During the holiday season, brands and retailers have a big opportunity attract shoppers who are at their peak of intent to buy for others, as well as themselves. According to the National Retail Federation, the end-of-year shopping bonanza accounts for 19% of retail sales for the year, and can be more for some businesses.

It’s a time when many retailers are also seeking to stand out, and they do so by showing off the latest ways they’re serving shoppers, and creating memorable experiences. This year, it’s a time when they launch new features that harness digital tools that elevate experiences in ecommerce, in-store shopping and connect the two.

Let’s take a look at five launches that arrived during this holiday season that point to where shopping is going next:

The Bay: Holiday helpers and marketplace gift guides

The Bay, which is the ecommerce arm of the Hudson’s Bay Company portfolio, rolled out a long list series of features specifically for holiday shopping. In particular, three of the new items highlight areas where retailers are seeking to harness digital tools to assist shoppers: Personalized service, a digitally-enabled in-store experience and marketplace curation. Here's a quick look at the new tools:

Ask a Holiday Helper: The Bay is offering access to digital stylists that will provide guidance through the shopping journey. This includes the chance to step into a virtual experience to explore looks and receive personalized experience.

See It, Scan It, Ship It: Here’s an example of shopping experience tools that cross digital and in-person stores. When visiting a Hudson’s Bay Showroom, shoppers can scan a QR code on a product, and have items sent directly to their home or someone else's. It's easy to see how this could also help to expand the assortment available.

The Ultimate Guide: Drawing on a wide assortment that includes a marketplace of independent artisans, The Bay put together a list to guide shoppers. It’s an example of the power of curation, especially in the area of certain themes and events.

TalkShopLive: Window shopping with livestreaming

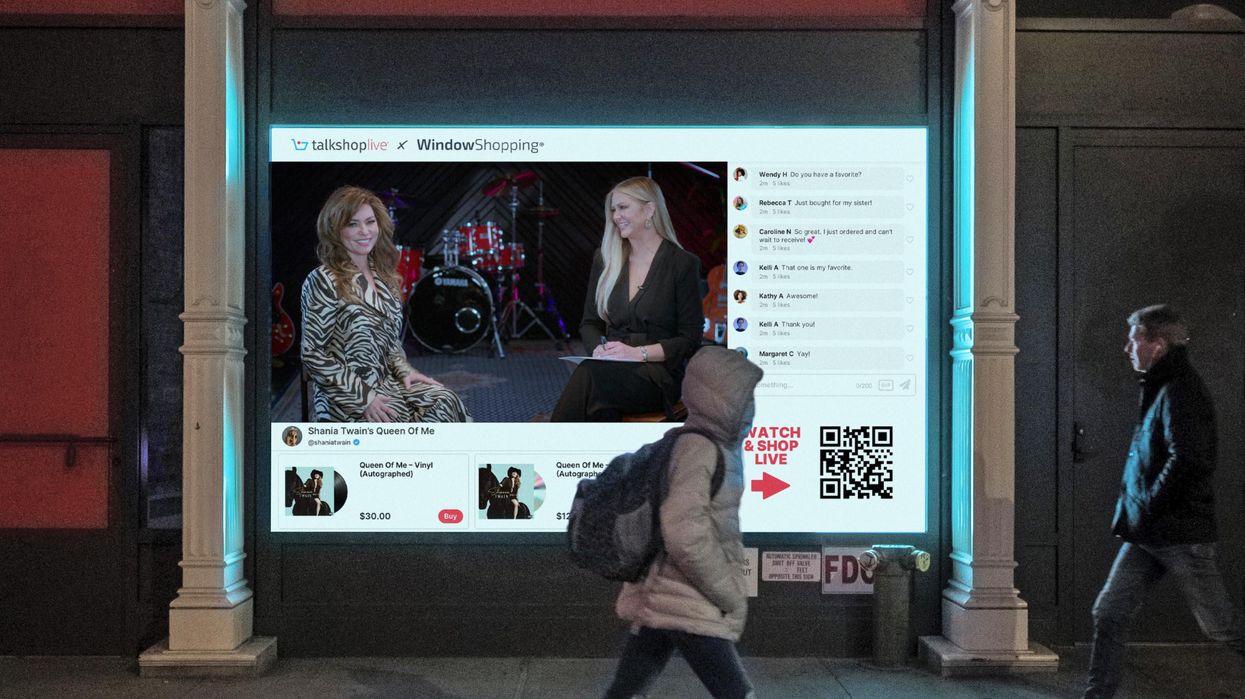

A TalkShopLive livestream window in New York. (Courtesy photo)

There’s nothing like window shopping in the holiday season, when displays help get people in the spirit, and allow retailers to show off their best items. TalkShopLive is bringing live commerce to this experience. In New York City, the company partnered with FrontRunner Technologies to deploy large screens with live shopping shows around the city. Along with dynamic hosts discussing goods, these displays include QR codes to make the content shoppable.

The activation allows for plenty of star power to come to the streets. Shania Twain will discuss her upcoming album, celebrity chef Bobby Flay will be live for a cooking demo, Dolly Parton will discuss her book, TikTok influencer Noah Schnacky will showcase new products, author and rapper Ludacris will feature a new kid's book and actress/daytime TV host Drew Barrymore will discuss her line of home goods.

It’s an example of the crossover between digital and physical, in which longstanding features of the in-person experience can be remade for ecommerce.

“Content is at the core of product discovery and purchase, and through our unique technology we can support a connected approach to digital experience that maximizes content and amplifies omnichannel sales,” said Bryan Moore, TalkShopLive cofounder and CEO, in a statement.

Nordstrom: Augmented reality

Through its app, Nordstrom is adding 3D elements to its product display. More than 300 varieties of men's, women's and kid's shoes are now available in two areas:

View in 360 allows shoppers to examine the shoe from all sides, while toggling the view around it.

Augmented reality uses a phone’s camera to superimpose an image of the shoe into the real world. While a demo did not include a virtual try-on feature, this technology is the groundwork for such a capability.

These digital tools can make an impact on real KPIs. Retailers are looking to curb return rates, and creating a way to provide a better look at an item reduces the likelihood that it will be sent back.

“Our hope is that with this new feature, customers will have greater confidence in their online purchases as they are better able to evaluate a product, which reduces the hassle of needing to return an item that's not right for them,” Nordstrom wrote in a blog post. “This is one way we are creating an engaging and immersive experience for customers on our app today.”

Victoria’s Secret: Mobile bra fitting

(Courtesy photo)

With this innovation in the shopper experience, augmented reality is being applied to fit.

Victoria’s Secret partnered with the technology provider Verifyt to offer a bra fitting tool for mobile devices. Using a 3D scan, the feature provides personalized recommendations of bra sizes.

Offering the ability to try on a product is one area where the physical store has a longstanding advantage. Many services offer home try-on with free returns, but these types of tools show how technologists are working to make a mobile device the center of the try-on experience.

"Finding the correct bra fit is a challenge for most women, and the challenge is magnified for those looking to shop online," said Julia Barry, director of marketing at NetVirta, in a statement. "Together with Victoria's Secret, we will solve for one of the hardest-to-fit product categories in apparel retail."

Bloomingdale’s: Virtual Store

Moving toward the metaverse, the store can become a digital experience in and of itself.

Department store chain Bloomingdale’s partnered with virtual reality technology provider Emperia to create a shopping experience that has unique spaces for individual brands, as well as activations that allow users to treat themselves.

An elevator transports users to different brand rooms. A Chanel store is set on the moon, while a Ralph Lauren store takes shoppers from a magical holiday forest to a ski chalet. A Nespresso store is set in a Parisian cafe.

To further elevate the experience, additional rooms include a luxury beauty/spa room, party room and gifting experience.

While it draws on recent advances in immersive technology, this experience in many ways harkens back to the heyday of the department store, when the goal was not only to provide a large shopping space with a variety of categories under one roof, but also an experience that provided an escape from every day life.

“Emperia believes that the multi-brand virtual experience will become the new department store of the future,” says Olga Dogadkina, CEO of Emperia, in a statement. “The virtual environment provides endless opportunities for brand creativity, design, and user engagement, breaking barriers of accessibility and physical space limitations - providing a new technology playground for retailers.”

For brands, such department stores represent a new opportunity to tell a story that contextualizes and communicates a vision through a creative activation. It’s why brands like Coach and Crocs have also made virtual stores a part of their holiday campaigns.

For retailers, virtual stores can function as an extension of the physical store. Data tools available with these technologies also allow for measurement of product engagement, demographics, stock demand and layout effectiveness. In turn, the digital not only complements the physical, but informs it, as well.