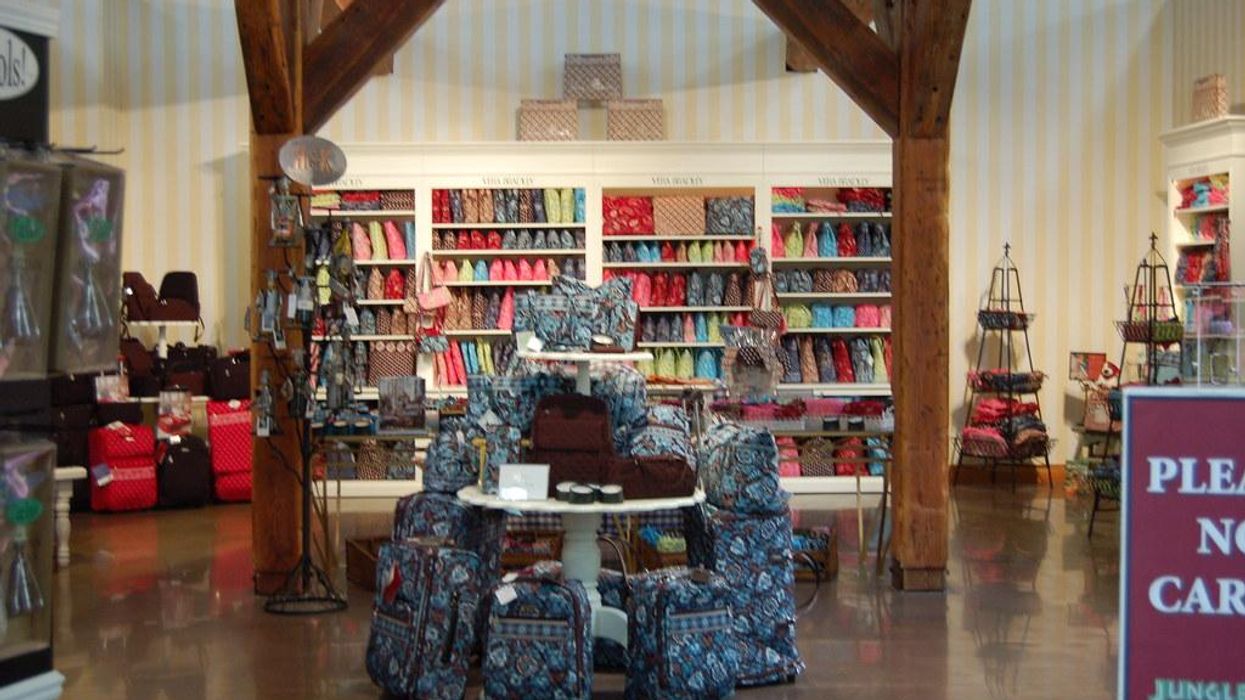

Vera Bradley, LLC began in 1982 founded by Barbara Bradley Baekgaard and Patricia R. Miller, naming their company after Barbara’s mother. The brand’s recognizable patterns are inspired by French Provencal fabrics, with VB originally starting out selling these designs on wallpaper. The two founders eventually pivoted to travel bags after noticing that women were carrying the same bland-colored travel luggage designed for more masculine tastes.

Their goal was to offer women something brighter and more interesting than common brown, black, and gray bags that were available in the early 1980s. The business originally began with $500 and over the years brand awareness grew among women via college sororities and more recently digital radio channels. VB expanded its product lines over the years, solidifying itself as a brand of choice for forward-thinking women that are drawn to the brilliant colors in VB’s design patterns.

Vera Bradley operates 70 full line and 75 factory outlet stores (as of January 2022) and operates eCommerce in the US and Canada. One-third of total revenue is generated from ecommerce, with a digital advertising-based marketing strategy centered around Facebook (2M followers), Instagram (600k followers), and Tiktok (33k followers). Third-party ecommerce also is a developing channel as Chewy.com is now carrying their line of pet products.

In recent years the company has added a craft jewelry brand in an effort to broaden its product offering. In 2019 the company purchased a controlling 75% stake in Pura Vida Bracelets for $75 million. At the time of purchase, Pura Vida was fully an ecommerce D2C business. A sole brick and mortar store in San Diego opened in August 2021 and three additional stores are now in the works. The combined business of these two brands performed well during the COVID pandemic, seeing their best year for sales in the fiscal year ended January 2022 (+15% YoY).

(Source: Vera Bradley)

In its most recent earnings report, the company saw sales of $98.5 million (-9.8% YoY). The mix of this revenue was $61.6 million (-7.6% YoY) from Vera Bradley Direct, $17 million (+11.2% YoY) from Vera Bradley indirect, and $19.8 million for Pura Vida (-26.8% YoY). Vera’s CEO Robert Wallstrom characterized this performance as “below our expectation and resulted in a net loss.” Management attributed this outcome to a “clear bifurcation of spending of our customer base,” specifically pointing out the decline in activity from households below an income of $55,000. Their product mix appears to be normalizing back toward pre-pandemic normals, as their core travel segments return to strong growth.

( Source: VRA Investor Relations)

The company’s current initiatives are geared toward responding to the recent softness in sales, this includes cost management, price increases, and continued expansion of the Pura Vida store count. The company also touted their Tupperware and Star Wars partnerships, where they hope to follow on the success of the Harry Potter partnership that features annual new product lines. The company does appear well poised to take advantage of an increase in sales of luggage and travel-related products that big box retailers have pointed out in their recent commentary.

A Vera Bradley bag. (Courtesy photo)

Looking into how these challenges are impacting performance, management shared commentary on their most recent earnings call. On pricing, they’ve increased the retail price for Pura Vida's full catalog and remarked that this “has been taken well.” Most items in the Pura Vida catalog are under $50, so they’re increasing price in many instances on a $10 bracelet. The Vera Bradley brand, with higher price points, has “limited ability to pull the pricing lever,” especially in relation to lower-income consumers. Promotional pricing is not currently needed to maintain purchasing behavior of their higher-income customers.

On supply chain disruption, neither of their brands are back to pre-pandemic on delivery times and they’re also experiencing extended inbound freight lead times. They are working to reduce the lead times and achieve an “optimal” balance that takes their recent softness into account. The team framed this optimistically, saying “we are in a better inventory position than last year” yet adding that they will reduce future inventory purchases.

Their marketing strategy is also pivoting. The previous strategy was based on social media-centered acquisitions, but this has been negatively affected by iOS targeting challenges and rising costs. Going forward they are moving toward first-party marketing via their physical stores and pivoting the social strategy toward influencers. The CEO remarked that he believes lower AOV DTC companies should move toward using influencers rather than paid performance marketing spend (presumably due to high CAC and iOS privacy).

(Source: VRA Investor Relations)

(Source: VRA Investor Relations)

Vera Bradley’s company-wide performance is mixed, they have seen some slight gross margin improvement QoQ, but continued declines in total operating margin as pricing increases are offset by higher marketing costs and investments in Pura Vida physical stores. The macro-environment has clearly been a headwind, as modest and mid-income earners have primarily pulled back on fashion apparel and other discretionary purchases in recent months.

VB’s initiatives seem to be similar to several others in the Bainbridge Index: vigilance on inventory growth, pull back on performance marketing, and lean into omnichannel strategy. As we get through the second half we will watch closely to see how this plays out, as ramping up the omnichannel approach appears to drive operating and gross margin rates in opposite directions.