Operations

28 March 2023

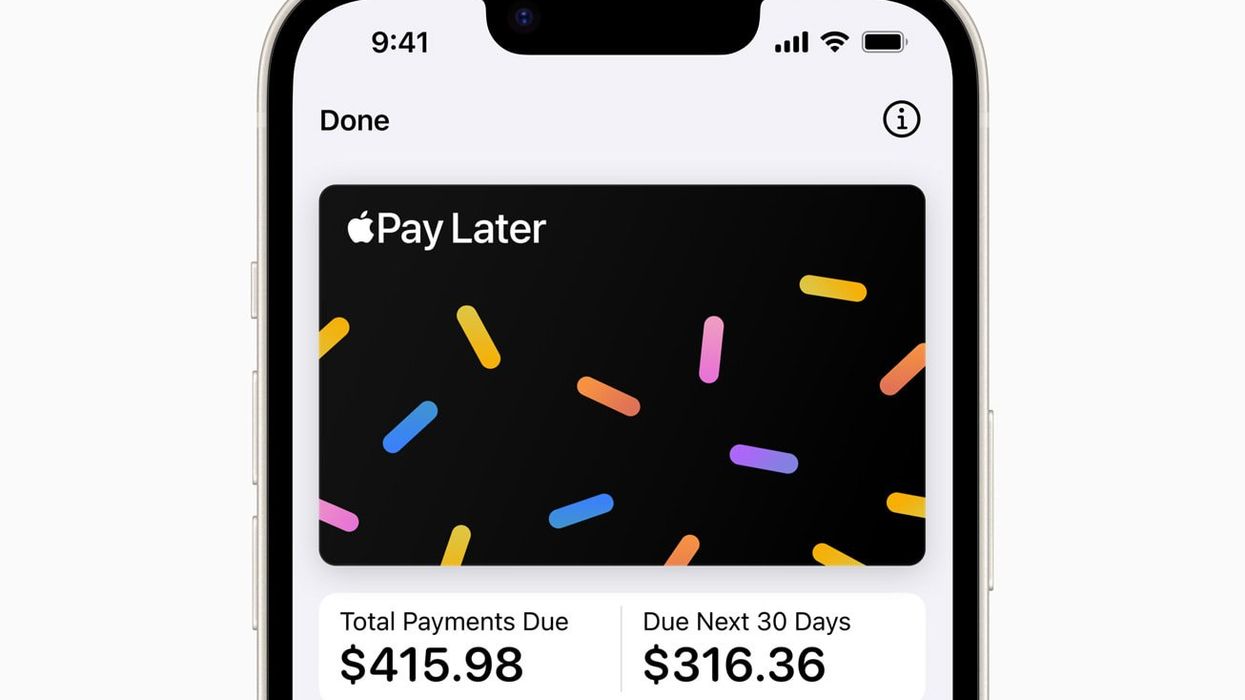

Apple's buy now pay later offering launches with built-in advantages

Apple Pay Later comes inside Wallet, and merchants don't have to take any extra steps to start accepting it.

Apple Pay Later (Courtesy photo)

Apple Pay Later comes inside Wallet, and merchants don't have to take any extra steps to start accepting it.

Apple Pay Later (Courtesy photo)

In June 2022, Apple shook up the digital payment market with news that it would enter the Buy Now Pay Later space.

It came at a time when BNPL’s trajectory seemed to be moderating, as the return to in-person experiences and tightening economy were pulling back pandemic-era gains across ecommerce.

Still, Apple’s announced entrance was a big deal. With a BNPL option that was pre-loaded into Apple Wallet coming to iPhones everywhere, it was easy to see a path for Apple to become a new leader in the market overnight.

But as months went on, the service didn’t launch. In September, word came down from Bloomberg Apple sleuth Mark Gurman that the product was facing “significant technical and engineering challenges.” Speculation about the service stretched on, but there was no further official word from Cupertino.

On Tuesday, the talk will be put to rest. Apple Pay Later formally launched with an announcement that the company will begin inviting select users to test a prerelease version. A wider launch will follow in the coming months.

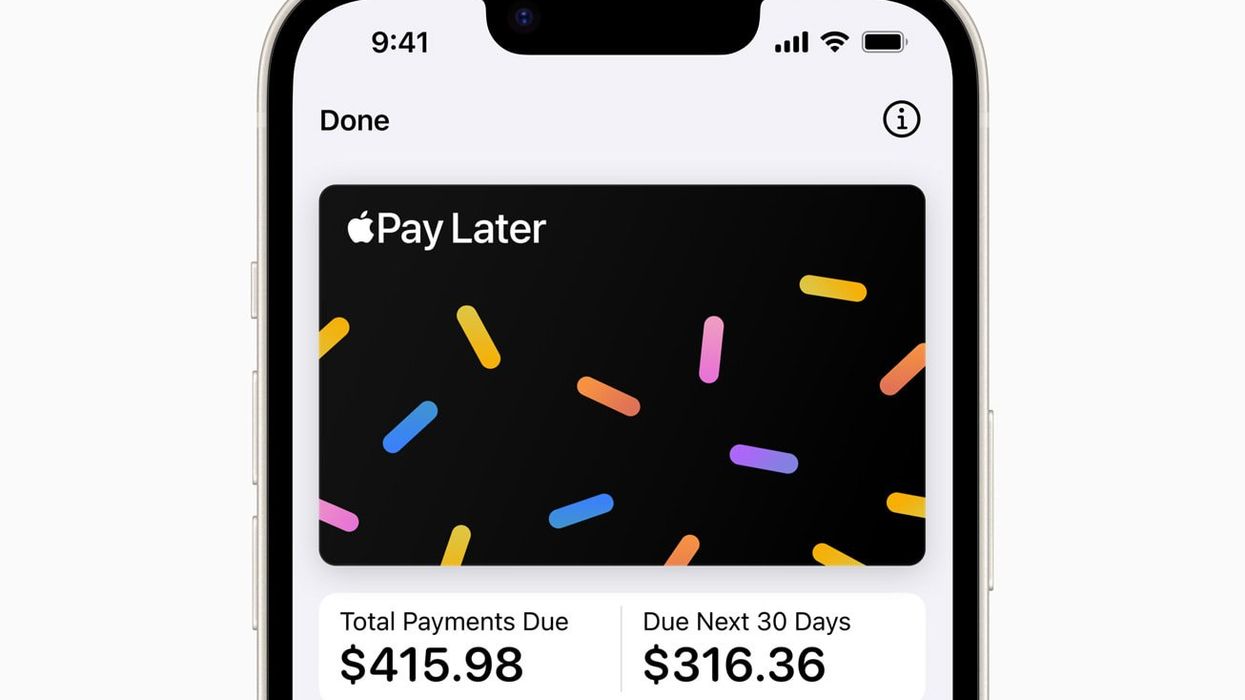

This launch comes with more details about what Apple's Buy Now Pay Later service will look like. For users, here's how it works: Apple said loans can range from $50-1,000. Payments can be made in four installments over six weeks.

As expected, Apple Pay Later is built directly into Apple Wallet, so tracking, management and repayment stays in one place. Users can also view a total amount of existing loans, and view repayment on a calendar. Notifications will also be provided before a payment is due.

“There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, in a statement. “Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

Apple Pay Later enters a crowded market for BNPL, where Klarna, PayPal, Afterpay, Affirm and Sezzle all have a sizable presence, and are already battling for share. Many of those services have been around for a decade, and saw significant growth spurts in 2020 and 2021 as more shopping migrated online. Yet Apple has some advantages. Along with being a name brand, it has fewer barriers to adoption.

The product’s presence in a widely-used digital payment app on a massively popular smartphone means people won’t have to download a separate app to access it. Merchants won’t have to add it as one of a growing number of payment options, either. Apple Pay Later is implemented through a program called Mastercard Installments, which means brands and retailers don’t have to take any extra steps to add it to their offerings, according to the company.

The launch also serves as a reminder: BNPL wasn't just a pandemic phenomenon. Apple Pay Later is also launching at a time when the market in general appears to be showing more staying power than was perhaps expected upon the initial announcement. According to data released recently by Adobe, the share of online purchases made with BNPL continued to grow at a rate of 14% year-over-year, while revenue grew 27%. During this period of high inflation, there is evidence that consumers are using BNPL on smaller purchases like groceries, as well as discretionary items like furniture.

Apple appears to have product and timing on its side. Now that it will start appearing in the wild, the market will surely be taking note. As we wrote at the time of the initial launch, “A category inventor and a category leader aren’t always the same.”

Campbell Soup Company CEO Mark Clouse offered thoughts on messaging amid inflationary shifts in consumer behavior.

After months of elevated inflation and interest rate hikes that have the potential to cool demand, consumers are showing more signs of shifting behavior.

It’s showing up in retail sales data, but there’s also evidence in the observations of the brands responsible for grocery store staples.

The latest example came this week from Campbell Soup Company. CEO Mark Clouse told analysts that the consumer continues to be “resilient” despite continued price increases on food, but found that “consumers are beginning to feel that pressure” as time goes on.

This shows up in the categories they are buying. Overall, Clouse said Campbell sees a shift toward shelf-stable items, and away from more expensive prepared foods.

There is also change in when they make purchases. People are buying more at the beginning of the month. That’s because they are stretching paychecks as long as possible.

These shifts change how the company is communicating with consumers.

Clouse said the changes in behavior are an opportunity to “focus on value within our messaging without necessarily having to chase pricing all the way down.”

“No question that it's important that we protect affordability and that we make that relevant in the categories that we're in," Clouse said. "But I also think there's a lot of ways to frame value in different ways, right?”

A meal cooked with condensed soup may be cheaper than picking up a frozen item or ordering out. Consumers just need a reminder. Even within Campbell’s own portfolio, the company can elevate brands that have more value now, even if they may not always get the limelight.

The open question is whether the shift in behavior will begin to show up in the results of the companies that have raised prices. Campbell’s overall net sales grew 5% for the quarter ended April 30, while gross profit margins held steady around 30%. But the category-level results were more uneven. U.S. soup sales declined 11%, though the company said that was owed to comparisons with the quarter when supply chains reopened a year ago and expressed confidence that the category is seeing a longer-term resurgence as more people cook at home following the pandemic. Snacks, which includes Goldfish and Pepperidge Farm, were up 12% And while net sales increased overall, the amount of products people are buying is declining. Volumes were down 7%.

These are trends happening across the grocery store. Campbell is continuing to compete. It is leading with iconic brands, and a host of different ways to consume them. It is following that up with innovation that makes the products stand out. Then, it is driving home messaging that shows consumers how to fit the products into their lives, and even their tightening spending plans.

Campbell Soup is more than 150 years old, and has seen plenty of difficult economic environments. It is also a different business today, and will continue to evolve. At the end of the day, continued execution is what’s required.

“If it's good food, people are going to buy it, especially if it's a great value,” Clouse said.