Brand News

21 October 2022

Ahold Delhaize USA, Instacart, 7-Eleven boost retail media

CPG brands have a growing number of advertising options.

CPG brands have a growing number of advertising options.

The prevalence and capabilities of retail media networks appear to be growing with each passing week. That was true on a literal and exponential level on this particular week.

Coinciding with industry events such as Advertising Week New York and P2PI Live, a number of retail platforms and companies made announcements about builds and upgrades to the advertising capabilities they can offer to CPG brands.

It comes as retail media is expected to double to $85 billion by 2026, according to Forrester. The forecast is a result of conditions we're seeing now. Amid the growth of marketplaces, retailers are seeking to put high-margin revenue streams in place at a time when grocery ecommerce is proving to have staying power, Grocery is already low-margin, and delivery operations put further strain on profitability. At the same time, advertisers are shopping for new partners amid the push toward privacy in digital marketing. and retailers have first-party data on the transaction level that stands to help them effectively reach consumers.

We’ve already covered the retail media news from companies including DoorDash and Uber, as well as how it fits into the Kroger-Albertsons merger. Here’s a look at a fresh bundle of developments from Ahold Delhaize USA, Instacart and 7-Eleven:

The retail media network of Ahold Delhaize USA is coming in-house.

Peapod Digital Labs, which is the digital and ecommerce arm of the East Coast grocer, announced that it plans to build “an end-to-end, in-house retail media business.” Called AD Retail Media, it will function as an in-house agency, and is looking to grow the team.

Coming four years after Peapod Digital Labs first launched retail media capabilities in 2018, this expansion will result in new partnerships and capabilities. This will include:

A number of partnerships have moved into place to support this shift. To stand up capabilities and scale up the team, AD Retail Media will transition to the retail tech platform CitrusAd, which is powered by Epsilon. It will also partner with LiveRamp Safe Haven for data collaboration. Meanwhile, Quotient will continue to serve as the digital coupon provider.

“Retail media is already a sizable percentage of total advertising spend – with forecasts showing it will continue to grow significantly,” said JJ Fleeman president of Peapod Digital Labs. “By bringing AD Retail Media in-house, we will create a connected go-to-market offering for CPGs, grounded in new capabilities, simplicity and value generation.

ADUSA enters the retail media fold with scale in place. Grocers under its umbrella include Food Lion, Giant Food, The GIANT Company, Hannaford and Stop & Shop. Together, they operate more than 2,000 stores, process more than 23 million transactions per week and have nearly 24 million active loyalty card users. All of that totals up to more than $51 billion in annual sales.

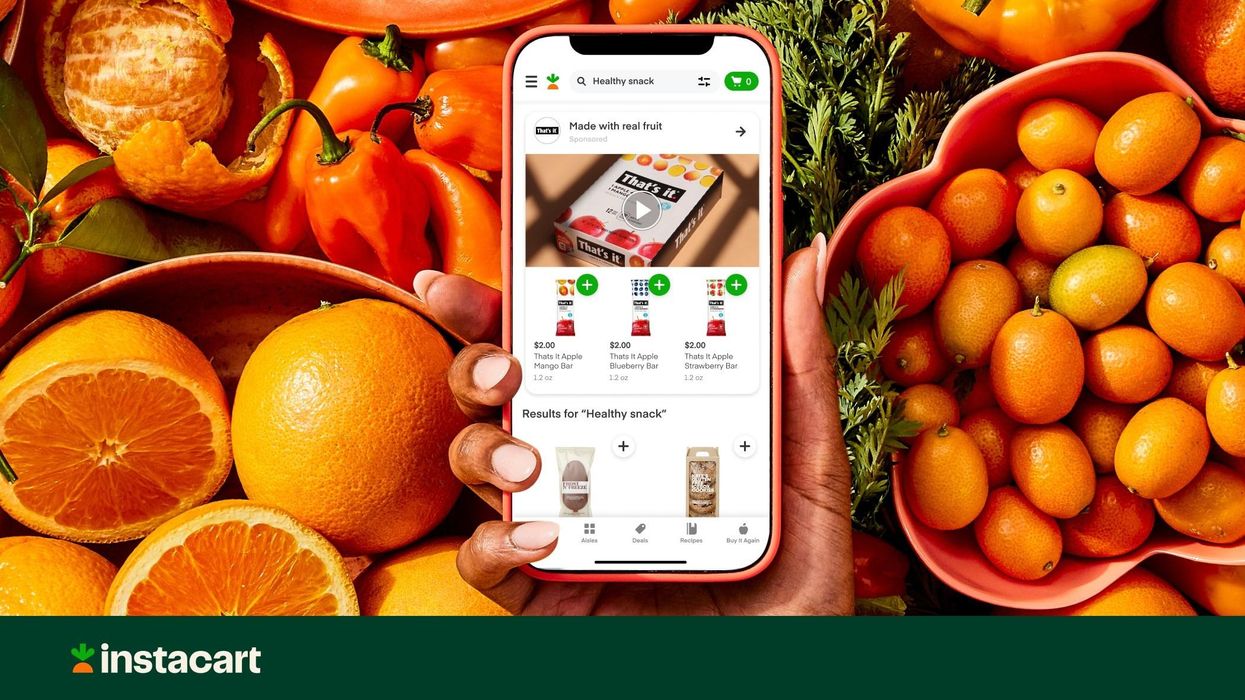

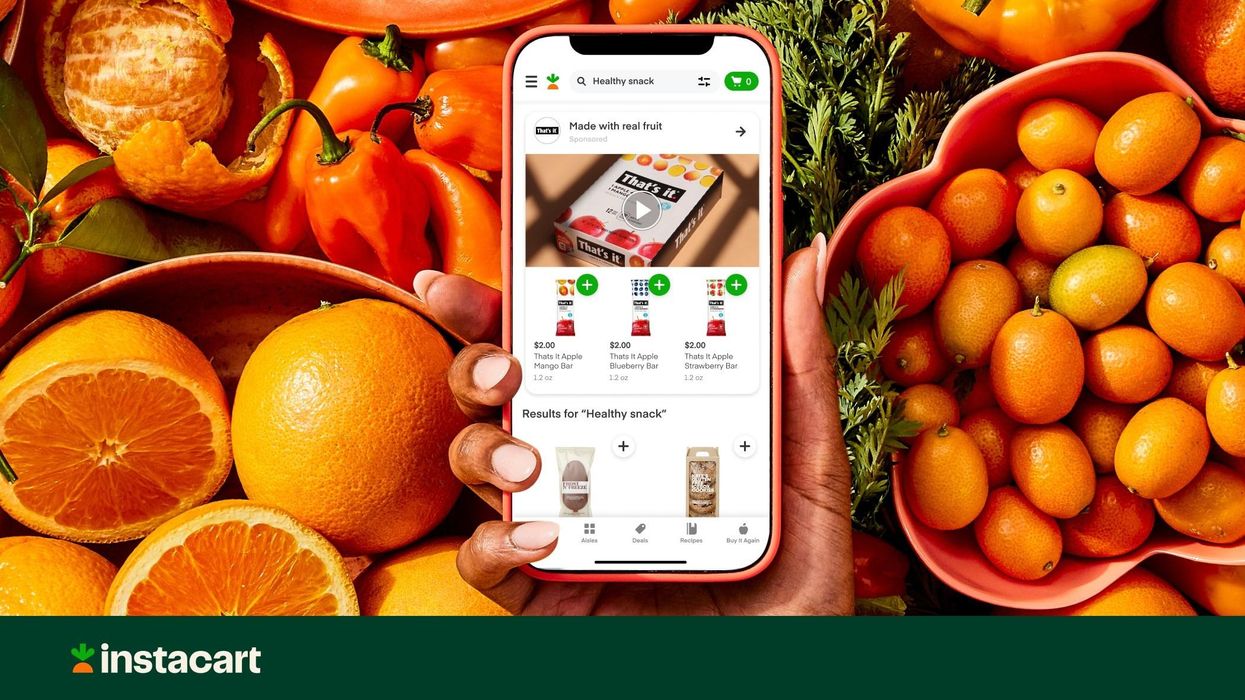

Instacart operates one of the prime retail media networks, as it leverages a marketplace with goods from multiple grocers, a big audience on its app and direct purchase information. The delivery service's advertising business currently works with 5,500 brands.

This week, it announced a pair of upgrades to the ad network:

Ads Manager, which is Instacart’s self-serve portal, is upgrading the ad-buying experience to provide more guidance and optionality. Brands will now begin the buying process by choosing an objective. Instacart said this will orient campaigns around specific goals. Brands that choose 'reach,' 'engage,' or 'maximize sales' will be offered tailored recommendations for ad formats, targeting and bidding options.

Shoppable ads will now also be available to all brands as part of the Ads Manager experience, allowing advertisers to create content with products that can be clicked and purchased directly from the ad itself. Brands can use this to spotlight product launches, shape complementary regimens or create ready-to-go baskets for target consumers.

Details on these ads include the following:

Launched in May, this feature was previously only available to select brands as part of a test.

"At Mondelēz International, reaching and engaging the online consumer is a major part of our growth strategy – and Instacart is a partner that helps us drive this," said Francesca Hahn, VP of Digital Commerce at Mondelēz International, in a statement. "We were excited to pilot Instacart's new shoppable video ads because they helped us tell richer stories to consumers as they shopped some of our most loved brands, like OREO. Instacart offers us a toolkit of shopper-driven ad products that we can leverage to fuel our company's growth."

Convenience store giant 7-Eleven is eying the “immediate consumption purchase occasion" with its retail media network.

It announced the new Gulp Media Network at P2PI LIVE in Chicago on Oct. 18.

While it taps into first party data as it aims to reach the right users with the right message, this network will be more focused on marketing on third-party platforms and properties.

7-Eleven shoppers, or immediate consumption consumers, are probably not shopping online as much as grocery shoppers and they're not loyal to any one retailer. They tend to skew younger and pick and choose what they need in any given moment.

In fact, [7-Eleven Director of Brand and Consumer Insights Ben] Tienor said that geotargeting data shows that the average 7-Eleven customer shops six other stores in the convenience store space throughout the year. “Shoppers are loyal to fulfilling their need and that’s the experience,” he added.

7-Eleven is also ramping up its research to learn more about consumer behavior. It formed a 160,000-person strong community called the Brainfreeze Collective that will gather both quantitative and qualitative data, and test new concepts. Combining these insights with retail media can help to personalize both experiences and messages that go to consumers.

It’s a reminder that retail media doesn’t exist alone within an organization.The key is the first-party data that powers these networks can be used to improve areas of the shopper experience and ecommerce operations, as well.