Operations

14 January 2023

Amazon Monitron turned fulfillment downtime into business upside

Amazon CEO Andy Jassy shared details on the AWS device for conveyor monitoring.

Amazon CEO Andy Jassy shared details on the AWS device for conveyor monitoring.

Amazon CEO Andy Jassy posted on LinkedIn about Monitron, which is equipment monitoring technology developed by Amazon that uses machine learning to detect issues in fulfillment centers. Built by Amazon Web Services (AWS), the company is also sold to other companies. The post reads:

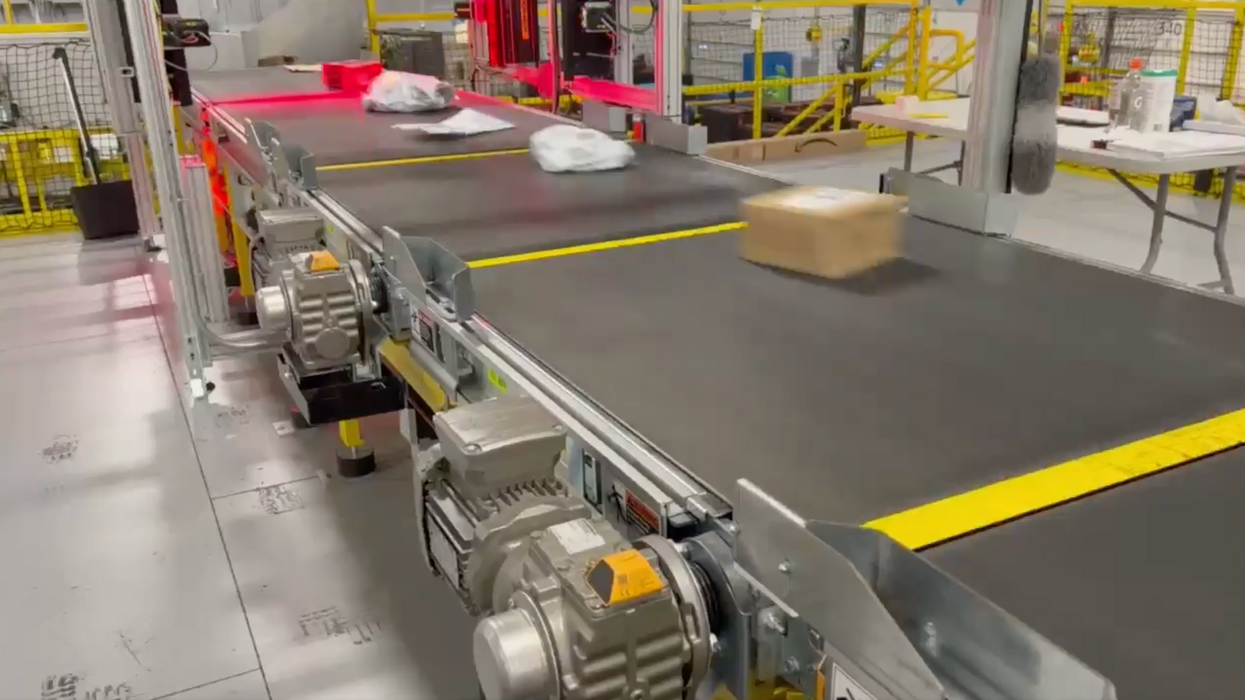

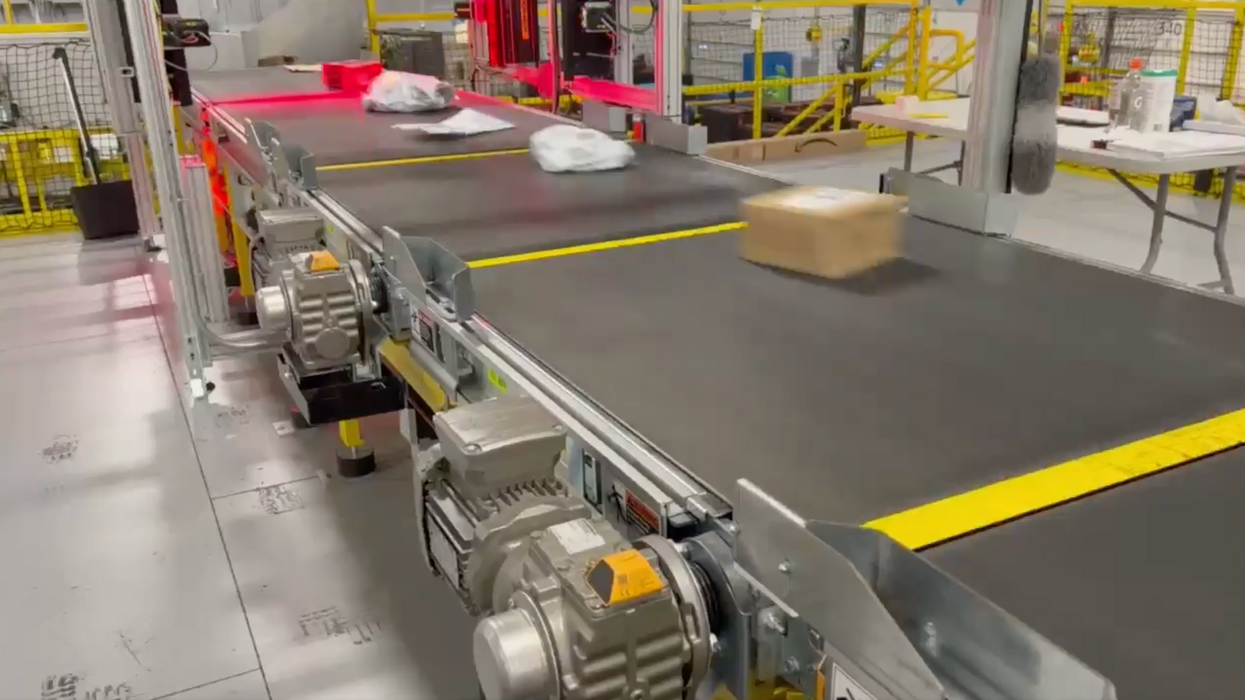

I recently visited one of our Sort Centers in Colorado where many of our customer packages go before they are sent to an Amazon delivery station or partner facility (like USPS). I saw firsthand how our AWS machine learning-based equipment monitoring service named Amazon Monitron is detecting potential issues with our fulfillment and sort center machinery before they happen.

Since a typical Fulfillment Center has dozens of miles of conveyors being driven by hundreds of motors and belts, keeping them running is super important to delivering reliably for customers. The orange sensors continuously collect temperature and vibration measurements, and send these metrics to the AWS cloud to be analyzed in real time using machine learning modeling that can predict when a part might stop working.

Amazon Monitron alerted the team that one of our induction belts (critical for sorting and moving packages) might fail soon. Our team was able to safely plan a time to look at it and perform predictive maintenance, saving hours of downtime and ensuring customer deliveries were made on time.

We always knew that if we were having these challenges it meant others were as well, which is why the AWS team built Amazon Monitron as a turnkey solution for other companies. So far, Amazon Monitron has reduced unplanned downtime by 70% at Amazon sites where it’s used and gained fast acceptance from industrial customers.

The report illustrates a pair of approaches taken by Amazon that by this point are built into the company's DNA:

Developing in-house: Amazon encountered a problem in its fulfillment. To solve it, the company puts its own talent and technology to work, and got building. The result was a compact orange sensor that drew on the company's cloud capabilities. It's in the area of logistics, which has been the scene of frequent invention for Amazon as it sought to optimize fulfillment and delivery of packages on a vast scale. With businesses like Fulfillment by Amazon and its recently-launched delivery for mall-based stores, Amazon is taking capacity in its network and turning it into a profit center.

A new business line: By creating a device to solve its own problems, Amazon recognized an opportunity to sell the technology. So, it started selling the technology. What had been a challenge that proved costly in downtime became a way to make money from other retailers. It's fitting that this technology came from AWS. After all, the massively profitable division's origin story followed a similar path with Jassy at the helm, albeit on a much larger scale.

On the Move has the latest from Amazon, Lovesac and more.

Ryan Cohen is executive chairman of GameStop. (Photo by Flickr user Bill Jerome, used under a Creative Commons) license.

This week, leadership is changing at GameStop, Sorel and Beautycounter. Meanwhile, key executives are departing at Amazon, Wayfair and Lovesac.

Here’s a look at the latest shuffles:

GameStop announced the termination of Matthew Furlong as CEO on Wednesday. A brief statement did not provide a reason for the firing.

With the move, Chewy founder and activist investor Ryan Cohen was named executive chairman of the video game retailer. Cohen will be responsible for capital allocation and overseeing management.

It came as the company reported a 10% year-over-year decline in net sales for the first quarter. Meanwhile, the company’s net loss improved by 62%.

In an SEC filing, GameStop further added this “We believe the combination of these efforts to stabilize and optimize our core business and achieve sustained profitability while also focusing on capital allocation under Mr. Cohen’s leadership will further unlock long-term value creation for our stockholders.”

Cohen was revealed as GameStop's largest shareholder when he disclosed a 10% stake in the retailer in 2020. GameStop went on to become a leading name in the meme stock rise of 2021.

Mark Nenow is stepping down as president of the Sorel brand in order to focus on his health.

After rising to the role in 2015, Nenow spearheaded a transformation of Columbia Sportswear-owned Sorel from a men’s workwear brand to a fashion-focused brand that led with a women’s offering of boots, sandals and sneakers.

“Mark led the brand to sales of $347 million in net sales in 2022,” said Columbia Sportswear CEO Tim Boyle, in a statement. “His leadership has been invaluable to this company, and we wish him the very best.”

Columbia will conduct a search for Nenow’s replacement. Craig Zanon, the company’s SVP of emerging brands, will lead Sorel in the interim.

Beautycounter appointed board member Mindy Mackenzie as interim CEO, succeeding Marc Rey. According to the brand, Rey and the board “mutually decided to transition to a new phase of leadership for Beautycounter.”

McKenzie, a former executive at Carlyle, McKinsey and Jim Beam, will lead the company as it conducts a search for a permanent CEO. Additionally, former Natura & Co CEO Roberto Marques will join Beautycounter’s board as chair.

As part of the transition, Nicole Malozi is also joining the company as chief financial officer. She brings experience from Tatcha, Nike, and DFS Group Limited.

Melissa Nick, a VP of customer fulfillment for North America at Amazon, will leave the company, effective June 16, CNBC reported. Nick joined the company in 2014, and oversaw a region that included nearly 300 fulfillment centers. After doubling its supply chain footprint during the pandemic, Amazon recently reorganized its fulfillment operations to take a regional approach, as opposed to a national model that often resulted in items shipping across the country.

Jon Blotner (Courtesy photo)

Steve Oblak will retire from the role of chief commercial officer at home goods marketplace Wayfair. With the move, Jon Blotner will be promoted to chief commercial officer.

"Steve has served as a critical part of our leadership team and played a pivotal role in Wayfair's growth, helping us grow from a $250 million business when he joined to $12 billion in net revenue today,” said Wayfair CEO Niraj Shah, in a statement. “He oversaw countless milestones, from helping to launch the Wayfair brand as we brought together hundreds of sites into a single platform, to launching new categories, business lines, and geographies while overseeing our North American and European businesses, to leading our debut into physical retail.”

Blotner previously oversaw exclusive and specialty retail brands, as well as digital media at Wayfair. Before joining the company, he served as president of Gemvara.com prior to its 2016 acquisition by Berkshire Hathaway.

Furniture retailer Lovesac said Donna Dellomo will retire as EVP and CFO, and move to an advisory role, effective June 30. Dellomo was with Lovesac for six years.

Keith Siegner was appointed as the next EVP and CFO. He brings experience as CFO of esports company Vindex, as well as executive roles at Yum! Brands, UBS Securities and Credit Suisse.

Additionally, Jack Krause will retire from the role of chief strategy officer, effective June 30. His responsibilities will be divided between CEO Shawn Nelson and president Mary Fox.

“Since joining Lovesac, Jack has played an instrumental role in transforming the Company into a true omni channel retailer by helping expand our physical touchpoints and digital platform as we continue to disrupt the industry,” said Nelson, in a statement.

The National Retail Federation announced the addition of five new board members. They include: