Economy

05 July 2022

The Week Ahead: Countdown to Prime Day, Latest jobs data

Check out what's happening in ecommerce as July kicks off.

Prime Day is a week away. (Illustration by The Current)

Check out what's happening in ecommerce as July kicks off.

Prime Day is a week away. (Illustration by The Current)

Good morning, we hope you had a great Independence Day. Welcome to a new quarter. Having fully settled into summer, here’s what The Current is tracking in ecommerce and the economy over the next four days, and the coming month.

With the short summer week, there's less activity on the ecommerce calendar over the next few days. So here’s a quick look at what’s coming up in July:

It’s the first week of the month, so all eyes are on jobs. The US Bureau of Labor Statistics (BLS) is set to release the results of its Job Openings and Labor Turnover Survey on Wednesday, July 6. Then, on Friday, the BLS drops the monthly jobs report.

Last month showed a relatively strong jobs report, especially in the face of soothsaying about a recession. But retail was one exception, as stores shed 61,000 jobs amid a shift to consumer spending on experiences over shopping for goods. The data for June will offer a look at whether that shift was temporary, or on the way to being more lasting.

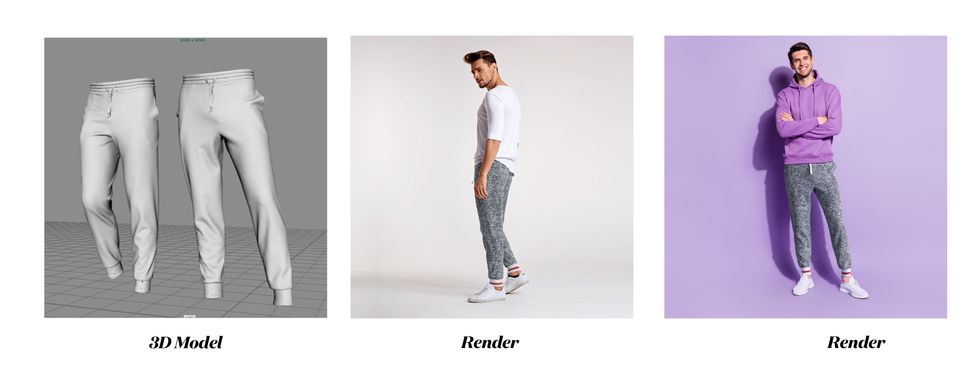

Amazon partnered with Hexa to provide access to a platform that creates lifelike digital images.

A 3D rendering of a toaster from Hexa and Amazon. (Courtesy photo)

Amazon sellers will be able to offer a variety of 3D visualizations on product pages through a new set of immersive tools that are debuting on Tuesday.

Through an expanded partnership with Hexa, Amazon is providing access to a workflow that allows sellers to create 3D assets and display the following:

Selllers don't need prior experience with 3D or virtual reality to use the system, according to Hexa. Amazon selling partners can upload their Amazon Standard Identification Number (ASIN) into Hexa’s content management system. Then, the system will automatically convert an image into a 3D model with AR compatibility. Amazon can then animate the images with 360-degree viewing and augmented reality, which renders digital imagery over a physical space.

Hexa’s platform uses AI to create digital twins of physical objects, including consumer goods. Over the last 24 months, Hexa worked alongside the spatial computing team at Amazon Web Services (AWS) and the imaging team at Amazon.com to build the infrastructure that provides 3D assets for the thousands of sellers that work with Amazon.

“Working with Amazon has opened up a whole new distribution channel for our partners,” said Gavin Goodvach, Hexa’s Vice President of Partnerships.

Hexa’s platform is designed to create lifelike renderings that can explored in 3D, or overlaid into photos of the physical world. It allows assets from any category to be created, ranging from furniture to jewelry to apparel.

The result is a system that allows sellers to provide a new level of personalization, said Hexa CEO Yehiel Atias. Consumers will have new opportunity see a product in a space, or what it looks like on their person.

Additionally, merchants can leverage these tools to optimize the entire funnel of a purchase. Advanced imagery allows more people to view and engage with a product during the initial shopping experience. Following the purchase, consumers who have gotten a better look at a product from all angles will be more likely to have confidence that the product matches their needs. In turn, this can reduce return rates.

While Amazon has previously introduced virtual try-on and augmented reality tools, this partnership aims to expand these capabilities beyond the name brands that often have 1P relationships with Amazon. Third-party sellers are an increasingly formidable segment of Amazon’s business, as they account for 60% of sales on the marketplace. Now, these sellers are being equipped with tools that enhance the shopping experience for everyone.

A video displaying the new capabilities is below. Amazon sellers can learn more about the platform here.

Hexa & Amazon - 3D Production Powerhousewww.youtube.com