Retail Channels

06 April 2023

US resale market to reach $70B by 2027

A new report from thredUP says online resale will grow at 20%, pacing the growth of the global secondhand market.

A new report from thredUP says online resale will grow at 20%, pacing the growth of the global secondhand market.

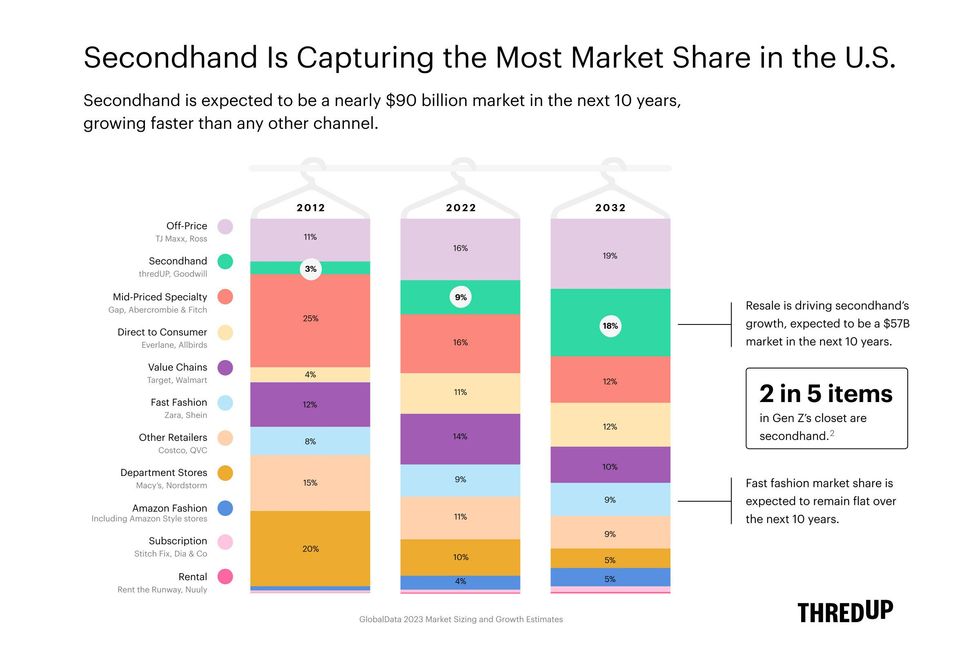

New projections are showing continued growth for the worldwide resale market, as Gen Z increasingly embraces secondhand shopping.

A new report from thredUP and GlobalData shared the following about the resale market:

The global secondhand market is expected to double by 2027, reaching $350 billion.

The U.S. secondhand market is expected to reach $70 billion by 2027.

Online resale is expected to grow 21% annually over the next five years, reaching $38 billion by 2027. It's the fastest growing resale segment.

Here's a look at the key factors behind resale's growth:

Apparel: From thrift to consignment, secondhand clothing has long been sought by consumers. A new generation of resale is shifting shopping online, but demand to mine old threads for new looks remains high – and potentially more sought-after than ever. According to the report, 52% of consumers shopped secondhand apparel in 2022. Meanwhile, one in three apparel items purchased in the last year were secondhand, while two in five items in the closets of Gen Zers are secondhand.

Price savings: At a time of 40-year-high inflation, consumers are also seeking to stretch dollars, and turning to resale to do so. Value was the top motivator among consumers surveyed. In all, 37% of consumers spent a higher proportion of their apparel budget via secondhand, and 63% of those said inflation was the reason for increasing spend.

Secondhand first: A new generation of consumers is seeking out resale as a primary option. According to the report, 82% of Gen Z eyes the resale value of apparel before buying it, while 64% indicated that they look for an item secondhand, before opting for a new item.

(Courtesy of thredUP)

At a time when consumers are seeking to reduce carbon footprints and remain environmentally conscious, resale offers an option to keep an item that would’ve gone to waste in use, rather than buying a new item. Demand for these circular approaches is only growing. The share of consumers who bought a secondhand apparel item that they normally would have purchased new increased by 40% in 2022, to 1.4 billion items.

(Courtesy of thredUP)

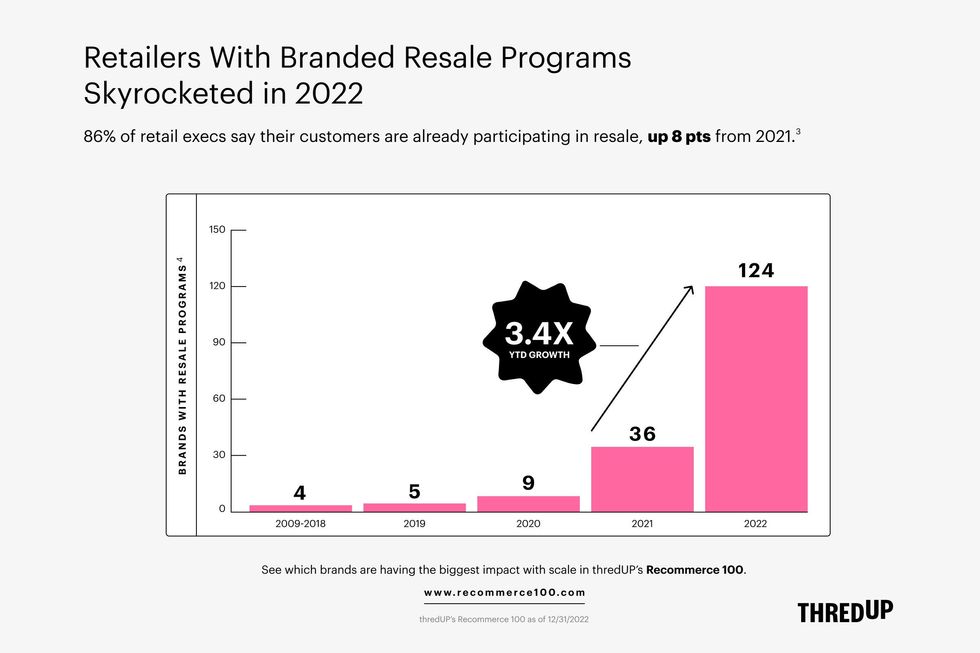

Retailers are also looking to make resale part of their operations. One-third said that if resale proved successful, they would cut production of new products. To grow resale, brands are launching their own dedicated programs that include trade-ins, incentives and dedicated ecommerce sites for resale items of their products.

In all, 88 brands launched dedicated resale programs in 2022. That’s a 244% increase from 2021. The report states that 30% of the top 20 brands are offering dedicated resale. Torrid, lululemon, Madewell and Zara remain some of the most popular brands.

They’re responding to demand. The number of retail executives who said their customers are already participating in resale was up 8 points from 2021, to 86%.

It underscores that, increasingly, executives are viewing resale as a must. The survey found that the share of retail executives who say offering resale options is becoming “table stakes” rose six points over 2021, to 58%.

"What's particularly striking this year is new detail around how much younger generations are expected to account for future growth as their purchasing power increases,” said Neil Saunders, managing director of GlobalData, in a statement. “Traditional retailers are responding to this demand by entering resale and are really the ones driving the market forward, and we expect increased adoption in retail as secondhand becomes more of a lifestyle for consumers."

Labor disputes on the West Coast could cause further disruption heading into peak season.

When the first half of 2023 is complete, imports are expected to dip 22% below last year.

That’s according to new data from the Global Port Tracker, which is compiled monthly by the National Retail Federation and Hackett Associates.

The decline has been building over the entire year, as imports dipped in the winter. With the spring, volume started to rebound. In April, the major ports handled 1.78 million Twenty-Foot Equivalent Units. That was an increase of 9.6% from March. Still it was a decline of 21.3% year over year – reflecting the record cargo hauled in over the spike in consumer demand of 2021 and the inventory glut 2022.

In 2023, consumer spending is remaining resilient with in a strong job market, despite the collision of inflation and interest rates. The economy remains different from pre-pandemic days, but shipping volumes are beginning to once again resemble the time before COVID-19.

“Economists and shipping lines increasingly wonder why the decline in container import demand is so much at odds with continuous growth in consumer demand,” said Hackett Associates Founder Ben Hackett, in a statement. “Import container shipments have returned the pre-pandemic levels seen in 2019 and appear likely to stay there for a while.”

Retailers and logistics professionals alike are looking to the second half of the year for a potential upswing. Peak shipping season occurs in the summer, which is in preparation for peak shopping season over the holidays.

Yet disruption could occur on the West Coast if labor issues can’t be settled. This week, ports from Los Angeles to Seattle reported closures and slowdowns as ongoing union disputes boil over, CNBC reported. NRF called on the Biden administration to intervene.

“Cargo volume is lower than last year but retailers are entering the busiest shipping season of the year bringing in holiday merchandise. The last thing retailers and other shippers need is ongoing disruption at the ports,” aid NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “If labor and management can’t reach agreement and operate smoothly and efficiently, retailers will have no choice but to continue to take their cargo to East Coast and Gulf Coast gateways. We continue to urge the administration to step in and help the parties reach an agreement and end the disruptions so operations can return to normal. We’ve had enough unavoidable supply chain issues the past two years. This is not the time for one that can be avoided.”