Operations

19 October 2022

Ecommerce changed over a decade, but the importance of data remains

Tadpull's cofounders discuss the journey to helping brands access and understand their data.

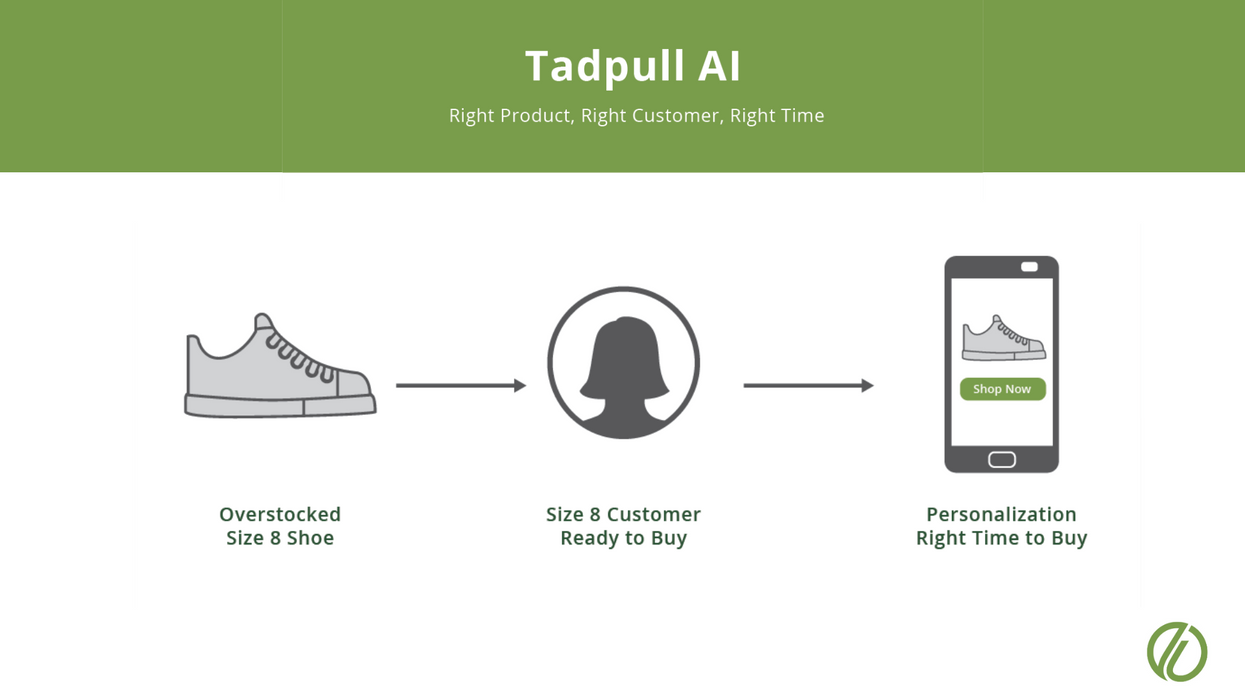

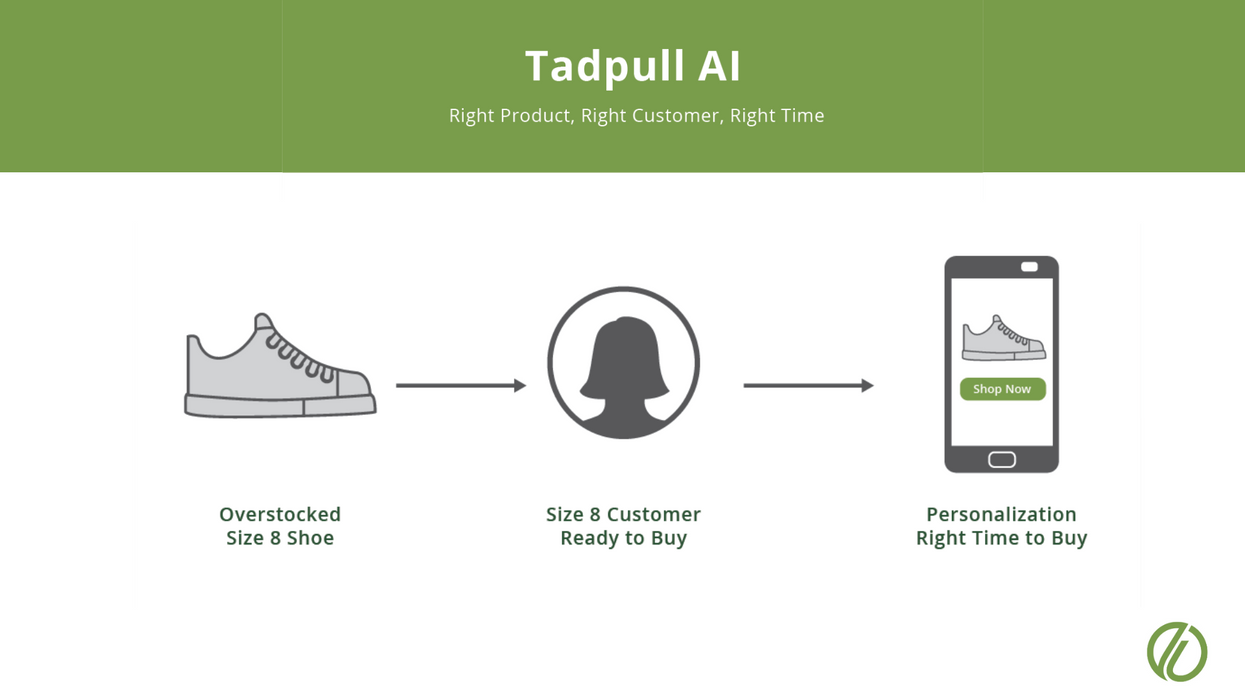

How the Tadpull AI works. (Courtesy photo)

Tadpull's cofounders discuss the journey to helping brands access and understand their data.

How the Tadpull AI works. (Courtesy photo)

About a decade ago, Jake and Eulalie Cook started the ecommerce software and services firm Tadpull out of their basement. They were helping clients make sense of their data at a time when it felt like the “Wild West,” as Eulalie put it.

Ten years isn’t that much time in the history of the world, but it’s a long time in the history of the internet.

Around 2012, user experience was still a relatively new concept. But they saw how orienting design around users could have a huge impact in ecommerce: If a website or app was easy to use, it was more likely that they would complete a sale. This led to a whole new area of qualitative data, which was gleaned from interviews and observations in how people used a website. It was widely available, and accessible enough that it could easily be put to use, Eulalie said.

At the same time, they were finding ways to bring quantitative data into the equation. This inventory and margin data often gets overlooked, and exists in many different places. But when connected to campaigns, it could be harnessed to optimize a brand’s website, or improve performance.

Jake had been an adjunct marketing professor at the University of Montana College of Business since 2007, and noticed a change taking place.

“All of my marketing students were studying marketing, they didn't want to go into finance or accounting. Then they ran smack dab into having to use quantitative data,” he said.

2012 was the same year that Facebook held its initial public offering. There were questions floating around at the time about whether the business would work or not. But soon, they saw how the targeting capabilities propelled a new generation of businesses to become efficient acquisition machines.

Fast forward a decade, and that’s changed. Customer acquisition costs have gone up. Privacy-oriented changes like Apple’s App Tracking Transparency has made attribution, which powers performance, more difficult.

“The tide’s gone out,” Jake said. “It’s getting harder.”

At the same time, Amazon’s third-party marketplace became its own engine. A brand may seek to sell there. But that comes with its own series of tradeoffs, Eulalie said.

“There are so many eyeballs on Amazon, you can't ignore it. Also, if you're an existing brand, and people are searching for your stuff on Amazon, being present there is important. So I think a lot of brands really need to be thoughtful about how they approach the Amazon question,” she said.

It’s a place to land transactions, but it requires conforming to Amazon’s policies. Shipping times must be met and stock levels must be intact. Over the long haul, it could challenge margins. Rates get added, and the issue of private-label knockoffs has emerged. There’s also the relationship with the customer to consider.

“I think you can generate a lot of cash” on Amazon, Jake said. “But the fact is, there's a silent exchange of value, which is the customer data. You have no idea who your customers are, where they came from, what they're going to buy next.”

Consumers also started to become more skeptical about advertising in this realm, as well. People searched for an item, then saw it popping up in ads all the time. They had questions about how this was happening.

“The research shows that consumers are open to giving you data, if they understand how you're going to use it, and if you use it ethically,” Jake said.

As they worked with small and medium-sized brands who were having challenges with Amazon and wanted to have all of their data in one place, Jake and Eulalie set out to build a new way to serve them. They wanted to arm the Luke Skywalkers of the ecommerce world in the fight against the Death Star – with data.

The goal was to make data easy to access, actionable and they wanted to introduce automation for many processes, too. The result is Pond, a proprietary software platform that Tadpull applies alongside services to help ecommerce businesses grow.

The company “identifies the right product for the right customer, and then does that at the right time,” Jake said. When a customer has bought an item, it seeks to help brands sell others. It considers key questions: Is that next product a good margin? Is the customer likely to buy this product? Is it in stock?

This requires upfront work to prepare, and that's where the services side comes in. Tadpull considers strategy, such as what goals a team wants to achieve (growth or profitability) and whether the team has the culture in place to execute the sprints that it uses to get there.

Jake likens the process of preparing a brand’s data to taking a sink full of dirty dishes, then cleaning and simplifying it by putting them in the dishwasher and organizing them. Tadpull’s work begins in earnest when it comes to setting the table. You have to know where the forks and spoons go, and over a decade, they’ve devised a predictable playbook on the order of operations. Then they’re ready for the sprint to put it into action.

Once the sprints are underway, the software guides them. It can detect anomalies, and help ecommerce managers orient around key metrics like revenue, conversion rate or website traffic.

Simplifying the data helps surface what matters for managers that have a lot on their plate, and find insights in places they may not typically look. After all, they have more systems to manage and partners to work with today. This is all producing more data, as well.

Jake and Eulalie have put all they’ve learned from witnessing the evolution of ecommerce firsthand as cofounders and developing coursework for college students into how they serve brands. As Jake puts it, Tadpull wants to make it so that “your job is to push the button at the end of the day. And then when you're not sure he should push the button, we've got a services team on the other side that you can have a weekly call with that'll help you understand which buttons to push if you're not quite sure.”

When it comes to size, the playbooks and frameworks tend to work best for businesses operating at scale. This is the time in a business’ lifecycle when a small change can bring big changes, and there’s a lot of data coming in.

“Based on the maturity, the company and their product selection, there's a lot you can do if you're able to gather that data and make sense of it, and help them really harness it,” Lee said. “Because if they have enough customers coming through, then if you know what they previously purchased, you have a lot of transaction data that you can analyze and surface insights to really help serve new customers better.”

The company tends to work with direct to consumer businesses and omnichannel retailers who have both in-person and digital operations. Jake also sees more potential to work with B2B businesses that are still in the process of going digital. As millennials take over generational trades like HVAC or plumbing, chances are that they’ll want to order online. But the processes aren’t in place. As was the case a decade ago, the conditions are lining up for new opportunities to emerge.

"Fashion ecommerce is one of the most cumbersome customer experiences that exists," said Rent the Runway CEO Jennifer Hyman.

Photo by Daniel G. Wells III, used under a Creative Commons license.

The rise of generative AI is bringing with it a groundswell of interest and concern about how the capability to automatically synthesize information and create something new will change how we work.

Given that AI will sit within the architecture of our digital lives, it’s also worth considering how the technology will introduce new tools for other aspects of life, as well.

For two ecommerce innovators in the apparel space, it’s a time to explore how it will transform shopping. Rent the Runway is set to roll out new AI-powered search capabilities, while Stitch Fix is drawing on a long history with data science and machine learning to personalize the inventory buying process.

Here’s a look at the initiatives underway at each company, and their visions for the future:

Rent the Runway is putting a focus on the customer experience this year as it seeks to retain more subscribers and continue a yearslong push toward profitability.

This is resulting in the introduction of a variety of new initiatives, from the addition of an extra item to all orders to speeding up page load times. Yet as CEO Jennifer Hyman zooms out, she sees change being necessary on an industry-wide level in fashion. Beyond adding new features, AI can play a transformational role.

“I think that fashion ecommerce is one of the most cumbersome customer experiences that exists. You are searching through pages and pages and pages of content to find the items that you like and no one likes doing this,” Hyman told analysts on the company’s earnings call this week. “As an industry that still is selling physical products, AI is going to be -- fashion is going to be a major beneficiary as an industry.”

As a rental service, Rent the Runway has a distinct niche in fashion that lends itself to AI’s advantages, Hyman said. As opposed to a retailer that a consumer may visit a couple of times a year, RTR is used frequently by customers. So Hyman said there are opportunities to turn Rent the Runway into a “utility” by creating a more seamless experience.

This frequent use also provides a “highly unique” dataset, Hyman said. They know what a customer is planning to do based on what they rented. They know whether she liked or disliked an item, and many customers are reviewing 10 items per month. They know her size and how an item fits. This can be put to work in tools that allow customers to ask questions, and find answers.

The first application that combines AI and these advantages will appear in the coming weeks, when Rent the Runway plans to launch a beta of AI-driven search. The tool will allow customers to search for common terms or use cases for an item. So a person will be able to write “Miami vibe,” “‘clambake in Nantucket,” or “tropical motifs,” and receive results about what to wear for such an occasion.

The goal is to help customers sift through the endless aisle, and instantly finds what's right for them.

“I think that across all fashion sites, all over the world, the way that people are searching for product is fairly vanilla, it's fairly functional, right?" Hyman said. "You can go to a site and search for a T-shirt, you can go to a site and search for a black-tie gown. The fact that we're going to be able to enable our customers to search how they actually want to use this closet in the cloud, to search for items to wear to my beach bonfire this weekend, that is a completely different way to search, and I think that it really brings out the value proposition of what a closet in the cloud is all about."

Hyman sees this as a first step in the company using AI models to improve the product experience, and expects more tools to appear in the coming months. RTR is also introducing an SMS concierge experience for onboarding that allows customers to text with a member of the customer service team. The company is already exploring ways that AI can be incorporated into that tool, as well.

In the longer term, Hyman said the company has a vision that will leverage AI to allow customers to communicate with Rent the Runway asynchronously across different modalities, and have a stylist that is constantly available to recommend items, pick out new inventory and answer questions.

“If we are utilizing AI appropriately over the next few years, I see no reason why someone even has to come to our website,” Hyman said.

Stitch Fix has long married AI with human curation to provide outfits on a subscription basis.

“For years, we have utilized capabilities in generative AI, injecting scores and language into our personalization engines and, more recently, automatically generated product descriptions,” CEO Katrina Lake told analysts. “We have also developed and implemented more advanced proprietary tools such as outfit generation and personalized style recommendations that create a unique and exciting experience we believe is unmatched in the market.”

A new area where the company is applying AI is inventory buying.

“We have historically utilized a number of tools to make data-informed decisions with our inventory purchases,” Lake said. “Now, directly leveraging our personalization algorithms, we have developed a new tool that creates an exciting paradigm shift, which will utilize math scores at the client level to drive company-level buying actions. We expect the clarity of demand signals at the individual client level to drive more proactive and efficient inventory decisions as a company. And because of this, we expect to see higher success rates on fixes and drive increases in keep rates and [average order value] over time.”

Early results are promising. When compared with existing buying tools, testing showed a 10% lift in keep rate and AOV. By the end of this quarter, Stitch Fix expects 20% of all purchase orders to be algorithmically informed.

With experience using AI and a team in place to build, Stitch Fix is investing in the technology. Like Rent the Runway, it also has a unique dataset that offers an immediate advantage.

Here are Lake’s thoughts about how Stitch Fix’s AI strategy:

One of the things that I love about our experience is that we have generative AI that's really in more of a visual format. And so, the outfits that we have in our app, those are actually taking into account your preferences, what we know about you, and then in combination with what we know that you own in your closet. And to be able to kind of continue to push that technology and to be able to continue to give people more value in their experience with Stitch Fix, that's a really good example of, I think, a capability that is, firstly, really aligned with our capabilities around data and personalization and really unique to us.

And then I think it's also really compelling because I really think that pushes us as we think about what that addressable market is. I think if we can push outfits to be something that can be an asset to everybody, I think that is a universal thing that people would love to be able to have, is to have access to advice on a daily basis around what to wear and how to wear it.

While these are distinct companies, their plans lead us to a common conclusion: While the talk around generative AI might be new, many technology-forward companies already have assets sitting inside them that can be leveraged to build new tools. Uncover what’s already there, learn about the AI’s capabilities and develop a solution that's right for your organization. Then, talk to customers to determine how to improve it. It might mean commerce looks different, but that’s okay. The point is to create a better experience.