Photo by Artem Beliaikin on Unsplash

June 24 (Reuters) - U.S. consumer sentiment fell to a record low in June, but Americans saw a marginal improvement in the outlook for inflation, a survey showed on Friday, a rare silver lining for Federal Reserve policymakers as they assess how quickly they need to raise interest rates this year.

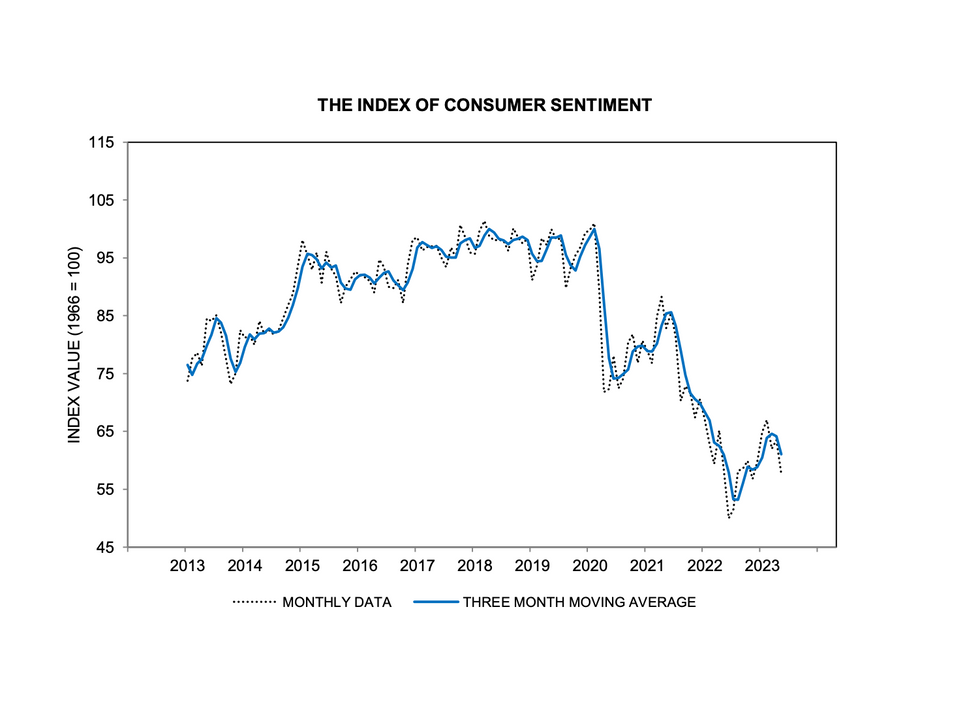

The University of Michigan said its final consumer sentiment index reading for the month fell to 50.0 from 55.2 in May on the persistence of high inflation and rising fears of an economic slowdown. That compared with a preliminary reading of 50.2 earlier in June.

The survey's one-year inflation expectation was unchanged from May at 5.3%, but ticked down from a preliminary June reading of 5.4%. The five-year inflation outlook edged up to 3.1% from 3.0% in May, but was down from 3.3% earlier in June.

A poor preliminary reading two weeks ago, along with other worrying inflation data on the same day, caused the U.S. central bank to pivot to delivering a bigger-than-expected rate hike of 75 basis points last week on worries that inflation expectations were beginning to become unmoored.

The Fed has since signaled it will raise its benchmark overnight interest rate by either 50 or 75 basis points at its next policy meeting in July in a bid to more decisively dent inflation, calling that battle "unconditional."

The moderation in inflation expectations - particularly at the 5-year horizon - triggered a drop in yields on the Treasury securities most sensitive to Fed policy expectations.

The yield on the 2-year note dropped by as much as 10 basis points in the moments after the University of Michigan data was released. It was last at 3.04% versus 3.02% late on Thursday but still down 5 basis points from the day's high.

Interest rate futures also reacted following the report, with contracts tied to the Fed's July policy meeting now reflecting a 83.4% probability of another 75-basis-point rate hike versus 93.3% on Thursday. The likelihood of the Fed scaling back that pace to 50 basis points at its mid-September meeting was further solidified by the data. (Reporting by Lindsay Dunsmuir and Dan Burns; Editing by Paul Simao)

The debt ceiling crisis is weighing on consumers, erasing gains made in recent months.

Consumer sentiment dipped to a six-month low to begin May, as worries about the economy renewed and the debt ceiling debate delivered another dose of uncertainty into the American public.

According to the University of Michigan, sentiment fell 9% in the first May reading. This metric had been climbing steadily since hitting a historic low last June. But the preliminary May reading erased half of the gains made in recent months.

There were precipitous falls across the survey. Year-ahead expectations fell 23%, while long-run expectations were down 16%.

Consumers are seeing more negative news about the economy, and the federal debt ceiling standoff between Republicans in Congress and US President Joe Biden is particular cause for alarm.

“Throughout the current inflationary episode, consumers have shown resilience under strong labor markets, but their anticipation of a recession will lead them to pull back when signs of weakness emerge,” University of Michigan Survey of Consumers Joanne Hsu wrote. “If policymakers fail to resolve the debt ceiling crisis, these dismal views over the economy will exacerbate the dire economic consequences of default.”

There are also signs that consumers believe inflation will stay higher. Long-run inflation expectations hit their highest reading since 2011, rising to 3.2% from 3% in April. Meanwhile, year-ahead expectations dipped slightly to 4.5% after a 4.6% reading in April that UMich described as “spiking.”

This result comes after the latest Consumer Price Index data showed that inflation cooled only slightly in April to 5%. GlobalData Managing Director Neil Saunders wrote of a “frugal mindset” taking shape among consumers."

Nevertheless, there was one sign this week that there could be more relief on the way on inflation. The Producer Price Index, which measures wholesale inflation, rose 2.3% on an annual basis. That's a further cooling from 2.7% in March. The PPI is seen as a forward-looking indicator of inflation.