Operations

08 May 2023

Shopify hands its logistics business to the man who built Amazon's

As Flexport picks up most of Shopify's logistics network, it looks like CEO Dave Clark is ready to build...again.

Dave Clark. (Photo via Amazon)

As Flexport picks up most of Shopify's logistics network, it looks like CEO Dave Clark is ready to build...again.

Shopify doesn’t want to build a logistics business anymore, but Shopify’s logistics business isn’t done being built.

As Shopify announced on May 4 that it would sell the key pieces of its logistics business, leadership signaled that the ecommerce software company was done pursuing “side quests.” Even while acknowledging that logistics is a side business “that all eccommerce entrepreneurs are eventually pulled into,” due to the complexity of moving the physical goods that are sold online, Shopify President Harley Finkelstein told analysts that “we do something in the world better than anybody else, which is building commerce software. And that's what we want to be able to do.”

It was an about-face for Shopify after spending $2.1 billion to acquire the startup Deliverr last year in its largest-ever M&A move. And it came on an especially tough day for Shopify, which laid off 20% of its workforce in concert with the announcement, marking its second such reduction in a year.

Yet the side hustle of a business that’s turning the ship around can end up right in the path toward another business’ destination.

Flexport is buying the majority of the logistics business in a deal that will give Shopify a 13% stake in the company.

Decade-old Flexport’s primary focus was already on the supply chain, and the company was an existing partner to Shopify. Last year, the company brought on a new CEO in Dave Clark, who previously led the build of Amazon’s vaunted logistics network and led the company’s commerce division. Now, it will have the assets and team of Deliverr, which built software to position items close to demand, and a network of logistics facilities to move them. It will also have built-in ties to millions of brands that use Shopify to run their ecommerce stores. Flexport will become the official logistics partner of Shopify, and preferred provider for Shop Promise, which provides guaranteed five-day delivery.

For Flexport, this equation will produce immediate benefits. The company will introduce last mile and ecommerce services for customers right away. But with Clark at the helm of Flexport, there’s also an opportunity out on the horizon.

In a note to staff, he called Shopify’s network “the last piece of the puzzle that enables us to drive technology-fuelled solutions across the product life cycle, from the manufacturer’s floor, across the oceans and skies, through ports and [fulfillment] and now, right into the hands of customers.”

It looks like Clark was up on Sunday thinking about what's in front of him:

\u201cThere\u2019s nothing better than a Sunday where you love your work so much you can\u2019t wait for Monday to keep building. The acquisition of Shopify Logistics opens up incredible possibilities for Flexport. Can\u2019t wait to hit the ground running. Together, we'll revolutionize the world of\u2026\u201d— Dave Clark (@Dave Clark) 1683488324

Hand the keys of a logistics network to Dave Clark, and he is likely going to know what to do with them. As The Current wrote last year upon Clark’s departure, the executive’s legacy at the company is intertwined with the logistics buildout of the 2010s. It created a fulfillment and delivery network that is now the size of UPS. It also turned the cost center of storing and moving goods into a massive new business line that offered these services to Amazon’s own third-party merchants through Fulfillment by Amazon.

Now, Clark will lead a business that is often compared with Fulfillment by Amazon. Shopify Fulfillment Network was built to give brands that use the platform access to storage, fulfillment and returns services. As Clark told CNBC, Flexport will continue to build that out. The goal will be to build a logistics network that is available to merchants that sell on any platform. From CNBC:

“The big difference between what we’re going to offer, and an Amazon or maybe a Walmart logistics or some of the other places offer, is this isn’t just for one system or store or platform. We have very much the same vision that Shopify has. We’re just about the success of the merchant and our customers, and we don’t care if they sell in their stores or on Amazon or on Walmart.”

Clark is shying away from the idea that Flexport will take on Amazon. He characterized Flexport as an “extension” of the Amazon network to Fox Business’ Maria Bartiromo as opposed to a competitor. But it’s clear that he wants to go big. He also spoke about the ambition to build an end-to-end network prior to last week’s announcement. When asked by Reuters in March about whether he would aim to repeat the feat of building a global ecommerce logistics network, he said he wanted to “do it again for everyone else.”

Assembling a global ecommerce logistics network isn’t easy, and Flexport faces plenty of challenges ahead.

Flexport’s prior expertise is in freight forwarding, but it is still new to last-mile ecommerce despite a Shopify partnership that has been growing. Now, a team at Flexport led by former Deliverr CEO Harish Abbott will be tasked with building out a network that likely was never prioritized fully by a company that made its big splash at a time when it was crashing into economic headwinds that forced it to change course.

Flexport is also entering a crowded market for ecommerce-focused third-party logistics that just saw a big growth spurt during the pandemic. There are giants in this space. Amazon has recalibrated after its network grew even larger during the pandemic. FBA continues to be an easy-mode option for sellers and the recently-launched Buy With Prime offers the same type of badge-and-delivery guarantee service as Shop Promise. Walmart is also pouring resources into automation as it expands its supply chain network in part to boost profits by offering fulfillment to its merchants. Logistics-as-a-service is also gaining fashion among a wider group of retailers. Gap Inc. is now offering its own warehouse space up to others.

There are also cautionary tales emerging among even the new entrants to the market. American Eagle Outfitters tried to build its own logistics alternative to the big players through the acquisition of Quiet Platforms, but recently replaced the division’s CEO while admitting that the results didn’t meet expectations.

Yet Flexport now has a leader who has built one of those marketing-leading networks before, and a direct line to the platform that powers 10% of ecommerce.

That’s a strong base from which to build.

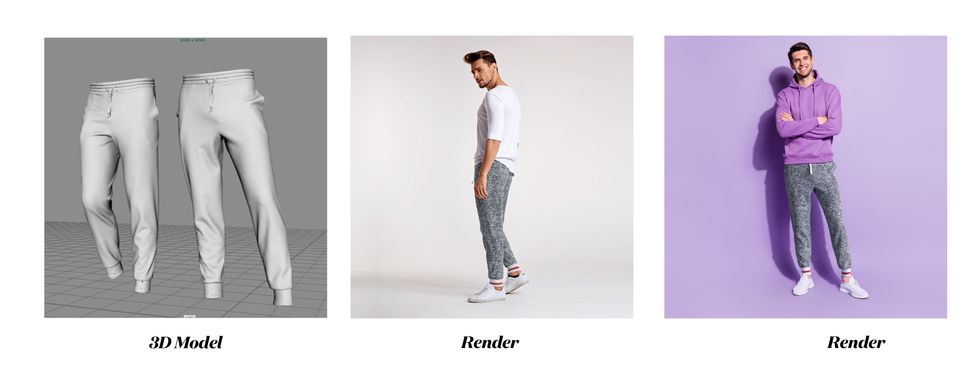

Amazon partnered with Hexa to provide access to a platform that creates lifelike digital images.

A 3D rendering of a toaster from Hexa and Amazon. (Courtesy photo)

Amazon sellers will be able to offer a variety of 3D visualizations on product pages through a new set of immersive tools that are debuting on Tuesday.

Through an expanded partnership with Hexa, Amazon is providing access to a workflow that allows sellers to create 3D assets and display the following:

Selllers don't need prior experience with 3D or virtual reality to use the system, according to Hexa. Amazon selling partners can upload their Amazon Standard Identification Number (ASIN) into Hexa’s content management system. Then, the system will automatically convert an image into a 3D model with AR compatibility. Amazon can then animate the images with 360-degree viewing and augmented reality, which renders digital imagery over a physical space.

Hexa’s platform uses AI to create digital twins of physical objects, including consumer goods. Over the last 24 months, Hexa worked alongside the spatial computing team at Amazon Web Services (AWS) and the imaging team at Amazon.com to build the infrastructure that provides 3D assets for the thousands of sellers that work with Amazon.

“Working with Amazon has opened up a whole new distribution channel for our partners,” said Gavin Goodvach, Hexa’s Vice President of Partnerships.

Hexa’s platform is designed to create lifelike renderings that can explored in 3D, or overlaid into photos of the physical world. It allows assets from any category to be created, ranging from furniture to jewelry to apparel.

The result is a system that allows sellers to provide a new level of personalization, said Hexa CEO Yehiel Atias. Consumers will have new opportunity see a product in a space, or what it looks like on their person.

Additionally, merchants can leverage these tools to optimize the entire funnel of a purchase. Advanced imagery allows more people to view and engage with a product during the initial shopping experience. Following the purchase, consumers who have gotten a better look at a product from all angles will be more likely to have confidence that the product matches their needs. In turn, this can reduce return rates.

While Amazon has previously introduced virtual try-on and augmented reality tools, this partnership aims to expand these capabilities beyond the name brands that often have 1P relationships with Amazon. Third-party sellers are an increasingly formidable segment of Amazon’s business, as they account for 60% of sales on the marketplace. Now, these sellers are being equipped with tools that enhance the shopping experience for everyone.

A video displaying the new capabilities is below. Amazon sellers can learn more about the platform here.

Hexa & Amazon - 3D Production Powerhousewww.youtube.com