Retail Channels

20 October 2022

Klarna launches price compare, shoppable video, creator platform

The company wants to be a destination for more than payments.

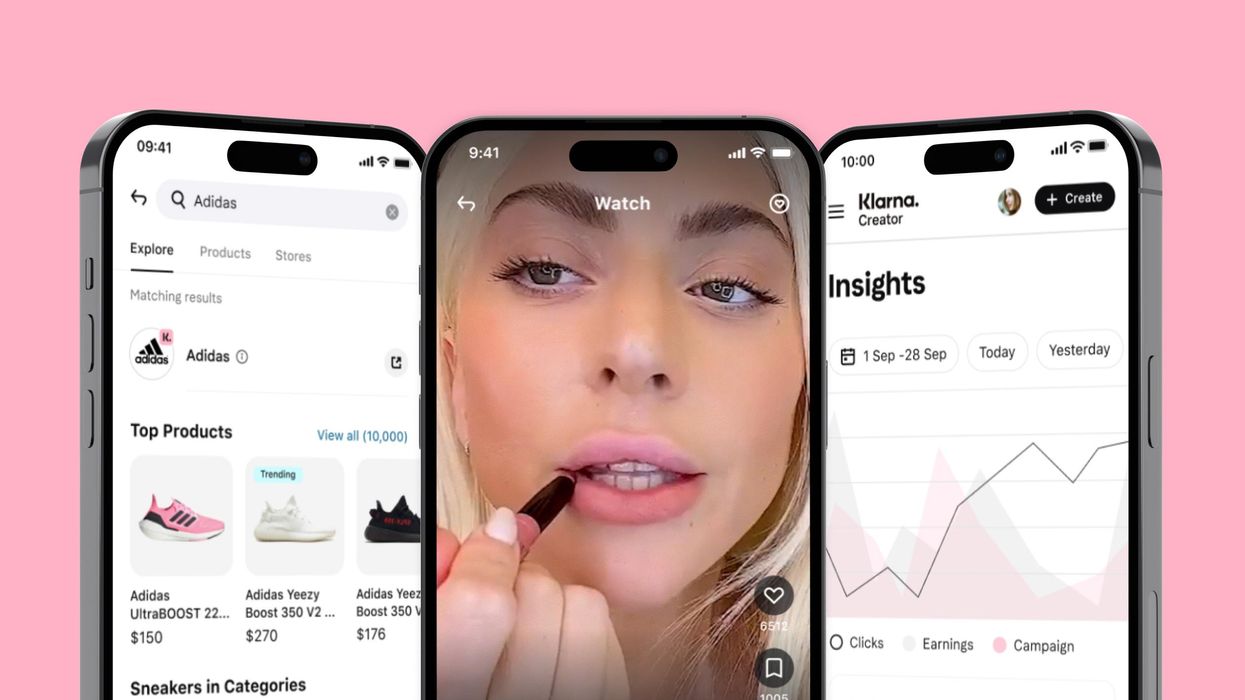

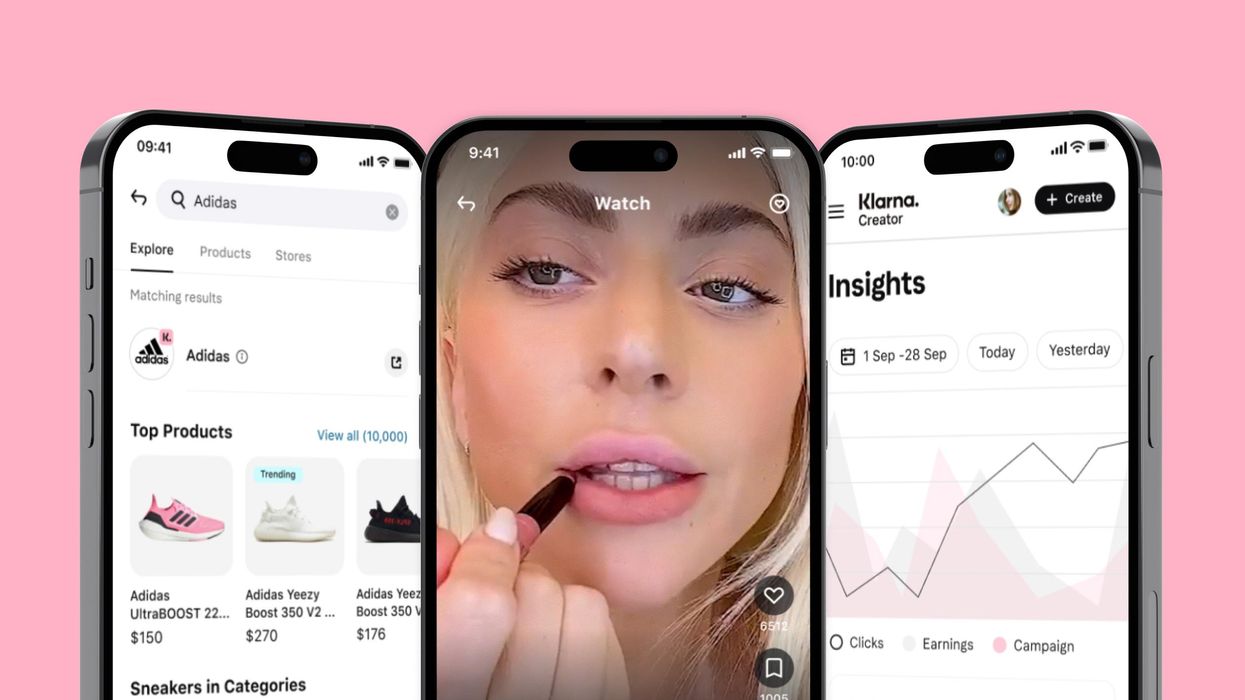

Klarna Spotlight features. (Courtesy image)

The company wants to be a destination for more than payments.

Klarna Spotlight features. (Courtesy image)

Klarna is known for providing tools to facilitate purchases. Now it wants to be more known as a place to find products to buy, too.

The company on Wednesday rolled out a number of new shopping features under the heading of Klarna Spotlight, including search, shoppable video and a creator platform. While Klarna already had shopping, it is not as widely known as a destination for browsing and discovery as it is for payments. In particular, its buy now pay later function, which allows users to pay in installments, became popular during the pandemic, though it offers multiple ways to pay.

CEO Sebastian Siemiatkowski said in an announcement on Wednesday that “payments solve only part of the puzzle,” and the new features will help it evolve beyond them. The company wants to become a “true shopping utility for consumers and growth partner for retailers” and become a “starting point” for purchases.

“The new products revealed today mark a major milestone in Klarna's evolution to becoming a place where consumers and retailers can now search, discover, and create,” Siemiatkowski said. “From inspiring product discovery all the way to delivery tracking, digital receipts and seamless returns – we are powering ecommerce and accelerating trade across the world."

Here’s a look at the new features:

Klarna’s search tool is built to help users locate the best price for a product. The unbiased tool compares prices across thousands of websites. Results are listed in an “orderly overview,” the company said, with both new and pre-loved items displayed. Items can be filtered by color, size, features, customer ratings, store availability and shipping options. A price range can also be displayed.

The search tool is available in the Klarna App and on Klarna.com. But there’s another area where it could have a bigger impact: The functionality will also be available in a new panel within the company’s in-app browser. This means information will appear when a user is browsing a product page, including whether other retailers are offering a better price, faster and cheaper delivery options or different sizes and color. At checkout, the tool will also look for and apply available coupons.

Here’s how the company is positioning it: “With over 23 million monthly active users on the Klarna App, the search and compare tool becomes a key acquisition channel for merchants, boosting their visibility, traffic, and sales with a captive audience.”

Klarna is also bringing content into the shopping experience through shoppable video that is available under the Watch and shop widget in its app. This feature will allow users to watch unboxings, tutorials and reviews from thousands of videos made by brands and creators. The items that appear can be shopped directly from the videos.

Brands can either share existing videos or make new content for the platform. They can also partner with Klarna to be featured in curated content and campaigns. Brands using the feature to date include e.l.f. Cosmetics, Keys Soulcare and Haus Labs by Lady Gaga.

“Our mission at Haus Labs is to deliver supercharged, clean artistry makeup, powered by innovation,” said Lady Gaga, in a statement. "Haus Labs is excited to launch shoppable video content in the Klarna App, empowering our community of artists and creators to express themselves through high-performance makeup and their unique artistry, while engaging with millions of fans around the world.”

Along with shoppable video, Klarna has a new hub for the creators who make content. Klarna says the platform provides a “one-stop shop” for creators to connect with retailers. It provides tools that automate initial outreach, partnerships, as well as tracking sales and commissions.

Klarna touted scale for both sides of the equation. Creators can directly access retailers, who are making available “hundreds of thousands” of products to be recommended to audiences. For retailers, the company says the platform provides a pool of 500,000 creators, and tracking for performance.

Klarna is rolling out an upgraded carbon emissions tracker that provides insights into the environmental impact of purchases. It displays emissions set free for over 50 million items throughout the product’s lifecycle, from the sourcing of raw materials to recycling.

Klarna is also adding a new donations feature to its app. This allows shoppers to donate to vetted organizations that are focused on planet health. The feature also allows users to track the aggregate volume of donations made, and learn more about the nonprofits.

This isn't the first time we've seen a shopping rollout from Klarna this year. The new features follow the release of Klarna’s Virtual Shopping feature earlier this year. Here’s how we described it at launch:

The service connects online shoppers with experts at brick-and-mortar stores who can offer a closer look at the items they are browsing. Through the newly-launched, merchant-facing Klarna Store App, members of an in-store team can send photos and video of products, and present live demos.

This feature gelled with a company that integrates with many in-store retailers, and, judging by the banners on view during a recent trip to the mall, sees opportunity to expand in that area.

The new features, however, are more tied to direct ecommerce purchases by consumers through Klarna, and less about providing additional services to its merchant partners. Of the new features, tying search to price feels particularly natural for Klarna, given its reputation for payments and its existing goal of providing a way to shop the internet from its app. The new browser panel in particular, stands out as a tool that could help shoppers feel like they have an advantage. Shoppable video and a creator platform feel very 2022, and they may well prove to be table stakes for ecommerce going forward. The scale of content and creators at launch is also noteworthy. But it’s less clear how Klarna plans to reach shoppers with the content that they want to see. Remember: TikTok’s power is just as much about the “For You” algorithm as it is about creators and short-form video.

Klarna is making these additions at a time when it has faced a pullback. After expanding quickly to meet demand for buy now pay later during the pandemic, the company’s reported losses in the first half of 2022 that were three times as high as the year prior, even as its revenue jumped 24%, CNBC reported. It has made two rounds of layoffs, including one that accounted for about 10% of the company’s team. It also raised funds at a valuation that was 85% lower than its prior round. The company had been profitable until 2019, when it mounted an aggressive US expansion.

At the same time, buy now pay later as a whole has attracted scrutiny. In September, the US Consumer Financial Protection Bureau expressed concern about rising late fees, and growing use of BNPL for routine purchases, while promising to bring regulation.

It’s a moment when creating new revenue streams and leaning into less controversial business lines may be necessary.

Ask Instacart answers prompts with personalized recommendations.

A pair of recent launches from Instacart highlight how the grocery ecommerce company is integrating two of the key emerging areas of technology into its offerings: Generative AI and marketplaces.

Let’s take a look:

Instacart is seeking to harness generative AI to create a more personalized shopping experience.

A new tool called Ask Instacart that is launching this week is designed to allow customers to type in questions about specific recipes or general recommendations for an occasion. Embedded in the search bar, Ask Instacart also provides personalized questions to be asked by customers. In addition to specific items, it provides information about food preparation, product attributes and dietary considerations.

For those eying how generative AI will play a role in the shopping experience, Ask Instacart shows how search can be transformed into a place for discovery. Instacart is aiming to provide answers to the more open-ended questions that people would naturally ask, not just simply provide info in response to a question that has one answer. It shared the following sample prompts:

The tool is also showing the way for generative AI to integrate with retail media. Ask Instacart is designed to integrate with a brand's sponsored products campaign, so that the answers to questions that match consumer needs can also provide a way for brands to stand out.

To create the tool, Instacart combined the language understanding of ChatGPT with its own AI models. It added in catalog data from 80,000 retail partner locations around the country, which together have more than one billion shoppable items.

Beyond mission: Ecommerce marketplaces have honed a shopping experience where it’s easy to find what you’re looking for. But if shoppers want to happen upon something they didn’t know they needed, social media or the store is still the best place to visit. Instacart is showing how generative AI can make discovery a marketplace function. It also signals that advertising will come to generative AI by way of retail media. Going forward, the growth of discovery could make retail media more valuable as a tool for advertising that raises brand awareness, not just lower-funnel conversions.

Instacart will power a new virtual convenience store for the grocery chain Aldi.

Aldi Express will feature 2,000 of the most-shopped Aldi items, ranging from prepared food and snacks to grocery staples.

Drawing on 2,100 Aldi locations around the country, items will be delivered as fast as 30 minutes, the companies said.

“Through ALDI Express, we’re making shopping more convenient so you can satisfy a craving or get a missing ingredient in minutes,” said Scott Patton, VP of National Buying at ALDI, in a statement. “Together with Instacart, we’ll continue to find ways to innovate and make the online grocery experience even more effortless and accessible.”

Aldi began offering delivery via Instacart in 2017, and has since expanded services to include pickup as well as alcohol delivery.

Aldi’s marketplace moment? While Aldi previously offered delivery, making the assortment available through a virtual store offers the opportunity to create a marketplace for its goods. With the virtual store, it will more closely resemble DoorDash and Uber Eats, which have been expanding their grocery assortment. With a marketplace, additional revenue opportunities could open up for the grocer, such as advertising through retail media.