experience of ecommerce. It makes shopping fast, convenient and plentiful in choice, but doesn’t provide the moment of discovery that live shopping did. Another is the work of the in-store associate. As retailers seek to attract new talent amid worker shortages in the wake of the pandemic and The Great Resignation, providing additional opportunities for employees to gain skills and add engagement with digital experiences could reshape the position for a new era.

As it happened, Klarna launched a new service called Virtual Shopping that offers a new solution at the intersection of the two.

The service connects online shoppers with experts at brick-and-mortar stores who can offer a closer look at the items they are browsing. Through the newly-launched, merchant-facing Klarna Store App, members of an in-store team can send photos and video of products, and present live demos.

Drawing on the large base Klarna built up offering payments, the new service is already live with over 300 brands, including Levi's, Hugo Boss, and Herman Miller. Now, it is being offered to the 400,000+ retailers with which Klarna integrates, and it is available in 18 markets.

“At Klarna, we want to provide the world's best shopping experience – whether that is online or in-store. In the past, online shopping has been missing a key element: human interaction,” said David Sandström, Chief Marketing Officer of Klarna, in a statement. “With Virtual Shopping, we replicate the brick-and-mortar experience of receiving personalized advice from an in-store expert and bring it to the online realm. This will empower our partnered retailers around the world to bring their online stores to life and build customer relationships that last."

It’s a notable move to extend commerce commerce capabilities for Klarna. The Sweden-based company is primarily associated with digital payments, including Buy Now Pay Later services that allow shoppers to pay for an item in installments. This launch follows the company’s 2021 acquisition of social shopping platform Hero, which specializes in shoppable content. Klarna also acquired influencer marketing platform Apprl last year.

It’s particularly well-timed with the move back to in-store experiences taking place in the first half of this year. However, the company shared data that underscored it is following a path shoppers want anytime. Its Klarna Shopping Pulse report that showed 80% of global retail sales still come from in-person stores, and that shoppers favor the social interaction and customer service of that shopping experience. It added that 78% of respondents said online retailers should invest in new technology to create more personalized experiences.

In recent months, an uptick in technologies from virtual try-on to new sizing solutions aim to allow online shoppers to get a better sense of how an item will look and feel.

Bringing an employee into the experience can add a human touch. With the app accessible anywhere, the associates could also connect with shoppers from other settings, such as a dark store or even at home.

It’s an approach that has helped other experiences that bridge the physical and digital take off. Store associates became key to live shopping experiences in China as it exploded over the last five years, with employees trained in running livestreaming events. The additional skills and opportunity to take on a hosting role that’s typically the province of influencers helps put a new twist on the role of store associates. Plus, it can help fill inevitable down time that comes when foot traffic slows.

As the live shopping trend started to spread west over the last two years, JC Penney applied the approach of putting associates front and center as hosts.

For its part, Klarna has also been among the vanguard of companies hosting live shopping events for brands.

With Virtual Shopping, it’s taking another step toward making the go-live moment a part of the every day experience. With the direct interaction involved between shopper and store employee, it points toward how ecommerce is becoming more social, as well.

Labor disputes on the West Coast could cause further disruption heading into peak season.

When the first half of 2023 is complete, imports are expected to dip 22% below last year.

That’s according to new data from the Global Port Tracker, which is compiled monthly by the National Retail Federation and Hackett Associates.

The decline has been building over the entire year, as imports dipped in the winter. With the spring, volume started to rebound. In April, the major ports handled 1.78 million Twenty-Foot Equivalent Units. That was an increase of 9.6% from March. Still it was a decline of 21.3% year over year – reflecting the record cargo hauled in over the spike in consumer demand of 2021 and the inventory glut 2022.

In 2023, consumer spending is remaining resilient with in a strong job market, despite the collision of inflation and interest rates. The economy remains different from pre-pandemic days, but shipping volumes are beginning to once again resemble the time before COVID-19.

“Economists and shipping lines increasingly wonder why the decline in container import demand is so much at odds with continuous growth in consumer demand,” said Hackett Associates Founder Ben Hackett, in a statement. “Import container shipments have returned the pre-pandemic levels seen in 2019 and appear likely to stay there for a while.”

Retailers and logistics professionals alike are looking to the second half of the year for a potential upswing. Peak shipping season occurs in the summer, which is in preparation for peak shopping season over the holidays.

Yet disruption could occur on the West Coast if labor issues can’t be settled. This week, ports from Los Angeles to Seattle reported closures and slowdowns as ongoing union disputes boil over, CNBC reported. NRF called on the Biden administration to intervene.

“Cargo volume is lower than last year but retailers are entering the busiest shipping season of the year bringing in holiday merchandise. The last thing retailers and other shippers need is ongoing disruption at the ports,” aid NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “If labor and management can’t reach agreement and operate smoothly and efficiently, retailers will have no choice but to continue to take their cargo to East Coast and Gulf Coast gateways. We continue to urge the administration to step in and help the parties reach an agreement and end the disruptions so operations can return to normal. We’ve had enough unavoidable supply chain issues the past two years. This is not the time for one that can be avoided.”