Brand News

08 September 2022

Unilever makes ice cream delivery available nationwide on Instacart

The Ice Cream Shop is expanding from select cities to the entire US.

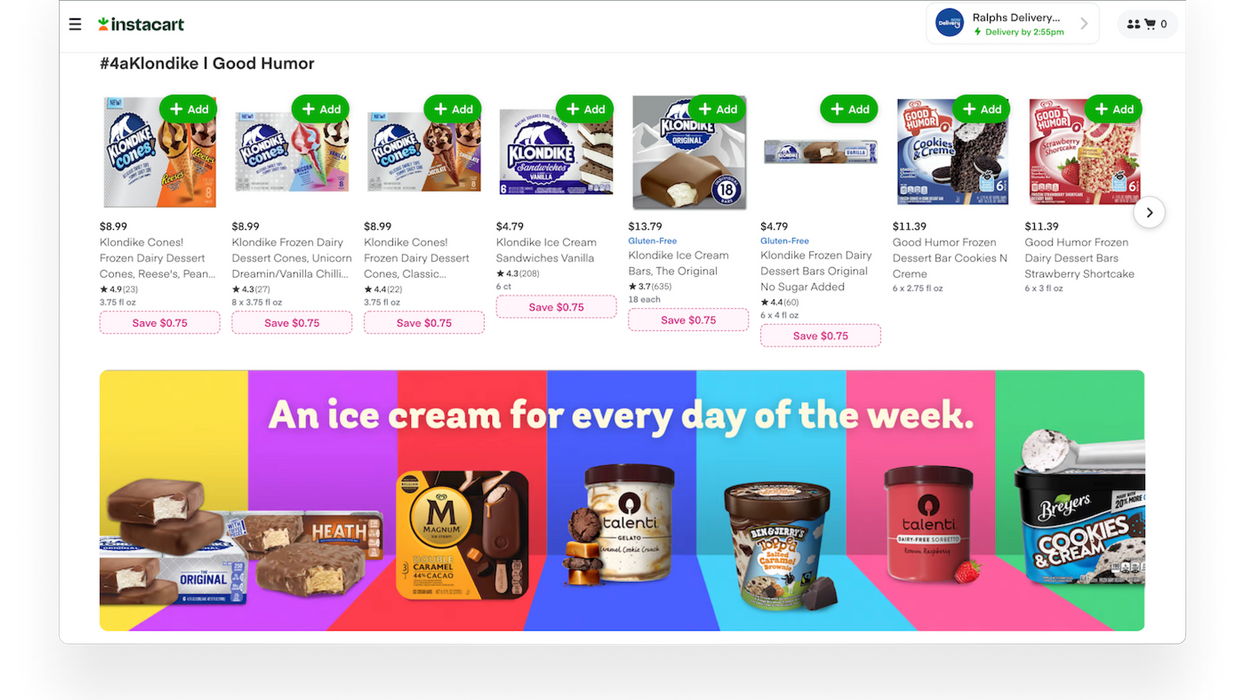

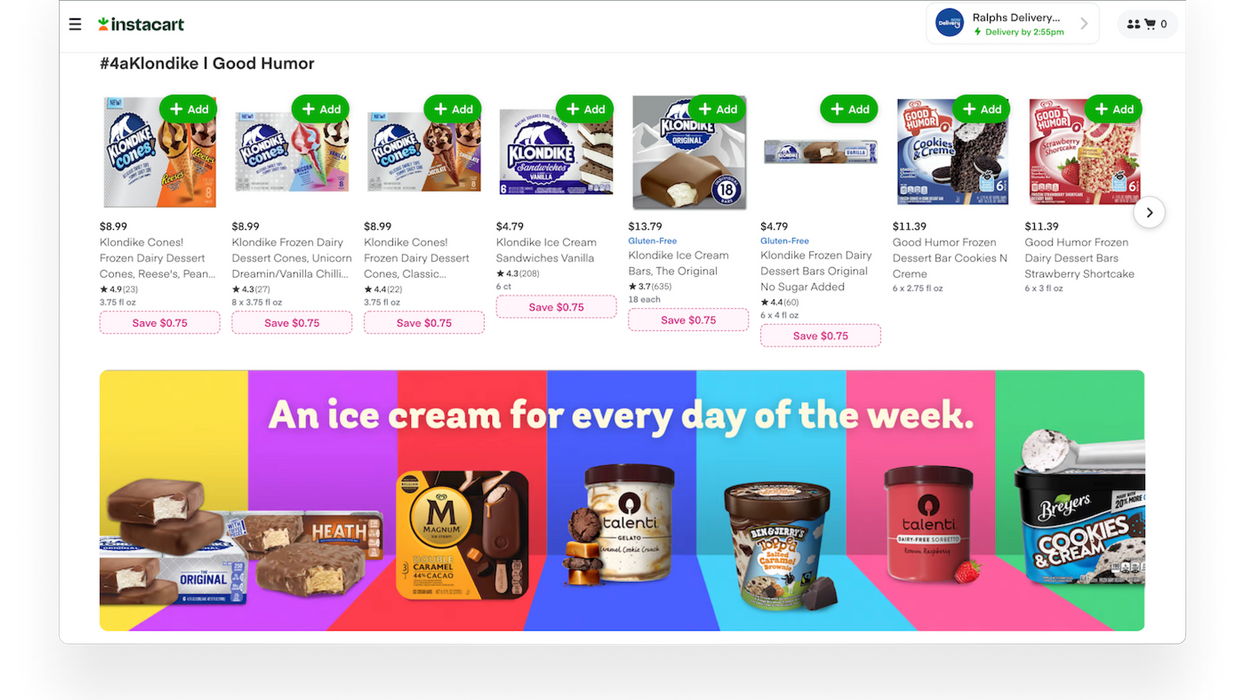

The Ice Cream Shop on Instacart. (Courtesy photo)

The Ice Cream Shop is expanding from select cities to the entire US.

The Ice Cream Shop on Instacart. (Courtesy photo)

It’s rare that the end of summer brings news about ice cream availability getting wider, but that’s the case in a partnership announced on Thursday.

Unilever is expanding an on-demand ice cream delivery service nationwide through a new partnership with grocery tech company Instacart.

With a wide variety of brands in its freezer, Unilever says it is the world’s largest ice cream company. To offer delivery, it launched The Ice Cream Shop, an app-based delivery service available in major metro areas that has grown via partnership.

“We’re thrilled that our new partnership with Instacart expands The Ice Cream Shop’s virtual storefront to a nationwide scale,” said Daan Westdijk, heads of sales and category strategy for North American ice cream at Unilever. “Since 2018, The Ice Cream Shop has offered convenient delivery to ice cream fans in major cities including New York, Chicago, Los Angeles, and now thanks to our expanded partnership with Instacart, we can build upon our vision of delivering smiles to even more doorsteps across the US.”

The Ice Cream Shop will be accessible through Instacart’s grocery delivery platform. Shoppers can browse flavors from brands such as Ben & Jerry’s, Breyers, Good Humor, Klondike, Magnum ice cream, Popsicle and Talenti. The flavors can also be sorted by categories, such as best sellers, chocolate & vanilla or chunks & swirls.

Now that it is available through Instacart, The Ice Cream Shop’s service area will extend throughout the United States, as ice cream is delivered to customers from nearby locations. Delivery, which will be executed through Instacart's team and logistics, is available in as little as 30 minutes, according to the companies.

The Ice Cream Shop on Instacart's app. (Courtesy of Unilever)

It’s the latest delivery innovation for The Ice Cream Shop, which aims to sweeten the experience for online grocery shoppers by bringing ice cream to a customer’s door without letting it melt, and make the road to delivery of frozen goods less rocky in the process.

Earlier this summer, The Ice Cream Shop launched a pilot in Los Angeles to deliver ice cream through the mobile convenience store service Robomart that deployed mobile convenience trucks carrying ice cream to customer doorsteps. In a digital update to the typical ice cream truck experience, shoppers were able to swipe to open the truck and pick out their ice cream.

The ice cream was flown to customers in a separate pilot. In North Carolina and Texas, Unilever teamed with the drone delivery service Flytrex to ferry pints to customers’ backyards in under three minutes.

Delivery via Robomart and drone will not be available to customers that order through Instacart. However, a spokesperson said The Ice Cream Shop team remains excited about those delivery options and continues to look for new, innovative ways to shorten delivery time and increase availability of the ice cream it offers.

Perhaps the most pertinent recent development to this partnership was a new feature that launched on the Instacart platform in recent weeks. With the introduction of Carts, the company said it was rolling out a push to transform the platform into an experience that is fueled by inspirational shopping. Carts allow users to shop from the grocery orders of celebrities, or pick orders based on specific themes. It's one of a number of branded and shoppable experiences rolling out with partners throughout the marketplace.

This points at how Instacart is seeking to build around shoppable experiences. A feature like Carts is based around meeting customers' wants rather than needs, so it benefits from being able to deliver everyone’s favorites. It’s easy to see ice cream – and The Ice Cream Shop – mixing right into this approach. In fact, we spotted a Ben & Jerry's pint in Lizzo's Cart at launch:

(Photo courtesy of Instacart)

Campbell Soup Company CEO Mark Clouse offered thoughts on messaging amid inflationary shifts in consumer behavior.

After months of elevated inflation and interest rate hikes that have the potential to cool demand, consumers are showing more signs of shifting behavior.

It’s showing up in retail sales data, but there’s also evidence in the observations of the brands responsible for grocery store staples.

The latest example came this week from Campbell Soup Company. CEO Mark Clouse told analysts that the consumer continues to be “resilient” despite continued price increases on food, but found that “consumers are beginning to feel that pressure” as time goes on.

This shows up in the categories they are buying. Overall, Clouse said Campbell sees a shift toward shelf-stable items, and away from more expensive prepared foods.

There is also change in when they make purchases. People are buying more at the beginning of the month. That’s because they are stretching paychecks as long as possible.

These shifts change how the company is communicating with consumers.

Clouse said the changes in behavior are an opportunity to “focus on value within our messaging without necessarily having to chase pricing all the way down.”

“No question that it's important that we protect affordability and that we make that relevant in the categories that we're in," Clouse said. "But I also think there's a lot of ways to frame value in different ways, right?”

A meal cooked with condensed soup may be cheaper than picking up a frozen item or ordering out. Consumers just need a reminder. Even within Campbell’s own portfolio, the company can elevate brands that have more value now, even if they may not always get the limelight.

The open question is whether the shift in behavior will begin to show up in the results of the companies that have raised prices. Campbell’s overall net sales grew 5% for the quarter ended April 30, while gross profit margins held steady around 30%. But the category-level results were more uneven. U.S. soup sales declined 11%, though the company said that was owed to comparisons with the quarter when supply chains reopened a year ago and expressed confidence that the category is seeing a longer-term resurgence as more people cook at home following the pandemic. Snacks, which includes Goldfish and Pepperidge Farm, were up 12% And while net sales increased overall, the amount of products people are buying is declining. Volumes were down 7%.

These are trends happening across the grocery store. Campbell is continuing to compete. It is leading with iconic brands, and a host of different ways to consume them. It is following that up with innovation that makes the products stand out. Then, it is driving home messaging that shows consumers how to fit the products into their lives, and even their tightening spending plans.

Campbell Soup is more than 150 years old, and has seen plenty of difficult economic environments. It is also a different business today, and will continue to evolve. At the end of the day, continued execution is what’s required.

“If it's good food, people are going to buy it, especially if it's a great value,” Clouse said.