Shopper Experience

18 April 2023

Google adds shipping, returns info to shopping listings

Merchants can show the info right alongside pricing.

Photo by Alex Dudar on Unsplash

Merchants can show the info right alongside pricing.

In ecommerce, logistics are a customer-facing function. The latest proof comes from Google.

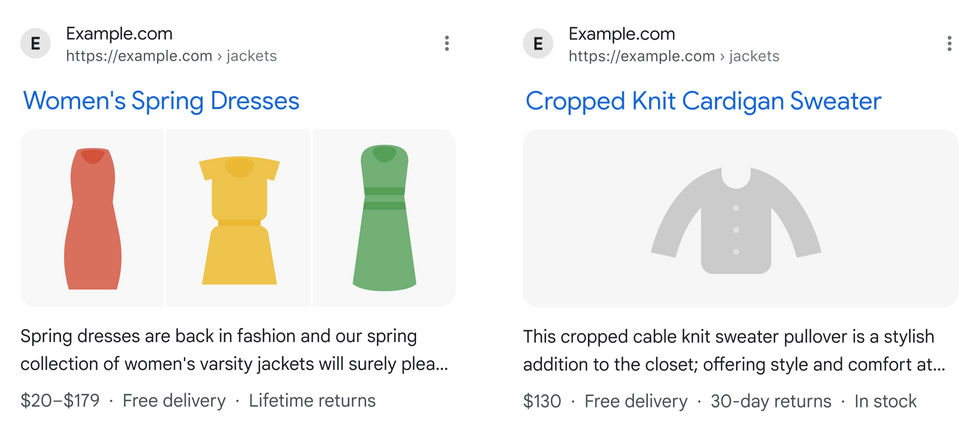

The search engine is expanding the display of information about shipping and returns in product listings on merchant sites. This is designed to provide consumers with all of the information not just about what a product is and how much it costs, but also when it will arrive and how easy it is to send back if it’s not quite right.

“When shopping, people want to know the total price for the products they're purchasing, including the shipping price. Shipping speed, cost, and return policy are major factors considered by shoppers when buying products online,” a Google Search Central update states. “Often, consumers will not complete a purchase because the shipping cost is too high, the shipping speed is not fast enough, or return information isn't clear. Therefore, displaying shipping and return information clearly up front is critical for the success of your online sales.”

The functionality is available in the U.S., and will soon roll out in other countries.

Google said it is also making it easier to monitor and fix the structured data required to enable the shipping and returns display. Google will send warnings to merchants that don’t have the information, or when it was added incorrectly.

The shipping and returns information can now be displayed next to product pricing info at the bottom of a listing.

The new feature comes at a time when return policies appear to be in a state of flux. Consumers are accustomed to free and flexible returns from ecommerce platforms that sought to make buying online seamless, but mounting logistics costs and higher return rates are pressuring bottom lines at brands and retailers. That’s prompting leaders to rethink the longstanding freebies. Last week, The Information reported that Amazon will begin charging a $1 fee for returns made to a UPS store when there is a Whole Foods, Amazon Fresh or Kohl’s closer to the delivery address. While this looks like a targeted test, it’s a reminder that return policies aren’t always uniform. So making it easy for consumers to access information can also provide a clearer path to clicking “Buy.”

This is the first significant shopping feature to roll out from Google in 2023 following a busy 2022. Last year, the company made a host of upgrades to shopping listings, as it sought to embed commerce within the primary search experience. The updates ranged from augmented reality shopping tools to price comparison. Given that flurry of activity, this likely won’t be the last feature update of the year.Labor disputes on the West Coast could cause further disruption heading into peak season.

When the first half of 2023 is complete, imports are expected to dip 22% below last year.

That’s according to new data from the Global Port Tracker, which is compiled monthly by the National Retail Federation and Hackett Associates.

The decline has been building over the entire year, as imports dipped in the winter. With the spring, volume started to rebound. In April, the major ports handled 1.78 million Twenty-Foot Equivalent Units. That was an increase of 9.6% from March. Still it was a decline of 21.3% year over year – reflecting the record cargo hauled in over the spike in consumer demand of 2021 and the inventory glut 2022.

In 2023, consumer spending is remaining resilient with in a strong job market, despite the collision of inflation and interest rates. The economy remains different from pre-pandemic days, but shipping volumes are beginning to once again resemble the time before COVID-19.

“Economists and shipping lines increasingly wonder why the decline in container import demand is so much at odds with continuous growth in consumer demand,” said Hackett Associates Founder Ben Hackett, in a statement. “Import container shipments have returned the pre-pandemic levels seen in 2019 and appear likely to stay there for a while.”

Retailers and logistics professionals alike are looking to the second half of the year for a potential upswing. Peak shipping season occurs in the summer, which is in preparation for peak shopping season over the holidays.

Yet disruption could occur on the West Coast if labor issues can’t be settled. This week, ports from Los Angeles to Seattle reported closures and slowdowns as ongoing union disputes boil over, CNBC reported. NRF called on the Biden administration to intervene.

“Cargo volume is lower than last year but retailers are entering the busiest shipping season of the year bringing in holiday merchandise. The last thing retailers and other shippers need is ongoing disruption at the ports,” aid NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “If labor and management can’t reach agreement and operate smoothly and efficiently, retailers will have no choice but to continue to take their cargo to East Coast and Gulf Coast gateways. We continue to urge the administration to step in and help the parties reach an agreement and end the disruptions so operations can return to normal. We’ve had enough unavoidable supply chain issues the past two years. This is not the time for one that can be avoided.”