Operations

08 June 2022

Will Apple reshape buy now, pay later?

Apple Pay Later enters a category that grew alongside ecommerce, but is now facing scrutiny.

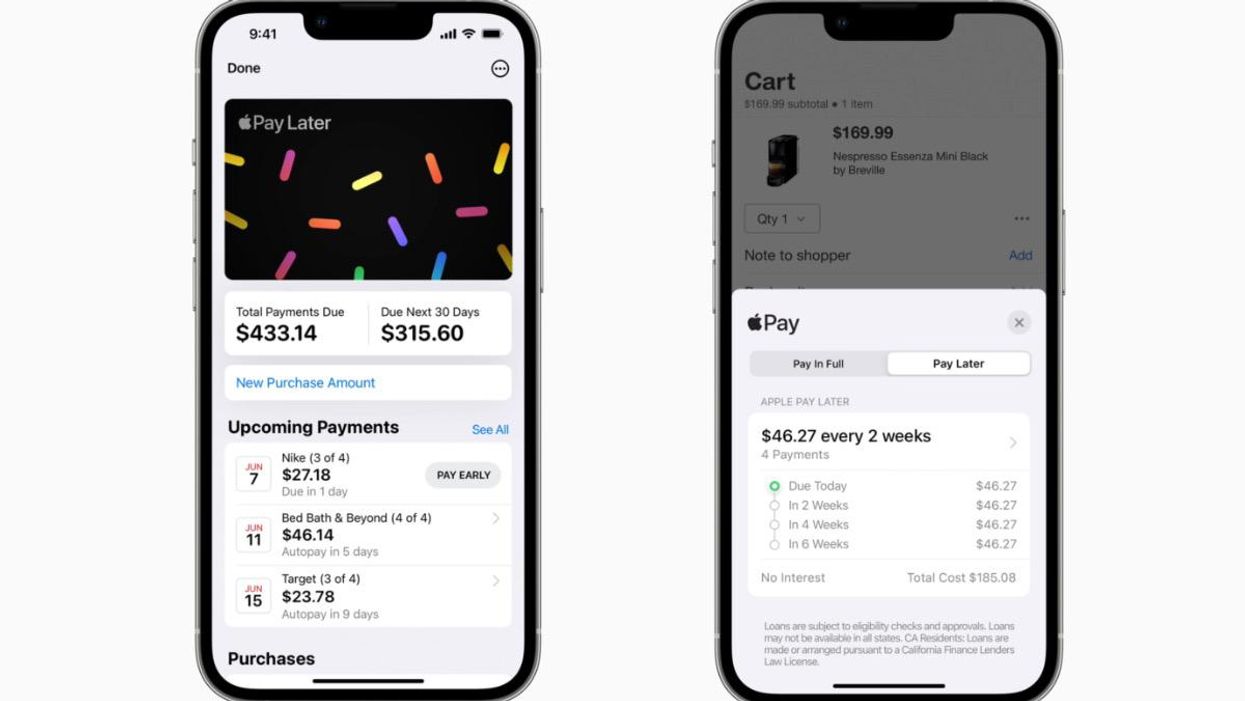

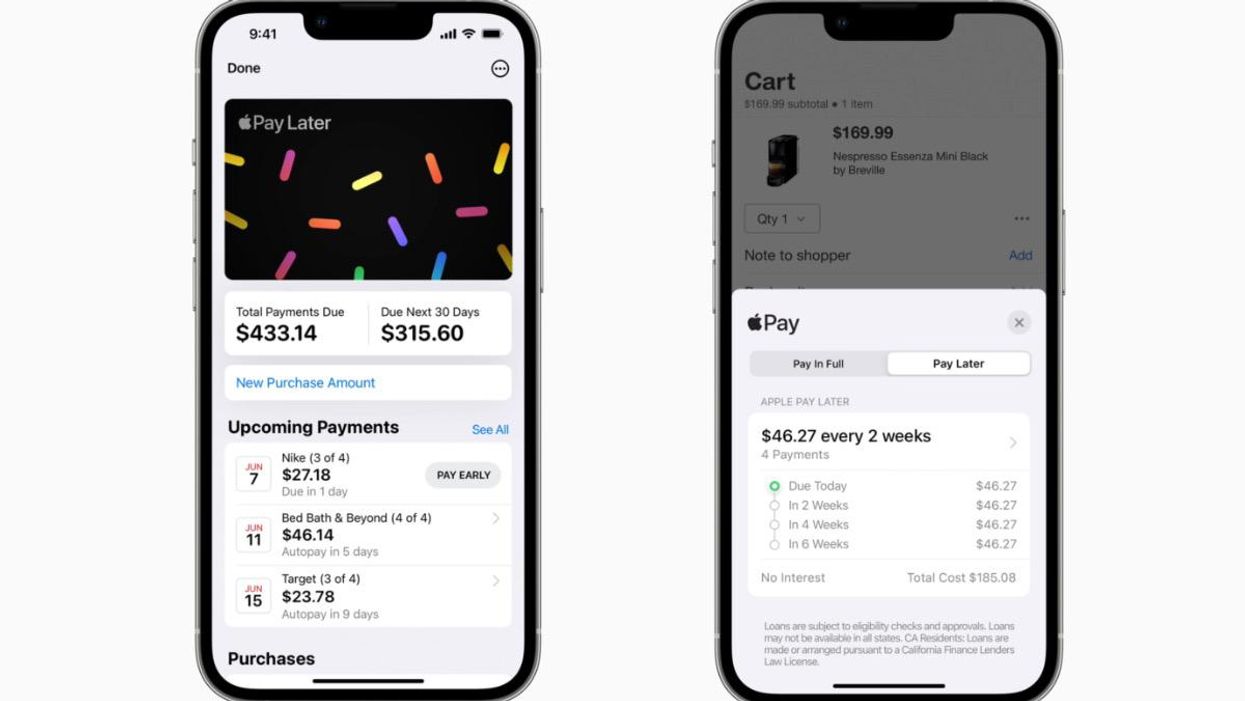

Apple Pay Later. (Screenshots via Apple)

Apple Pay Later enters a category that grew alongside ecommerce, but is now facing scrutiny.

Apple Pay Later. (Screenshots via Apple)

A category leader and a category inventor aren’t always the same figure.

In a new area of tech, progress is often made by a number of teams and companies. They fight for market share and can seem at odds, yet each contribute to progress, and face down whether the model is actually built for massive scale. Given this, established leader that enters the space later can prove to be a stabilizing force, albeit one that stands to surpass those who came before it.

That came to mind this week with Apple’s WWDC conference for developers, as the company made announcements about updates coming with its latest iPhone operating system, iOS 16. Of particular note to ecommerce professionals, Apple announced that it will be entering the buy now, pay later (BNPL) arena.

Making good on reports that first started circulating last summer, Apple Wallet will include a new service called Apple Pay Later. This will allow US users to split the cost of a purchase made with Apple Pay into four installments. These can be repaid over six weeks. The company won’t collect interest, or charge any fees.

This service is available everywhere that Apple Pay is accepted, whether online or in-app. For the installment payments, Apple is tapping Mastercard’s network. To access the program, users apply for the program when they check out with Apple Pay.

CNBC reports that Goldman Sachs will be the technical issuer of the loans that allow the installment plan to be issued, but a wholly-owned subsidiary of Apple will be the entity that actually extends the loans. More from CNBC on the behind-the-scenes process:

Apple will run a soft credit check to ensure that borrowers are capable of paying back the loans, which will likely be capped at around $1,000, the company said. If Apple Pay Later loans aren’t repaid, then Apple will no longer extend those users credit. But the company said it won’t report the missed payments to credit bureaus.

With this new service, Apple is entering a category of fintech where a number of startups found growth in recent years.

BNPL describes digital payment services that allow consumers to split payments for an item into installments. Billed as an alternative to credit cards, which often rely on interest and fees, BNPL grew in tandem with the rise of ecommerce during the pandemic. Black Friday 2021 saw use increase 400%, according to Adobe. BNPL has been particularly popular with younger users. According to a Bain & Company report from March 2022, nearly 40% of Americans under the age of 44 used BNPL in the prior 12 months.

With a quick application process and no interest due, the service's model aligned with online shopping’s penchant for convenience. For merchants, the ability to offer installments added a perk that could help to entice customers as they decided whether to make a purchase. It also stood to make shoppers willing to spend more, helping to move larger-ticket items that were increasingly being offered through ecommerce.

This uptick in interest catapulted growth for several fintech companies founded in the last decade. Affirm rose by providing a path to purchase Peloton’s exercise bikes, and inked a partnership with Amazon in 2021 that made installment payments available to Amazon.com customers at checkout, and said in its most recent quarterly earnings statement that the number of merchants using its service grew from 12,000 to 207,000 year-over-year. Another partnership announced last week with Stripe will extend it to more merchants.

Increasing US revenue in the pandemic for Swedish BNPL provider Klarna led the company to reach a $45.6 billion valuation in June 2021 as it raised new equity funding from prominent venture capital firm SoftBank. Australian company Zip and Minneapolis-based Sezzle were part of the growing vanguard, as well.

As the services became more popular, existing fintech companies added BNPL services.

Afterpay, another leader in the space, was acquired by the fintech giant Block in 2021 and integrated into its Seller and Cash App products after growing to reach 100,000 merchants as an independent company.

Shop Pay, which is ecommerce platform Shopify’s payments service, added the ability to pay with installments through a partnership with Affirm. In early June, the service added the ability to pay in monthly installments for up to 12 months for all US merchants.

PayPal launched an installment service called Buy in 4 in August 2021, and attracted nine million users by Black Friday.

Despite the activity already happening in the space, Apple’s entrance will have an outsize impact. Given its size and influence in tech, that’s fitting.

When it comes to BNPL, Apple’s advantage is built-in. By including BNPL as part of Apple Wallet, it makes the service directly and easily available to anyone with an iPhone. Not all iPhone users have set up Apple Wallet, but offering Pay Later is one way to encourage them to do so. Once they set up Apple Pay, they won’t have to check which service a merchant is offering. They will be able to turn to an app where they are already conducting payments.

Part of BNPL’s appeal was its easy availability at checkout. Apple could make it part of the checkout process. In turn, BNPL could also be part of using an iPhone, which has made habits out of everything from games to social media.

At the least, it stands to make a BNPL transaction a choice between Apple and one of the other services that is offered by the merchant. And when it comes to market share, the other services are only available at some merchants. Apple Pay is much more widely available, as the company says it is available at over 85% of retailers in the US. Add in Apple’s built-in trust among users and near-universally-celebrated user experience, and it starts to feel like an unfair advantage.

One caveat to all of this is adoption of Apple Pay. A 2021 survey from PYMNTS showed that about 6% of people who activated Apple Pay used it for in-store purchases. If Apple’s goal is to increase usage of Apple Pay, then Apple Pay Later’s importance becomes the company’s ability to offer it as a service that makes the app more attractive. And the company is adding more features to Wallet, as well. Of note for ecommerce, Apple is adding order tracking to Wallet at the same time as BNPL. Apple has said it wants Wallet to replace a physical wallet. With these fintech offerings, however, it is adding capabilities beyond storage of cards and dollars. Here, Apple again stands to benefit from the fact that there are millions of iPhone users that could opt-in to the service straight from a phone’s operating system.

Apple is also entering the BNPL category at a time when it is facing scrutiny. The US Consumer Finance Protection Bureau opened an inquiry into the companies over concerns about accumulation of debt, as the government watchdog pointed out that the ability to pay later could lead customers to spend more than they can afford.

All of the BNPL services also hold out that users can incur overdraft fees, and Apple will be among those, as well. A Morning Consult survey found that one-in-three BNPL users overdrafted in January, which was higher than the 15% of the full US population that did. The most bracing portrait to date came from SF Gate, which looked at how GenZers that have embraced BNPL for fashion are now using it for essential purchases, and taking on debt as baskets get larger.

At the same time, the companies that rose alongside BNPL are showing signs that growth is slowing.

Bloomberg reported that Affirm is facing a squeeze over securitization packages, which it uses for financing of loans, while investors worry that it could be hit by a “double whammy of rising rates and a squeeze on household incomes.”

According to the Wall Street Journal, Klarna is seeking to raise new funds at one-third less than the valuation it reached last year, and it had to lay off 10% of its staff.

There are also signs of consolidation, as Sezzle and Zip inked a plan to merge, resulting in cuts to 20% of Sezzle’s North American staff.

To be sure, the companies are still making moves to stand out and grab market share. Affirm recently partnered with Stripe, showing that it will continue to grow visibility with merchants. Klarna is showing signs of building out an ecosystem for retailers around its payment offerings with a new virtual shopping experience that connects online shoppers with in-store associates. And this is all happening against the backdrop of wider economic swings that are affecting companies across the tech landscape. For its part, Klarna cited “a highly volatile stock market and a likely recession” as a reason for its layoffs.

The entrance of Apple figures to add further upheaval, but potential competitors aren’t projecting concern outwardly yet.

Klarna CEO Sebastian Siemiatkowski tweeted that, "It is a great win for consumers worldwide that Apple is now embracing a better form of consumer credit," adding quip that, "Plagiarism is also the highest form of flattery." To all who would characterize the feature as a "Klarna killer," he also noted that 40% of Klarna's payments are via debit.

Affirm CEO Max Levchin told Bloomberg Television that, “There’s a lot of room for growth for all involved.”

Levchin added that Apple’s entrance into the space can raise awareness for the entire category, providing a "nice tailwind." It could help to attract additional attention. This could also open Apple up to the same type of scrutiny the industry as a whole is facing, however, more details of its business model and the effectiveness of its execution remains to be seen.

But Apple's entry also holds out the promise that the tech company will put its own spin on BNPL, and so it has a lot to gain. By its very nature, Apple is a different kind of company in BNPL. By learning and adjusting following the concerns being raised now while capitalizing on its positioning, Apple could redefine the category. Given the company's standing, the other firms are likely to follow in its footsteps as they seek to catch a draft of its reach.

Apple didn’t create BNPL, but it stands to have a big role in its future. If its new service proves to be effective, the iconic tech company may have arrived at the right moment to sure up a long-term future for short-term payments.

Still, plans to buy big-ticket items ticked up.

“Deterioration.” “Gloomy.”

Those were a couple of the words used to describe consumer confidence in May. The Conference Board reported that the index fell to a six-month low amid debt ceiling anxiety and increasing concerns about employment.

“Consumer confidence declined in May as consumers’ view of current conditions became somewhat less upbeat while their expectations remained gloomy,” said Ataman Ozyildirim, senior director of economics at the Conference Board, in a statement. “...While consumer confidence has fallen across all age and income categories over the past three months, May’s decline reflects a particularly notable worsening in the outlook among consumers over 55 years of age.”

The dip among those over 55 came as Congress negotiated a deal over increasing the debt ceiling that included talk of cuts to programs such as social security and Medicare. While officials reached an agreement over Memorial Day weekend, the Conference Board’s survey was fielded prior to that date.

The job picture appears to be more anecdotally cloudy, as the number of consumers reporting jobs as “plentiful” fell to four percentage points to 43.5%. The job market has been consistently robust for nearly three years, as unemployment remains near historic lows. In April, the economy added 253,000 jobs, which remained a positive sign despite being below the gains of prior months. The confidence reading comes ahead of fresh data from the U.S. Bureau of Labor Statistics on Friday.

Despite the declines, there were signs that consumers are not completely pulling back on big-ticket items. Plans to buy big-ticket items such as cars and appliances ticked up on a monthly basis. It’s worth watching whether this extends to providing resilience in other discretionary categories, which have seen a pullback in early 2023.

Nevertheless, the index offered another sign that the consumer mood is getting more pessimistic. It was the fourth time in five months that confidence fell. On Friday, the University of Michigan offered another with a consumer sentiment report that showed a 7% dip.

Brands and retailers must work to reach consumers that are increasingly in less of a buying mood than the month before.