Many of the companies that run the platforms powering the ecommerce landscape reported earnings from the second quarter of 2022 this week.

The results came on a week when the macro picture got cloudier, as the latest GDP report showed the second straight quarter of contraction in the economy, while the Federal Reserve raised interest rates to cool demand. While all of the executives acknowledged “headwinds” from inflation and higher gas prices, as well as a concern about a pullback in consumer spending as the economy tightens, the results were not uniform across the board.

Here’s a look at key numbers that illustrate how each of the retail channels are faring:

Amazon: 7%

That’s the year-over-year sales growth posted by the largest ecommerce company in a second quarter that was seen as an improvement over Q1 results. Though Amazon as a whole reported its second straight quarterly loss of $2 billion, Wall Street was cheered by the increase in revenue, as well as bigger projected third quarter sales growth of 13% to 17%. As always with Amazon, there was lots of fascinating data reflecting not only performance across its many business lines, but also the scale at which the company operates. Here are a few more that particularly stood out.

- Total online store sales were down 4% year-over-year, to $50.9 billion. Under that headline number, third-party seller services rose 9% to $27.3 billion, showing the continuing importance of the marketplace at a time when it is increasing fees. For the quarter, third-party sellers represented 57% of all units sold on Amazon, which is the highest percentage ever.

- Advertising was up 18% year-over-year to $8.8 billion. Since Amazon first broke out its advertising revenue at the end of 2021, it continues to be a category that provides one of the biggest lifts to the company outside of AWS.

- 99,000. That’s how many employees Amazon let go after it acknowledged overbuilding warehouses in its fulfillment network during the pandemic boom, and declining productivity as a result of staffing amid the omicron surge. That’s a massive reduction in people terms, yet overall headcount is still up 188,000 year-over-year, CFO Brian Olsavsky said.

Walmart: 11%-13%

That’s how much Walmart said its profit would drop in the second quarter. While the company doesn’t report earnings until August, its Monday evening move to pre-emptively warn the market about dipping profits made waves this week, given what it highlighted about consumer behavior amid inflation.

Walmart said it was seeing customers spending more on food and fuel. As a result, there was less spending on general merchandise items, which are more profitable. It will be more heavily discounting that general merchandise, namely clothing, to move inventory. So, lower profits.

This comes at a time when Walmart was already offering markdowns on many items in the categories that were popular in the pandemic, but showed up after demand for them dipped as a result of supply chain issues.

Shopify: 47%

The real headline stat of the week from Shopify was 1,000, or 10%. That’s the number of people that were laid off by the software company as a result of what CEO Tobi Lütke said was a misplaced bet on pandemic growth continuing at early pandemic rates. Read more here.

During its earnings call on the day after the layoff announcement, Shopify reported that its gross merchandise value for offline commerce grew 47% year-over-year, helping revenue grow to $1.3 billion. This category includes the point-of-sale systems Shopify offers to power operations at merchants’ brick-and-mortar stores.

The growth in this area comes amid a return to more in-store shopping as pandemic restrictions lifted in 2022. Executives said the company added thousands of new merchants onto the POS in the quarter, and saw existing ecommerce customers add the hardware for brick-and-mortar, as well.

Executives said that building out the in-store system was another bet it made on building early in the pandemic. Now, it’s showing signs of paying off.

Overall, Shopify reported revenue growth of 16% year over year for the second quarter, reaching $1.3 billion. It also reported a net loss of $1.2 billion.

Etsy: 6 million

That’s how many new buyers the Etsy marketplace added in the second quarter across its marketplaces. It’s a “meaningfully elevated” rate of new customer acquisition when compared to pre-pandemic levels, indicating that the growth of the last two years isn't subsiding at all ecommerce platforms. Reported alongside second-quarter revenue growth of 10% year-over-year that beat Wall Street expectations, shares in the company surged following the earnings report, CNBC reported.

On Etsy's earnings call, CFO Rachel Glaser also provided a deeper look at movement in various categories of goods on the platform. From the Seeking Alpha transcript:

Reopening headwinds have specifically pressured the home and living and craft supply categories, which collectively represented over 40% of our second quarter GMS and were meaningful beneficiaries of stay at home related consumer purchasing trends during the pandemic. Trends remain positive in paper and party and apparel categories, as consumers continue to shift to in-person events and activities. Demand was also strong for travel related needs, including luggage tags, travel wallets, and fanny packs. Weddings and parties remained bright spots, especially wedding favors as larger in-person weddings resumed.

Overstock: $121 million

That’s how much profit the ecommerce home and furniture retailer reported in the second quarter. Even though Overstock’s revenue declined 34% year-over-year, this stands out because many other platforms are posting losses this year. The company completed its transition to a singular focus on home furnishings and furniture in June, and is now seeing home improvement items outpace other categories.

“While we cannot control the macro environment and the impact of high gas prices, increasing interest rates, record inflation and uncertainty surrounding geopolitical events has on a consumer’s sentiment and competitor's behavior, we can control and have controlled many elements of our business. In fact, our asset-light business model is highly advantageous during times like these. We don't have expensive logistics operations with a high fixed cost base or significant owned inventory on our balance sheet,” CEO Jonanthan Johnson told analysts.

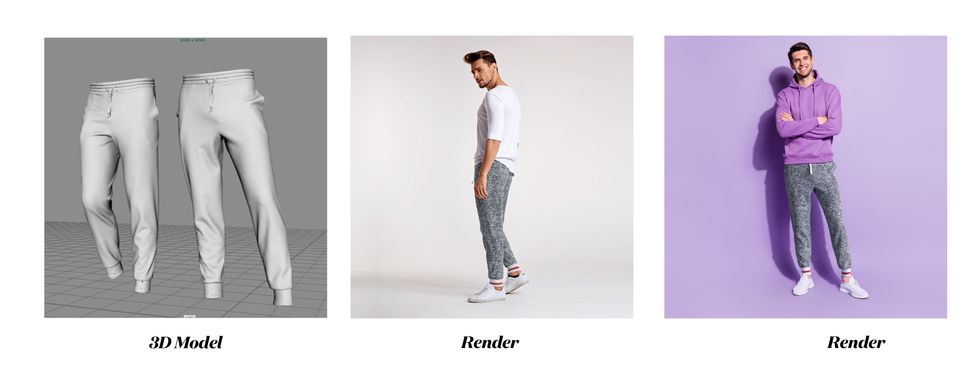

A Hexa 3D rendering (Courtesy photo)

A Hexa 3D rendering (Courtesy photo)