Brand News

17 February 2023

3 ways L'Oréal is building for an 'AI and tech-led' era

Executives outline the company's beauty tech and ecommerce expansion.

Photo by Helio Vega on Unsplash

Executives outline the company's beauty tech and ecommerce expansion.

Looking out on the future, L'Oréal sees a different and more tech-enabled world emerging for brands and retailers after the shifts caused by pandemic, supply chain shocks and inflation.

“It is increasingly clear that these past few years of crisis and constant change will mark the dawn of a new era,” said Nicolas Hieronimus, CEO of the beauty company, told investors on a recent call to recap the full year results. “It will be an increasingly multipolar era, more fragmented than the previous one, an AI and tech-led era with the highest expectations in terms of sustainability, purpose and cultural diversity."

The seeds for this shift were planted in 2022. There was a return to brick-and-mortar stores, which saw sales rise 12% year-over-year. At the same time, L'Oréal is continuing to expand in ecommerce channels, with 8.9% growth for the year. Ecommerce now accounts for 28% of sales for the company.

From this, L'Oréal sees a “multipolar” distribution strategy emerging, with stores that are owned-and-operated by the company working in tandem with ecommerce that moves beyond the traditional channels to both DTC and B2B platforms, Hieronimus said.

The company wants to innovate in the products it makes, the way it sells them and its impact on the world. It has built a large team to do so, with over 2,000 people working in beauty tech and IT, along with 800 data analysts.

It all comes together under the banner of beauty tech, and L'Oréal is partnering with others to augment the work.

“Our entire RNI organization is being augmented with powerful AI and data including strategic partnership with the experts such as Verily, an Alphabet subsidiary, where we will combine our very large scale consumer data with our own to better understand skin and our aging,” Hieronimus said. “Data and AI will allow us to develop next level diagnosis services for personalized recommendation to drive loyalty and satisfaction.”

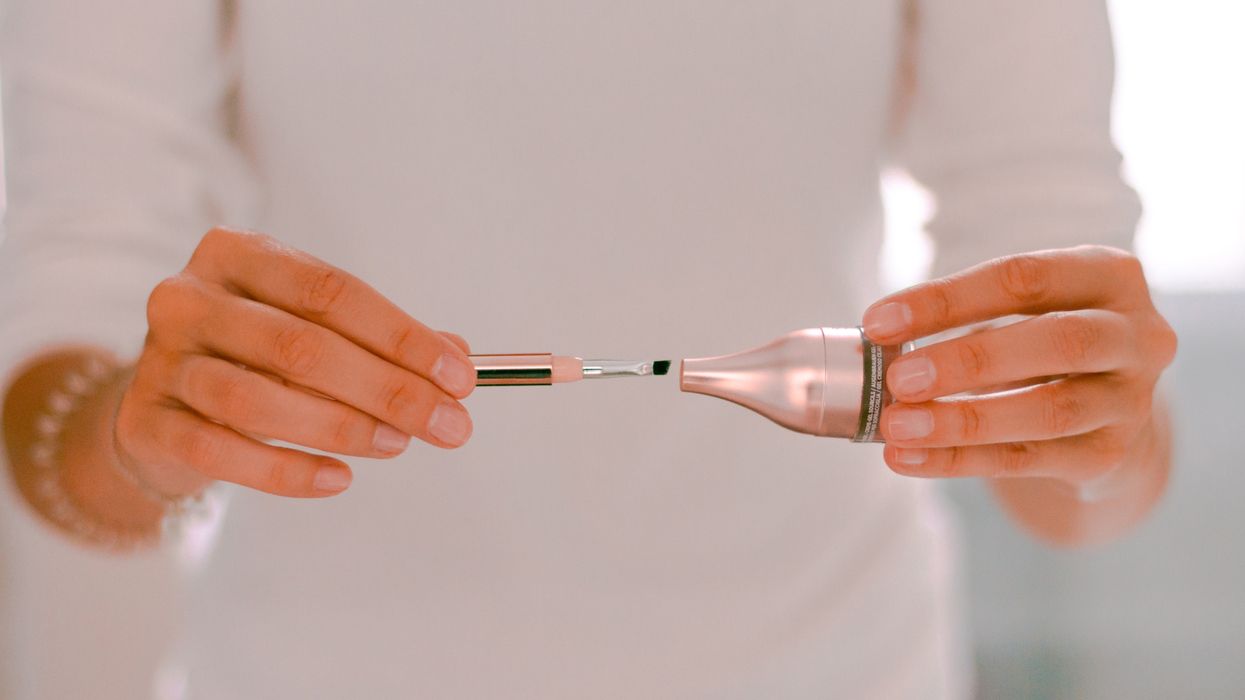

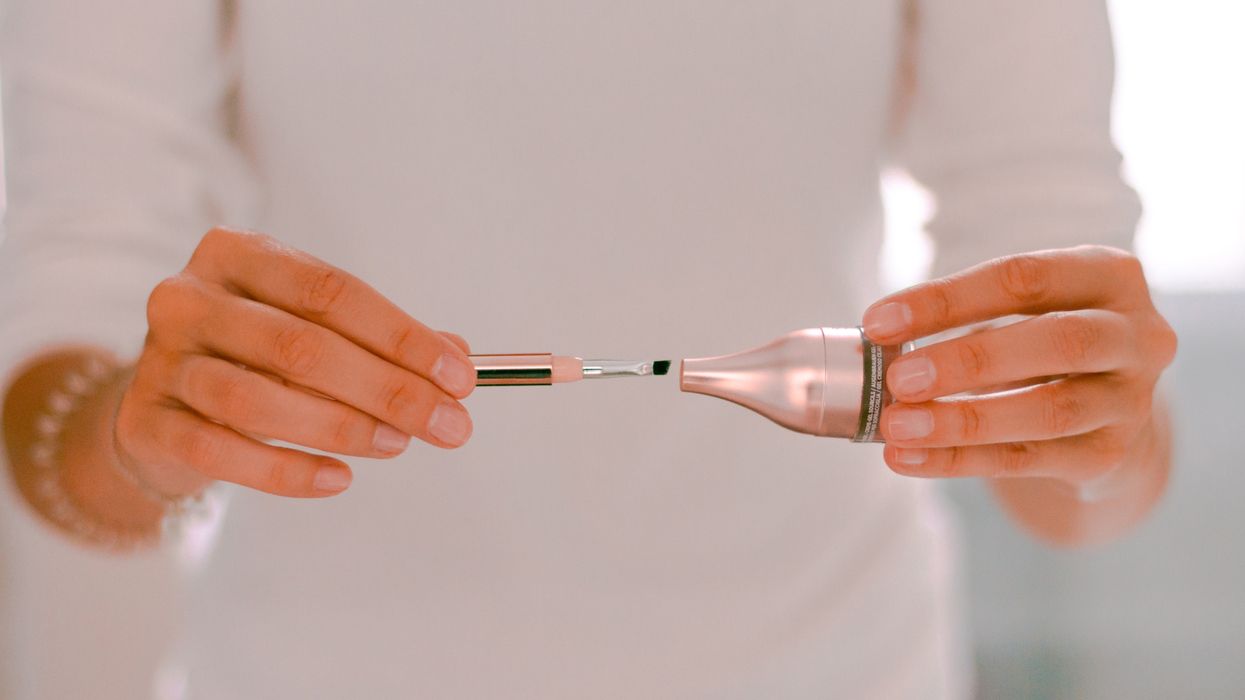

Beauty tech is bringing new tools for cosmetics and skincare. It developed a makeup applicator for people with limited arm movement called HAPTA, and a Skin Genius diagnosis to provide beauty adviser-like service.

It is also exploring digital spaces. It brought together 3D artists and beauty makers in the web community GORJS, and saw NYX Professional Services launch a new metaverse experience in Roblox. To work with startups exploring the metaverse, it developed an incubator in partnership with Station F and Meta.

The company’s professional products business has a particular focus on expanding ecommerce, said division president Omar Hajeri.

“Digital now drives our relationship with salons and stylists,” said Hajeri. “…“We continuously adapt to an ever evolving market, characterized by the rise of independent stylists. To reach them all, we are building the most powerful data driven digital ecosystem.”

In ecommerce, it has a platform called L'Oréal Partnership. In education, it has an online academy called L'Oréal Access.

In active cosmetics, the company is also reaching more doctors through digital tools. L'Oréal recorded 48% of the share of views of brand videos posted by doctors. The division also sees 20% of revenue generated through ecommerce.

“Digital allows us to amplify our medical strategy,” said division president Myriam Cohen-Welgryn. “We can now reach many more consumers than before.”

Campbell Soup Company CEO Mark Clouse offered thoughts on messaging amid inflationary shifts in consumer behavior.

After months of elevated inflation and interest rate hikes that have the potential to cool demand, consumers are showing more signs of shifting behavior.

It’s showing up in retail sales data, but there’s also evidence in the observations of the brands responsible for grocery store staples.

The latest example came this week from Campbell Soup Company. CEO Mark Clouse told analysts that the consumer continues to be “resilient” despite continued price increases on food, but found that “consumers are beginning to feel that pressure” as time goes on.

This shows up in the categories they are buying. Overall, Clouse said Campbell sees a shift toward shelf-stable items, and away from more expensive prepared foods.

There is also change in when they make purchases. People are buying more at the beginning of the month. That’s because they are stretching paychecks as long as possible.

These shifts change how the company is communicating with consumers.

Clouse said the changes in behavior are an opportunity to “focus on value within our messaging without necessarily having to chase pricing all the way down.”

“No question that it's important that we protect affordability and that we make that relevant in the categories that we're in," Clouse said. "But I also think there's a lot of ways to frame value in different ways, right?”

A meal cooked with condensed soup may be cheaper than picking up a frozen item or ordering out. Consumers just need a reminder. Even within Campbell’s own portfolio, the company can elevate brands that have more value now, even if they may not always get the limelight.

The open question is whether the shift in behavior will begin to show up in the results of the companies that have raised prices. Campbell’s overall net sales grew 5% for the quarter ended April 30, while gross profit margins held steady around 30%. But the category-level results were more uneven. U.S. soup sales declined 11%, though the company said that was owed to comparisons with the quarter when supply chains reopened a year ago and expressed confidence that the category is seeing a longer-term resurgence as more people cook at home following the pandemic. Snacks, which includes Goldfish and Pepperidge Farm, were up 12% And while net sales increased overall, the amount of products people are buying is declining. Volumes were down 7%.

These are trends happening across the grocery store. Campbell is continuing to compete. It is leading with iconic brands, and a host of different ways to consume them. It is following that up with innovation that makes the products stand out. Then, it is driving home messaging that shows consumers how to fit the products into their lives, and even their tightening spending plans.

Campbell Soup is more than 150 years old, and has seen plenty of difficult economic environments. It is also a different business today, and will continue to evolve. At the end of the day, continued execution is what’s required.

“If it's good food, people are going to buy it, especially if it's a great value,” Clouse said.