Economy

27 January 2023

Consumer spending, inflation cool in December, as sentiment perks up

U.S. GDP rose 2.9% in the fourth quarter of 2022.

U.S. GDP rose 2.9% in the fourth quarter of 2022.

While there are plenty of gloomy economic forecasts floating around, data paints a mixed picture of the U.S. consumer economy as 2023 gets underway.

Inflation is cooling off, but consumer spending is pulling back, a key report from December shows. Meanwhile, consumer sentiment is improving and the economy is showing signs of growth, but plenty of uncertainty remains.

Here’s the data that was released this week:

Consumer spendingfell 0.2% in December, as shoppers spent less on goods, even as they spent more on services, according to the Personal Consumption Expenditures data report issued Friday.

There are signs that the fall may be driven by inflation. A primary of the goods decrease was gasoline, where prices are coming down. Housing, where inflation is going up, was a driver of the increase in services. Yet the decreases in goods were “widespread,” the U.S. Bureau of Economic Indicators noted.

The PCE’s measure of Inflation increased 0.1% from November, marking the second straight month of slower growth after months of higher prices.

The annual inflation increase also slowed to 5%, down from 5.5% the month prior. PCE inflation, which is the pricing measure preferred by the Fed, is continuing to fall in a similar fashion to the more widely-used Consumer Price Index.

Core inflation, which is the inflation measure that leaves out the more volatile food and energy categories, slowed to 4.4%. That was its lowest level since October 2021.

The report offers a textbook look at how the Federal Reserve’s monthslong campaign to hike interest rates are playing out across the economy. The Fed’s main goal is to cool inflation, and prices are coming down. However, the Fed’s monetary policy tools also have the side effect of cooling demand, which leads to a decrease in consumer spending that is also evident.

The report comes days before the Fed will consider a further interest rate hike next week. Officials have signaled that they will continue the increases to fight inflation, but will consider whether to keep scaling back the size of the rate hike. The 0.5% increase in December was smaller than the 0.75% increases delivered at the four prior meetings.

The pullback in consumer spending was also evident among consumer goods companies that issued earnings reports this week.

3M, which makes Post-it notes, said organic sales fell 5.7% for the year.

“The slower-than-expected growth was due to rapid declines in consumer-facing markets, such as consumer electronics and retail, a dynamic that accelerated in December, as consumers sharply cut discretionary spending and retailers adjusted inventory levels,” said CEO Mike Roman.

U.S. GDP: 2019-2022 (US Bureau of Economic Analysis)

The Fed’s moves bring with them the risk that the economy could tip into recession if demand cools off too much. Yet the overall economic data for the fourth quarter signaled to the positive.

Gross domestic product, which is a broad-based measure of economic activity, rose 2.9% in Q4 from the prior quarter, the BEA reported on Thursday.

Consumer spending, which is about two-thirds of GDP, was a key driver of the increase, as it rose 2.1%. Notably, spending on goods was up by 1.1% in the holiday quarter after three straight quarters of decline.

“We continue to see consumption as having tailwinds from tight labor markets, high levels of excess saving, and falling gasoline prices, among other factors,” Bank of America Economist Michael Gapen wrote in a research note.

The report also points at another trend of 2022: People returned to spending on experiences and services as pandemic restrictions were lifted. However, that may be cycling out. The increase in goods spending and a corresponding slowdown in services “suggests the rotation of household spending back toward services may be nearing its end, though we hesitate to say it is completed,” Gapen wrote.

It marked a second straight quarter of economic growth to end 2022, showing that the economy turned around from two straight quarters of decline to begin the year.

Inflation also cooled for the quarter. The PCE Price Index rose 3.2% for the quarter, compared with an increase of 4.3% in the third quarter.

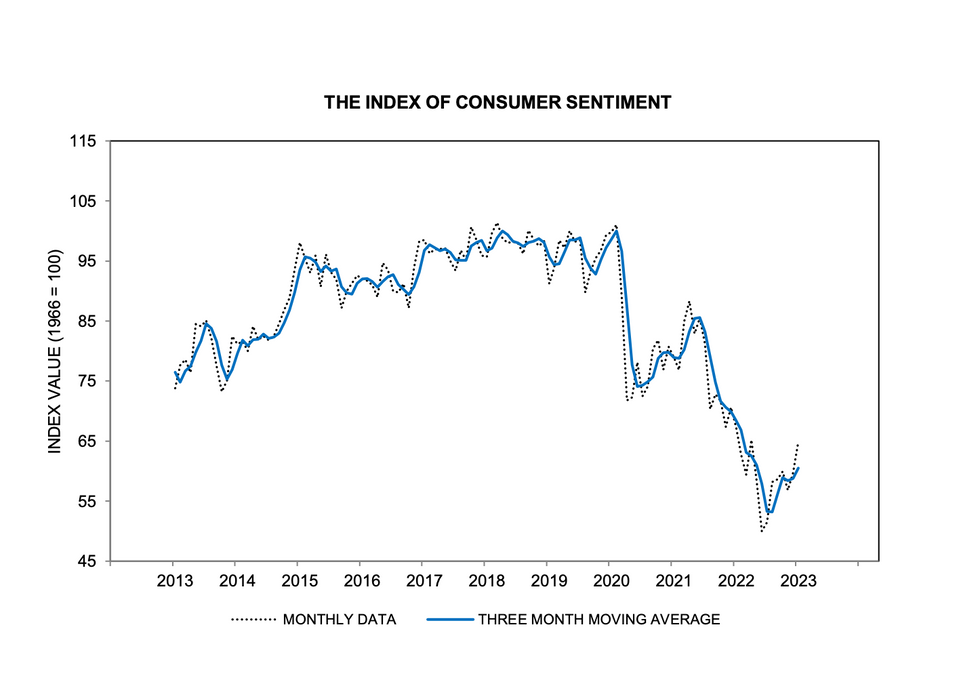

U.S. consumer sentiment, 2013-2023

U.S. consumer sentiment rose 9% in January from the prior month, continuing a climb of the doldrums that reached historic lows at inflation’s height over the summer, according to the University of Michigan.

In particular, consumers’ view of current economic conditions rose 15%. With strong incomes in a tight job market and falling prices as inflation cools, people feel better about their finances and would be more likely to make bigger purchases, UM wrote.

People are also looking for inflation to continue to cool. The year-ahead inflation expectation of 3.9% was the lowest level since April 2021. Yet declines should be viewed as “tentative,” since uncertainty remains, UM said.

While sentiment is improving, it is still at historic lows. Economic volatility remains, so the good signals shouldn’t necessarily be interpreted as outright optimism.

“There are considerable downside risks to sentiment, with two-thirds of consumers expecting an economic downturn during the next year,” wrote University of Michigan Survey of Consumers Director Joanne Hsu. “Notably, the debt ceiling debate looms ahead and could reverse the gains seen over the last several months.”

Campbell Soup Company CEO Mark Clouse offered thoughts on messaging amid inflationary shifts in consumer behavior.

After months of elevated inflation and interest rate hikes that have the potential to cool demand, consumers are showing more signs of shifting behavior.

It’s showing up in retail sales data, but there’s also evidence in the observations of the brands responsible for grocery store staples.

The latest example came this week from Campbell Soup Company. CEO Mark Clouse told analysts that the consumer continues to be “resilient” despite continued price increases on food, but found that “consumers are beginning to feel that pressure” as time goes on.

This shows up in the categories they are buying. Overall, Clouse said Campbell sees a shift toward shelf-stable items, and away from more expensive prepared foods.

There is also change in when they make purchases. People are buying more at the beginning of the month. That’s because they are stretching paychecks as long as possible.

These shifts change how the company is communicating with consumers.

Clouse said the changes in behavior are an opportunity to “focus on value within our messaging without necessarily having to chase pricing all the way down.”

“No question that it's important that we protect affordability and that we make that relevant in the categories that we're in," Clouse said. "But I also think there's a lot of ways to frame value in different ways, right?”

A meal cooked with condensed soup may be cheaper than picking up a frozen item or ordering out. Consumers just need a reminder. Even within Campbell’s own portfolio, the company can elevate brands that have more value now, even if they may not always get the limelight.

The open question is whether the shift in behavior will begin to show up in the results of the companies that have raised prices. Campbell’s overall net sales grew 5% for the quarter ended April 30, while gross profit margins held steady around 30%. But the category-level results were more uneven. U.S. soup sales declined 11%, though the company said that was owed to comparisons with the quarter when supply chains reopened a year ago and expressed confidence that the category is seeing a longer-term resurgence as more people cook at home following the pandemic. Snacks, which includes Goldfish and Pepperidge Farm, were up 12% And while net sales increased overall, the amount of products people are buying is declining. Volumes were down 7%.

These are trends happening across the grocery store. Campbell is continuing to compete. It is leading with iconic brands, and a host of different ways to consume them. It is following that up with innovation that makes the products stand out. Then, it is driving home messaging that shows consumers how to fit the products into their lives, and even their tightening spending plans.

Campbell Soup is more than 150 years old, and has seen plenty of difficult economic environments. It is also a different business today, and will continue to evolve. At the end of the day, continued execution is what’s required.

“If it's good food, people are going to buy it, especially if it's a great value,” Clouse said.