Retail Channels

20 July 2022

Prime Day 2022: Inflation's impact, and a look at the halo effect

Data shows price-conscious consumers sought essentials, while non-Amazon US retailers got a lift.

(Illustration by The Current)

Data shows price-conscious consumers sought essentials, while non-Amazon US retailers got a lift.

(Illustration by The Current)

If done with planning and foresight, Amazon Prime Day can have an impact beyond the day itself.

This applies to brands who sell as part of Amazon’s massive deals event. But it also applies to those of us eager to glean insights on what the two biggest online selling days of the year mean for ecommerce as a whole.

Given its far-reaching impact, Prime Day results in a font of data that can be helpful on a number of levels. For one, Amazon is said to be planning another Prime Day in the fall, so there’s a chance to apply lessons right away. The data also provides insight about what’s working in ecommerce, and the state of the economy as a whole.

So, while we already reviewed some of the headline data released right as the event came to close, it's worth taking a closer look across categories, and sources to see what else is worth learning. Here are a few of the key data points that have emerged since the event:

The early numbers showed Prime Day’s sales marked growth from a year ago. Amazon itself shared that the 300 million products purchased on July 12-13 were up from the roughly 250 million items it reported were bought in 2021. The company hasn’t released dollar figures. But when it comes to overall sales across all retailers, online spending on July 12 and 13 totaled $11.9 billion, according to the Adobe Digital Economy Index. That represents 8.5% growth over 2021.

Drilling down into consumer spend on Amazon, market research data firm Numerator’s Prime Day Tracker shows more growth.

Based on its initial read of data from the two days, the average order size for Prime Day was $52.26, up from $44.75 in 2021. Numerator added that 62% of households placed two or more separate items. The average household order size was $144.56.

Four out of the top five best-selling items on the day were Amazon-branded, from Fire TV sticks to Echo Dots. The lone non-Amazon item in the top five was home security cameras and doorbells from Blink. Meanwhile, variety packs from Frito Lay finished in sixth position.

Top categories included household essentials (29%), health and beauty (28%), and consumer electronics (27%), according to Numerator. Meanwhile, 87% of purchases made were either for a household or everyday goods, while larger ticket items shoppers would only purchase on sale accounted for 20% of spend, Numerator reports.

While electronics are typically big sellers at the event, the popularity of household essentials could suggest that shoppers are stocking up on the key items at a time when they are watching their wallets or have fewer discretionary funds available amid signs of economic tightening.

Indeed, 65% of shoppers spent the same or less this year. Further, inflation impacted 83% of Prime Day shoppers, Numerator reported.

Another cohort that is closely tracked on Prime Day can best be described as, “retailers not named Amazon.” While these big names in shopping don't sell on Amazon, they often run their own sales and promotions on Prime Day, and get a midsummer lift because of it. This has been termed the “halo effect” of Prime Day.

In the US, this year’s Prime Day brought growth for US brands and retailers selling on their own sites and platforms, according to data from Salesforce. When compared with the second Tuesday and Wednesday of July in 2021, the two days of Prime Day showed 8% growth for American online sales, the B2B software company’s shopping index found.

In one interesting twist, Walmart still benefitted from Prime Day, even though it didn’t run a specific promotion advertising deals around Prime Day. According to results of a survey of 1,000 consumers from supply chain software firm Blue Yonder, 49% of consumers said they took advantage of deals at Walmart on Prime Day. In 2021, the number that gave the same answer was 35%. Among retailers that did hold deal events, 40% shopped at Target in 2022 through its "deal days" event, versus 26% in 2021. Best Buy’s Black Friday in July event, meanwhile, attracted 26% of respondents in 2022, versus 15% in 2021.

Globally, sales on non-Amazon sites were down 12% in 2022 compared to Prime Day 2021, Salesforce reports, noting that this number was soft itself when compared with 2019 and 2020.

In a post analyzing the results, Salesforce Director of Consumer Strategy and Insights Caila Schwartz wrote that this was the result of oversaturation of product as demand for goods rose in key categories, as opposed to shopper behavior.

“High-ticket products like electronics and sporting goods saw meteoric holiday sales growth in 2020 and the first half of 2021 — resulting in a market with too much product and not enough customers,” Schwartz wrote.

Prime Day provided a boost on the heels of a quarter that showed slowing ecommerce sales growth. In the second quarter, US ecommerce sales were up 2% year-over-year, while global sales for the same period declined 6% year-over-year, Salesforce reported. During a period of elevated inflation, however, prices are going up. The average selling price for the second quarter rose 9% in the US, and 4% globally.

As back-to-school shopping kicks into gear and brands and retailers start to get ready for the holidays, it's a fair bet that a big focus will remain on prices. Especially as many retailers continue to attempt to clear out inventory that is mismatched to demand as a result of supply chain challenges, the discounting behavior that appeared on Prime Day appears poised to continue all year long.

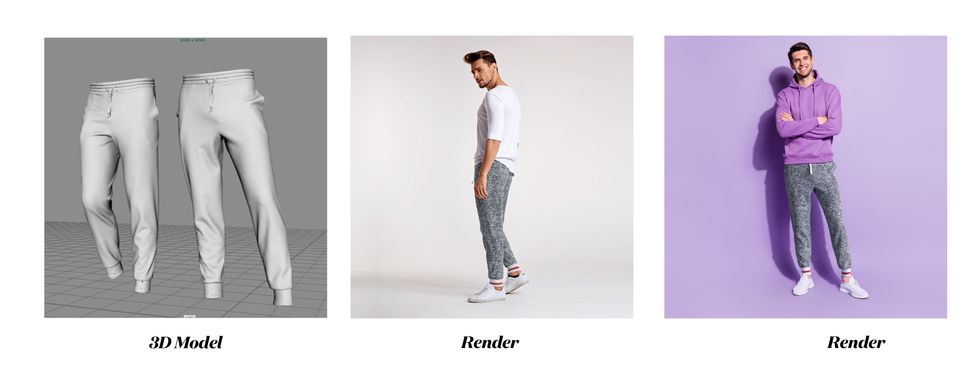

Amazon partnered with Hexa to provide access to a platform that creates lifelike digital images.

A 3D rendering of a toaster from Hexa and Amazon. (Courtesy photo)

Amazon sellers will be able to offer a variety of 3D visualizations on product pages through a new set of immersive tools that are debuting on Tuesday.

Through an expanded partnership with Hexa, Amazon is providing access to a workflow that allows sellers to create 3D assets and display the following:

Selllers don't need prior experience with 3D or virtual reality to use the system, according to Hexa. Amazon selling partners can upload their Amazon Standard Identification Number (ASIN) into Hexa’s content management system. Then, the system will automatically convert an image into a 3D model with AR compatibility. Amazon can then animate the images with 360-degree viewing and augmented reality, which renders digital imagery over a physical space.

Hexa’s platform uses AI to create digital twins of physical objects, including consumer goods. Over the last 24 months, Hexa worked alongside the spatial computing team at Amazon Web Services (AWS) and the imaging team at Amazon.com to build the infrastructure that provides 3D assets for the thousands of sellers that work with Amazon.

“Working with Amazon has opened up a whole new distribution channel for our partners,” said Gavin Goodvach, Hexa’s Vice President of Partnerships.

Hexa’s platform is designed to create lifelike renderings that can explored in 3D, or overlaid into photos of the physical world. It allows assets from any category to be created, ranging from furniture to jewelry to apparel.

The result is a system that allows sellers to provide a new level of personalization, said Hexa CEO Yehiel Atias. Consumers will have new opportunity see a product in a space, or what it looks like on their person.

Additionally, merchants can leverage these tools to optimize the entire funnel of a purchase. Advanced imagery allows more people to view and engage with a product during the initial shopping experience. Following the purchase, consumers who have gotten a better look at a product from all angles will be more likely to have confidence that the product matches their needs. In turn, this can reduce return rates.

While Amazon has previously introduced virtual try-on and augmented reality tools, this partnership aims to expand these capabilities beyond the name brands that often have 1P relationships with Amazon. Third-party sellers are an increasingly formidable segment of Amazon’s business, as they account for 60% of sales on the marketplace. Now, these sellers are being equipped with tools that enhance the shopping experience for everyone.

A video displaying the new capabilities is below. Amazon sellers can learn more about the platform here.

Hexa & Amazon - 3D Production Powerhousewww.youtube.com