Retail Media

23 May 2023

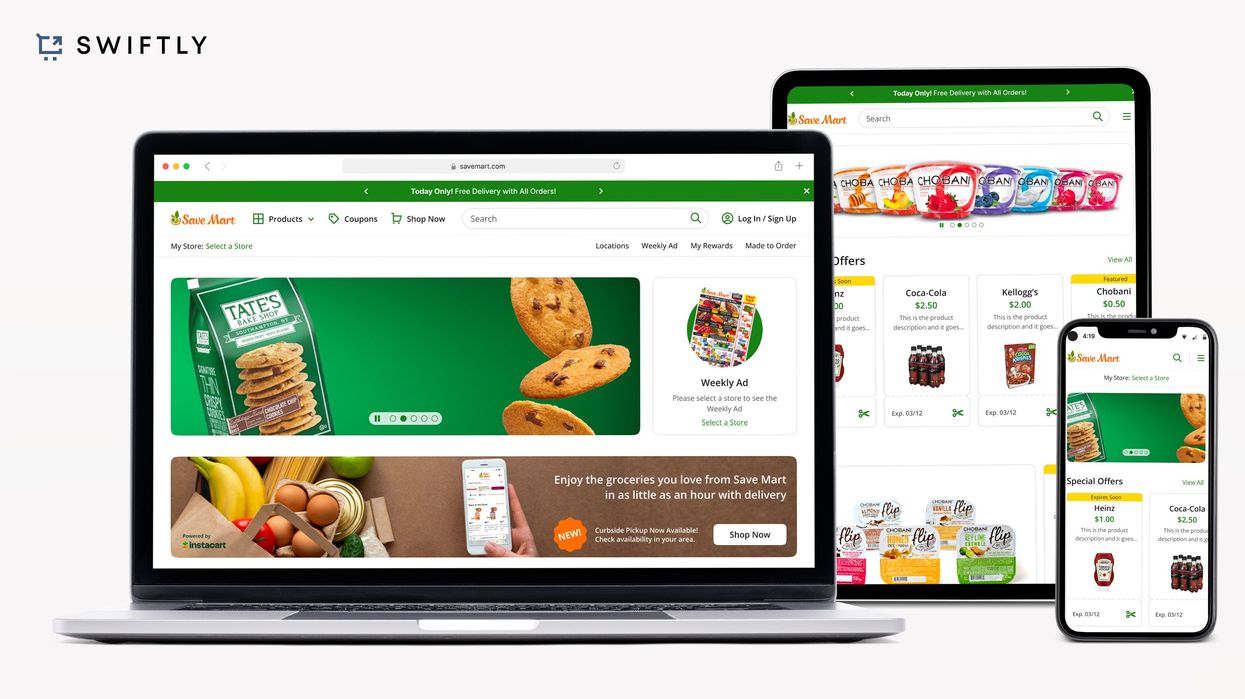

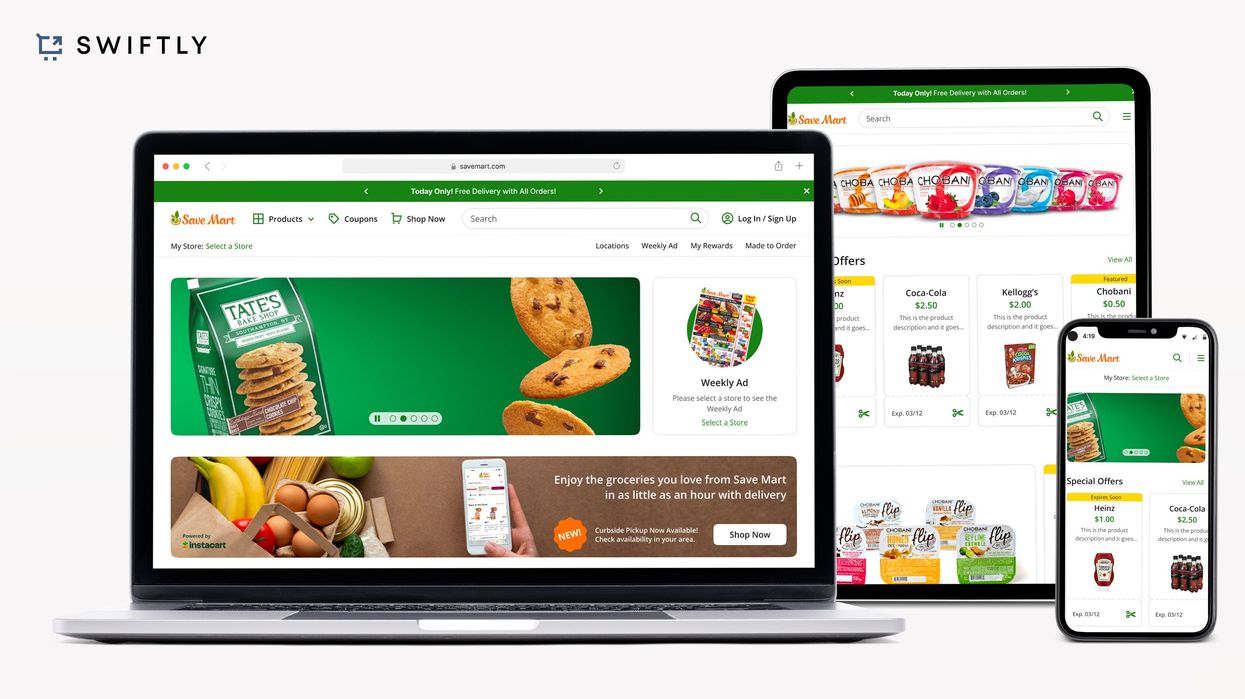

Save Mart launches digital ad network to drive in-store shopping

The California-based grocer is expanding its retail media partnership with Swiftly.

(Photo courtesy of Swiftly/Save Mart)

The California-based grocer is expanding its retail media partnership with Swiftly.

(Photo courtesy of Swiftly/Save Mart)

Retail media is growing at a breakneck pace and it’s at the top of commerce conversations in 2023. But it’s worth taking a step back to remembering that marketplace-based advertising remains in early stages of development. That means there is room for a variety of retailers to adopt it, and apply a diverse range of approaches to find what success looks like for their particular business.

The latest example comes in the form of news out Tuesday from The Save Mart Companies (TSMC) and Swiftly.

TSMC, a grocer that operates approximately 200 stores under the Save Mart, Lucky and FoodMaxx banners in California and Western Nevada, is launching a retail media network through the retailer’s websites and mobile apps that aims to drive in-store traffic and sales. The new offering expands TSMC’s partnership with Swiftly, a digital customer engagement company that helps brick-and-mortar retailers grow digital relationships with shoppers.

TSMC’s retail media network is taking an approach that is distinct from the advertising offerings of ecommerce platforms such as Amazon, Walmart and Instacart. Rather than search-based advertising in which brands purchase media to improve their ranking in results, TSMC and Swiftly are offering content, coupons and loyalty experiences alongside display advertising and product listings.

One part of the impetus for the focus on in-store shopping comes by way of category imperatives. About 80-90% of grocery transactions still take place in stores, and that’s especially true for regional-level grocers. Additionally, consumers are moving more seamlessly across digital and physical shopping. According to Swiftly data, over 85% of consumers prefer interacting with brands using both channels, so brands will want to show on apps just like they do in the store.

But it’s clear that they’re also thinking about injecting new ideas into the market. Swiftly CTO Sean Turner said the companies believe they can “out-innovate” competitors.

“There is a lot of opportunity to democratize the industry by bringing a lot of the capabilities that the larger players have, and enabling those in the rest of the industry,” said Sean Turner, CTO of Swiftly. “Save Mart is a very forward thinking grocer…and we've partnered together to look to leapfrog what its very formidable competitors are doing in digital.”

Turner offered a few examples of early campaigns being run on TSMC’s sites through the retail medai network:

Chobani has an activation that includes recipes that highlight how yogurt fits into full breakfast meals.

Freebie Friday offers a digital coupon to Save Mart items that offers redemption of a full-sized item available in the store.

Quaker Grits is featuring content on grits for California shoppers who may not be as familiar with a food that’s popular in the South and Midwest. This includes storytelling, pricing and availability.

Foster Farms’ Honey Crunchy Mini Corndogs is featuring a $2-off coupon in the frozen section. When users click into the coupon, they can also see other products available in the store to which the coupon can be applied.

The variety of available media speaks to how shoppers are using digital properties at a grocer such as Save Mart. The company’s websites and mobile apps don’t offer an ecommerce marketplace. Rather, digital is complementary to the in-store shopping experience. So shoppers are interacting with the content in a number of different ways. Rather than pointing to online checkout, everything must orient back to the store.

“They might open up the retailer's weekly ad, they might go to see what coupons are available, they might look at what items are on sale, and we leverage the digital properties to help to tell that story," Turner said. “And that's really where a lot of this brand storytelling can come in. Shoppers are able to leverage some of the great stories, both around savings as well as around new product ideas, to educate shoppers, and offer a better service to shoppers when they come into the store.”

Like most of retail media, part of the advantage lies in targeting capabilities. Advertising through these owned web and app experiences is powered by first-party data. That’s different from the third-party data that for years powered cookies and social media-based advertising. It’s an area where grocers can gain a particular advantage. Their stores are the site of regular purchases, and as a result they have the potential to access lots of data about consumer habits.

“I can't think of a vertical where you've got a richer first party data set, and more choice in terms of just the number of SKUs and brands that you have in your average grocery store, Turner said. “That's ripe for this kind of advancement.”

For regional grocers that have long operated on tight margins, there’s another significant opportunity in retail media: Adding a high-margin digital business that scales quickly. Now, the local supermarket is an internet-based business, too.

Campbell Soup Company CEO Mark Clouse offered thoughts on messaging amid inflationary shifts in consumer behavior.

After months of elevated inflation and interest rate hikes that have the potential to cool demand, consumers are showing more signs of shifting behavior.

It’s showing up in retail sales data, but there’s also evidence in the observations of the brands responsible for grocery store staples.

The latest example came this week from Campbell Soup Company. CEO Mark Clouse told analysts that the consumer continues to be “resilient” despite continued price increases on food, but found that “consumers are beginning to feel that pressure” as time goes on.

This shows up in the categories they are buying. Overall, Clouse said Campbell sees a shift toward shelf-stable items, and away from more expensive prepared foods.

There is also change in when they make purchases. People are buying more at the beginning of the month. That’s because they are stretching paychecks as long as possible.

These shifts change how the company is communicating with consumers.

Clouse said the changes in behavior are an opportunity to “focus on value within our messaging without necessarily having to chase pricing all the way down.”

“No question that it's important that we protect affordability and that we make that relevant in the categories that we're in," Clouse said. "But I also think there's a lot of ways to frame value in different ways, right?”

A meal cooked with condensed soup may be cheaper than picking up a frozen item or ordering out. Consumers just need a reminder. Even within Campbell’s own portfolio, the company can elevate brands that have more value now, even if they may not always get the limelight.

The open question is whether the shift in behavior will begin to show up in the results of the companies that have raised prices. Campbell’s overall net sales grew 5% for the quarter ended April 30, while gross profit margins held steady around 30%. But the category-level results were more uneven. U.S. soup sales declined 11%, though the company said that was owed to comparisons with the quarter when supply chains reopened a year ago and expressed confidence that the category is seeing a longer-term resurgence as more people cook at home following the pandemic. Snacks, which includes Goldfish and Pepperidge Farm, were up 12% And while net sales increased overall, the amount of products people are buying is declining. Volumes were down 7%.

These are trends happening across the grocery store. Campbell is continuing to compete. It is leading with iconic brands, and a host of different ways to consume them. It is following that up with innovation that makes the products stand out. Then, it is driving home messaging that shows consumers how to fit the products into their lives, and even their tightening spending plans.

Campbell Soup is more than 150 years old, and has seen plenty of difficult economic environments. It is also a different business today, and will continue to evolve. At the end of the day, continued execution is what’s required.

“If it's good food, people are going to buy it, especially if it's a great value,” Clouse said.