Amazon is making improvements to a tool that helps third-party sellers stay aware of whether they are up to date on complying with account policies that the company sets out.

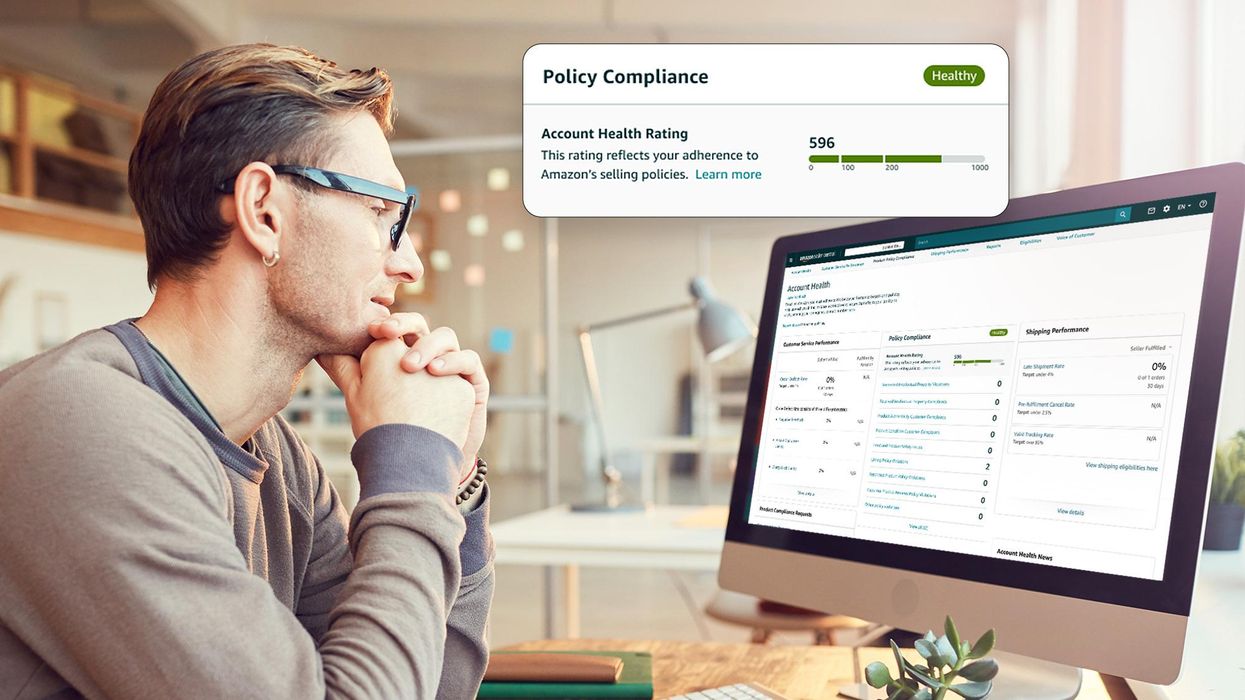

For the two million sellers on its marketplace, Amazon will now provide a metric that’s designed to provide an overall picture of where sellers stand, as opposed to only providing a list of violations. Known as the Account Health Rating, it will appear as a score of 1-1000.

Along with simplifying the presentation for sellers, it will also be an enforcement mechanism. Amazon said this number will be the “determining factor for account suspension based on accumulated policy violations.”

The rating will additionally detail whether the account is “Healthy,” “At-Risk,” or “Unhealthy.”

Alongside the number, sellers will be able to see the severity of any violations they’ve incurred, and prioritize the most important issues for correction. Amazon said it is also adding support team resources to respond to queries over the phone, or via email.

Some of Amazon's seller policies include requirements to provide accurate information, and prohibitions on things like influencing reviews or ratings and maintaining more than one account without a legitimate business need.

“We’re excited to help sellers better understand exactly where their account health stands, prioritize potential issues, and ensure that their account status remains healthy so they can focus on selling amazing products and growing their businesses,” wrote Dharmesh Mehta, Amazon VP of worldwide selling partner services, in an announcement. “This is one of many new offerings we are rolling out to improve sellers’ overall experience.”

Amazon plans to roll out the Account Health Rating in the US and Canada beginning in August, with additional countries gaining access in 2023.

Money management

In all, Amazon said it provides more than 150 tools and services to third-party sellers.

The company is also in the early stages of rolling out Amazon Seller Wallet, a tool for converting funds from Amazon to their bank account.

"This early stage solution gives sellers an easy, hassle-free way to hold, view, and transfer Amazon store proceeds directly to their bank account on their schedule—all within Seller Central," which is Amazon's hub for managing accounts, Max Bardon, VP of Amazon Worldwide Payments, wrote.

Now available to a select group of sellers, Amazon said it is planning to collect feedback, make improvements and expand the scope of the tool to other uses, such as third-party payments and foreign exchange rate tools.

It has been a time of flux for third-party sellers lately. Amazon has been

increasing various fees for

Fulfillment by Amazon, the logistics service used by many sellers. Most notably, it added a first-of-its-kind

fuel surcharge to account for inflation in April. The same month, it introduced

Buy with Prime, a service that will allow sellers to embed Prime checkout and the delivery guarantees that come with it on websites beyond Amazon.com. On the

recently-completed Prime Day, Amazon said the growth of third-party seller sales outpaced Amazon’s, adding that customers spent over $3 billion on more than 100 million items from small businesses included in a program called the Support Small Businesses to Win Big sweepstakes.. Nevertheless, sellers have said they face the

same challenges with supply chain snarls and overstocked inventory as Amazon and other retailers.

A Hexa 3D rendering (Courtesy photo)

A Hexa 3D rendering (Courtesy photo)