Shopper Experience

24 August 2022

Rewards programs help retailers cross online and in-store shopping

Here's a look at new loyalty programs from Walmart+ and Bath and Body Works.

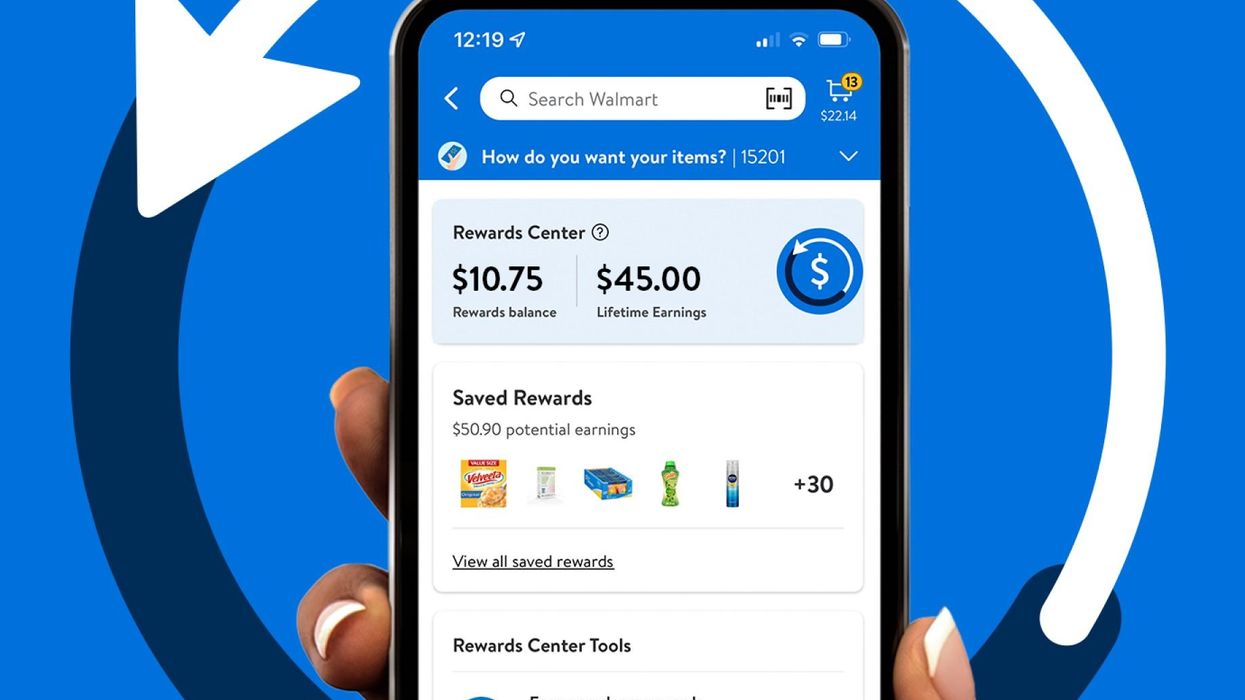

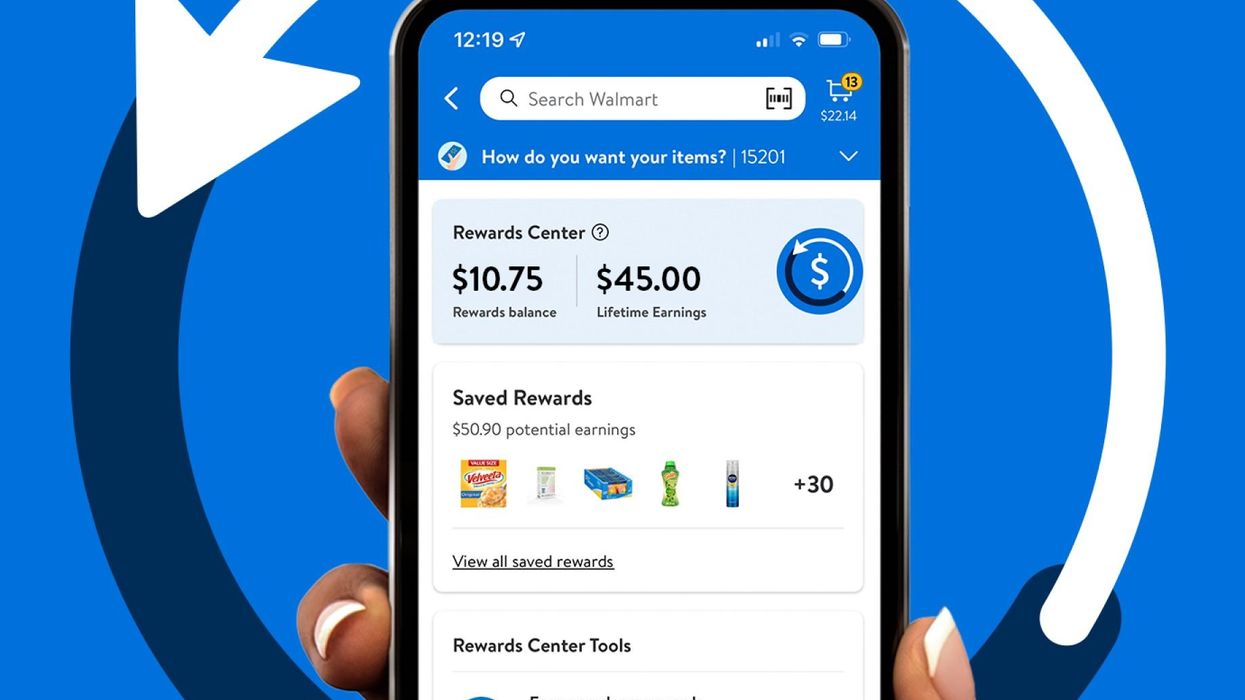

Walmart+ Is adding rewards. (Courtesy photo)

Here's a look at new loyalty programs from Walmart+ and Bath and Body Works.

Walmart+ Is adding rewards. (Courtesy photo)

Brands and retailers bring a lot of energy to attracting new customers. After all, to keep growing it helps to keep adding new people to the fold. But at a time when customer acquisition costs are rising and consumer behavior is oriented around price due to 40-year-high inflation, it’s worth remembering that a relationship with a shopper doesn’t have to stop after a single purchase.

When shoppers have already discovered an outlet and made the decision to buy, there are plenty of opportunities to turn that identification into repeat purchases. With loyalty programs, retailers are delivering value that can lead to long-term relationships.

One tool to do this is rewards, in which shoppers often receive points or other benefits for making a purchase that are redeemed later. Through these programs, brands can provide savings – always appreciated at a time of rising prices – while increasing touchpoints with a consumer. Engaging through a digital experience like an app provides a chance to offer additional ways to demonstrate what a brand or retailer offers. Eventually, these apps could be the springboard to personalize experiences. Further, it can connect online and in-store experiences across a single surface.

Rewards can be a motivator of purchases in and of themselves. A recent Salesforce survey of 2,500 retailers consumers found that loyalty or rewards programs increased the likelihood of a purchase for 56% of respondents, while loyalty programs were at the top of list of benefits that kept consumers who responded coming back to a brand. The impact of inflation

This week, a pair of new rewards programs appeared from large retailers Walmart and Bath & Body Works appeared that show these characteristics in action. Here’s a look:

A rewards program is the latest way Walmart is adding to the perks offered by Walmart+ as it aims to ramp up the membership offering.

A new program called Walmart Rewards provides a way for shoppers to earn additional savings toward future purchases from the retailer.

Here's how it works: Shoppers using the Walmart app will see an option to add rewards in categories ranging from groceries to household goods to pet care. Members then bank the rewards in a Walmart wallet within the app. As the rewards build up over time, they can then redeem the rewards on future purchases in-store using a QR code, or online.

“Let’s say after a few shopping trips or online orders, a member has accumulated $10 in Walmart Rewards,” said Chris Cracchiolo, SVP and general manager of Walmart+, in a blog post. “When they apply those savings at checkout, what was previously a $25 basket now only costs $15.”

The item-specific rewards are powered by the Ibotta Performance Network, a Denver, Colorado-based provider enabling digital cash back offers with which Walmart signed a partnership last year. In that announcement, Walmart indicated that customers will be seeing rebates beyond its own app:

As an additional component of the agreement, Walmart will be joining the Ibotta Performance Network (IPN), the first digital network that enables cash rebates to be delivered in a coordinated fashion across large third-party sites including social media networks, recipe sites and other platforms. Walmart customers on those platforms will be presented with digital offers for relevant products, which they can select and seamlessly add to their Walmart digital cart for online or in-store shopping.

This gets at how the Rewards program is built. Through Walmart’s program, suppliers are the source of the discount for the Rewards, rather than Walmart itself. In order to access Walmart Rewards, suppliers must first work with Ibotta to set up an offer that is available at other retailers and nationally, Walmart said.

It points to how loyalty programs have another built-in perk that has the potential to flow to brands. Often, rewards programs can provide first-party data about customer purchases that can prove valuable for merchandising. If this data is made available to brands, it could prove to be a compelling way to tap insights from the many customers of the nation’s largest retailer. The fact that Walmart suppliers can fund the Rewards indicates this may happen, but specifics have not emerged yet.

The Rewards program will also have links with Walmart Connect, which is Walmart’s retail media arm that powers advertising across its platforms. In a separate blog post out Wednesday from Walmart Connect SVP and General Manager Rich Lehrfeld detailed how this integration will be made possible.

Through a Sponsored Products campaign, advertisers can seamlessly amplify their products and maximize engagement with Walmart customers and members looking to discover and purchase new products. With the introduction of Walmart Rewards, we will be integrating item rewards into these Sponsored Product ads in the same format as organic search result listings, maintaining a cohesive user experience. These item rewards will appear in search in-grid placements for logged in Walmart+ members.

Walmart says this will enable suppliers to “reap the benefits of both marketing strategies.” It shows a crossover between advertising and loyalty, with the ability to reach beyond Walmart’s own app. Walmart indicated it is exploring the expansion of Rewards beyond Walmart+, meaning its reach has room to grow.

While this is one benefit of an ever-growing program, one question for Walmart's business as a whole is whether a rewards program will help Walmart+ grow. It’s among a number of perks being added, including free streaming from Paramount+, an expansion of fuel discounts to 10-cents a gallon at Exxon and Mobil stations and members-only events such as the recently-held Walmart+ Weekend. Executives have said they are intent on growing Walmart+, and adding to its value. Yet they haven’t provided numbers on the program. A recent analysis from the market research firm Consumer Intelligence Research Partners found that growth of the program had plateaued in the first half of the year.

Yet subscriber growth may not be the goal here. A subscription program's perks can have different purposes. Some are designed to attract members, while others increase value for those who are already signed up. There's benefit to the latter, as more usage of the program means more shopping at Walmart. Rewards is a loyalty program by design, which is typically firmly planted in the camp of going deeper with existing customers. Still, the prospect of deals could prove enticing at a time of 40-year-high inflation. Adding many perks at one time also offers the opportunity to show how the totality of the benefits added this year have an increased the membership's value proposition. Walmart can go to market showing not only how much it has grown what you get with Walmart+, but, in a particularly important theme for Walmart, it can also show how much it saved.

A Walmart Rewards screenshot. (Courtesy photo)

The perks are also set to start emanating from Bath & Body Works.

The fragrance-rooted home and personal care retailer launched a new program called My Bath & Body Works Rewards this week. After beta testing, the rewards are now available nationwide. With enrollment accessible in-store, online or through the retailer’s My Bath & Body Works app, Bath & Body Works is offering the following benefits:

For Bath & Body Works, a key theme is that members receive new products for their points. The retailer also points out that while others offer sample sizes, Bath & Body Works is offering full-size items.

“With just a $100 spend, customers receive a free product valued up to $16.50,” the company stated.

Along with the loyalty program itself, Bath & Body Works is also debuting the app with this launch. That digital interface offers additional perks, including the ability to earn points, store offers, gift cards and points in a wallet and access to “Appsclusive” events.

“We know that customers expect fun and engaging experiences whether shopping in our store, online or in the app, and we’ve crafted our program to deepen the engagement and connection with our customers,” said Joanne Friess, SVP of marketing strategy, in a statement.

Bath & Body Works seems a good candidate for a loyalty program, given that its candles, soaps and other goods require repeat purchases. Plus, its recognizable scent and unique in-store experience has engendered fans. It is seeking to build a stronger relationship with those customers. There is also potential to reach a big audience. Leaders said the company is inviting 60 million people to join, and expect rewards to help attract more.

“In our test markets, we saw that our loyalty customers have higher spend and retention rates than our average customer,” interim CEO Sarah Nash said on the company’s second quarter earnings call last week. “We look forward to enrolling a significant number of our customers in the first year as well as attracting new customers, capitalizing on enthusiasm for the brand and helping drive the growth of our customer base.”

The program also underscores where the retailer is heading. Nash said on the call that the company is eliminating 130 roles as it seeks to emphasize an omnichannel approach across online and in-store. The fact that the loyalty program sits on both surfaces, with a mobile app at the center, underscores how retailers want to engage to provide savings now, and continue reaching across channels going forward.

Consumer behavior is shifting amid 40-yearh-high inflation and talk of a recession. Yet there may be a chance to build loyalty, as shoppers stick with their favorites at a time when they may be pulling back in other areas. According to a recent study from Brand Keys, 17 categories – including apparel, pet food, beauty care, footwear and snack foods – saw increased loyalty levels among consumers who believe there is currently a recession. (Another 15 categories, including goods such as appliances and electronics, saw loyalty levels decline).

An opportunity to strengthen relationships combined with the importance of keep customers during a period of economic tightening, it's a good bet that loyalty programs including rewards will remain a focus for brands and retailers.

With that in mind, here are several more rewards programs that were launched in recent weeks:

On the Move has the latest from Amazon, Lovesac and more.

Ryan Cohen is executive chairman of GameStop. (Photo by Flickr user Bill Jerome, used under a Creative Commons) license.

This week, leadership is changing at GameStop, Sorel and Beautycounter. Meanwhile, key executives are departing at Amazon, Wayfair and Lovesac.

Here’s a look at the latest shuffles:

GameStop announced the termination of Matthew Furlong as CEO on Wednesday. A brief statement did not provide a reason for the firing.

With the move, Chewy founder and activist investor Ryan Cohen was named executive chairman of the video game retailer. Cohen will be responsible for capital allocation and overseeing management.

It came as the company reported a 10% year-over-year decline in net sales for the first quarter. Meanwhile, the company’s net loss improved by 62%.

In an SEC filing, GameStop further added this “We believe the combination of these efforts to stabilize and optimize our core business and achieve sustained profitability while also focusing on capital allocation under Mr. Cohen’s leadership will further unlock long-term value creation for our stockholders.”

Cohen was revealed as GameStop's largest shareholder when he disclosed a 10% stake in the retailer in 2020. GameStop went on to become a leading name in the meme stock rise of 2021.

Mark Nenow is stepping down as president of the Sorel brand in order to focus on his health.

After rising to the role in 2015, Nenow spearheaded a transformation of Columbia Sportswear-owned Sorel from a men’s workwear brand to a fashion-focused brand that led with a women’s offering of boots, sandals and sneakers.

“Mark led the brand to sales of $347 million in net sales in 2022,” said Columbia Sportswear CEO Tim Boyle, in a statement. “His leadership has been invaluable to this company, and we wish him the very best.”

Columbia will conduct a search for Nenow’s replacement. Craig Zanon, the company’s SVP of emerging brands, will lead Sorel in the interim.

Beautycounter appointed board member Mindy Mackenzie as interim CEO, succeeding Marc Rey. According to the brand, Rey and the board “mutually decided to transition to a new phase of leadership for Beautycounter.”

McKenzie, a former executive at Carlyle, McKinsey and Jim Beam, will lead the company as it conducts a search for a permanent CEO. Additionally, former Natura & Co CEO Roberto Marques will join Beautycounter’s board as chair.

As part of the transition, Nicole Malozi is also joining the company as chief financial officer. She brings experience from Tatcha, Nike, and DFS Group Limited.

Melissa Nick, a VP of customer fulfillment for North America at Amazon, will leave the company, effective June 16, CNBC reported. Nick joined the company in 2014, and oversaw a region that included nearly 300 fulfillment centers. After doubling its supply chain footprint during the pandemic, Amazon recently reorganized its fulfillment operations to take a regional approach, as opposed to a national model that often resulted in items shipping across the country.

Jon Blotner (Courtesy photo)

Steve Oblak will retire from the role of chief commercial officer at home goods marketplace Wayfair. With the move, Jon Blotner will be promoted to chief commercial officer.

"Steve has served as a critical part of our leadership team and played a pivotal role in Wayfair's growth, helping us grow from a $250 million business when he joined to $12 billion in net revenue today,” said Wayfair CEO Niraj Shah, in a statement. “He oversaw countless milestones, from helping to launch the Wayfair brand as we brought together hundreds of sites into a single platform, to launching new categories, business lines, and geographies while overseeing our North American and European businesses, to leading our debut into physical retail.”

Blotner previously oversaw exclusive and specialty retail brands, as well as digital media at Wayfair. Before joining the company, he served as president of Gemvara.com prior to its 2016 acquisition by Berkshire Hathaway.

Furniture retailer Lovesac said Donna Dellomo will retire as EVP and CFO, and move to an advisory role, effective June 30. Dellomo was with Lovesac for six years.

Keith Siegner was appointed as the next EVP and CFO. He brings experience as CFO of esports company Vindex, as well as executive roles at Yum! Brands, UBS Securities and Credit Suisse.

Additionally, Jack Krause will retire from the role of chief strategy officer, effective June 30. His responsibilities will be divided between CEO Shawn Nelson and president Mary Fox.

“Since joining Lovesac, Jack has played an instrumental role in transforming the Company into a true omni channel retailer by helping expand our physical touchpoints and digital platform as we continue to disrupt the industry,” said Nelson, in a statement.

The National Retail Federation announced the addition of five new board members. They include: