Marketing

17 October 2022

DoorDash, Pinterest launch new commerce-focused ad tools

The new features were announced as Advertising Week got underway.

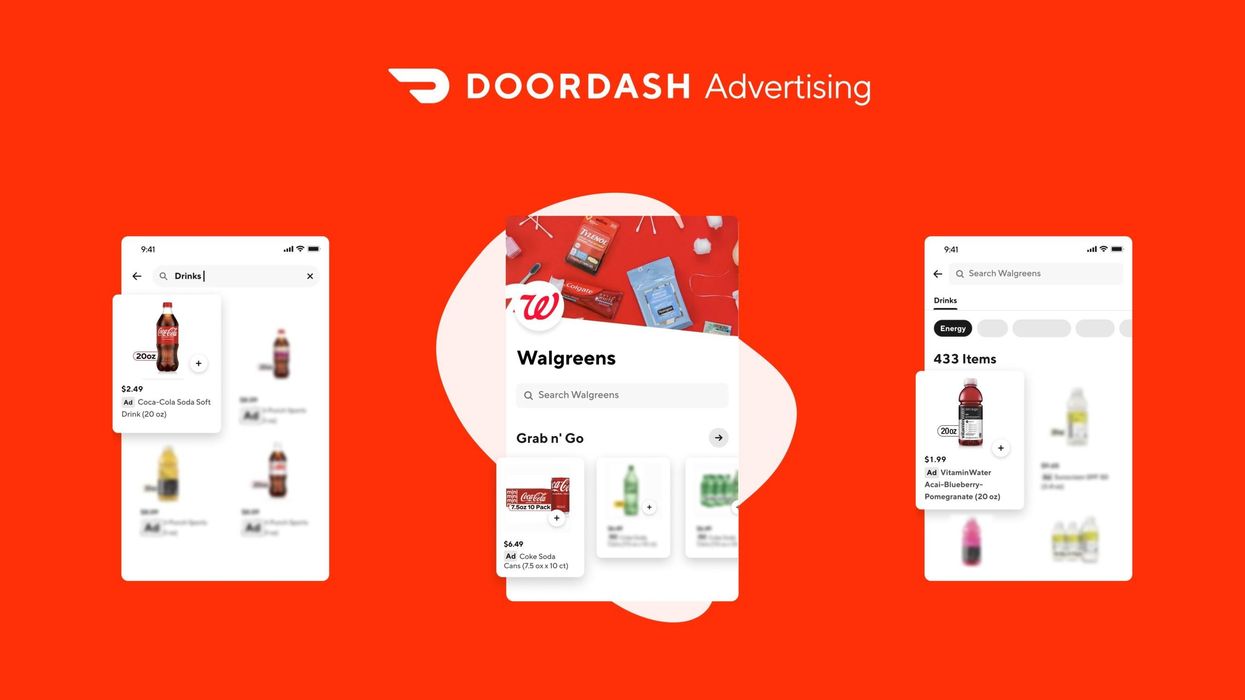

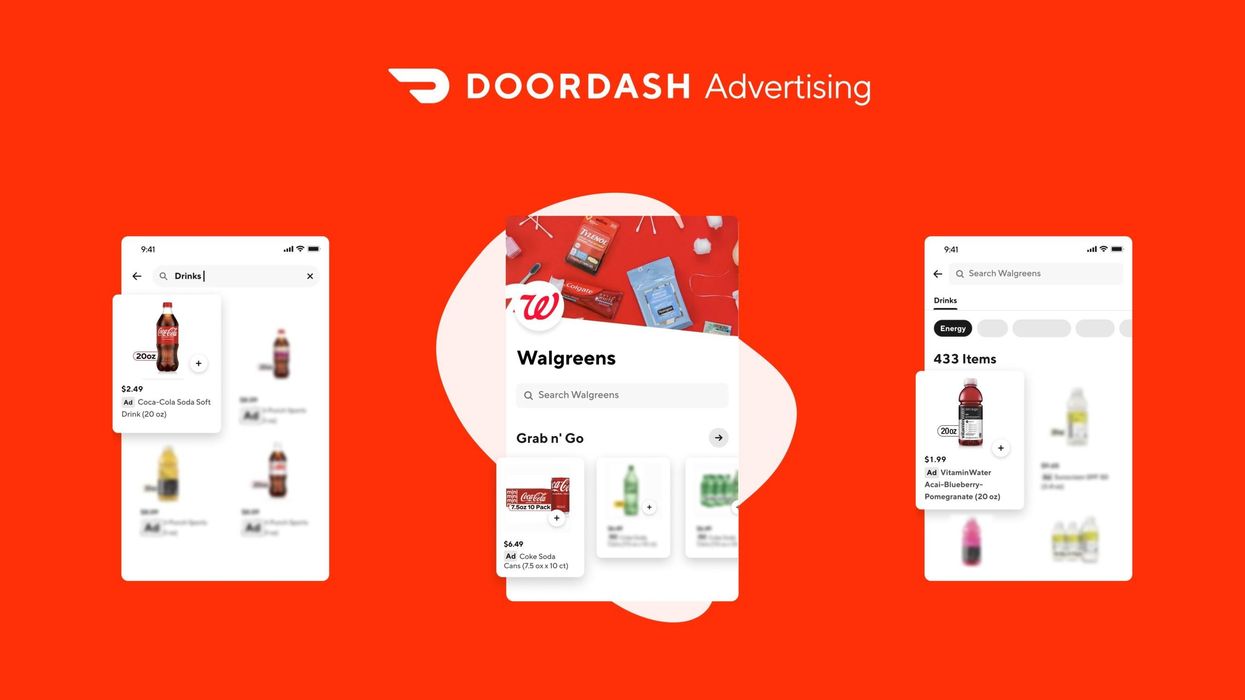

DoorDash is working with CPG brands on advertising. (Courtesy photo)

The new features were announced as Advertising Week got underway.

DoorDash is working with CPG brands on advertising. (Courtesy photo)

Advertising Week arrived in New York on Monday for its 2022 US session, bringing together marketing, advertising and technology leaders from Oct. 17-20.

As the event was kicking off, a pair of platforms announced new ad offerings that each reflected where commerce-focused media is heading in their own way. DoorDash is expanding its retail media offerings, as it rolled out new self-serve advertising tools for CPG brands. Meanwhile, Pinterest has a new tool that aims to help advertisers measure performance at a time when privacy features have made that more difficult.

Here are the details on the latest launches:

DoorDash is primarily known for food delivery, but it has since expanded into delivering goods from other retailers, ranging from groceries to convenience items and even office supplies. It’s a full-blown marketplace that connects more than 25 million monthly active customers to a network of more than 75,000 convenience, grocery and retail stores. As brands and retailers seek to stand out within the app, the company is rolling out more advertising offerings, joining a number of marketplaces building up retail media networks within their apps. Increasingly, these ad offerings are drawing investment from brands seeking to boost the products that are sold from stores through the app.

“We work with all of the top 10 CPG manufacturers in the US, and in just one year, we’ve generated more than $3B in sales for merchants through ads and promotions,” DoorDash said in a news release, citing July 2021-June 2022 figures.

On Monday, the company rolled out new tools for CPG brands that advertise through DoorDash:

DoorDash Ads Manager is a tool that allows brands to activate, manage and measure Sponsored Product Ads. These ads describe product placements displayed by brands within the grocery and convenience marketplace, with preference for prominent locations within the app.

New ad types allow brands to reach consumers on additional surfaces within the app. These include Collections Ads which display products on specifc aisles, Categories Ads that display at the top of category results like snacks or drinks, and Search Ads that appear at the top of search results.

Third-party partnerships will allow brands to access ads through the Pacvue software platform, and the digital commerce agency Flywheel.

An API integration will allow brands to build on DoorDash’s API and manage within their own platforms.

Self-serve sponsored listings are expanding to more countries, with Canada and Australia gaining access. These ads allow small businesses to increase visibility on the platform.

The move comes as delivery marketplaces are bolstering their advertising offerings. To name a few recent developments: Grocery-focused Instacart has been bolstering its offerings, including the addition of shoppable Carts, recipes and ads. Convenience item service Gopuff bolstered offsite advertising capabilities and alcohol delivery platform Drizly launched its own retail media network. This space is evolving fast as platforms recognize the opportunity to harness data and grow revenue that is higher-margin than delivery.

Pinterest Trends. (Image via Pinterest)

Pinterest is continuing a push into ecommerce, as the visual platform seeks to harness the high intent, inspiration-minded behavior of its users for shopping.

On Monday, it rolled out a pair of new tools for advertisers:

The Pinterest Trends tool will expand from the US, UK and Canada to 30 more countries. This tool is designed to offer insights on when top search teams will reach their peak. Trends can be broken down into trends among their followers in the last 90 days, demographic trends such as age and place, as well as seasonal trends. In turn, this can be used to align creative, targeting, merchandising, content and sales calendars, Pinterest said.

Pinterest API for Conversions is a new tool that allows advertisers to connect their data to Pinterest, and measure targeting and performance. It comes after Apple's 2021 App Tracking Transparency update, which made attribution more difficult to measure among iPhone users. Pinterest said the tool is a “tagless, server-to-server solution” that offers continuous visibility, while allowing for optimization on Pinterest campaigns. A direct integration that requires developer resources is immediately available, and third-party integrations with Shopify and Google Tag Manager will be available in the coming weeks.

As Pinterest looked to gauge the tool’s impact on performance and reliability, the API for Conversions has already been used by hundreds of brands. Pinterest said the most frequent use case is lower funnel actions, like checkouts. Some have also used it for full funnel actions, such as add to cart and page visits. Pairing it with Pinterest Tags, brands seek to increase metrics including cost per action and attributed conversion volume.

"Pinterest is uniquely positioned at the intersection of discovery and commerce, where inspiration meets intent,” said Pinterest Chief Revenue Officer Bill Watkins. “We are investing across our advertising platform to help businesses around the world reach their goals and connect with leaned in consumers at every stage of the campaign lifecycle."

New advertising opportunities are being beta tested for in-store audio and product demos.

Retail media’s fast growth isn’t only limited to increasing spend. The advertising itself is also poised to appear in more places beyond ecommerce marketplaces, and even beyond the web.

The latest example comes from Walmart Connect, which is the retail media arm of the world’s largest retailer.

Walmart shared details on testing that it is completing for in-store retail media. To this point, Walmart Connect has been considered the advertising platform for Walmart’s ecommerce site. But these tests indicate that’s poised to expand.

Stores present a potent opportunity for Walmart. It has 4,700 big box locations around the U.S., and customers returned to them in droves last year. In 2022, 88% of the retailer’s customers visited Walmart stores.

Walmart Connect already has already dipped a toe into in-store advertising, with a TV wall, self-checkout ads and integrated marketing. The new pilots aim to take a step further.

“The next frontier of retail media is in-store experiences, and it’s one we’re excited to chart,” Whitney Cooper, head of omnichannel transformation at Walmart Connect, wrote in a blog post on the new tests. “But it’s still an emerging opportunity for us, as we continue to test what serves customers best and which solutions are scalable to Walmart’s size.”

Here’s a look at the two new offerings currently under beta test:

Walmart suppliers will be able to integrate product demos into campaigns across in-store and digital environments.

Product demos aren’t new to store floors, but Walmart Connect is seeking to give them an update that blends digital and physical experiences.

“Part of our test is how to enhance the omnichannel experience by bridging the physical back to digital: For example, by pairing a demo cart with QR codes that link back to a curated Walmart.com landing page so customers can find inspiration and shop their list all in one spot,” Cooper wrote.

Walmart is currently offering 120 demos at stores each weekend, and plans to scale to 1,000 by the end of 2023.

Walmart Connect will now offer advertising placements on Walmart’s in-store radio network. Suppliers will have the option to purchase ads by region or store, enabling targeting of key markets.

“This is the first time brands will be able to speak directly to Walmart customers through this medium,” Cooper writes. “These ads also create a new upper-funnel touchpoint for brand marketers and out-of-home (OOH) buyers to create awareness, because in-store audio is about connecting with customers wherever they are in the store — they don’t have to pass the brand in the aisle.”

With the tests, we’ll be watching for how this advertising is measured, and whether Walmart Connect is tracking impact across different types of formats, and not just a single campaign.