Operations

29 September 2022

BNPL update: Apple Pay Later delayed, Canadian expansion

Checking in on Buy Now Pay Later in a year of headwinds, regulation, and inflation.

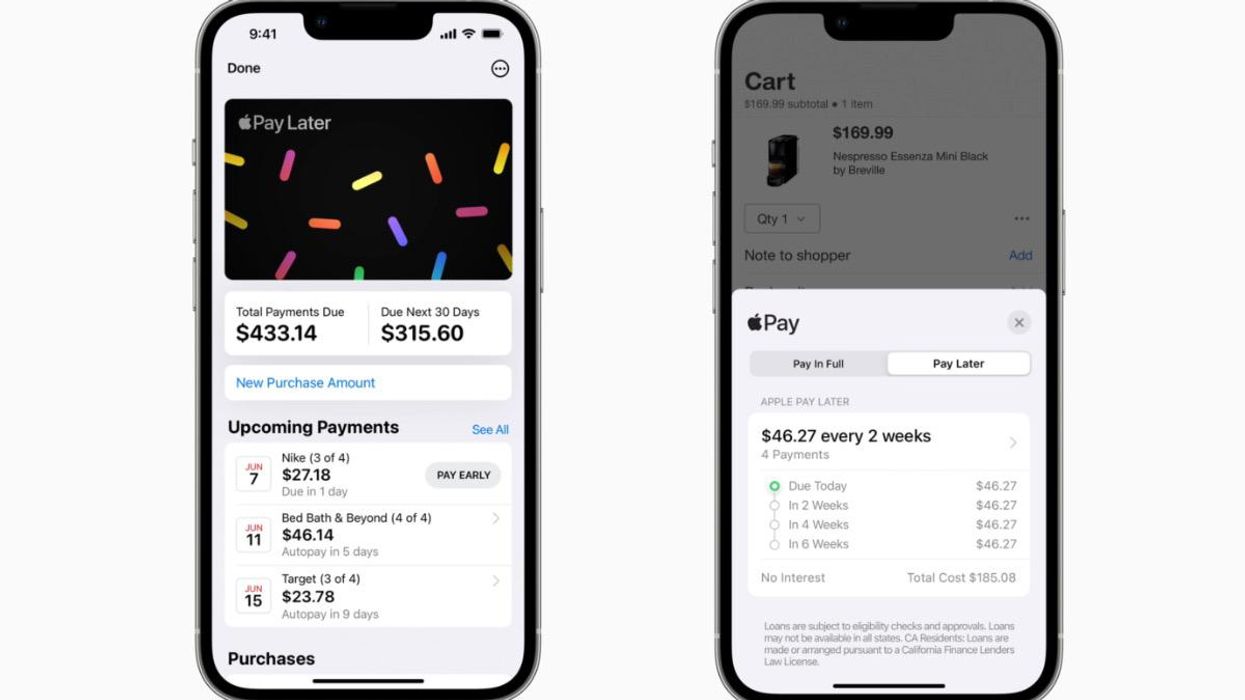

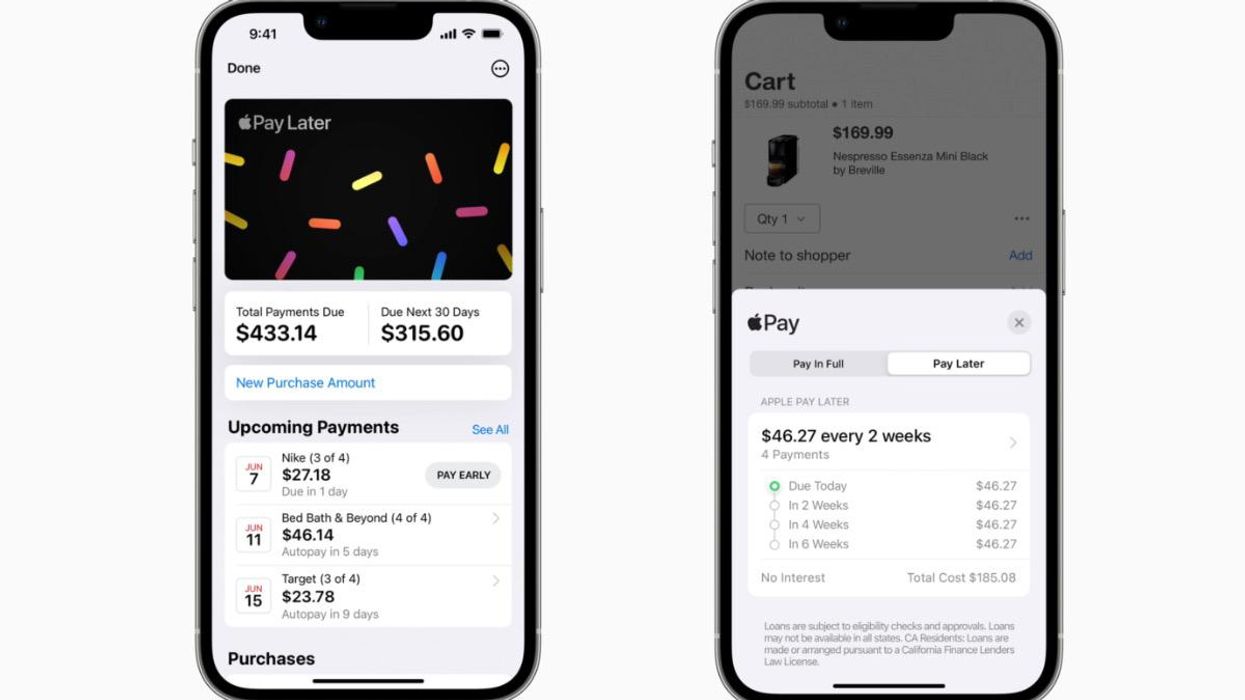

Apple Pay Later wasn't in iOS 16. (Photo via Apple)

Checking in on Buy Now Pay Later in a year of headwinds, regulation, and inflation.

Apple Pay Later wasn't in iOS 16. (Photo via Apple)

The Buy Now Pay Later space was a growth magnet of the pandemic, but the digital installment payments services continue to operate on shakier ground in 2022, while regulation looks more and more likely. Let’s check in on the key players in the space.

Apple made a big splash in the market back in June when it unveiled Apple Pay Later, a buy now pay later service that would be available through Apple Pay. Executives had said iOS 16 would essentially come with Buy Now Pay Later built-into Wallet, holding out the specter of wide adoption and a massive new presence in the space arriving with a single software update.

However, when iOS16 arrived, Apple Pay Later wasn’t there.

According to a report from Bloomberg’s Apple sleuth Mark Gurman, Apple’s release of iOS 16 in September included this note about Apple Pay Later:

Coming in a future update for qualifying applicants in the United States for purchases online and in apps on iPhone and iPad. May not be available in all states.

This raised Gurman’s eyebrows, who said the lack of date indicated it may not be available until iOS 16.4 in the spring, and that there have been “fairly significant technical and engineering challenges.”

More speculation is likely to follow, especially as the headwinds for the space continue to blow (we'll get to that later). Apple set off a frenzy with its initial announcement, so its absence will likely set off a new round of opinions about the reason behind the delay. But you likely won’t find other BNPL firms like Klarna, Affirm and Afterpay too upset.

Before the iOS16 release, Affirm CEO Max Levchin was asked at the Goldman Sachs Communacopia + Technology Conference about Apple’s entrance into the space.

"Apple choosing to enter by now pay later with no late fees is a profoundly important statement to the industry," Levchin told Yahoo Finance. "We’re still massively underpenetrated in the U.S. and even worldwide. ... Apple coming in and saying 'No late fees is the right way to do this' endorses our approach for the last 11 years. Generally speaking, I'm quite positive."

But he might be a little more positive now that they’re delayed.

In fact, it could be a time for the existing companies to gain market share.

For its part, Affirm said this month that it is deepening a partnership with Amazon as it expands into Canada. Through the tie-up, Affirm will be available as the BNPL option on Amazon.ca. It allows customers to split purchases of $50 or more into monthly installments.

Afterpay is also growing northward. It has a new integration with Square that allows ecommerce sellers in Canada to offer the BNPL service, expanding a service that’s already available in the US and Australia. The service is also partnering with Sephora Canada to offer the beauty retailer’s online customers the option to pay in four installments. More than 340 brands will be available under this option.

The reason for the expansion is likely one of proximity, and because the installment payments are growing in the country. As Betakit reported, Research and Markets’ Q4 2021 BNPL survey showed that BNPL payment in Canada is expected to grow by 63.5% annually, and reach $5.95 billion in 2022. This growth comes in part because of the economic slowdown, which is leaving consumers seeking out different financing options. That's one way BNPL could get a boost in a tough economic environment, but the industry has issues of its own in a downturn.

In fact, the use of BNPL is among the bellwethers of shifts in consumer spending amid the pandemic. The New York Times reported on how BNPL was being used for groceries. From the report:

Food, which accounted for about 6 percent of [BNPL] purchases, appears to be an important part of the growth. In the last year, Zip, a company based in Sydney, Australia, says it has seen 95 percent growth in U.S. grocery purchases, and 64 percent in restaurant transactions. Klarna reports that more than half of the top 100 items its app users are currently buying from national retailers are grocery or household items. Zilch, says groceries and dining out account for 38 percent of its transactions.

If households have to pay for food in order to eat on installments, it's considered a sign their budgets are stretching. Industry executives, on the other hand, say BNPL can help cover essentials without taking on credit card debt.

At Klarna, the Sweden-based fintech company that became prominent due to its BNPL service, a second round of layoffs arrived last week. Sifted reported that fewer than 100 of the company’s 6,000 employees will be affected, but it is a sign of continuing cutbacks. The company already made one round of layoffs over the summer, cutting 10% of its workforce. It also raised a round of funding that saw its valuation drop from $46 billion to $6.7 billion.

Sifted offers a reminder that the current economic situation brings plenty of headwinds for BNPL companies:

BNPL startups like Klarna thrive in a low-interest rate environment where it doesn’t cost much to offer credit to consumers.

For the past couple of years this has meant merchant fees and late payment charges brought in enough revenue — but their margins begin to narrow when central banks hike rates, as they have done in recent months.

In the US, the Federal Reserve raised interest rates 0.75% for the third straight meeting this month, and chairman Jerome Powell all but said that this posture would continue. So, the environment might be about to get tougher.

Perhaps the most consequential BNPL news of the month came out of a US regulatory agency that also has a four-letter acronym. The Consumer Financial Protection Bureau (CFPB) issued a long-awaited report on the BNPL industry, and called for the services to be monitored just like credit card companies.

The report laid out several details:

Factor in that the CFPB also offered a reminder about shrinking profits at the services: In 2021, the leaders’ margins were 1.01% of the total amount of loan originated, down from 1.27% in 2020.

Looking ahead, the report laid out several areas of risk in BNPL: Consumer protections are inconsistent. Lenders are shifting to a data monetization model that “may threaten consumers’ privacy, security, and autonomy,” as well as result in market consolidation.

“In some ways, these firms aren’t just lenders, they are also advertisers and virtual mall operators,“ CFPB Director Rohit Chopra told reporters earlier this month. “Because they are deeply embedded as a payment mechanism for e-commerce, Buy Now, Pay Later lenders can gather extraordinarily detailed information about your purchase behavior, in a way traditional cards cannot.”

Accumulation of debt by users who take out multiple loans in a short timeframe is also a concern.

While not addressed directly in the report, the potential risk of loans taken out at a time of inflation could be another area to keep an eye on as the economic conditions worsen. Delinquencies are already on the rise.

CFPB is planning to issue guidance that ensures BNPL adheres to protections and supervisory exams that are issued to credit card companies. It will also “identify the data surveillance practices that Buy Now, Pay Later lenders should seek to avoid,” a news release states.

Klarna's CEO offered this take:

\u201c\ud83c\uddfa\ud83c\uddf8 Good to see @CFPB findings recognize the clear benefits of BNPL over credit cards, which profit from sky high limits and double-digit interest. Here\u2019s why we have a superior product compared to credit cards that benefit consumers exponentially \ud83e\uddf5\u201d— Sebastian Siemiatkowski (@Sebastian Siemiatkowski) 1663252888

Nevertheless, it appears that when Apple Pay Later does release, it seems likely it will be debuting in a world of increased scrutiny on BNPL, and perhaps even full-blown regulations. Is that factoring into the timing of the release? We don't know anything beyond what Gurman has reported.

One open question is whether the market will have the same shape by the time Apple Pay Later is out. On Affirm’s recent second quarter earnings call, Levchin made a statement that seemed to indicate movement could be on the horizon.

“For quite some time, we've expected consolidation to begin in this space,” he said, according to a Motley Fool transcript. “Our exciting mission, market leadership and a strong cash position make Affirm an exit of choice for teams with great talent now that the prices and the parlance of our times have corrected a bit. We have no specific M&A targets to report today, but are keeping a very keen eye on the market.”

To be clear, he was referring to Affirm being the buyer. It's clear that shopping has begun.

Still, plans to buy big-ticket items ticked up.

“Deterioration.” “Gloomy.”

Those were a couple of the words used to describe consumer confidence in May. The Conference Board reported that the index fell to a six-month low amid debt ceiling anxiety and increasing concerns about employment.

“Consumer confidence declined in May as consumers’ view of current conditions became somewhat less upbeat while their expectations remained gloomy,” said Ataman Ozyildirim, senior director of economics at the Conference Board, in a statement. “...While consumer confidence has fallen across all age and income categories over the past three months, May’s decline reflects a particularly notable worsening in the outlook among consumers over 55 years of age.”

The dip among those over 55 came as Congress negotiated a deal over increasing the debt ceiling that included talk of cuts to programs such as social security and Medicare. While officials reached an agreement over Memorial Day weekend, the Conference Board’s survey was fielded prior to that date.

The job picture appears to be more anecdotally cloudy, as the number of consumers reporting jobs as “plentiful” fell to four percentage points to 43.5%. The job market has been consistently robust for nearly three years, as unemployment remains near historic lows. In April, the economy added 253,000 jobs, which remained a positive sign despite being below the gains of prior months. The confidence reading comes ahead of fresh data from the U.S. Bureau of Labor Statistics on Friday.

Despite the declines, there were signs that consumers are not completely pulling back on big-ticket items. Plans to buy big-ticket items such as cars and appliances ticked up on a monthly basis. It’s worth watching whether this extends to providing resilience in other discretionary categories, which have seen a pullback in early 2023.

Nevertheless, the index offered another sign that the consumer mood is getting more pessimistic. It was the fourth time in five months that confidence fell. On Friday, the University of Michigan offered another with a consumer sentiment report that showed a 7% dip.

Brands and retailers must work to reach consumers that are increasingly in less of a buying mood than the month before.