Shopper Experience

29 April 2022

Home shopping for the next gen

PrivCo's The Daily Stack offers a look at a retail reinvention. It's QVC meets DTC.

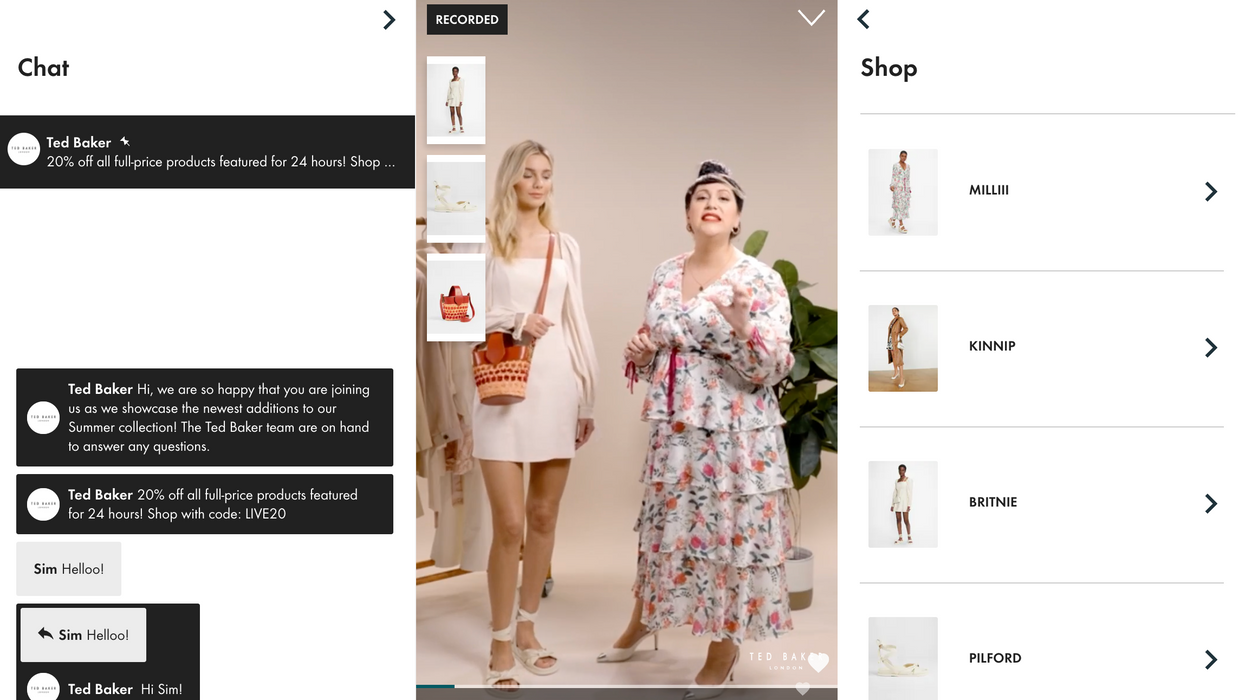

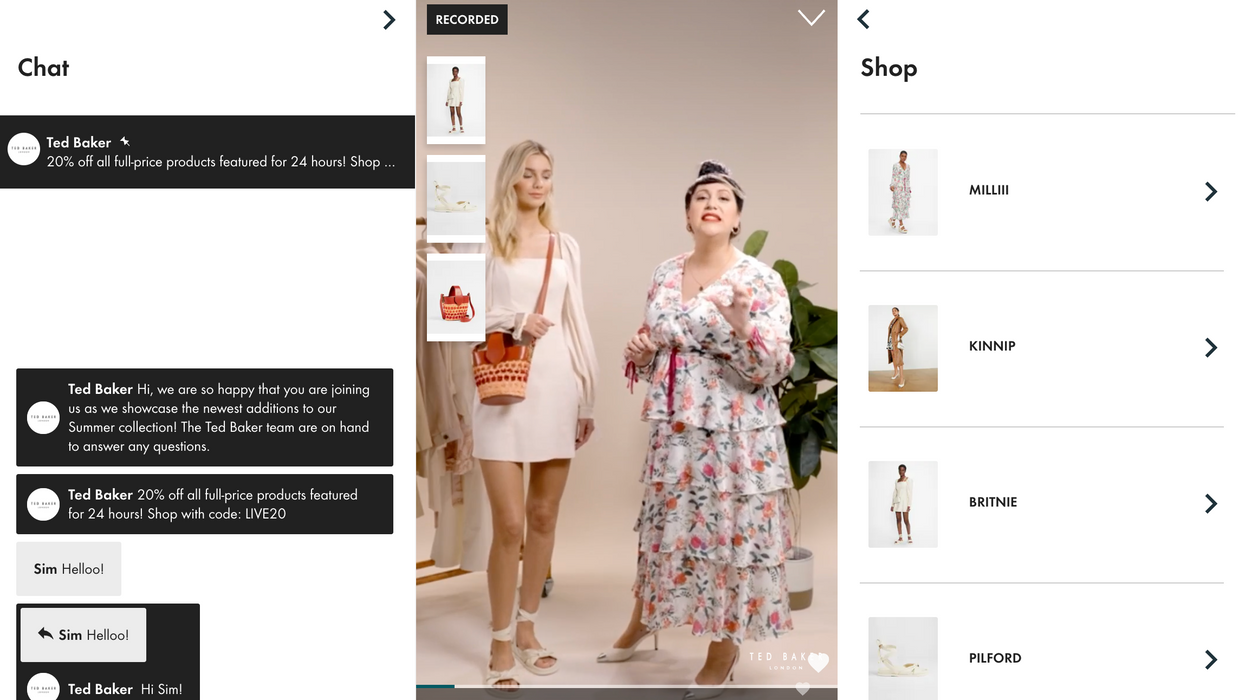

A look at Bambuser's live event from Ted Baker (Screenshot by Bambuser)

PrivCo's The Daily Stack offers a look at a retail reinvention. It's QVC meets DTC.

A look at Bambuser's live event from Ted Baker (Screenshot by Bambuser)

This article originally appeared in The Daily Stack, a daily private market insights newsletter by PrivCo, a private company intelligence platform.

Increasingly, it seems brands are turning to old methods and making them new. Direct mail campaigns were left for mattress companies and grocers until DTC brands made them cool again. Now, it’s home shopping's turn for a rebrand.

QVC is the first company that comes to mind, reminding me of previous bouts of insomnia, up at 3 a.m. watching blank-staring models displaying sparkly bracelets and Christmas decorations. But the real frontrunners in the resurgence of home shopping are in China. The industry is already valued at $137 billion, utilizing today’s tech and home-shopping essentials like clever hosts and flash sales.

Gen Z is starting to earn disposable income as the generation hits its mid-twenties (the members in the cohort are between 10 and 25 years old), contributing to their $360 billion spending power. For these kids who have grown up trusting their Youtube creators and TikTok stars like the cool older siblings they wish they had, reaching them by authentic, relatable sellers makes all the difference. The new home shopping is a mix of influencer sponcon, social media and a dash of QVC.

Whatnot is a leader in this space. The company has created a marketplace where anyone can become a seller, promote a launch, and livestream his or her inventory of vintage tees, playing cards, or NFTs. Bambuser was an innovator in the category and has been the brand choice for live shopping events. The Stockholm-based company went public in 2017.

Identity, value and innovation are keys to remaining relevant for specialty retail, CI&T's Melissa Minkow writes.

"There's no Bed Bath & Inbetween," writes CI&T's Melissa Minkow. (Photo by Flickr user JJbers, used under a Creative Commons license).

The recent Bed Bath & Beyond news has begged many questions, but the unbranded, overarching question that should be getting asked, is “What is the future of specialty retail?”

Every day, big box retailers bring another DTC brand under their roof and add even more categories to their assortment. What’s more, the increase in marketplace models and constant debut of new DTC brands paint a vivid picture of a challenging landscape for specialty. Over the last decade, and especially over the last year (thanks to inflation), retail has bifurcated from a price standpoint, matching the widening gap between high and low income. Now, it seems successful specialty retail is following a somewhat similar suit: either you’re DTC or you’re big box, there’s no Bed Bath & Inbetween.

For decades, Bed Bath & Beyond created a blueprint for towing the line between big box and specialty. The retailer possessed a footprint as large as big box stores, offered a much wider array of categories than typically within the bounds of specialty retail, yet sat strictly in the home space. This model eventually proved to be a struggle for Bed Bath & Beyond, but there are large specialty retailers who appear to have figured out how to hybrid. What does this mean for the landscape in the future? Let’s unpack.

It goes without saying, but I’ll say it anyway: By definition, specialty retail products can always be bought at multi-category retailers. Specialty is intended, though, to provide both breadth and depth where larger retail typically doesn’t. Lately, however, between the increase in marketplace models and overall expansionist strategies among many big box chains, not only are the categories offered by multi-category retail broadening, but so is the level of assortment. When department stores, big box stores and dollar stores are actually offering more breadth and/or depth than a specialty store, that’s the first sign of rough waters ahead.

While one end of the specialty spectrum is rapidly growing due to large chains, the other end happens to be growing due to the inverse reason: small DTC startups. DTC brands have grown in quantity over the last several years, allowing founders freedom, flexibility and ample control over their business models. TikTok’s skyrocketing popularity has certainly played a key role in building DTC appeal among both entrepreneurs and consumers, along with the increasing marketing capabilities of social media overall. Just as it makes sense from a scalability perspective for large chains to enter into more specialty terrain, it is perfectly sensible for DTC to stick within the confines of one specialty in order to remain strategically focused. In general, developing a massive retail footprint (physically, with exorbitant square footage, and digitally) out of one niche is going to be economically challenging. Interestingly noteworthy, big box retailers such as Target and Walmart have embraced bringing in DTC brands (e.g. Billie, Quip, Casper) in home, beauty and personal care. This demonstrates that there can absolutely be a place for DTC within big box, as long as that DTC identity remains strong within that environment. Perhaps had Bed Bath & Beyond pulled big DTC brands in, rather than attempting its own private label DTC identity, there would have been more consumer engagement. DTC brands are who they are because of the relationships they build with shoppers, and smart large retailers leverage that to their advantage versus endeavoring their own wins in these aisles.

At the start of COVID, the big headline was that the virus had infected a long list of retailers, forcing them into the red. The reality was that the pandemic served as the sounding bell or nail in the coffin for many retailers who had actually been struggling for longer than they would have liked us to believe. Bed Bath & Beyond is a prime example of one of those retailers whose struggle has essentially been forgotten, leading many to assume that this is another coronavirus casualty. But it’s important to note that the home space as a whole has been a big pandemic winner, especially for specialty retailers such as Home Depot. Outside of the home world, specialty has seen success as well, with Ulta as a case in point. So, it’s clearly not that specialty retail has become irrelevant thanks to DTC and big box encroachments. Ultimately, specialty retail’s survival comes down to ensuring that retailers hoping to remain relevant as specialty players must evolve with the retail times.

The first element in remaining relevant is matching the rest of retail’s price bifurcation strategy. Mid-price retail simply makes no sense given the economic backdrop. Both big ticket (including luxury) and discount have continued to thrive thanks to an erosion of middle income, and consequently, the erosion of mid-price retail. Smart specialty brands will pick a side and stick to it.

Beyond establishing a price identity, specialty brands in today’s competitive environment must also comprehensively establish their overall identity. Designating a price range is crucial, and so is determining a brand image that can be consistently achieved to keep that niche carved out. When a retailer struggles in specialty, it’s often because their brand has failed to fully differentiate. Consumers have their first-stops when shopping most categories, so securing a unique brand identity is foundational to loyalty. Especially considering the role specialty is meant to play, if there isn’t a specific reason a consumer would shop a particular brand, that ground will be easily lost to either DTC or big box.

Specialty is a tough type of retail to compete in for the aforementioned reasons, however, there’s also opportunity for specialty to soar in ways that other types of retail really can’t. Given how deep specialty retail inherently runs, the space is primed to offer services to compliment the products. There is a level of expertise and knowledge that greatly benefits specialty since consumers are making decisions between highly similar goods. Specialty retailers who double-down on the educational and service sides of providing will earn more loyalty. This investment in education could look like gated tutorials accessible upon purchase, pre-purchase consultations with obligation to buy after, free installation/styling/repairs/makeovers or exclusive, direct lines to associates who can answer nuanced questions. This can also merely mean that the retailer takes extreme care in building out detailed product comparison tools, FAQ’s and content that are available without purchase commitment. The bottom line is that specialty retail can and should focus on decision support in ways that more diversified retail wouldn’t.

Just as specialty retail is primed for educating and providing services, it is also primed for innovation. Brands playing in specialty need to own their specialty to cement their positioning as leaders with differentiated value and perspective. In order to lead, these retailers must innovate and improve the category they occupy. Specialty retailers can innovate via their own brands, collaborations with renowned brands, partnerships or ownership of a manufacturing component, or a demonstration of innovation in an alternative piece of the retail lifecycle (e.g. rolling out a new way to recycle products in the category). Not only is the innovator identity invaluable as a specialty retailer, but it is a status that must be maintained. It’s not enough to cause one breakthrough in the history of a category. Successful specialty retailers have to be influential in their category in perpetuity.

Every type of retail is facing dramatic change as the world opens up and technology continues to advance. Specialty retail, however, perhaps faces some of the most challenging changes, and Bed Bath & Beyond is one of the most visible victims of that. The stakes have been raised, and when a specialty retailer surpasses those stakes, the reward could be unconditional loyalty. If a specialty retailer fails to pick a price point lane, offer the breadth and depth expected, solidify its identity, offer creative services, and continually innovate, said retailer’s fate is just about sealed.

Melissa Minkow is director of Retail Strategy at CI&T.