Economy

03 August 2022

A look at how 2022 back-to-school season is shaping up

With inflation pushing prices up, ecommerce emerges as a source for deals.

(Illustration by The Current)

With inflation pushing prices up, ecommerce emerges as a source for deals.

(Illustration by The Current)

Welcome to Data File. In this weekly feature, The Current shares key findings shaping the ecommerce landscape. At The Current, we comb industry, analyst and economic sources for the data that matters to ecommerce professionals, and include it throughout our work. This feature is one of the ways we’re sharing what we find.

When it comes to shopping, there are no signs of a summer lull.

Back-to-school season is one of the busiest for retailers, as families gear up for the year ahead by purchasing new school supplies and refreshing wardrobes for fall.

“The back-to-school season is among the most significant shopping events for consumers and retailers alike, second only to the winter holiday season,” said National Retail Federation CEO Matthew Shay.

While deals are always in focus, this year’s event arrives amid a pair of economic swings that are pushing prices in opposite directions: 40-year-high inflation that’s raising prices and the summer of sales resulting from a glut of inventory due to supply chain issues and seasonal mismatch that’s leading many retailers to discount heavily.

Into this complicated environment steps shoppers. Nevertheless, they are figuring it out and expected to continue to spend at record levels. Here’s a look at trends that are being spotted as the season gets going:

With its midsummer placement and discount-driven nature, Amazon Prime Day and the deal events retailers hold around it have been serving as the start to back-to-school season in recent years.

However, 2022 did not bring a roaring start on par with other years, at least when it came to back-to-school-specific categories, according to NPD Group.

The market research group noted that unit sales for the Prime Day week that ended July 16 were down 1% from the same week last year, which was not the week of a promotional event. When compared to 2019, which was in line with a promotional event, sales revenue rose 17%, while unit sales declined 5%.

During Prime Day, there was more demand for small appliances, beauty, and technology than typical back-to-school categories. Household essentials also proved popular at a time of rising costs for groceries.

“Consumers are clearly getting energized by promotions as they continue to spend, but elevated prices and the lack of promotional depth are hindering already low demand,” said Marshal Cohen, chief retail industry advisor for NPD, in a statement. “The typical back-to-school kickoff provided by Prime Days and other July retail promotions did not hit all industries equally, indicating this will be another flattened retail shopping period, similar to what we’ve seen with holiday peaks year-to-date.”

An analysis released by NPD on July 27 indicated that consumers were just starting to spend on back-to-school items by the third week of July, as only 26% of consumers told the group that they had already started on back-to-school spending.

Of those who had not started, 41% said they were waiting for sales, while 56% don’t plan to start back-to-school shopping until August.

In other words, the rush may be coming as the first day of school gets closer.

“The growing influence of promotional activity alongside the consumer’s ‘here and now’ shopping mindset will fragment sales results across industries and an extended back-to-school shopping season,” Cohen said. “Retailers and manufacturers need to monitor consumer activity across both short and long-term views to get a clear picture of how they are approaching spending.”

While back-to-school is often a time where consumers expect discounts, the higher prices that are resulting from inflation are expected to play a big role in motivating deal-seeking behavior this year. According to a survey of nearly 2,400 consumers by market research firm Numerator, 89% of consumers expect inflation to affect back-to-school shopping.

This will mean they are looking for ways to save, as 98% said they plan to cut spending. With prices still high for gas, this could be achieved by doing less buying in some categories. About 35% of consumers said they planned to cut back spending on shoes and clothes, while 26% expected to pull back on backpacks and 24% will power down in electronics. Meaningful numbers of shoppers are also planning to buy fewer craft supplies and art supplies like crayons, markers and colored pencils.

When shoppers do buy, they will also be seeking deals. About 75% of consumers plan to buy items on sale, 52% of respondents plan to look for online deals and 50% plan to reuse old supplies. Families will also be using more coupons, switching to cheaper brands and buying fewer items.

Back-to-school is typically a time when the largest retailers see the most lift, and that’s expected to collide with a return to in-person shopping this year. According to Numerator, nearly nine in 10 consumers plan to shop at mass retailers, while 36% plan to shop at online-only retailers. Club stores, drug stores and specialty retailers will also see traffic.

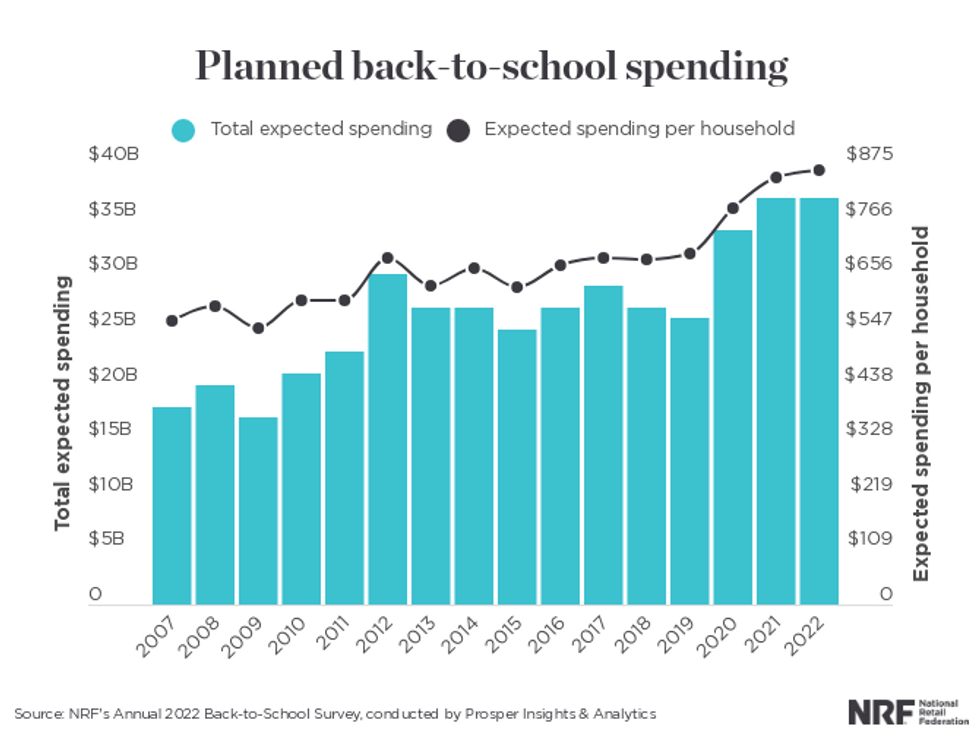

(Source: National Retail Federation)

As they seek to manage inflation and find deals, shoppers will turn to ecommerce, a trend report released ahead of back-to-school season by influencer marketing platform LTK found.

Like Numerator, LTK’s survey of about 2,100 consumers found that turning online for discounts was the second most popular choice for saving money, with a majority planning to shop from their phone.

The most popular items identified by consumers this year are shoes, backpacks and staples like pencils and notebooks, indicating a move toward the basics. It’s worth noting that Gen Z has different priorities: electronics, personal care and beauty products, clothing and food rose higher in this age cohort than in the rest of the population. Gen Zers are between the ages of 9 and 24.

To attract shoppers in the Gen Z and millennial groups, LTK head of marketing and brand partnerships Rodney Mason advised brands and retailers to put an emphasis on mobile tools and promotions, as well as hybrid approaches such as buy online pickup in store.

Working with creators is another way to reach shoppers. Partnerships with these social media stars can help to promote in-store sales or influence tastes. When it comes to who consumers turn to for recommendations, creators ranked just behind friends and family, LTK found. Among Gen Z respondents, trust was higher in creators than friends and family.

In all, tapping creators is an approach that fits with the season. Deals are a strong topic for this form of marketing, as 61% of LTK posts focus on sales or discount alerts.

So how will it all add up? That’s the question as we head into the busiest weeks of the season, but projections are already being made.

As back-to-school season was getting underway, the National Retail Federation and Prosper Insights & Analytics said that their survey of about 2,000 consumers showed families were expecting to spend more on items for K-12 education and college this year due to higher prices.

However, they indicated they were expecting to continue spending. Families with children in K-12 plan to spend an average of $864 on school items, which would be about $15 more per household than last year. That would be a total of $168 more on average than the pre-pandemic year of 2019, which was prior to the shift to more virtual and hybrid learning.

“Families consider back-to-school and college items as an essential category, and they are taking whatever steps they can, including cutting back on discretionary spending, shopping sales and buying store- or off-brand items, in order to purchase what they need for the upcoming school year,” NRF CEO Matthew Shay said.

In all, back-to-school spending on K-12 is expected to total $37 billion, which would match the record high of 2021. Back-to-college spending is expected to reach nearly $74 billion, which would top the record of $71 billion set in 2021.

Labor disputes on the West Coast could cause further disruption heading into peak season.

When the first half of 2023 is complete, imports are expected to dip 22% below last year.

That’s according to new data from the Global Port Tracker, which is compiled monthly by the National Retail Federation and Hackett Associates.

The decline has been building over the entire year, as imports dipped in the winter. With the spring, volume started to rebound. In April, the major ports handled 1.78 million Twenty-Foot Equivalent Units. That was an increase of 9.6% from March. Still it was a decline of 21.3% year over year – reflecting the record cargo hauled in over the spike in consumer demand of 2021 and the inventory glut 2022.

In 2023, consumer spending is remaining resilient with in a strong job market, despite the collision of inflation and interest rates. The economy remains different from pre-pandemic days, but shipping volumes are beginning to once again resemble the time before COVID-19.

“Economists and shipping lines increasingly wonder why the decline in container import demand is so much at odds with continuous growth in consumer demand,” said Hackett Associates Founder Ben Hackett, in a statement. “Import container shipments have returned the pre-pandemic levels seen in 2019 and appear likely to stay there for a while.”

Retailers and logistics professionals alike are looking to the second half of the year for a potential upswing. Peak shipping season occurs in the summer, which is in preparation for peak shopping season over the holidays.

Yet disruption could occur on the West Coast if labor issues can’t be settled. This week, ports from Los Angeles to Seattle reported closures and slowdowns as ongoing union disputes boil over, CNBC reported. NRF called on the Biden administration to intervene.

“Cargo volume is lower than last year but retailers are entering the busiest shipping season of the year bringing in holiday merchandise. The last thing retailers and other shippers need is ongoing disruption at the ports,” aid NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “If labor and management can’t reach agreement and operate smoothly and efficiently, retailers will have no choice but to continue to take their cargo to East Coast and Gulf Coast gateways. We continue to urge the administration to step in and help the parties reach an agreement and end the disruptions so operations can return to normal. We’ve had enough unavoidable supply chain issues the past two years. This is not the time for one that can be avoided.”