Marketing

26 May 2022

Instacart rolls out shoppable ads

Video and "pop-up shop" ads are being piloted by CPG brands ahead of general release.

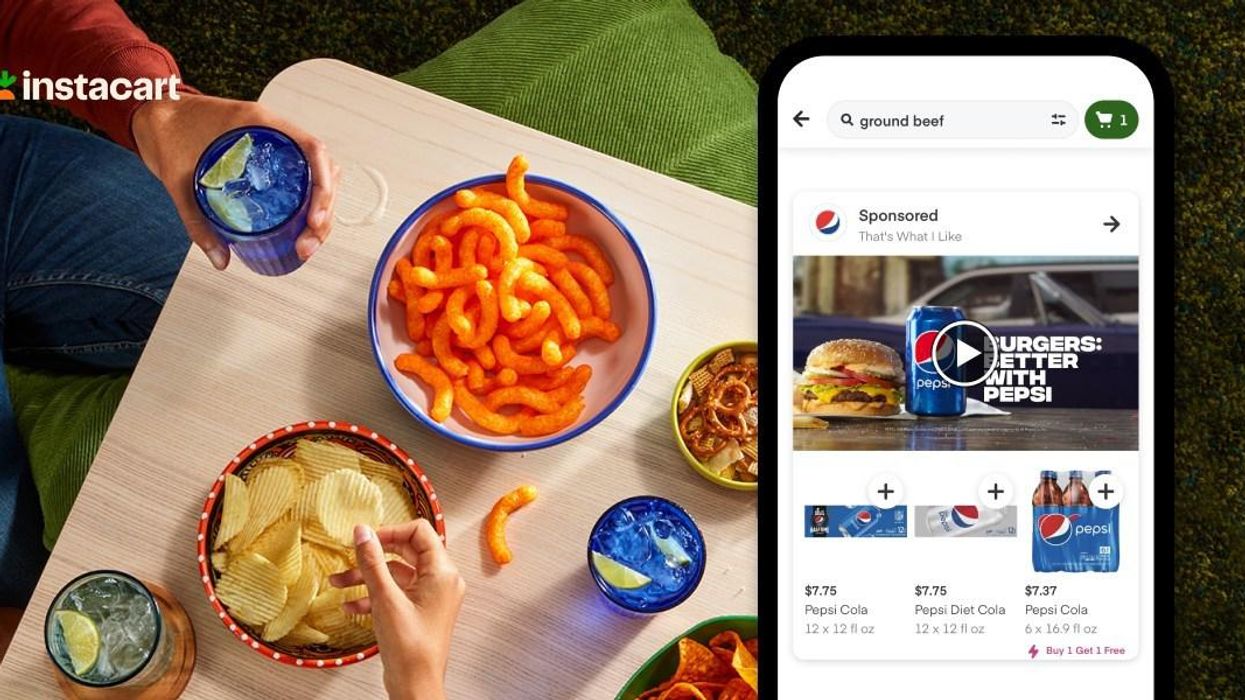

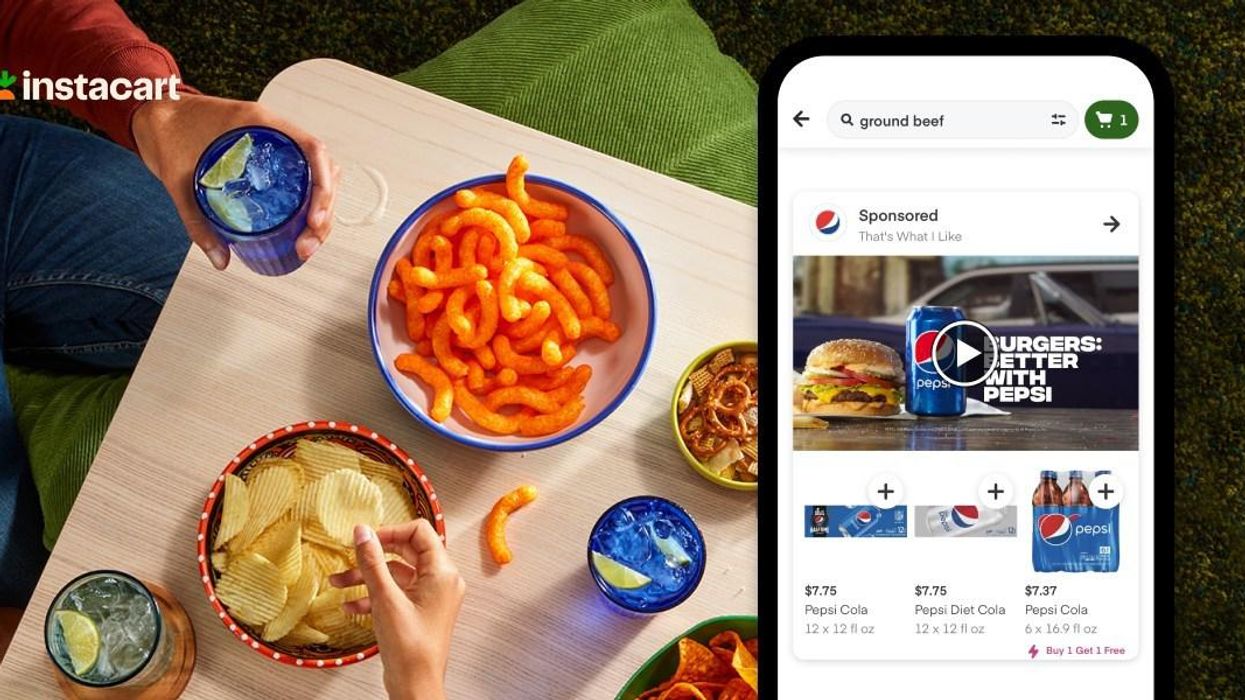

Click video to buy. (Photo courtesy of Instacart)

Video and "pop-up shop" ads are being piloted by CPG brands ahead of general release.

Click video to buy. (Photo courtesy of Instacart)

Instacart is making ads more shoppable.

On Thursday, the grocery ecommerce platform is launching a pair of new advertising offerings for CPG brands. They include:

This move that signals Instacart is seeking to enhance its advertising offerings with the kinds of click-to-buy capabilities that are growing on social media platforms and streaming TV. Earlier this year, it launched shoppable recipes that can be used by creators. These new ads bring the direct-to-cart capabilities to its own marketplace, where ads exist alongside the product listings that customers browse as they order items for grocery delivery from nearby stores.

In a grocery store, end caps, and store entrance product displays are the tried-and-true promotional tools brands use to stand out in the aisle. Instacart's platform shows that digital grocery shopping is remaking this experience with product curation, video and targeting capabilities.

"Advertisers choose Instacart because we've built a platform with high-intent consumers, unparalleled scale of retailers, and closed-looped measurement, all of which drives meaningful results for our brand partners," said Ali Miller, Vice President of Ads Product at Instacart, in a statement. "We designed our new shoppable ad products to create more brand storytelling opportunities for CPGs, help them inspire and reach new and existing consumers, and ultimately drive sales in a singular unit.”

Miller said that the ads are also proving to resonate with shoppers, bringing “more discovery and inspiration to the online shopping experience.”

The new ad offerings come as Instacart is preparing for an initial public offering, bringing its shares to a public stock exchange. In a move that was widely speculated over for months, the company filed confidentially for the IPO earlier this month. This, in turn, came about a month after Instacart cut its valuation by about 40%, to $24 billion.

Advertising is key to Instacart’s future growth, company leaders have said. At ShopTalk earlier this year, CEO Fidji Simo said that, in the long-term, she sees the company making a profit on ads, while essentially breaking even on delivery.

Following that talk, advertising was prominent in the launch of a suite of tech offerings called Instacart Platform, as the company rolled out capabilities to stand up ad services on grocers' websites. With the new shoppable ads, the company is upgrading what it can offer the brands who sell at grocery stores on its own platform.

With the launch, Instacart is touting pilot work on the new ads with brands that are familiar on grocery store shelves, such as Dove, Oreo and Ritz owner Mondelēz International, PepsiCo and S.Pellegrino. In all, it said 40 CPG brands piloted the new display ads.

"Partnering with Instacart helps us stay ahead of the curve when it comes to inspiring and engaging consumers along their shopping journey," said Emily Frankel, SVP of eCommerce Marketing head at PepsiCo, which has multiple brands in the pilot. “Shoppable display has proven to be an effective way to drive first-time purchase of our products via the Instacart platform, and while we're just getting started with shoppable video, we look forward to continuing our work to give consumers a compelling omnichannel experience."

These ads follow moves earlier this year to launch dedicated brand pages on the Instacart platform where CPG brands could offer a curated selection of products, and auction-based ads. It also expanded existing sponsored product offerings to Canada. The company said it offers self-service and managed ad services for more than 5,000 CPG brands.

New advertising opportunities are being beta tested for in-store audio and product demos.

Retail media’s fast growth isn’t only limited to increasing spend. The advertising itself is also poised to appear in more places beyond ecommerce marketplaces, and even beyond the web.

The latest example comes from Walmart Connect, which is the retail media arm of the world’s largest retailer.

Walmart shared details on testing that it is completing for in-store retail media. To this point, Walmart Connect has been considered the advertising platform for Walmart’s ecommerce site. But these tests indicate that’s poised to expand.

Stores present a potent opportunity for Walmart. It has 4,700 big box locations around the U.S., and customers returned to them in droves last year. In 2022, 88% of the retailer’s customers visited Walmart stores.

Walmart Connect already has already dipped a toe into in-store advertising, with a TV wall, self-checkout ads and integrated marketing. The new pilots aim to take a step further.

“The next frontier of retail media is in-store experiences, and it’s one we’re excited to chart,” Whitney Cooper, head of omnichannel transformation at Walmart Connect, wrote in a blog post on the new tests. “But it’s still an emerging opportunity for us, as we continue to test what serves customers best and which solutions are scalable to Walmart’s size.”

Here’s a look at the two new offerings currently under beta test:

Walmart suppliers will be able to integrate product demos into campaigns across in-store and digital environments.

Product demos aren’t new to store floors, but Walmart Connect is seeking to give them an update that blends digital and physical experiences.

“Part of our test is how to enhance the omnichannel experience by bridging the physical back to digital: For example, by pairing a demo cart with QR codes that link back to a curated Walmart.com landing page so customers can find inspiration and shop their list all in one spot,” Cooper wrote.

Walmart is currently offering 120 demos at stores each weekend, and plans to scale to 1,000 by the end of 2023.

Walmart Connect will now offer advertising placements on Walmart’s in-store radio network. Suppliers will have the option to purchase ads by region or store, enabling targeting of key markets.

“This is the first time brands will be able to speak directly to Walmart customers through this medium,” Cooper writes. “These ads also create a new upper-funnel touchpoint for brand marketers and out-of-home (OOH) buyers to create awareness, because in-store audio is about connecting with customers wherever they are in the store — they don’t have to pass the brand in the aisle.”

With the tests, we’ll be watching for how this advertising is measured, and whether Walmart Connect is tracking impact across different types of formats, and not just a single campaign.