Economy

13 September 2022

Ecommerce prices rose again in August as inflation proves stubborn

Rising food and apparel prices kept the price pressure on the US economy in August.

Inflation continues to rise.

Rising food and apparel prices kept the price pressure on the US economy in August.

Inflation continues to rise.

Gas prices are coming down, but spiking costs of food and other goods are keeping inflation marching upward at stubbornly high rates. In fact, prices ticked back up in the latter part of the summer after a brief period where they appeared to be falling.

Those are the main takeaways from August reports on inflation across the US economy. With each passing month of price increases, the road to bring inflation down will get longer, and potentially more arduous.

For a snapshot of where we are now, here’s a look at the latest data from the US Consumer Price Index, and Adobe’s Digital Price Index, plus a brief look at household incomes:

In August, US inflation rose 8.3% over the previous year, according to the Consumer Price Index from the US Bureau of Labor Statistics. This was down slightly from the 8.5% increase recorded in August, keeping inflation at 40-year highs, but now below the record pace of 9.1% recorded in June.

While downward is the motion that many want to see, there were signs in the report that inflation is sticking around. Month-to-month, inflation increased 0.1% over July, according to the CPI. Economists had expected this metric to decrease by 0.1% for the month, according to CNBC. The monthly reading was unchanged for July when compared to June, so it’s actually a sign that some of the price increases are ticking back up.

There are also signs of shifts in certain categories, indicating that no one sector will bring us out of this. During this monthslong bout with inflation, consumers have paid more for gas and food. Now, those prices appear to be heading in opposite directions, while the cost of living is still generally going up.

Further underscoring how those categories outside of gas are increasing, core inflation, which sets aside volatile food and gas prices, was up 0.6% month-over-month after rising 0.3% in July. For the year,

The shelter index was also up 0.7% in August, compared to 0.5% in July. This index, which includes rent prices, rose 6.2% over the last year. That accounts for about 40% of the total increase in the core inflation rate, per the CPI.

In other consumer goods categories, household furnishings increased 1% in August, personal care increased 0.6% and apparel increased 0.2%.

The inflation data arrives just over a week before the Federal Reserve is set to announce its latest decision on whether to increase interest rates. At its last meeting in July, rates were increased 0.75% for the second straight month. Chairman Jerome Powell has since given speeches hammering the point that the central bank is set to keep taking action until inflation is back down to the Fed’s desired year-over-year inflation rate of 2%. The message from this month’s CPI appears to be that there’s a long way to go to get there. The Fed has said it will make decisions based on the latest data, and this doesn’t appear to change much.

“We must keep at it until the job is done,” Powell put it this way at a speech in Jackson Hole, Wyoming.

Even though sticker shock at the pump may start to recede, consumers will still be facing higher costs at the grocery store and in monthly housing and utility bills. That could keep eating into discretionary funds available for other purchases. This could have a cumulative effect during the holidays, which is typically peak season for retailers as people are buying for both themselves and others. On Tuesday, Deloitte released a new forecast that holiday retail sales will rise between 4% and 6% in 2022 when compared to the prior year, which would under the inflation rate. However, the price-conscious environment could push consumers to seek deals online, where Deloitte is forecasting a sales increase of 12.8% to 14.3% in 2022.

"As inflation weighs on consumer demand, we can expect consumers to continue to shift how they spend their holiday budget this upcoming season," said Nick Handrinos, vice chair of Deloitte LLP, and US retail, wholesale and distribution and consumer products leader, in a statement. "Retail sales are set to increase as a result of higher prices, and this dynamic has the potential to further drive ecommerce sales as consumers look for online deals to maximize their spending. Retailers across channels who remain aligned with consumer demand and offer convenient and affordable options can be well positioned for success this season."

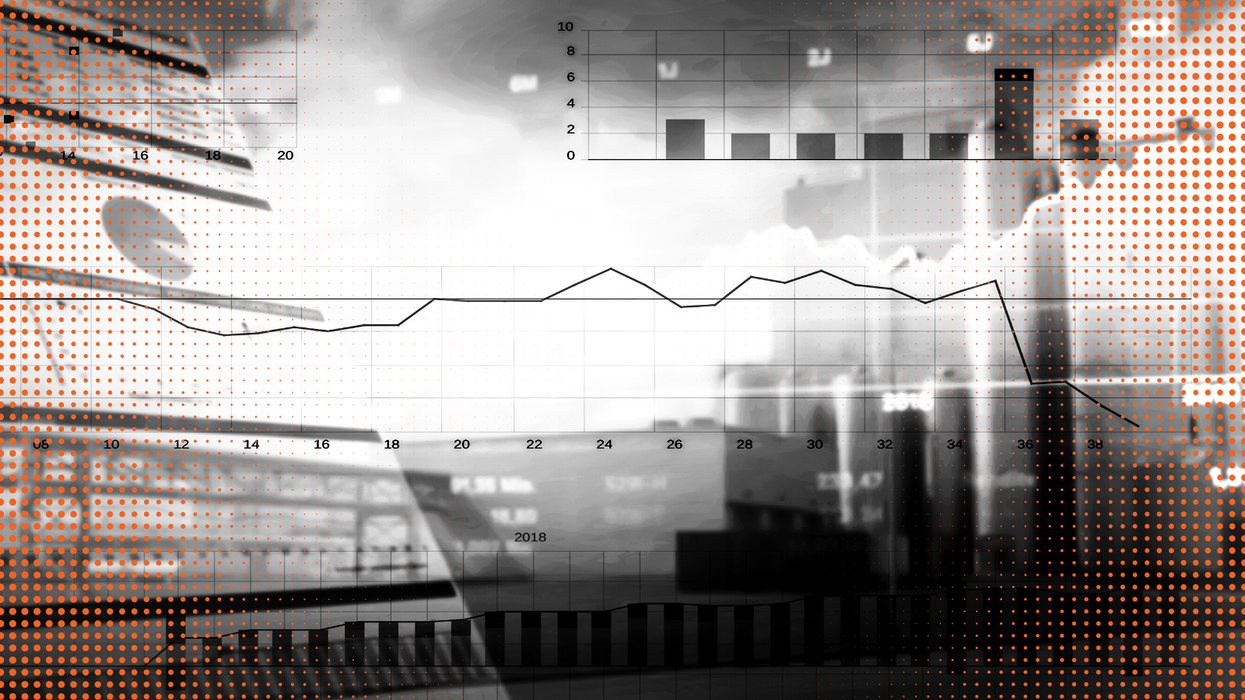

(Courtesy of Adobe Analytics)

Online inflation was back on the rise in August after entering deflation in July. Ecommerce prices rose 0.4% year-over-year and 2.1% month-over-month, according to the Adobe Digital Price Index. In July, online prices had dropped 1% year-over-year.

The return to rising prices was driven by the following categories:

A continued surge in grocery prices drove the return to rising inflation in digital commerce. The food category’s inflation increased 14.1% year-over-year, marking a new record high. Online grocery prices tend to more closely mirror those in the CPI than other ecommerce categories, and prices in this area have been on the rise for 31 straight months in a similar pattern to the wider economy. It's the category to watch for price spikes, no matter where you're selling.

A rise in apparel prices was also a big contributor to online inflation, increasing 4.9% year-over-year and 8.7% month-over month. Prices in this category were down 1% year-over-year in July as a result of discounts offered for back-to-school season, and markdowns made by big retailers as they sought to work through a glut of inventory. Adobe notes that this category tends to be more seasonal, as retailers offer discounts in certain months to make way for new inventory.

Personal care products also rose 2.7% year-over-year. This was the highest year-over-year increase in the category since March 2021, when prices were up 3.6% year-over-year.

“Demand for personal care products has risen in tandem with online grocery shopping, as the two categories often share the same ecommerce basket,” Adobe writes.

Falling consumer electronics prices continue to buoy the overall rise of inflation. Electronics prices in August were down 10% year-over-year, which outpaced the average of 9.1% in the five pre-pandemic years. Meanwhile, computer prices were down 12.6% year-over-year, which was the largest drop since the onset of COVID-19 quarantine measures in March 2020.

Despite rising prices, demand remains elevated. Adobe said the $64.6 billion spent in August was a 6.5% year-over-year increase. Continued spending will also play a role with inflation, as brands and retailers won’t see as much reason to drop prices.

“The modest uptick we see in online prices for August was driven in large part by rising food costs that show no signs of abating, just as seasonal discounts in a category like apparel phased out through the end of summer,” said Patrick Brown, vice president of growth marketing and insights at Adobe, in a statement. “Consumer demand for ecommerce also remains steady and will keep prices elevated, especially for growing categories such as groceries, pet products and other consumer staples.”

Digital prices by category. (Courtesy of

US household incomes didn’t get any larger in 2021, and they didn’t get any smaller either.

According to the US Census Bureau, real median income was $70,784 in 2021. This was “not statistically different” than the 2020 total of $71,186.

The Bureau’s estimates are adjusted for inflation. This latest reading came on a year when inflation rose 4.7%. That was already the largest annual increase in the cost-of-living adjustment since 1990, even as it came well before the worst months of inflation that have set in during the middle part of 2022.

Income levels can help to paint a picture of how much consumers have to spend. But as this year has reminded us, it’s one of a number of factors in the equation, alongside costs and expenses. The question surrounding inflation is whether the uptick in costs will outpace rising incomes, leading people to ask for higher wages, which in turn keeps prices higher. That’s an upward spiral the Fed wants to avoid, but the central bank has the difficult task of breaking the cycle without wrecking the economy in the meantime, so the change won’t all come at once. The question this time next year when this measure is released will be whether a period of inflation arriving during a hot job market has led to any meaningful change in income.

Here are some more facts on 2021 income and poverty from the Census.

The retailer's marketplace is expanding quickly.

When it comes to ecommerce growth, was the pandemic a blip or a new trendsetter?

As we move further from the height of COVID-related closures, it’s a question that will start to be answered through the lens of history.

So far, the narrative of ecommerce growth in the U.S. from 2019-2022 has gone like this: Ecommerce’s share of overall retail saw a huge spike at the height of the pandemic in 2020-21, when goods in general were in demand and online shopping was necessary to preserve health and safety. Experts looked out and saw a permanent exponential change in the penetration of ecommerce as a share of retail that would last beyond the pandemic. Then, in 2022, everyone went back to stores and the trendline came back to 2019 levels. Growth was no longer exponential. There was still growth, but it was not happening as fast as during the pandemic period.

With this in mind, it’s worth pointing out that 2023 is the first year that there likely won’t be a pandemic-influenced swing to influence ecommerce growth. It is also a year where demand has suffered challenges amid inflation and interest rate hikes.

So as we seek to determine the importance of ecommerce to overall retail, it’s worth it to continue taking a close look at what growth trends retailers are seeing now, whether ecommerce is remaining resilient amid consumer pullback and how retailers are preparing for the future.

The latest example arrived this week from Macy’s. It’s a fitting one for the times. Overall, Macy’s is seeing a slowdown as consumers pull back on discretionary purchases, with sales declining 7% in the first quarter versus the same quarter of 2022. Digital sales were down 8%.

Macy’s is particularly susceptible to the macroeconomic headwinds that many brands and retailers are facing, as spending among the middle-income consumers it counts as a primary customer base is particularly softening, said GlobalData Managing Director Neil Saunders.

But while ecommerce is slowing overall, the importance it gained to Macy’s business during the pandemic is remaining in place.

In 2019, ecommerce made up 25% of Macy’s revenue, CEO Jeff Gennette told analysts on the company’s earnings call. That jumped to a high of 44% in 2020. By 2022, digital reached 33% of sales after the pandemic boom. In the first quarter of 2023, it remained at 33%. So, while the trend line dipped after shoppers returned to stores, ecommerce share still settled in at a higher post-lockdown point than it was before the pandemic.

This came in a quarter in which traffic was “relatively good” across both online and in-store, Gennette said. It was “flattish” online, and slightly up in stores.

“We do expect that this is the reset year with the penetration between them,” Gennette said. “But we do expect more aggressive growth in digital in the future versus stores as we think about '24 and beyond. And that's going to be foisted by a lot of ideas and strategies.

Over the last year, the retailer has made investments in boosting ecommerce, even as shoppers returned to stores. In a bid to boost the assortment of goods available online, Macy’s launched a marketplace in September 2022 that welcomes goods from third-party sellers.

The marketplace had an “outstanding” first quarter, said Macy’s President Tony Spring, who is poised to succeed Gennette as CEO next year. Gross merchandise value increased over 50% when compared to the fourth quarter of 2022, while the average order value and units per order for marketplace customers was 50% above those not shopping at the marketplace.

Macy’s is continuing to build the marketplace even as it racks up sales. The retailer added 450 brands, ending the quarter with 950 brands.

This is helping to draw in new customers, as well as younger existing customers who are buying more items, resulting in increased basket size.

“We're very excited as to how marketplace is really attracting the Gen Z customer, particularly in categories where it was not economically feasible for us to carry in the past,” Gennette said.

In the end, Gennette said a strong digital and social presence is key to attracting younger consumers. That's a different type of shopper than other age groups.

“We know the younger customer starts first online,” Gennette said. That behavior will still be in place as the generation gets older, and gains more buying power in the process.

Going forward, Macy’s is seeking to expand the model to other retail banners in its portfolio. Bloomingdale’s will open a marketplace in the early fall.

The Macy’s ecommerce trajectory isn’t that different from the wider U.S. ecommerce narrative detailed above. With one quarter of 2023 data, there is evidence that ecommerce share settled out at a higher point after the pandemic than where it started before COVID arrived. There is flattening now, but the retailer is taking it not as a sign of a slowdown, or a signal to change course. Rather, it sees changing consumer behavior as a reason to build for the future.