Operations

23 May 2022

Surefront puts product data and collaboration tools in one place

The platform helps brands, retailers and manufacturers take an item from ideation to store.

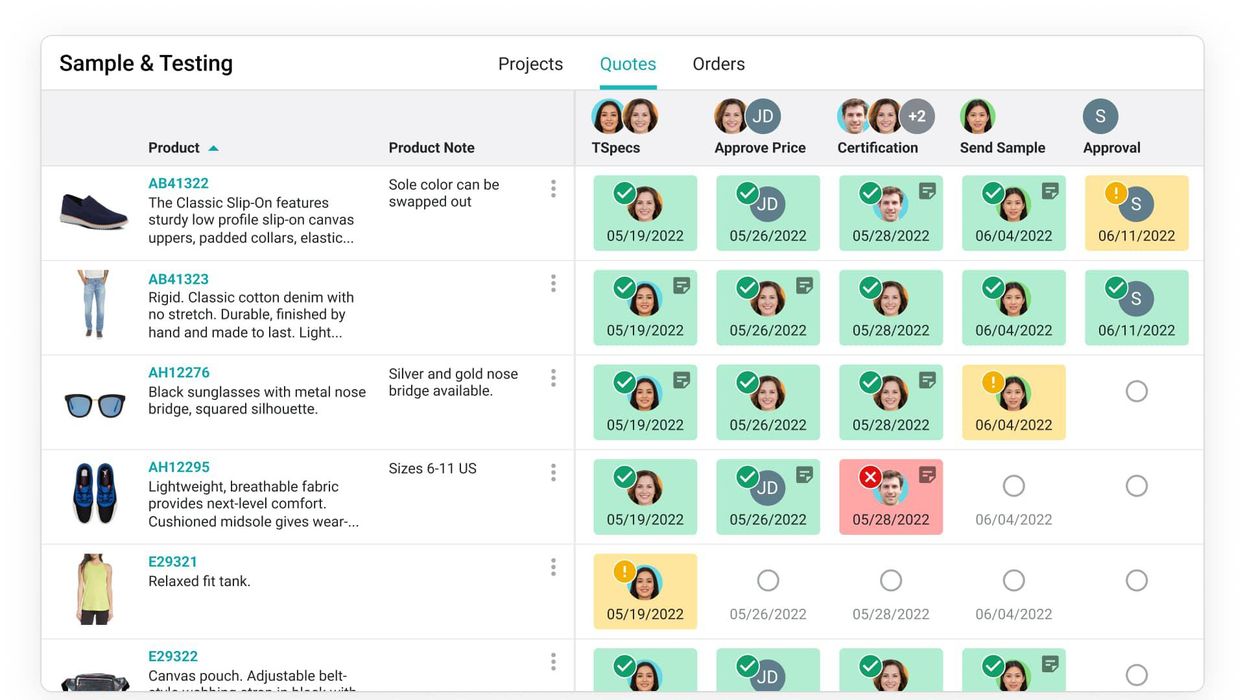

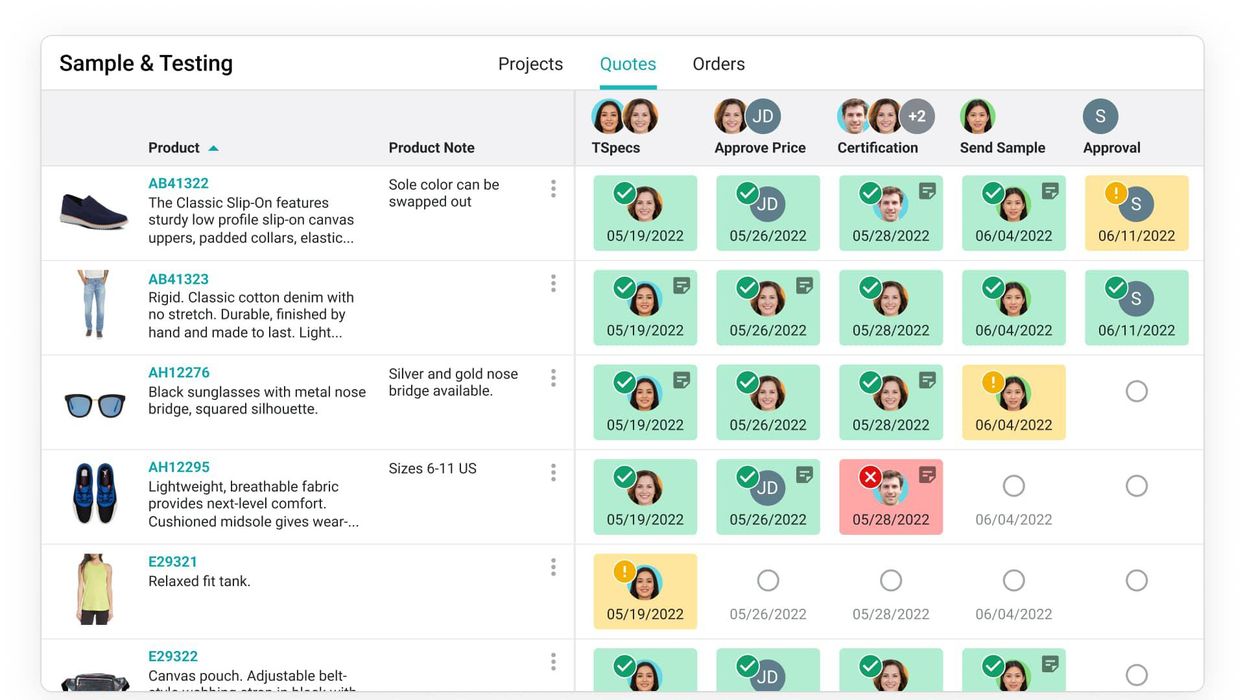

A screenshot of Surefront's product. (Courtesy photo)

The platform helps brands, retailers and manufacturers take an item from ideation to store.

A screenshot of Surefront's product. (Courtesy photo)

To Michael Forrest, retail is all about the interactions between people.

“The cornerstone of successful retail is relationships and how well you can foster those relationships, both between a retailer and consumer and a retailer and supplier,” Forrest said. “Ultimately, how you deliver products to your consumer, whether that’s online or in-store, is a representation of who you are.”

That insight has plenty of learning behind it. Forrest is a self-described “student of retail” has 30 years of experience in the industry. Along the way, he played a key role on the team that launched the Apple Store, served as global head of customer experience at Microsoft and led retail operations at Samsung, among other roles.

Now, Forrest is the CEO of Surefront. The company makes software that’s designed to streamline the process that brings those products to market. The Surefront team saw a retail space where lots of information needs to come together to develop, list and ultimately sell a new product. This disparate information, in turn, is often recorded and shared using disparate tools like email and spreadsheets, with lots of data entry involved. There are tools to share information internally, and others to share it with outside partners.

Surefront’s system, in turn, sits between brands, retailers, suppliers and manufacturing partners.

“They have one shared, collaborative space to go from new product ideation all the way through to an ecommerce listing or B2B sale for brick and mortar,” said Doug Heckmann, Surefront’s chief solutions officer.

Surefront's team. (Courtesy photo)

This involves bringing together familiar tools for product lifecycle management, product information management and merchandising into one platform. A soon-to-launch feature will add product data syndication.

With the information that is presented, stakeholders can collaborate on ideas, view updates with visual workflows, manage price quotes and export listings to ecommerce platforms. These capabilities exist alongside tools that enable communication between the different stakeholders. So the product’s data and imagery lives in the same space as the chat that takes place around its development. Plus, it's in a space where it can be revisited at a later date.

“We contextualize all of the communication to the product and to the quotations,” Heckmann said. This means "it’s always easy to have a shared history that you can quickly reference and leverage for insight for growth.”

The collaboration and communication helps speed up the time to market for a product, Forrest said. When companies with a large number of SKUs are working to meet demand or get products out in time for a new season, that’s valuable.

At the end of the day, brands, retailers and manufacturers are all working to get the right product to customers at the right time, and at the right price.

Surefront wants to help make it easier for these groups to work together to reach that goal, and in turn delight both customers and partners. That sounds like the basis for stronger relationships.

The marketplace teamed with Techstars to support entrepreneurs charting the future of ecommerce.

Ecommerce marketplace eBay is teaming up with a national pre-seed investor to launch a new accelerator for startups building ecommerce technology.

The program, called Techstars Future of Ecommerce powered by eBay, will apply an accelerator model from Techstars that has supported thousands of companies to innovation that aims "to make selling and buying more equitable, attainable and sustainable,” according to eBay.

“Techstars has supported thousands of entrepreneurs that are using innovative technologies to transform industries,” said Collin Wallace, Managing Director at Techstars. “eBay’s expertise as an ecommerce pioneer paired with the programming, capital and connections that Techstars provides will create an unparalleled opportunity for founders.”

Here are key details about the program: