When things are a bit gloomy, people tend to turn to the smaller things that bring them happiness.

That idea helps to explain why so many teachers turn to cat videos on bad days, but it has also been used as a guiding principle of consumer behavior during this millennium’s recessionary economies.

During the 2001 recession that followed the 9/11 attacks and dot-com bubble burst, then-Estée Lauder Cos. Chairman Leonard Lauder noted that American lipstick sales increased by 11%, even as sales in other categories were flagging. It pointed to the kind of counterintuitive trend that the data-inclined tend to love: Lipstick sales and the overall economy were inversely related.

Lauder called this the “lipstick index,” noting, “When things get tough, women buy lipstick.” This idea described how consumers tend to spend on the affordable luxuries at a time of economic downturn, even as they cut back on the largest purchases. Beauty ends up being a prime area that sees growth, as it offers the kind of accessible satisfaction that many are seeking for a pick-me-up. After all, a more expensive brand of lipstick is a splurge. A Coach bag, meanwhile, is an investment.

“On average, beauty products are less costly than other categories targeted toward self-care and appearance,” said Michelle Bacharach, founder and CEO of FindMine, which provides AI-powered dynamic content creation for brands. “Therefore, investing in lipstick – and the perceived category strength of the lipstick index – becomes the most cost-efficient way to invest in one’s self appearance, compared to higher-tag luxury products like clothing, jewelry and handbags.”

The lipstick index hasn’t always found correlations are directly linked with lipstick sales. In the 2009 recession, foundation overtook lipstick as the popular beauty product that doubled as a canary in the coal mine for the economy. In 2020, the COVID-19 pandemic lockdowns led many to question if the lipstick index should be ended for good, as people weren't buying much of anything to go out in public. But it was merely replaced. Over the last two years, fragrance sales rose, according to the NPD Group. People sought the smell of luxury and escape from a product that made them feel good, even though they weren’t leaving home.

“We call it the fragrance index, or fragrance effect,” Sue Nabi, CEO of CoverGirl owner Coty, told investors on the company’s most recent quarterly earnings call.

Ulta Beauty is gaining sales as other retailers are struggling. (www.flickr.com)

Ulta Beauty is gaining sales as other retailers are struggling. (www.flickr.com)

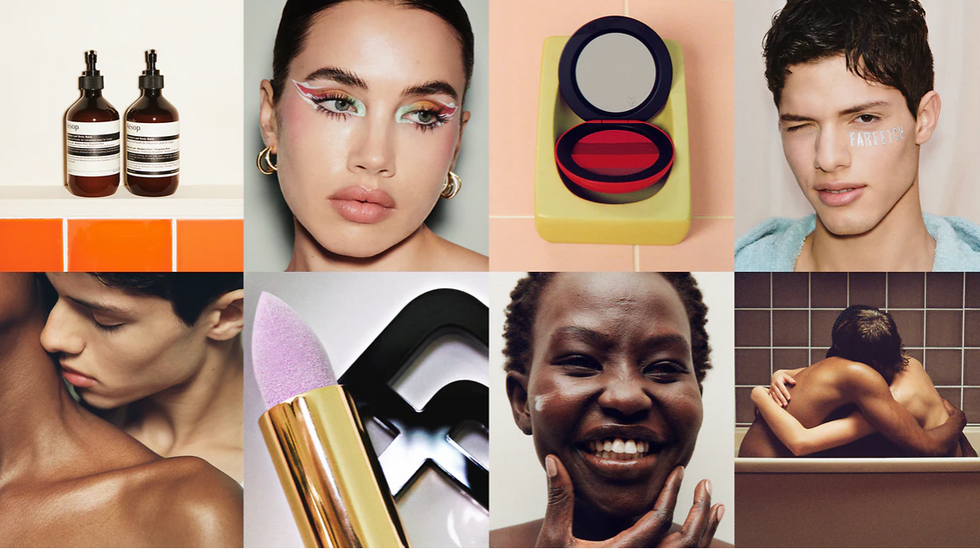

With the arrival of the inflation spike of 2022, beauty is gaining again. CoverGirl owner Coty and Lauder both posted strong earnings in the latest quarter. At Ulta Beauty, sales were up 16.3% annually in the second quarter, and the retailer raised its forecast for the rest of the year as others were slashing their outlooks and warning of uncertainty in a deteriorating macro environment. Meanwhile, ecommerce platforms and retailers like Farfetch, Moda Operandi, Best Buy and Shopbop are adding beauty products alongside core offerings such as fashion and electronics. It's clear they see opportunities to gain share in a growing category that has gotten a makeover for digital commerce by direct-to-consumer brands over the last decade. NPD called it the beauty index.

There’s a reason beauty has staying power in tough times. Right now, consumers are facing higher prices for food and gas amid 40-year-high inflation. When consumers are looking to stretch dollars, they tend to “trade down” to smaller sizes or store brands. That tends to play out in everyday purchases. Beauty products are in many of the same aisles, but don’t tend to see the same dynamics playing out.

“Trading down to a less expensive beauty brand doesn't get you very far, given the price difference and purchase frequency,” Bacharach said. “Consumers will experience more significant financial gain by skipping their daily latte than opting for a lower-cost foundation from a cost savings perspective.”

To be sure, the current rise of beauty may not only be attributable to inflation and the cooling economy. The 2022 surge in beauty sales arrived as many people were taking off their face masks, and returning to in-person activities such as work and social events. The shift from home to the public changed consumer behavior. Dressier clothes and beauty products replaced casual wear and TVs.

Farfetch is entering beauty as the category demonstrates strength. (Courtesy photo)

Farfetch is entering beauty as the category demonstrates strength. (Courtesy photo)

But the rise of the affordable luxury has taken hold across the consumer economy. PepsiCo CEO Ramon Laguarta referenced how the company provides “affordable treats and small moments of pleasure” as he spoke of sustained demand and organic sales growth for the company’s soda and snacks during the company’s third quarter earnings call on Wednesday. Meanwhile, a recent report on grocery shopper behavior from IRI noted that consumers were trading down at the grocery store so they could afford the premium brands that they particularly wanted.

It comes as consumer confidence remains at 1980s lows, just as inflation continues to reside at highs not seen since the same period. Uncertainty is the most often used term to describe the economy. As brands batten down the hatches, they are looking to recession-proof themselves. Beauty offers an important lesson: Consumers go on a journey with a brand, from discovery through content to try-on experience to purchase.

“In the beauty industry, the brand is the biggest differentiator,” Bacharach said. “For other categories looking to follow suit, capturing customer connections through brand storytelling and unique expertise is what builds long-term loyalty and larger shopping baskets,”

Through social platforms, makeup counters and AI-powered apps, beauty brands serve the consumers, just as much as they sell to them. Even as grocers see trade down behavior begin, they have no equivalent of the beauty brand experience in place, Bacharach said.

“The average consumer lacks the expertise most beauty stores provide during the guided in-store experience, leading to the explosive popularity of TikTok and social media makeup tutorials,” Bacharach said. “That lack of knowledge translates into a lack of consumer trust in other brand categories. Building long-term customer loyalty isn’t easy. I cofounded FindMine for that very reason, to support Fortune 1000 brands in the beauty, home and apparel spaces to translate the expert, guided in-store shopping experience to online and gain customers for life.”

It leads us to amend the statement that we made at the opening: As people look for the smaller things that bring them happiness, they also tend to look for the things they know. Plus, they remember the people who guided them along the way.

Ulta Beauty is gaining sales as other retailers are struggling. (

Ulta Beauty is gaining sales as other retailers are struggling. ( Farfetch is entering beauty as the category demonstrates strength. (Courtesy photo)

Farfetch is entering beauty as the category demonstrates strength. (Courtesy photo)