Economy

14 April 2023

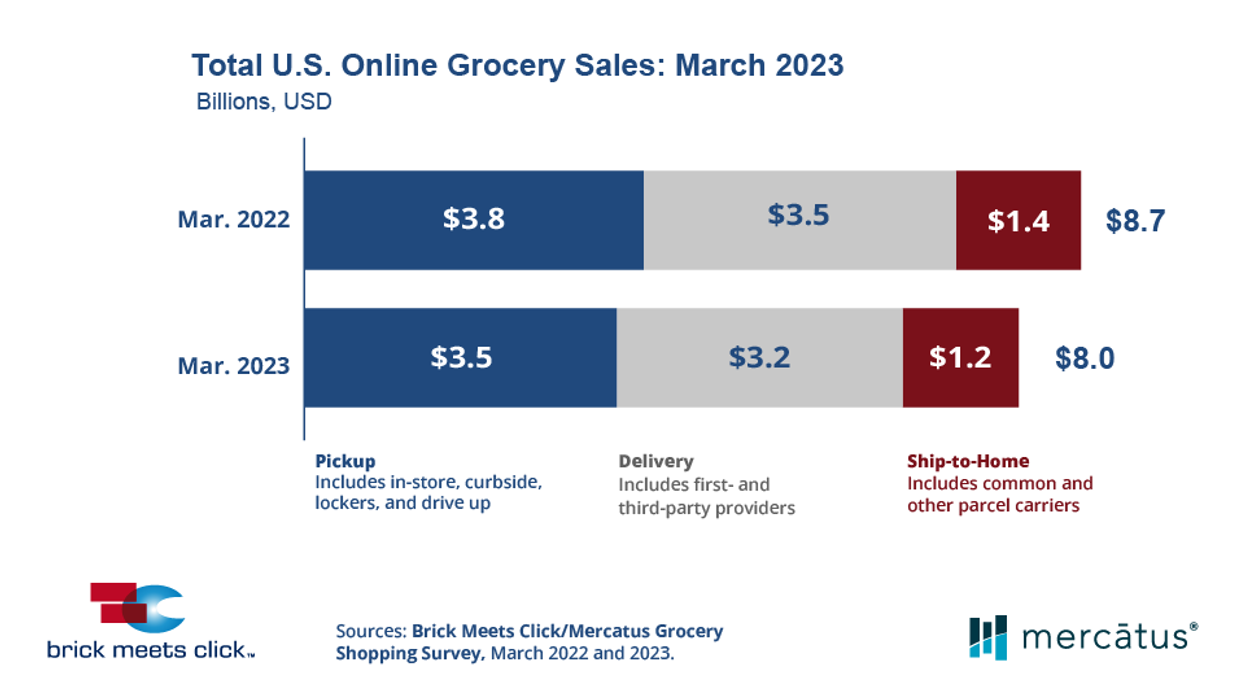

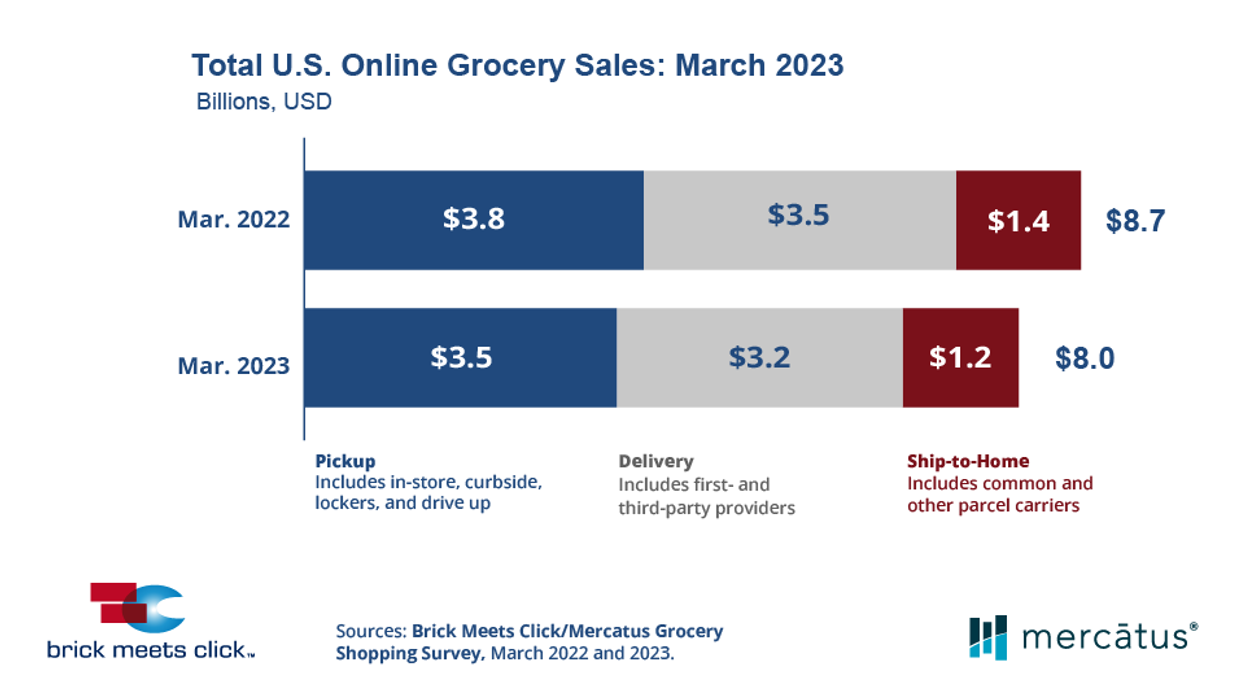

Egrocery sales declined 7.6% in March as shoppers looked to save

Cost topped convenience as the top consideration for consumers, Brick Meets Click reports.

(Source: Brick Meets Click/Mercatus)

Cost topped convenience as the top consideration for consumers, Brick Meets Click reports.

(Source: Brick Meets Click/Mercatus)

As shoppers consider whether to buy groceries online, cost concerns are taking priority.

That’s what the March results of the monthly Brick Meets Click/Mercatus Grocery Shopping Survey show, according to the authors.

Key U.S. egrocery data for March includes the following:

Inflation has been driving prices for essentials higher for months, particularly in food. That’s leading consumers to think twice about spending choices. The survey found that cost rose above convenience as the top consideration for online grocery shoppers.

When it comes to choosing which grocery ecommerce service to use, 44% of households indicated that “not paying more than necessary” was the top criteria. But there was some divergence by category. Households using pickup reported a 420-basis-point rise in cost considerations, while households using delivery reported a 140-basis-point gain.

Cost is also the top consideration when consumers are choosing whether to opt for pickup or home delivery.

“Lower income households are more attracted to pickup services because it costs much less to use than Delivery, due to the additional charges, fees, and tips,” said David Bishop, Partner at Brick Meets Click, in a statement. “During March 2023, households earning under $50,000 annually were 34% more likely to use pickup while households making over $200,000 per year were over twice as likely to use delivery.”

The survey also found declining repeat orders. Monthly order frequency fell to its lowest level since March 2020, when the pandemic altered in-person life. Meanwhile, the likelihood that a customer would use the same service fell to 61%, down 290 basis points from 2021.

Cost considerations are also likely pushing more shoppers to mass retailers such as Walmart and Target as opposed to pure-play grocers. Order frequency fell just 2% for mass, while the drop was 10% for grocery.

Still, there are signs that Walmart is continuing to hold strong despite the tougher retail environment. The rate of shoppers who went to both Walmart and a grocery store during the month was unchanged, while Target’s rate fell 280 basis points. Walmart executives have reported seeing more affluent shoppers during this period, and they are offering a recently-expanded ecommerce offering to serve them. It shows that the combination of price and digital services can continue to attract shoppers, even when they are increasingly “choiceful,” as Walmart executives put it.

Campbell Soup Company CEO Mark Clouse offered thoughts on messaging amid inflationary shifts in consumer behavior.

After months of elevated inflation and interest rate hikes that have the potential to cool demand, consumers are showing more signs of shifting behavior.

It’s showing up in retail sales data, but there’s also evidence in the observations of the brands responsible for grocery store staples.

The latest example came this week from Campbell Soup Company. CEO Mark Clouse told analysts that the consumer continues to be “resilient” despite continued price increases on food, but found that “consumers are beginning to feel that pressure” as time goes on.

This shows up in the categories they are buying. Overall, Clouse said Campbell sees a shift toward shelf-stable items, and away from more expensive prepared foods.

There is also change in when they make purchases. People are buying more at the beginning of the month. That’s because they are stretching paychecks as long as possible.

These shifts change how the company is communicating with consumers.

Clouse said the changes in behavior are an opportunity to “focus on value within our messaging without necessarily having to chase pricing all the way down.”

“No question that it's important that we protect affordability and that we make that relevant in the categories that we're in," Clouse said. "But I also think there's a lot of ways to frame value in different ways, right?”

A meal cooked with condensed soup may be cheaper than picking up a frozen item or ordering out. Consumers just need a reminder. Even within Campbell’s own portfolio, the company can elevate brands that have more value now, even if they may not always get the limelight.

The open question is whether the shift in behavior will begin to show up in the results of the companies that have raised prices. Campbell’s overall net sales grew 5% for the quarter ended April 30, while gross profit margins held steady around 30%. But the category-level results were more uneven. U.S. soup sales declined 11%, though the company said that was owed to comparisons with the quarter when supply chains reopened a year ago and expressed confidence that the category is seeing a longer-term resurgence as more people cook at home following the pandemic. Snacks, which includes Goldfish and Pepperidge Farm, were up 12% And while net sales increased overall, the amount of products people are buying is declining. Volumes were down 7%.

These are trends happening across the grocery store. Campbell is continuing to compete. It is leading with iconic brands, and a host of different ways to consume them. It is following that up with innovation that makes the products stand out. Then, it is driving home messaging that shows consumers how to fit the products into their lives, and even their tightening spending plans.

Campbell Soup is more than 150 years old, and has seen plenty of difficult economic environments. It is also a different business today, and will continue to evolve. At the end of the day, continued execution is what’s required.

“If it's good food, people are going to buy it, especially if it's a great value,” Clouse said.